Business Insurance Small

In the world of entrepreneurship, understanding the nuances of business insurance is crucial, especially for small businesses. These entities, often the backbone of local economies, require tailored protection to ensure their longevity and success. This article delves into the intricate world of small business insurance, offering a comprehensive guide to help entrepreneurs make informed decisions.

Navigating the Complex Landscape of Small Business Insurance

Small businesses face unique challenges when it comes to insurance. With limited resources and specific operational needs, finding the right coverage can be a daunting task. This section aims to demystify the process, providing a clear roadmap for entrepreneurs to navigate the complex landscape of insurance options.

Understanding the Fundamentals

At its core, business insurance serves as a safety net, protecting companies from potential financial ruin due to unforeseen events. For small businesses, this protection is even more critical, as they often lack the financial buffers of larger corporations. The right insurance policy can ensure continuity in the face of adversity, whether it’s a natural disaster, a legal liability claim, or an unexpected operational setback.

The first step in navigating this landscape is understanding the basic types of insurance available. These include general liability insurance, which covers common risks like property damage and bodily injury claims, and professional liability insurance (also known as errors and omissions insurance), which is crucial for businesses offering professional services and advice.

Other fundamental coverages include property insurance, safeguarding against physical damage to the business premises and its contents, and workers' compensation insurance, which provides benefits to employees injured on the job.

| Insurance Type | Description |

|---|---|

| General Liability | Covers property damage and bodily injury claims. |

| Professional Liability | Protects businesses offering professional services. |

| Property Insurance | Safeguards business premises and contents. |

| Workers' Compensation | Provides benefits for employee injuries. |

Tailoring Coverage to Your Business Needs

While understanding the basics is essential, the real challenge lies in tailoring these coverages to the specific needs of your business. Every enterprise is unique, and so are the risks it faces. For instance, a tech startup may require cyber liability insurance to protect against data breaches, while a retail store might prioritize product liability insurance to cover potential issues with the goods it sells.

Consider the following real-world example: A small consulting firm in the health sector might need professional liability insurance to protect against claims of negligence or errors in their advice. On the other hand, a local bakery might require product liability insurance to cover potential food contamination incidents.

The Cost-Benefit Analysis

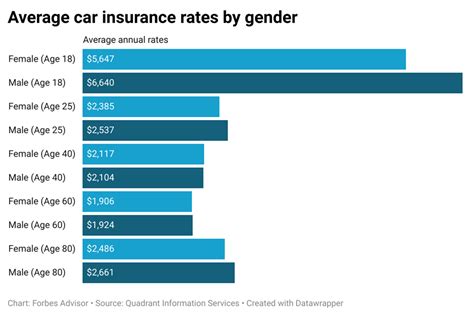

One of the biggest considerations for small businesses is the cost of insurance. Premiums can vary significantly based on factors like the nature of the business, its location, and the level of coverage desired. It’s crucial to strike a balance between adequate coverage and financial feasibility.

Conducting a thorough cost-benefit analysis is key. This involves not just considering the immediate financial impact of the premium, but also the potential long-term benefits of the coverage. For instance, while a high-premium policy might seem costly upfront, it could save the business from financial ruin in the event of a major claim.

Maximizing Coverage: Strategies for Small Businesses

Ensuring that your small business is adequately covered requires a strategic approach. Here, we delve into some advanced strategies to maximize the value of your insurance policies, ensuring they provide the protection your business truly needs.

Bundling Policies for Cost Efficiency

One effective strategy is to bundle multiple insurance policies together. Many insurance providers offer discounts when you purchase more than one policy from them. This could include combining general liability, professional liability, and property insurance into a single, comprehensive package.

For instance, a small marketing agency could bundle its general liability, professional liability, and cyber liability insurance to protect against a range of risks, from client lawsuits to data breaches. By doing so, the agency might qualify for significant discounts, making its insurance more cost-effective.

Understanding Exclusions and Deductibles

While insurance policies offer broad protection, they often come with exclusions—specific scenarios or events that aren’t covered. It’s crucial to thoroughly understand these exclusions to ensure your business isn’t left vulnerable. For instance, many general liability policies exclude damage caused by earthquakes or floods, which may require separate coverage.

