Good Car Insurance For Military

For those who have served or are actively serving in the military, finding the right car insurance can be a crucial aspect of financial planning. Military personnel often face unique challenges and circumstances, and having adequate insurance coverage is essential to protect their vehicles and finances. This article aims to delve into the world of car insurance specifically tailored for military personnel, exploring the features, benefits, and considerations to help you make an informed decision.

Understanding the Importance of Car Insurance for Military Personnel

Military life comes with its own set of complexities, including frequent relocations, deployments, and unique financial considerations. Having reliable car insurance is not just a legal requirement but also a financial safeguard. It provides protection against unexpected events such as accidents, theft, or natural disasters, ensuring that military members and their families are not left vulnerable to financial burdens.

The specific needs of military personnel often require insurance policies that offer more comprehensive coverage and flexible terms. This includes considerations like coverage during deployments, discounts for multiple vehicles, and options for temporary storage or non-operation of vehicles. Understanding these unique needs is the first step towards finding the right car insurance provider.

Key Features to Look for in Military Car Insurance

When shopping for car insurance as a member of the military, there are several key features that can significantly enhance your coverage and overall experience. Here are some of the most important aspects to consider:

Deployment Coverage

One of the most critical features for military personnel is deployment coverage. This type of coverage ensures that your vehicle is protected even when it’s not in use due to deployment. It typically covers incidents like theft, vandalism, or natural disasters that may occur while your vehicle is parked or stored. Some insurance providers even offer storage coverage, which can be a lifesaver for those leaving their cars behind during extended missions.

Multiple Vehicle Discounts

Military families often have multiple vehicles, whether it’s a car for each spouse or additional vehicles for children. Insurance companies that offer discounts for multiple vehicles can significantly reduce your overall insurance costs. This is especially beneficial for families with several drivers, as it encourages safe driving practices and provides comprehensive coverage for all vehicles under one policy.

Flexible Payment Plans

Given the unique financial circumstances of military life, it’s essential to find an insurance provider that offers flexible payment plans. This can include options like monthly, quarterly, or annual payments, with the ability to adjust the payment schedule as needed. Some insurers even provide discounts for paying the full premium upfront or for setting up automatic payments.

Military Discounts and Rewards

Many car insurance companies recognize and appreciate the service of military personnel by offering military discounts and rewards. These can range from percentage-based discounts on premiums to additional benefits like free roadside assistance or waived deductibles for certain incidents. Always inquire about these perks when comparing insurance providers, as they can make a significant difference in your overall costs.

Specialized Claims Handling

In the event of an accident or claim, having an insurance provider with specialized claims handling for military personnel can be invaluable. This means they have processes in place to understand the unique circumstances of military life, such as frequent moves or deployments. A good insurance company will have a dedicated team to handle military claims efficiently and compassionately, ensuring a smoother process during already stressful times.

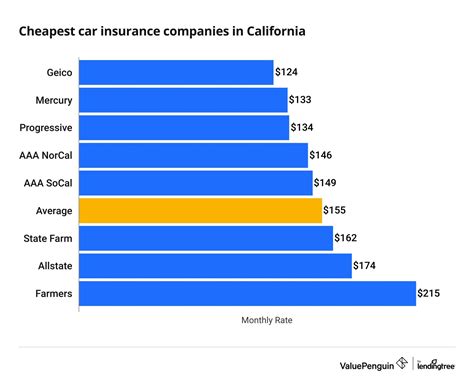

Top Car Insurance Providers for Military Personnel

While many standard insurance companies offer policies to military personnel, some providers have specialized offerings that cater specifically to the needs of the military community. Here’s an overview of some of the top car insurance providers for military personnel, along with their unique features and benefits:

| Insurance Provider | Key Features |

|---|---|

| USAA | Known for its exceptional service to military members, USAA offers comprehensive coverage with deployment protection, multiple vehicle discounts, and flexible payment options. They also provide military-specific benefits like waived deductibles for certain incidents and free roadside assistance. |

| GEICO | GEICO has a strong reputation for affordable insurance and excellent customer service. They offer deployment coverage, multiple vehicle discounts, and flexible payment plans. Additionally, GEICO provides military-exclusive benefits like discounts for certain military affiliations and special rates for active-duty members. |

| MetLife | MetLife specializes in customizable coverage for military personnel. They offer deployment protection, multiple vehicle discounts, and flexible payment options. MetLife also provides unique benefits like discounts for hybrid and electric vehicles and accident forgiveness, which can be particularly valuable for military families. |

| Progressive | Progressive is known for its innovative insurance products and customer-centric approach. They offer deployment coverage, multiple vehicle discounts, and flexible payment plans. Additionally, Progressive provides military discounts and special rates for certain military affiliations, making it a popular choice among military personnel. |

| Allstate | Allstate offers a range of coverage options tailored for military families. They provide deployment protection, multiple vehicle discounts, and flexible payment plans. Allstate also has a strong focus on customer satisfaction, with 24/7 customer service and claims support, ensuring military members receive the assistance they need, when they need it. |

Factors to Consider When Choosing Military Car Insurance

While the features and benefits offered by insurance providers are essential, there are several other factors to consider when choosing the right car insurance for military personnel. These considerations can help ensure you’re getting the best coverage and value for your specific needs.

