Medicare Advantage Insurance

In the ever-evolving landscape of healthcare, understanding your insurance options is crucial. One such option that has gained prominence in the United States is Medicare Advantage Insurance, often referred to as Medicare Part C. This comprehensive guide aims to delve into the intricacies of Medicare Advantage, providing an expert analysis of its benefits, coverage, and implications for those navigating the complex world of healthcare.

Understanding Medicare Advantage: An Overview

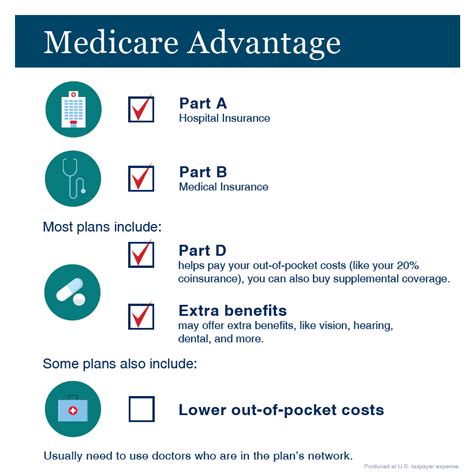

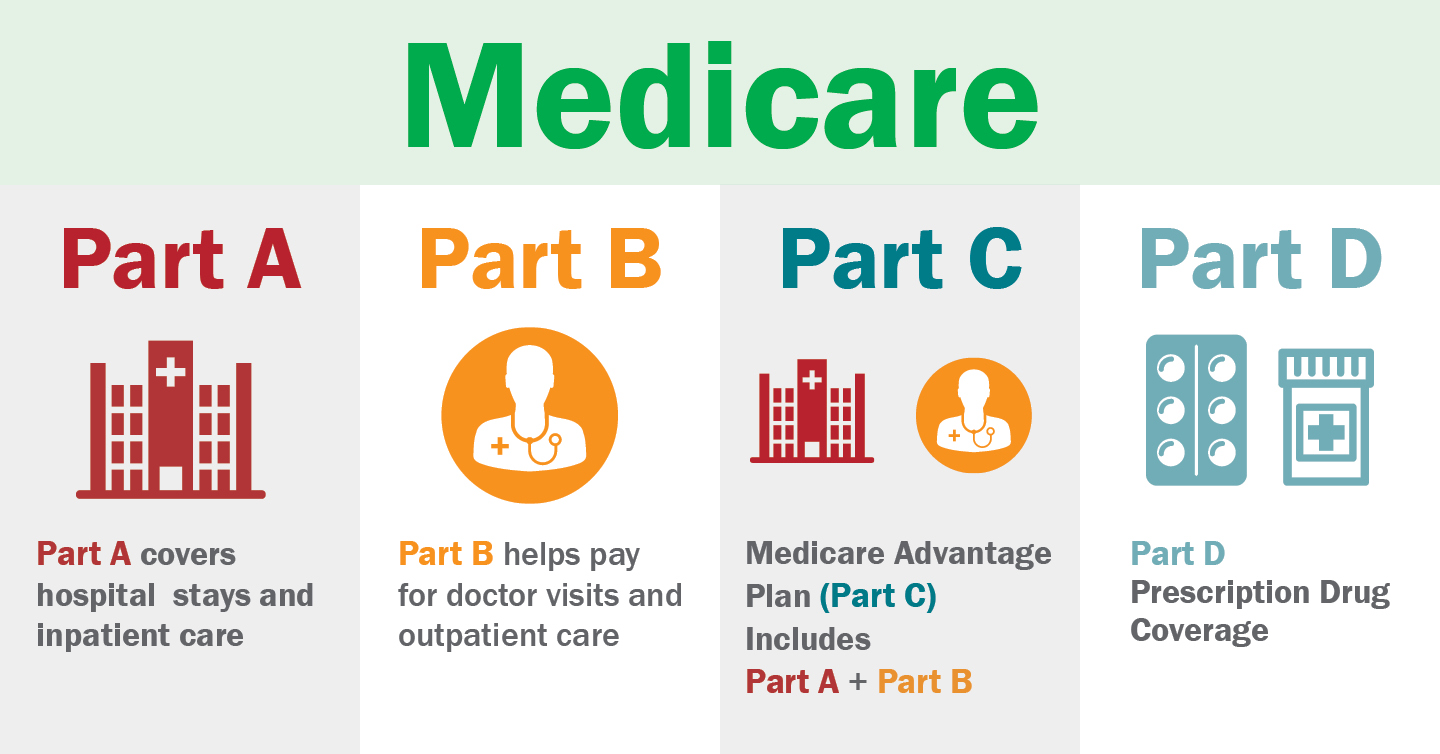

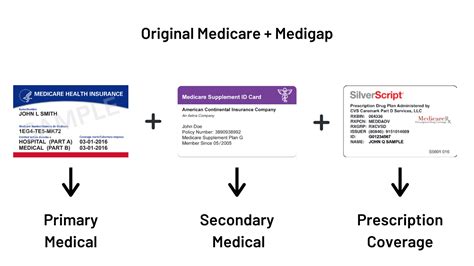

Medicare Advantage, a Medicare program administered by private insurance companies, offers an alternative to the traditional Medicare Part A and Part B coverage. Enrollees receive the same benefits as Original Medicare, with the added advantage of additional coverage options and potential cost savings.

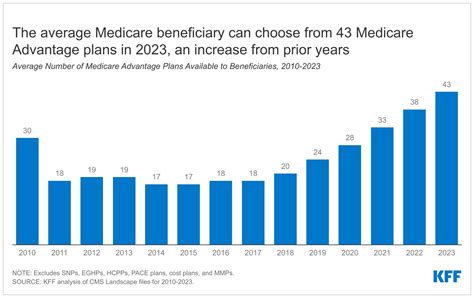

This program was introduced as part of the Balanced Budget Act of 1997, aiming to provide a more flexible and tailored approach to healthcare coverage for Medicare beneficiaries. Since its inception, Medicare Advantage has grown in popularity, now serving millions of Americans across the country.

Key Features of Medicare Advantage Plans

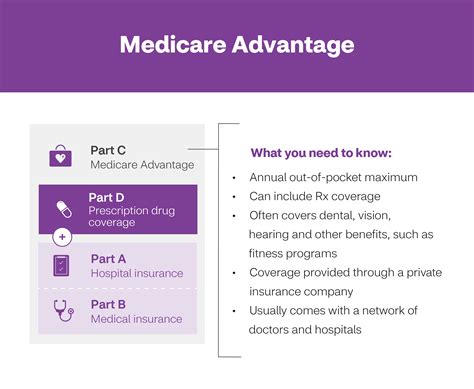