Similarly, understanding deductibles is essential. A deductible is the amount you must pay out of pocket before your insurance coverage kicks in. While higher deductibles can lower premiums, they also mean you'll have to pay more out of pocket if a claim is made. It's a delicate balance, and one that should be considered carefully based on your business's financial health and risk tolerance.

Utilizing Risk Management Strategies

In addition to traditional insurance policies, small businesses can benefit from implementing risk management strategies. These strategies aim to mitigate risks before they lead to claims. For example, a restaurant could implement rigorous food safety protocols to reduce the likelihood of food-borne illnesses, thereby lowering the need for costly product liability claims.

Another strategy could involve regular employee training to reduce the risk of workplace accidents. This not only lowers the chances of workers' compensation claims but also fosters a safer work environment, which can boost employee morale and productivity.

The Future of Small Business Insurance: Trends and Innovations

The world of insurance is evolving, and small businesses need to stay abreast of these changes to ensure they’re accessing the most cutting-edge protection. Here, we explore some of the latest trends and innovations shaping the future of small business insurance.

The Rise of Digital Insurance

The digital revolution has touched every industry, and insurance is no exception. Digital insurance, also known as insurtech, is transforming the way small businesses access and manage their insurance policies. With digital platforms, businesses can now compare policies, purchase coverage, and manage their claims online, often at a lower cost and with greater convenience.

For instance, platforms like PolicyBazaar or GoCo offer small businesses an easy-to-use interface to shop for insurance, providing real-time quotes and allowing businesses to customize their policies based on their specific needs.

Personalized Coverage Options

One of the most significant trends in small business insurance is the move towards personalized coverage. Insurance providers are now offering more tailored policies, recognizing that every business has unique risks and needs. This shift is driven by the increasing availability of data, which allows insurers to more accurately assess and price risks.

For small businesses, this means being able to access insurance products that are more closely aligned with their specific needs. For example, a freelance writer might be able to purchase a professional liability policy that specifically covers the risks associated with their work, such as copyright infringement or plagiarism claims.

Incorporating Technology for Risk Assessment

Insurers are increasingly leveraging technology to better assess and manage risks. This includes the use of artificial intelligence and machine learning algorithms to analyze vast amounts of data and identify patterns that can help predict and manage risks more effectively.

For instance, some insurers are now using drone technology to inspect properties for potential risks, such as fire hazards or structural damage. This technology not only improves the accuracy of risk assessments but also reduces the need for physical inspections, making the process more efficient and cost-effective.

Conclusion: Empowering Small Businesses with Insurance Expertise

As we’ve explored, the world of small business insurance is complex but navigable. By understanding the fundamentals, tailoring coverage to your specific needs, and staying abreast of the latest trends and innovations, you can ensure your business is adequately protected. Remember, insurance is an investment in your business’s future, and the right coverage can be the difference between survival and success.

What is the average cost of insurance for a small business?

+The average cost of insurance for a small business can vary widely depending on several factors, including the type of business, its location, and the level of coverage required. According to recent data, the average annual premium for a small business with a general liability policy can range from 500 to 900, while professional liability policies can cost between 300 and 1,500 annually. However, these are just averages, and actual costs can be higher or lower depending on the specific circumstances of the business.

How can small businesses reduce their insurance costs?

+There are several strategies small businesses can employ to reduce their insurance costs. These include shopping around for the best rates, bundling policies to qualify for discounts, increasing deductibles to lower premiums, and implementing risk management strategies to reduce the likelihood of claims. Additionally, small businesses can explore alternative insurance options, such as captive insurance or peer-to-peer insurance, which can offer more affordable coverage tailored to their specific needs.

What are some common mistakes small businesses make with their insurance?

+Some common mistakes small businesses make with their insurance include underestimating their risks and not purchasing adequate coverage, failing to understand the terms and conditions of their policies, and not regularly reviewing and updating their coverage to reflect changes in their business. Additionally, some businesses may try to cut costs by going without insurance, which can be a risky move as it leaves them vulnerable to potentially devastating financial losses.