Texas Car Insurance Rates

When it comes to car insurance, Texas stands out as a unique market with its own set of regulations and factors influencing rates. Understanding the intricacies of Texas car insurance rates is essential for both residents and those considering a move to the Lone Star State. In this comprehensive guide, we'll delve into the specifics of car insurance in Texas, exploring the average rates, the factors that impact them, and how to navigate this complex landscape to find the best coverage at the right price.

The Landscape of Texas Car Insurance Rates

Texas is known for its diverse demographics, sprawling cities, and expansive rural areas, all of which contribute to the complexity of car insurance rates. The state’s unique no-fault system, combined with its vast geographic diversity, makes it a challenging market to navigate for insurance providers and consumers alike. Let’s break down the key elements that shape the car insurance landscape in Texas.

The Average Texas Car Insurance Rate

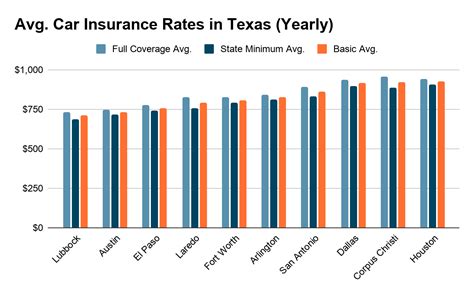

The average annual car insurance rate in Texas is approximately $1,500, which is higher than the national average. However, it’s important to note that this figure is just an average, and actual rates can vary significantly depending on various factors. Understanding these factors is crucial for predicting and managing your insurance costs effectively.

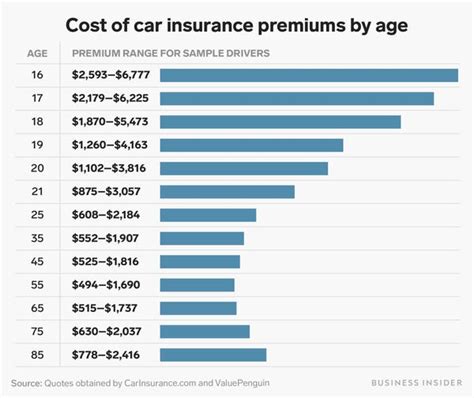

For instance, take the case of John Smith, a 35-year-old resident of Houston, Texas. John has a clean driving record and has been with the same insurance provider for over a decade. His annual premium is $1,200, which is lower than the state average due to his excellent driving history and long-term loyalty to his insurer. On the other hand, Sarah Johnson, a 22-year-old resident of Dallas, Texas, has a less pristine record with a few minor traffic violations. Her annual premium is $1,800, reflecting the higher risk associated with her driving history.

Factors Influencing Texas Car Insurance Rates

Several key factors come into play when determining car insurance rates in Texas. These include:

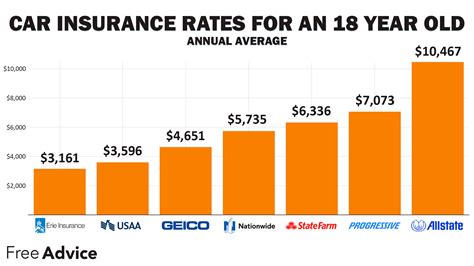

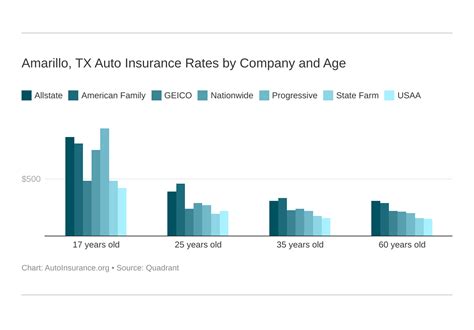

- Driver's Age and Gender: Younger drivers and males typically face higher insurance premiums due to their perceived higher risk.

- Driving Record: A clean driving record can lead to significant savings, while violations and accidents can increase rates.

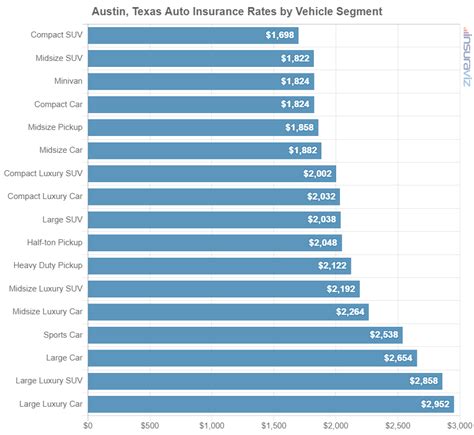

- Vehicle Type and Usage: The make, model, and age of your vehicle, as well as your daily commute and annual mileage, impact your rates.

- Location: Urban areas like Houston and Dallas often have higher rates due to increased traffic and accident risks.

- Coverage and Deductibles: The level of coverage you choose and your deductible amount can significantly affect your premium.

- Credit Score: In Texas, insurance providers are allowed to consider your credit score when determining your rate.

