Work Compensation Insurance Companies

The World of Work Compensation Insurance: A Comprehensive Guide

Work compensation insurance is an essential aspect of the modern business landscape, providing protection and peace of mind for both employers and employees. In this in-depth article, we delve into the intricate world of work compensation insurance, exploring its intricacies, benefits, and real-world applications. From understanding the basics to navigating complex policies, we aim to equip you with the knowledge needed to make informed decisions regarding this critical aspect of business operations.

Whether you're a business owner seeking to safeguard your workforce or an employee wanting to comprehend the coverage available, this guide offers valuable insights and practical advice. By the end of this comprehensive exploration, you'll possess a thorough understanding of work compensation insurance and its pivotal role in ensuring a secure and compliant workplace.

Understanding the Basics of Work Compensation Insurance

Work compensation insurance, often referred to as workers' compensation or simply compensation insurance, is a form of coverage designed to provide financial protection to employees who suffer work-related injuries or illnesses. It's a critical component of any business's risk management strategy, offering a safety net for employees and a means for employers to fulfill their legal and ethical responsibilities.

The origins of work compensation insurance can be traced back to the early 20th century when industrial accidents and occupational diseases were becoming increasingly prevalent. Recognizing the need to protect workers and ensure their financial stability, various jurisdictions began implementing laws mandating this type of insurance. Today, it is a standard requirement for most businesses, ensuring that employees receive prompt medical care and financial support in the event of a workplace injury or illness.

At its core, work compensation insurance operates on a no-fault basis, meaning that an employee can receive benefits regardless of who was at fault for the injury or illness. This approach streamlines the claims process, ensuring that injured workers receive the necessary medical treatment and compensation without the need for lengthy legal battles. In exchange for these benefits, employees typically give up their right to sue their employer for negligence, contributing to a more harmonious workplace environment.

Key Components of Work Compensation Insurance

- Medical Benefits: Covers the cost of medical treatment, including doctor visits, hospital stays, surgeries, medications, and rehabilitation services.

- Income Benefits: Provides a portion of the employee's regular income while they are unable to work due to a work-related injury or illness.

- Vocational Rehabilitation: Offers services to help injured workers return to work, such as job training, education, or counseling.

- Death Benefits: Provides financial support to the dependents of workers who suffer a fatal workplace injury or illness.

It's important to note that the specific benefits and coverage levels can vary depending on the jurisdiction and the terms of the insurance policy. Additionally, certain occupations or industries may have specialized coverage needs, such as additional benefits for first responders or hazardous material handlers.

The Role of Insurance Companies in Work Compensation

Insurance companies play a pivotal role in the work compensation landscape, offering policies that protect businesses and their employees from the financial repercussions of workplace injuries and illnesses. These companies, often referred to as workers' compensation carriers, provide a range of services that are crucial to the smooth functioning of this insurance system.

Policy Development and Underwriting

Insurance companies develop and underwrite work compensation policies, assessing the risks associated with different industries and occupations. This process involves a detailed analysis of historical data, industry trends, and potential hazards to determine appropriate premium rates and coverage limits. By understanding the unique risks faced by different businesses, insurance companies can tailor their policies to provide adequate protection while remaining financially viable.

Claims Management and Administration

When an employee suffers a work-related injury or illness, the insurance company steps in to manage the claims process. This involves investigating the claim, evaluating the extent of the injury or illness, and determining the appropriate benefits to be paid. Insurance companies have dedicated claims adjusters who work closely with injured workers, employers, and medical providers to ensure that claims are processed efficiently and fairly. They also handle any disputes that may arise, serving as a neutral third party to resolve conflicts and ensure compliance with the terms of the policy.

Risk Management and Loss Prevention

A key aspect of work compensation insurance is its focus on risk management and loss prevention. Insurance companies often provide valuable resources and guidance to help businesses implement safety measures and reduce the likelihood of workplace injuries and illnesses. This can include safety audits, training programs, and the development of comprehensive safety plans. By actively working with businesses to create safer work environments, insurance companies can help reduce the number of claims, leading to lower premiums and a more stable insurance market.

| Insurance Company | Premium Rate | Coverage Limits | Specialized Services |

|---|---|---|---|

| ABC Insurance | $1.20 per $100 of payroll | Up to $1 million per claim | Safety consulting, ergonomic assessments |

| Def Insurance Group | $1.15 per $100 of payroll | Unlimited coverage for medical benefits | Vocational rehabilitation programs, return-to-work coordination |

| GHI Mutual | $1.30 per $100 of payroll | Enhanced death benefits for specific occupations | 24/7 claims reporting hotline, online claim tracking |

Real-World Applications and Case Studies

To truly grasp the impact and importance of work compensation insurance, let's explore a few real-world examples and case studies. These stories illustrate how this insurance plays a pivotal role in the lives of employees and the success of businesses, demonstrating its practical applications and benefits.