These plans are renowned for their comprehensive coverage, often including Part A (hospital insurance), Part B (medical insurance), and sometimes even Part D (prescription drug coverage). Additionally, many plans offer extra benefits such as vision, dental, and hearing care, making them an attractive option for those seeking a holistic healthcare package.

Furthermore, Medicare Advantage plans are known for their cost-effectiveness. While Original Medicare typically requires beneficiaries to pay a deductible for Part A and Part B services, Medicare Advantage plans often have lower out-of-pocket costs and may include additional services with no additional charges.

| Plan Type | Key Benefits |

|---|---|

| Health Maintenance Organization (HMO) | Emphasizes preventive care and typically requires members to use in-network providers. |

| Preferred Provider Organization (PPO) | Offers more flexibility, allowing members to use both in-network and out-of-network providers, though costs may vary. |

| Private Fee-for-Service (PFFS) | Providers agree to treat members at rates set by the insurance company. Coverage and costs may vary. |

| Special Needs Plans (SNPs) | Designed for individuals with specific chronic conditions or those in institutional settings. |

Enrollment and Eligibility: A Step-by-Step Guide

Understanding the enrollment process is vital to making informed decisions about your healthcare coverage. Medicare Advantage plans typically have specific enrollment periods, and being aware of these timelines can help ensure a smooth transition.

