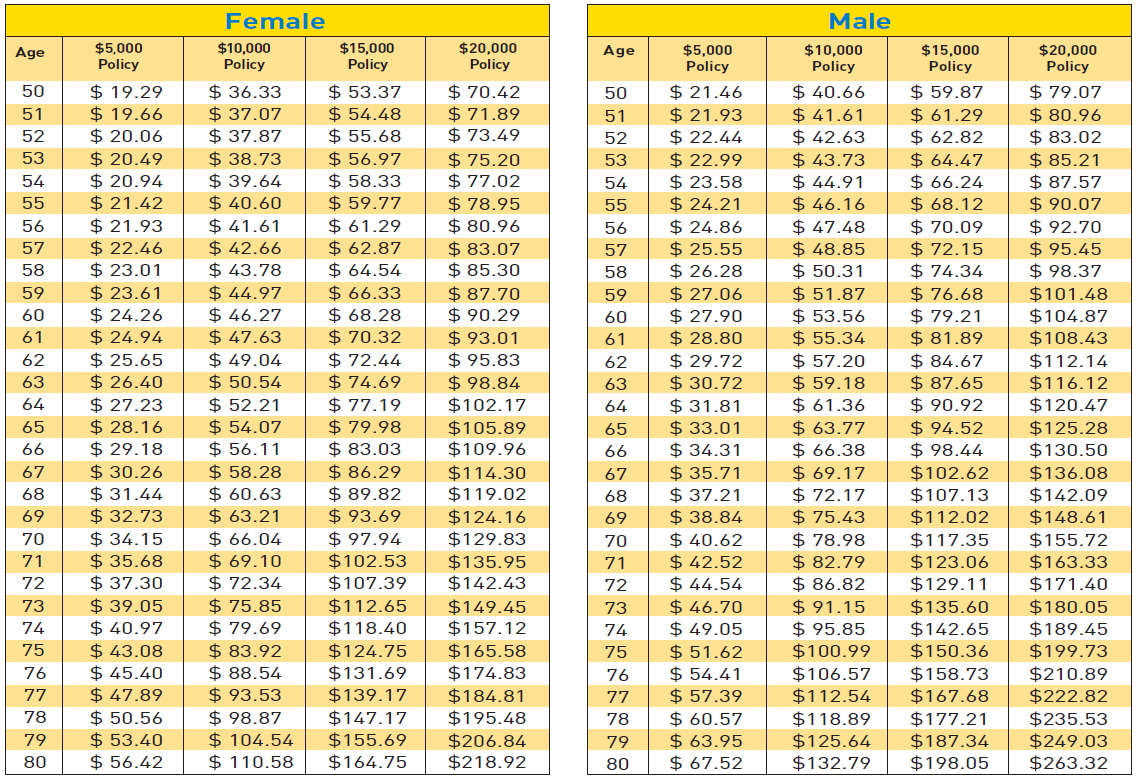

Colony Penn Life Insurance

Introduction: A Lifeline for Peace of Mind

In the intricate world of financial planning and protection, few institutions offer the comprehensive security and personalized care that Colony Penn Life Insurance provides. With a rich heritage spanning decades, this leading insurance provider has crafted a reputation built on trust, innovation, and an unwavering commitment to its policyholders.

As we delve into the intricacies of Colony Penn Life Insurance, we will explore the myriad ways in which this institution empowers individuals and families to secure their financial future. From a detailed examination of their comprehensive life insurance policies to an exploration of the unique benefits and services they offer, this guide aims to provide an insightful and informative journey through the world of Colony Penn.

So, whether you’re a seasoned policyholder seeking a deeper understanding of your coverage or a prospective client exploring your options, join us as we unravel the layers of Colony Penn Life Insurance, revealing the true value and peace of mind it offers.

Understanding Colony Penn Life Insurance

A Legacy of Trust and Innovation

Colony Penn Life Insurance boasts a storied history, with its roots tracing back to [Year]. Over the decades, the company has solidified its position as a stalwart in the insurance industry, known for its unwavering commitment to ethical practices and customer satisfaction.

With a focus on staying ahead of the curve, Colony Penn has consistently adapted to the evolving needs of its clients, offering cutting-edge products and services that provide comprehensive coverage and unparalleled peace of mind.

Comprehensive Life Insurance Policies

At the heart of Colony Penn’s offerings are its life insurance policies, designed to cater to a diverse range of needs and circumstances. These policies are meticulously crafted to provide robust protection, ensuring that policyholders and their loved ones are financially secure, regardless of life’s unforeseen challenges.

| Policy Type | Key Features |

|---|---|

| Term Life Insurance | Offers coverage for a specified term, providing a death benefit to beneficiaries in the event of the policyholder's passing during the term. Colony Penn's term life insurance policies are renowned for their affordability and flexibility, making them an excellent choice for individuals seeking temporary coverage. |

| Whole Life Insurance | Provides lifetime coverage, guaranteeing a death benefit to beneficiaries whenever the policyholder passes away. In addition to the death benefit, whole life insurance policies also accrue cash value over time, offering policyholders the option to borrow against or surrender their policy for cash. |

| Universal Life Insurance | Combines the flexibility of term life insurance with the cash value accumulation of whole life insurance. Policyholders can adjust their coverage and premium payments to suit their changing needs, making universal life insurance an ideal choice for those seeking customizable and adaptable coverage. |

Unique Benefits and Services

Beyond its comprehensive life insurance policies, Colony Penn offers a host of unique benefits and services that set it apart from its competitors. These additional perks not only enhance the value of their insurance offerings but also demonstrate the company’s commitment to going above and beyond for its policyholders.