Protecting Employees: A Manufacturing Plant's Experience

In a bustling manufacturing plant, employees work tirelessly to produce high-quality goods. However, the nature of the work carries inherent risks, from heavy machinery to repetitive tasks that can lead to injuries. Work compensation insurance ensures that these employees are protected in the event of an accident or illness.

Imagine a scenario where a worker, let's call her Maria, sustains a serious injury while operating a heavy press machine. The force of the accident leaves her with a broken arm and severe lacerations. Fortunately, the plant has robust work compensation insurance in place. Maria's medical expenses are promptly covered, including emergency room visits, surgery, and ongoing rehabilitation. Additionally, she receives a portion of her regular income while she recovers, ensuring financial stability during her time away from work.

The insurance company's claims adjusters work closely with Maria and her medical team to ensure a smooth and efficient claims process. They coordinate with the employer to understand the circumstances of the accident and implement measures to prevent similar incidents in the future. Through this collaborative effort, Maria receives the support she needs to recover fully, and the plant can maintain a safe and productive workplace.

Supporting Business Continuity: A Construction Firm's Perspective

In the construction industry, workplace injuries are a common concern. A leading construction firm understands the importance of work compensation insurance to protect its workers and ensure business continuity. By investing in comprehensive coverage, the firm demonstrates its commitment to employee welfare and safety.

Consider the story of John, a skilled construction worker who sustains a back injury while lifting heavy materials on a job site. With work compensation insurance in place, John's medical treatment is promptly covered, and he receives income benefits while he recovers. The insurance company's vocational rehabilitation services help John explore alternative career paths within the construction industry, ensuring he can continue contributing his skills and expertise.

Moreover, the construction firm benefits from the insurance company's risk management expertise. Through regular safety audits and training programs, the firm can identify and address potential hazards, reducing the likelihood of future injuries. This proactive approach not only protects the well-being of employees but also enhances the firm's reputation and productivity, fostering a culture of safety and excellence.

Navigating the Complexities: Tips and Strategies

While work compensation insurance provides essential protection, navigating the complexities of policies and claims can be daunting. Here are some tips and strategies to help businesses and employees make the most of this critical coverage:

Choosing the Right Insurance Provider

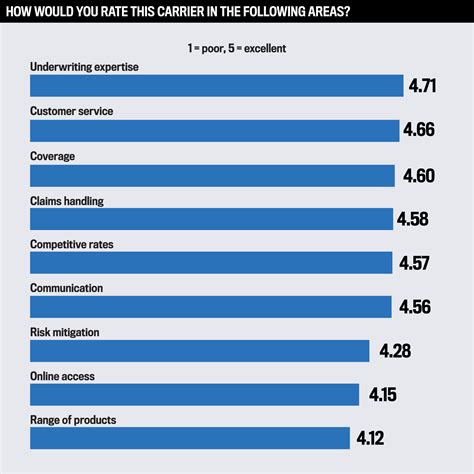

Select an insurance company that understands your industry and can offer tailored coverage. Look for providers with a strong track record in work compensation and a reputation for excellent customer service. Consider their financial stability and specialized services, ensuring they can provide the support you need in the event of a claim.

Implementing Effective Risk Management

Work closely with your insurance provider to develop a comprehensive risk management plan. Conduct regular safety audits, train employees on workplace safety, and implement measures to mitigate risks. By reducing the likelihood of injuries and illnesses, you can lower your insurance premiums and create a safer, more productive workplace.

Understanding Your Policy

Take the time to thoroughly understand your work compensation insurance policy. Know the specific benefits and coverage limits, as well as any exclusions or limitations. Familiarize yourself with the claims process and your rights as an employer or employee. This knowledge will empower you to make informed decisions and advocate for your interests effectively.

Communicating with Your Insurance Provider

Establish open lines of communication with your insurance company. Attend any training or educational sessions they offer, and don't hesitate to reach out with questions or concerns. Building a strong relationship with your provider can lead to better service and a more personalized approach to your insurance needs.