The Initial Enrollment Period (IEP)

The Initial Enrollment Period is a crucial window for individuals turning 65 or those already enrolled in Medicare Part A and/or Part B. This period, which lasts for 7 months (3 months before your 65th birthday, your birthday month, and 3 months after), allows for a seamless transition into a Medicare Advantage plan.

During this time, individuals can enroll without facing any additional costs or medical underwriting. It's a period of flexibility, enabling beneficiaries to explore their options and choose a plan that best suits their healthcare needs.

Special Enrollment Periods (SEPs)

Beyond the Initial Enrollment Period, Medicare Advantage offers Special Enrollment Periods for specific circumstances. These include:

- Moving to a new area: If you relocate to a new zip code where your current plan is no longer available, you can switch to a new Medicare Advantage plan during a 2-month SEP starting the month you move.

- Losing Medicare coverage: If you lose your Medicare coverage due to certain events (e.g., leaving a job), you have an 8-month SEP starting the month your coverage ends.

- Medicare Advantage disenrollment: If you're dissatisfied with your current Medicare Advantage plan, you can switch to a different plan during the annual Medicare Advantage disenrollment period, which runs from January 1st to February 14th.

Coverage and Benefits: Unlocking the Potential

One of the key advantages of Medicare Advantage plans is their ability to offer a wide range of coverage options. While Original Medicare covers the basics, Medicare Advantage plans often go the extra mile, providing comprehensive benefits tailored to individual needs.

Prescription Drug Coverage (Part D)

Many Medicare Advantage plans include Part D coverage, which is a significant benefit for those who rely on medications. Part D plans typically have a set of preferred drugs, known as a formulary, which can change from year to year. Enrollees can choose from a variety of plans, each with its own formulary and cost-sharing structure.

It's essential to review the formulary of potential plans to ensure that your medications are covered. Some plans may require prior authorization or step therapy, which involves trying a less expensive medication before moving on to a more costly one.

Additional Benefits: A Holistic Approach

Medicare Advantage plans often extend beyond traditional healthcare, offering a range of additional benefits that promote overall well-being. These may include:

- Dental and Vision Care: Many plans offer routine dental and vision services, covering exams, cleanings, and even certain procedures.

- Hearing Aids: Some plans provide coverage for hearing aids and related services, addressing a common need among older adults.

- Fitness and Wellness Programs: Certain plans partner with fitness centers to offer discounted or free memberships, encouraging beneficiaries to stay active and healthy.

- Transportation Services: Some plans provide transportation to and from medical appointments, ensuring that beneficiaries can access the care they need.

Comparing Plans: A Comprehensive Analysis

With a plethora of Medicare Advantage plans available, comparing options is essential to making an informed decision. Each plan has unique features, benefits, and costs, and understanding these nuances can significantly impact your healthcare experience.

Network Providers: In-Network vs. Out-of-Network

Medicare Advantage plans typically operate within a network of healthcare providers. Understanding the difference between in-network and out-of-network providers is crucial. In-network providers have contracted with the insurance company, often resulting in lower costs for beneficiaries. Out-of-network providers, on the other hand, may charge higher rates and may not be covered by your plan.

When comparing plans, pay close attention to the network of providers. Ensure that your preferred doctors, specialists, and hospitals are included in the network. This is especially important if you have ongoing treatments or prefer specific healthcare facilities.

Cost-Sharing Structures: Understanding Out-of-Pocket Costs

Medicare Advantage plans have various cost-sharing structures, including premiums, deductibles, copayments, and coinsurance. Understanding these costs is vital to managing your healthcare expenses effectively.

- Premiums: This is the monthly cost of your Medicare Advantage plan. It's important to note that you still need to pay your Part B premium, and some plans may have an additional premium.

- Deductibles: Like Original Medicare, Medicare Advantage plans may have deductibles for hospital stays and skilled nursing facility care. These deductibles can vary between plans.

- Copayments and Coinsurance: Copayments are fixed amounts you pay for a covered service, while coinsurance is a percentage of the Medicare-approved amount that you're responsible for paying.

