Affordable Health Care Insurance In Ohio

Finding affordable health insurance in Ohio can be a complex task, especially with the ever-changing landscape of healthcare policies and providers. This comprehensive guide aims to provide you with an in-depth analysis of the various options available in the Buckeye State, helping you navigate the system and make an informed decision to secure the best coverage for your needs.

Understanding the Ohio Health Insurance Market

Ohio’s health insurance market is diverse, offering a range of plans to cater to different demographics and needs. The state actively participates in the federal Affordable Care Act (ACA), which has expanded access to healthcare for many residents. Understanding the market dynamics and your rights under the ACA is crucial to finding the most suitable and affordable plan.

Key Players in Ohio’s Insurance Landscape

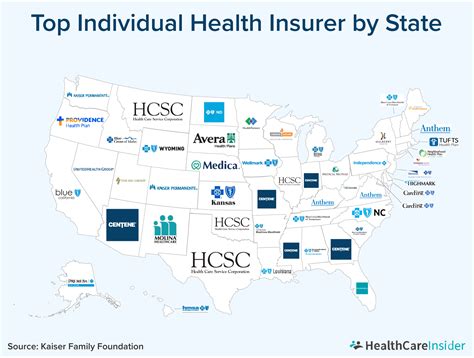

Ohio has a number of prominent insurance providers, each with its own set of plans and networks. Some of the major players include Anthem Blue Cross Blue Shield, Medical Mutual of Ohio, UnitedHealthcare, and CareSource. These companies offer a variety of plans, from HMOs to PPOs and POS plans, each with its own unique network of providers and coverage options.

| Insurance Provider | Plan Types | Notable Features |

|---|---|---|

| Anthem Blue Cross Blue Shield | HMO, PPO, POS | Wide network of providers, including specialty care. |

| Medical Mutual of Ohio | HMO, PPO | Flexible plans with competitive pricing. |

| UnitedHealthcare | HMO, PPO | National network access and robust telemedicine options. |

| CareSource | HMO | Specializes in Medicaid and Medicare plans, offering affordable options for low-income individuals. |

Assessing Your Needs and Budget

Before diving into the specifics of Ohio’s health insurance options, it’s crucial to evaluate your personal healthcare needs and budget. This self-assessment will help you narrow down your choices and find a plan that provides the right balance of coverage and affordability.

Identifying Your Healthcare Requirements

Consider your current and potential future healthcare needs. Do you frequently visit specialists or require regular prescriptions? Are you planning for any major medical events, like surgery or childbirth, in the near future? Understanding your healthcare usage patterns will help you choose a plan with appropriate coverage limits and benefits.

Determining Your Budget and Financial Assistance Options

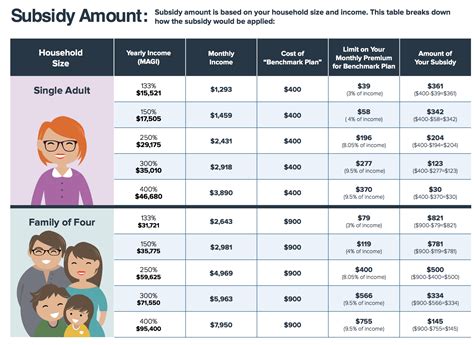

Health insurance can be a significant expense, but there are ways to mitigate the costs. Ohio residents who meet certain income criteria may be eligible for financial assistance under the ACA. This assistance can reduce the cost of premiums, making insurance more affordable. It’s important to research and understand your potential eligibility to leverage these benefits.

Additionally, consider your overall financial situation. Can you afford a higher premium in exchange for lower out-of-pocket costs when you need medical care? Or would a lower premium with potentially higher out-of-pocket expenses be more suitable for your budget? This decision will depend on your risk tolerance and expected healthcare usage.

Exploring Plan Types and Coverage Options

Ohio offers a variety of health insurance plans, each with its own set of benefits, networks, and costs. Understanding the different plan types and their nuances is essential to making an informed choice.

Health Maintenance Organizations (HMOs)

HMOs are a popular choice for those seeking comprehensive coverage at a fixed cost. These plans typically require you to choose a primary care physician (PCP) who coordinates your care and refers you to specialists within the HMO network. HMOs often have lower premiums and out-of-pocket costs but may limit your choice of providers.

Preferred Provider Organizations (PPOs)

PPOs offer more flexibility in choosing healthcare providers, both inside and outside the network. You can visit any provider, but you’ll generally pay less when using in-network doctors and hospitals. PPOs often have higher premiums but provide greater freedom of choice and can be a good fit for those who value flexibility.