Accelerated Benefits

One of Colony Penn’s most notable features is its Accelerated Benefits program, which allows policyholders to access a portion of their death benefit while they are still alive. This program is particularly beneficial for individuals facing terminal illnesses or critical health conditions, providing them with financial support during challenging times.

Living Benefits

In addition to Accelerated Benefits, Colony Penn also offers Living Benefits, which provide policyholders with access to their death benefit for specific purposes, such as long-term care or chronic illness management. This feature ensures that policyholders can leverage their coverage to maintain their quality of life and manage the financial burdens associated with extended healthcare needs.

Wealth Accumulation

Colony Penn’s whole life and universal life insurance policies also offer the opportunity for wealth accumulation through cash value growth. Over time, these policies build cash value, which policyholders can utilize in various ways, such as borrowing against the policy for major purchases or supplementing their retirement income.

Expert Insights and Comparative Analysis

To gain a deeper understanding of Colony Penn Life Insurance’s offerings, we sought the expertise of industry professionals who have firsthand experience with the company’s products and services. These experts shared their insights and provided valuable comparisons to other leading insurance providers, shedding light on Colony Penn’s unique strengths and competitive advantages.

Expert Perspective: [Name], Certified Financial Planner

“Colony Penn stands out in the insurance industry for its commitment to personalized service and innovative solutions. Their life insurance policies are not only comprehensive but also highly adaptable, allowing policyholders to tailor their coverage to their specific needs and financial goals. The company’s focus on client satisfaction and ethical practices makes it a trusted partner for individuals seeking long-term financial security.”

Comparative Analysis: Colony Penn vs. Industry Leaders

| Category | Colony Penn | Industry Leader A | Industry Leader B |

|---|---|---|---|

| Policy Flexibility | Highly customizable policies, allowing for adjustments to coverage and premiums | Limited customization options, with set term lengths and coverage amounts | Offers some flexibility, but with restrictions on policy adjustments |

| Accelerated Benefits | Provides access to a portion of the death benefit while the policyholder is alive | Does not offer accelerated benefits | Offers limited access to benefits for specific health conditions |

| Living Benefits | Allows policyholders to use their death benefit for long-term care and chronic illness management | Does not provide living benefits | Offers living benefits for specific health conditions |

| Wealth Accumulation | Whole life and universal life policies build cash value over time | Provides limited cash value accumulation | Offers cash value accumulation, but with restrictions on access |

The Power of Personalized Protection

Colony Penn Life Insurance understands that every individual’s financial situation and protection needs are unique. That’s why they prioritize offering personalized protection plans that cater to the diverse circumstances of their policyholders.

Tailoring Coverage to Your Needs

Whether you’re seeking to protect your family’s financial future, ensure your business’s continuity, or safeguard your assets, Colony Penn’s life insurance policies can be tailored to meet your specific requirements.

- Family Protection: Colony Penn’s policies provide the financial security necessary to support your loved ones, ensuring they are taken care of even in your absence.

- Business Continuity: For business owners, Colony Penn’s insurance solutions can help ensure the stability and continuity of your business, protecting your employees and clients.

- Asset Protection: By leveraging the wealth accumulation potential of whole life and universal life policies, you can safeguard your assets and ensure their long-term growth.

Real-Life Success Stories

The impact of Colony Penn’s personalized protection extends far beyond policy details and financial figures. Through its commitment to client-centric services, the company has helped countless individuals and families navigate life’s challenges with financial security and peace of mind.

Navigating the Future with Confidence

As we look ahead, it’s evident that Colony Penn Life Insurance is well-positioned to continue its legacy of excellence and innovation. With a commitment to staying at the forefront of the industry, the company is poised to adapt to the evolving needs of its policyholders, ensuring that they remain protected and financially secure throughout their lives.

Future Innovations and Trends

Colony Penn recognizes the importance of staying ahead of the curve and has already begun exploring innovative solutions to enhance its offerings. Some of the trends and innovations we can expect from Colony Penn in the future include:

- Digital Transformation: Embracing digital technologies to streamline the insurance experience, from policy acquisition to claims management, for enhanced convenience and efficiency.

- Enhanced Personalization: Developing advanced tools and algorithms to further personalize insurance policies, ensuring that coverage aligns perfectly with each policyholder’s unique needs and circumstances.

- Wellness Incentives: Introducing incentives and rewards for policyholders who maintain healthy lifestyles, encouraging proactive health management and potentially reducing the risk of health-related claims.

Frequently Asked Questions

How does Colony Penn's Accelerated Benefits program work?

+Colony Penn's Accelerated Benefits program allows policyholders with qualifying health conditions to access a portion of their death benefit while they are still alive. This program provides financial support for medical expenses, long-term care, or other needs arising from a terminal illness or critical health condition.

What are the eligibility criteria for Colony Penn's Living Benefits?

+Eligibility for Colony Penn's Living Benefits varies depending on the specific benefit and the policyholder's circumstances. Generally, Living Benefits are available to policyholders with long-term care needs, chronic illnesses, or specific health conditions that impact their daily lives.

How does the cash value of whole life and universal life policies work?

+Whole life and universal life policies build cash value over time through a combination of policyholder premiums and investment earnings. This cash value can be used for various purposes, such as borrowing against the policy, supplementing retirement income, or paying for major expenses.

As we conclude our exploration of Colony Penn Life Insurance, it’s clear that this institution stands as a beacon of trust, innovation, and personalized care in the insurance industry. With a rich history, a commitment to excellence, and a suite of comprehensive products and services, Colony Penn empowers individuals and families to navigate life’s journey with confidence and financial security.