Performance and Quality: Ensuring Excellence

When choosing a Medicare Advantage plan, it’s essential to consider the performance and quality of the insurance company. Several factors can influence the overall experience and satisfaction of enrollees.

Star Ratings: A Measure of Quality

The Centers for Medicare & Medicaid Services (CMS) rates Medicare Advantage plans using a 5-star rating system. This rating is based on a variety of factors, including member satisfaction, quality of care, and access to healthcare services. Plans with higher star ratings generally offer better quality and more satisfied members.

When comparing plans, pay attention to their star ratings. A higher star rating indicates a plan that has consistently met or exceeded CMS quality standards, providing a more reliable and satisfying healthcare experience.

Plan Reputation and Customer Service

The reputation of the insurance company offering the Medicare Advantage plan is crucial. Look for plans with a history of positive customer reviews and a solid track record of delivering quality healthcare services. Additionally, consider the accessibility and responsiveness of the plan’s customer service team. A responsive and helpful customer service department can make a significant difference in your overall experience.

Future Implications and Considerations

As the healthcare landscape continues to evolve, it’s important to consider the future implications of Medicare Advantage. While these plans offer numerous benefits, there are also considerations to keep in mind when making long-term healthcare decisions.

Plan Stability and Changes

Medicare Advantage plans are subject to change from year to year. Insurance companies may adjust their networks, benefits, and costs based on various factors, including regulatory changes and market competition. It’s essential to stay informed about these potential changes and ensure that your plan continues to meet your healthcare needs over time.

Regularly reviewing your plan's Annual Notice of Change (ANOC) and Evidence of Coverage (EOC) documents can help you stay abreast of any modifications. These documents provide detailed information about your plan's benefits, coverage, and costs for the upcoming year.

Medicare Advantage vs. Original Medicare: The Long-Term Perspective

While Medicare Advantage offers comprehensive benefits and potential cost savings, Original Medicare remains a reliable option for many beneficiaries. Original Medicare provides a standard level of coverage, allowing beneficiaries to choose their doctors and healthcare facilities without network restrictions. Additionally, Original Medicare has no annual limits on out-of-pocket costs, which can be beneficial for those with high healthcare needs.

When deciding between Medicare Advantage and Original Medicare, it's essential to consider your long-term healthcare needs and preferences. While Medicare Advantage plans offer added benefits, Original Medicare provides a more flexible and predictable structure for those who value choice and control over their healthcare decisions.

Conclusion: Navigating Your Healthcare Journey

Medicare Advantage Insurance offers a comprehensive and flexible approach to healthcare coverage, providing an attractive option for millions of Americans. By understanding the enrollment process, coverage benefits, and performance metrics, individuals can make informed decisions about their healthcare plans.

Whether you're enrolling for the first time or considering a switch, remember that your healthcare journey is unique. Take the time to research, compare plans, and seek expert advice to ensure you find the coverage that best aligns with your needs and preferences. With the right Medicare Advantage plan, you can unlock a world of comprehensive healthcare benefits and take control of your well-being.

FAQ

What is the difference between Medicare Advantage and Original Medicare?

+

Medicare Advantage, also known as Part C, is an alternative to Original Medicare (Parts A and B). It offers additional benefits and potential cost savings, while Original Medicare provides a standard level of coverage with more flexibility in choosing providers.

When can I enroll in a Medicare Advantage plan?

+

You can enroll during the Initial Enrollment Period, which is a 7-month window around your 65th birthday. Additionally, there are Special Enrollment Periods for specific circumstances, such as moving or losing Medicare coverage.

Do Medicare Advantage plans cover prescription drugs?

+

Many Medicare Advantage plans include Part D prescription drug coverage. It’s important to review the plan’s formulary to ensure your medications are covered.

What are the key benefits of Medicare Advantage plans?

+

Medicare Advantage plans offer comprehensive coverage, often including dental, vision, and hearing benefits. They may also provide access to fitness programs and transportation services.