- Claims History: Filing frequent claims can lead to higher premiums or even non-renewal of your policy.

| Factor | Impact on Rates |

|---|---|

| Driver's Age and Gender | Younger drivers and males face higher rates. |

| Driving Record | Clean records lead to lower premiums; violations increase costs. |

| Vehicle Type and Usage | Make, model, age, and mileage impact rates. |

| Location | Urban areas have higher rates due to increased traffic and accidents. |

| Coverage and Deductibles | Higher coverage and lower deductibles often result in higher premiums. |

| Credit Score | Good credit can lead to lower rates, while poor credit may increase costs. |

| Claims History | Frequent claims can lead to higher premiums or policy non-renewal. |

Comparing Car Insurance Providers in Texas

With a vast array of insurance providers operating in Texas, it’s crucial to compare your options to find the best coverage at the most competitive rate. Here’s a breakdown of some of the leading insurers in the state and their average rates.

State Farm: A Texas Favorite

State Farm is one of the most popular insurance providers in Texas, known for its extensive agent network and comprehensive coverage options. The average annual premium for State Farm customers in Texas is around $1,400, making it a competitive choice for many drivers.

Geico: Competitive Rates and Online Convenience

Geico has gained popularity in Texas for its affordable rates and convenient online services. The average annual premium for Geico customers in the state is approximately $1,300, making it a cost-effective option for many.

Progressive: Customizable Coverage and Discounts

Progressive offers a wide range of coverage options and discounts, catering to diverse driver needs. The average annual premium for Progressive customers in Texas is around $1,500, with the potential for significant savings through their various discounts.

USAA: Exclusive Military Benefits

USAA stands out for its exclusive benefits for military members and their families. While their rates are competitive, USAA’s eligibility criteria limit their services to those with military affiliations. The average annual premium for USAA customers in Texas is approximately $1,200.

Allstate: Personalized Service and Claims Satisfaction

Allstate is known for its personalized service and customer-centric approach. Their average annual premium in Texas is around $1,600, with a focus on providing comprehensive coverage and a positive claims experience.

Tips for Finding the Best Texas Car Insurance Rates

Navigating the Texas car insurance market can be daunting, but with the right strategies, you can secure the best coverage at an affordable rate. Here are some expert tips to guide you through the process:

- Shop Around: Compare quotes from multiple providers to find the best rate for your needs. Online quote comparison tools can be a valuable resource.

- Review Your Coverage: Regularly assess your coverage to ensure it aligns with your current needs. You might be paying for unnecessary coverage or missing out on valuable discounts.

- Explore Discounts: Insurance providers offer a variety of discounts, such as safe driver discounts, multi-policy discounts, and loyalty rewards. Take advantage of these opportunities to lower your premium.

- Improve Your Credit Score: In Texas, insurance providers can consider your credit score when determining your rate. Improving your credit can lead to significant savings on your premium.

- Consider Bundling: Bundling your car insurance with other policies, such as home or renters insurance, can often result in substantial discounts.

- Maintain a Clean Driving Record: A clean driving record is a key factor in keeping your insurance rates low. Avoid violations and accidents to maintain a favorable insurance profile.

The Future of Texas Car Insurance Rates

The Texas car insurance market is constantly evolving, and several trends and factors are shaping its future. Here’s a glimpse into what the future might hold:

Technological Advancements

The integration of technology in the insurance industry is transforming the way policies are priced and managed. Telematics devices, which track driving behavior, and the use of AI for claims processing are expected to play a more significant role in the future, potentially impacting rates.

Regulatory Changes

Texas’s unique no-fault insurance system is under scrutiny, with some advocating for a shift to a more traditional tort-based system. Any changes to the regulatory landscape could have a significant impact on insurance rates and the overall market dynamics.

Increased Competition

The entry of new insurance providers, particularly those focused on digital services and innovative coverage options, is expected to intensify competition in the Texas market. This could lead to more competitive rates and a wider range of coverage choices for consumers.

The Impact of Climate Change

Texas’s susceptibility to severe weather events, such as hurricanes and flooding, is a growing concern. The increasing frequency and severity of these events could lead to higher insurance rates, especially for those in high-risk areas.

Conclusion

Understanding the intricacies of Texas car insurance rates is essential for making informed decisions about your coverage. By staying informed about the factors that influence rates, comparing providers, and implementing cost-saving strategies, you can navigate the Texas car insurance landscape with confidence. Remember, the right coverage at the right price is within your reach, and with the right approach, you can ensure you’re adequately protected while keeping your insurance costs manageable.

What is the minimum car insurance coverage required in Texas?

+The minimum liability coverage required in Texas is 30/60/25, which covers bodily injury liability, property damage liability, and personal injury protection. However, many experts recommend purchasing higher limits to ensure adequate protection.

Can I get car insurance without a license in Texas?

+No, you must have a valid driver’s license to purchase car insurance in Texas. However, non-driving vehicle owners can purchase non-owner liability insurance to cover their vehicle when driven by others.

Are there any discounts available for Texas car insurance?

+Yes, Texas insurance providers offer a variety of discounts, including safe driver discounts, multi-policy discounts, loyalty rewards, and discounts for specific professions or affiliations. It’s worth exploring these options to lower your premium.

How often should I review my car insurance policy in Texas?

+It’s a good practice to review your car insurance policy annually, or whenever your circumstances change significantly. This ensures your coverage remains adequate and that you’re taking advantage of any new discounts or coverage options available.

Can I switch car insurance providers in Texas if I’m not satisfied with my current coverage or rate?

+Absolutely! You have the freedom to switch car insurance providers at any time in Texas. If you’re not satisfied with your current coverage or rate, it’s worth shopping around for a better deal. Remember to maintain continuous coverage to avoid gaps in your insurance history.