Future Trends and Innovations in Work Compensation Insurance

As the world of work evolves, so too does the landscape of work compensation insurance. Several emerging trends and innovations are shaping the future of this critical coverage, offering new opportunities for businesses and employees alike. Let's explore some of these developments and their potential impact.

Digital Transformation and Automation

The digital age has brought about significant changes in the insurance industry, and work compensation is no exception. Insurance companies are increasingly adopting digital technologies to streamline processes, enhance efficiency, and improve the overall customer experience. From online claims submission and tracking to automated risk assessments, digital transformation is revolutionizing the way work compensation insurance is delivered.

By leveraging advanced analytics and machine learning, insurance companies can now more accurately assess risks and tailor policies to the unique needs of businesses. This data-driven approach enables more precise premium calculations and targeted risk management strategies. Additionally, digital platforms and mobile apps are making it easier for employees to access information about their coverage and submit claims, ensuring a more seamless and convenient experience.

Focus on Preventative Care and Well-being

There is a growing recognition in the insurance industry that investing in preventative care and employee well-being can lead to significant cost savings and improved outcomes. As a result, insurance companies are increasingly offering services and incentives to promote workplace health and safety.

This shift towards preventative care is evident in the development of wellness programs, ergonomic assessments, and mental health initiatives. By addressing potential health risks before they lead to injuries or illnesses, insurance companies can help businesses reduce the number of claims and create a more resilient workforce. Additionally, by offering resources and support for employees' physical and mental well-being, insurance companies contribute to a culture of health and productivity, benefiting both the individual and the organization as a whole.

Collaborative Partnerships for Enhanced Safety

Recognizing the complex nature of workplace risks, insurance companies are forging collaborative partnerships with industry experts, safety organizations, and even technology providers. These partnerships aim to pool knowledge and resources, leading to more effective risk management strategies and innovative solutions.

For example, insurance companies may work with occupational health specialists to develop comprehensive injury prevention programs. They may also partner with technology firms to integrate advanced safety features into workplace equipment or utilize virtual reality for training and hazard simulation. By collaborating across sectors, insurance companies can leverage a wealth of expertise to create safer work environments and more robust insurance offerings.

Conclusion: The Vital Role of Work Compensation Insurance

Work compensation insurance is a cornerstone of responsible business operations, providing a vital safety net for employees and a means for employers to fulfill their obligations. Through this comprehensive guide, we've explored the various facets of this insurance, from its historical development to its real-world applications and future innovations.

By understanding the basics, navigating the complexities, and staying abreast of emerging trends, businesses and employees can make informed decisions and maximize the benefits of work compensation insurance. With the right coverage and a commitment to safety and well-being, workplaces can thrive, knowing that they are protected and prepared for whatever challenges may arise.

As we continue to navigate the evolving world of work, work compensation insurance will remain a critical component of a resilient and compassionate business landscape, ensuring that employees are cared for and businesses can operate with confidence and peace of mind.

What are the key benefits of work compensation insurance for employees?

+

Work compensation insurance provides employees with several key benefits, including medical coverage for work-related injuries or illnesses, income protection during recovery, and vocational rehabilitation services to assist in returning to work. It also offers death benefits to support the dependents of workers who suffer fatal workplace injuries.

How do insurance companies determine premium rates for work compensation insurance?

+

Insurance companies use a combination of factors to determine premium rates, including the industry and occupation of the business, historical claims data, and potential workplace hazards. They assess the level of risk associated with different businesses and occupations to set appropriate premium rates and coverage limits.

What role does risk management play in work compensation insurance?

+

Risk management is a critical aspect of work compensation insurance. Insurance companies often provide resources and guidance to help businesses implement safety measures and reduce the likelihood of workplace injuries and illnesses. By actively managing risks, businesses can lower their insurance premiums and create a safer work environment.

How can employees navigate the work compensation claims process effectively?

+

Employees should promptly report any work-related injuries or illnesses to their employer and seek medical attention as needed. They should also familiarize themselves with their work compensation insurance policy and understand their rights and the claims process. Open communication with the insurance company and employer can help ensure a smooth and efficient claims experience.

What emerging trends are shaping the future of work compensation insurance?

+

Emerging trends in work compensation insurance include digital transformation and automation, a growing focus on preventative care and employee well-being, and collaborative partnerships between insurance companies and industry experts. These trends aim to enhance the efficiency, effectiveness, and overall experience of work compensation insurance for both businesses and employees.