Point of Service (POS) Plans

POS plans combine elements of both HMOs and PPOs. You typically choose a PCP and receive coordinated care within the network, but you can also access out-of-network providers for an additional cost. POS plans offer a balance between the structure of HMOs and the flexibility of PPOs.

Other Plan Types

Ohio also offers other plan types, such as High Deductible Health Plans (HDHPs) which are often paired with Health Savings Accounts (HSAs) to provide tax-advantaged savings for healthcare expenses. There are also Short-Term Health Insurance plans, which can provide temporary coverage, and Medicaid and Medicare plans for low-income individuals and seniors.

Analyzing Provider Networks and Coverage Areas

The network of providers covered by your health insurance plan is a critical factor to consider. Ensure that your preferred doctors, hospitals, and specialists are in-network to avoid unexpected out-of-pocket expenses. Additionally, verify that the plan’s coverage area includes your primary residence and any secondary residences you may use regularly.

Researching Provider Networks

Each insurance provider maintains a network of contracted healthcare providers. These networks can vary significantly, even between plans offered by the same provider. Research the network to ensure it includes your preferred providers and covers the services you require. Some plans may have narrow networks, which can limit your choices, while others may have broader networks offering more flexibility.

Understanding Coverage Areas

While most plans will cover you nationwide in case of emergencies, regular care is often restricted to the plan’s coverage area. This is especially important if you travel frequently or have multiple residences. Ensure that your plan’s coverage area aligns with your lifestyle to avoid any gaps in coverage.

Comparing Costs and Benefits

Health insurance plans in Ohio vary widely in terms of costs and benefits. It’s crucial to thoroughly compare these aspects to find the plan that best suits your needs and budget.

Evaluating Premiums and Out-of-Pocket Costs

Premiums are the regular payments you make to maintain your health insurance coverage. Out-of-pocket costs include deductibles, copayments, and coinsurance. Deductibles are the amount you pay before your insurance coverage begins, while copayments and coinsurance are the fees you pay for covered services after your deductible is met.

When comparing plans, consider both the premium and the potential out-of-pocket costs. A plan with a lower premium may seem more affordable, but if it has a high deductible or copayments, your overall healthcare expenses could be higher. Conversely, a plan with a higher premium and lower out-of-pocket costs might be a better fit if you anticipate frequent medical needs.

Assessing Covered Services and Benefits

Health insurance plans cover a range of services, including doctor visits, hospital stays, prescription drugs, and more. Some plans may also offer additional benefits like vision or dental coverage, mental health services, or wellness programs. Ensure that the plan you choose covers the services you require and provides benefits that align with your personal health goals.

Enrolling in a Health Insurance Plan

Once you’ve identified the right plan for your needs, it’s time to enroll. Ohio residents can enroll in health insurance plans during the annual Open Enrollment Period, which typically runs from November to December. However, you may also be eligible for a Special Enrollment Period if you experience a qualifying life event, such as losing your job or having a baby.

The Enrollment Process

To enroll, you’ll need to provide personal and financial information. This includes your name, date of birth, Social Security number, and income details. You’ll also need to choose a plan that meets your needs and budget. The insurance provider will then verify your eligibility and process your enrollment.

Verification and Documentation

During the enrollment process, you may be required to provide documentation to verify your identity, residency, and income. This could include a driver’s license, passport, or other government-issued ID, proof of address (such as a utility bill), and tax returns or pay stubs to verify your income.

Conclusion: Securing Affordable Healthcare in Ohio

Navigating the health insurance landscape in Ohio can be complex, but with careful evaluation of your needs, budget, and the available plan options, you can find affordable and comprehensive coverage. Remember to research thoroughly, compare plans, and take advantage of any financial assistance for which you may be eligible. By making an informed decision, you can secure the peace of mind that comes with quality healthcare coverage.

What is the Affordable Care Act (ACA)?

+The Affordable Care Act, commonly known as Obamacare, is a federal law that aims to make healthcare more affordable and accessible. It requires most Americans to have health insurance and offers financial assistance to those who qualify. The ACA has significantly expanded coverage in Ohio and across the United States.

Can I get health insurance outside of the Open Enrollment Period?

+Yes, you can enroll in health insurance outside of the Open Enrollment Period if you experience a qualifying life event, such as losing your job, getting married, or having a baby. These events trigger a Special Enrollment Period, allowing you to enroll outside of the typical enrollment window.

How do I know if I’m eligible for financial assistance under the ACA?

+Eligibility for financial assistance under the ACA is based on your income. Generally, if your household income is below a certain threshold (which varies by family size and state), you may qualify for premium tax credits or cost-sharing reductions. You can use the Health Insurance Marketplace’s eligibility tool to determine if you’re eligible.