Coverage Options and Limits

Understanding the coverage options and limits offered by each insurance provider is crucial. This includes considering the liability coverage, collision coverage, comprehensive coverage, and any optional add-ons like rental car reimbursement or roadside assistance. Ensure the coverage limits are adequate for your needs and align with your financial ability to pay in the event of an accident or claim.

Discounts and Rewards

In addition to military-specific discounts, many insurance providers offer a range of other discounts and rewards. These can include safe driver discounts, good student discounts, loyalty rewards, and bundle discounts for combining multiple insurance policies (such as auto and home insurance). Taking advantage of these discounts can significantly reduce your insurance premiums over time.

Customer Service and Claims Handling

The quality of customer service and claims handling can greatly impact your experience with an insurance provider. Look for companies that offer 24⁄7 customer support, online account management, and a dedicated claims team with experience handling military-related claims. Reading reviews and testimonials from other military personnel can provide valuable insights into the level of service and support you can expect.

Financial Stability and Reputation

It’s essential to choose an insurance provider with a solid financial stability and a good reputation in the industry. This ensures they will be able to pay out claims promptly and fairly, even in the event of a large-scale disaster or economic downturn. Consider checking the insurer’s financial ratings and reading independent reviews to gauge their overall reliability and customer satisfaction.

Ease of Use and Digital Tools

In today’s digital age, many insurance providers offer a range of online and mobile tools to enhance the customer experience. Look for insurers that provide easy-to-use websites and apps for policy management, online claims reporting, digital ID cards, and real-time policy updates. These features can make it simpler to manage your insurance needs, especially during deployments or frequent relocations.

Comparative Analysis: Choosing the Best Fit for Your Needs

When comparing car insurance options for military personnel, it’s important to evaluate each provider based on your specific needs and circumstances. Here’s a step-by-step guide to help you make an informed decision:

- Identify your priority needs and budget constraints. Are you looking for the most comprehensive coverage, or are you more focused on finding the most affordable option? Understanding your priorities will help narrow down your options.

- Research and compare the coverage options, limits, and benefits offered by each provider. Pay attention to the details, especially those that are unique to military personnel, such as deployment coverage and multiple vehicle discounts.

- Evaluate the customer service and claims handling reputation of each provider. Look for insurers with a history of providing excellent service and support, especially when it comes to handling military-related claims.

- Consider the financial stability and reputation of each insurance company. Check their financial ratings and read independent reviews to ensure they are a reliable and trustworthy provider.

- Explore the digital tools and online resources offered by each insurer. In today's fast-paced world, having easy access to policy management and claims reporting can be a significant advantage, especially for those frequently on the move.

- Read reviews and testimonials from other military personnel who have used the insurance providers you're considering. Real-life experiences can provide valuable insights into the quality of service and coverage you can expect.

- Get quotes from multiple providers to compare prices and coverage. Remember, the cheapest option may not always be the best, so consider the value and benefits provided along with the cost.

- Once you've narrowed down your options, reach out to the insurance providers with any remaining questions or concerns. Speaking directly with a representative can give you a better sense of their customer service and willingness to accommodate your specific needs.

- Finally, make your decision based on a comprehensive evaluation of all the factors discussed above. Choose the provider that best aligns with your needs, budget, and priorities, ensuring you have the peace of mind that comes with reliable car insurance coverage.

Frequently Asked Questions (FAQ)

Can I get car insurance specifically for military personnel if I’m a veteran?

+

Yes, many insurance providers that offer military-specific car insurance also extend their services to veterans. While some benefits may differ, veterans can often still access deployment coverage, multiple vehicle discounts, and other military-related perks. It’s always best to check with individual insurance companies to understand their specific policies for veterans.

Do I need to notify my insurance provider if I’m deployed, or if my vehicle is temporarily stored?

+

Yes, it’s important to keep your insurance provider informed about any changes in the use or location of your vehicle. Deployments and temporary storage can impact your insurance coverage and premiums. Most insurance companies offer deployment coverage, but you should always verify the specific terms and conditions with your provider to ensure you’re adequately covered during these periods.

Are there any special considerations for military personnel when it comes to filing car insurance claims?

+

Yes, military personnel may have unique considerations when filing car insurance claims. It’s important to inform your insurance provider about your military status and any relevant details, such as deployment or relocation. Many insurance companies have dedicated claims teams for military personnel, who are trained to handle these unique circumstances and can provide specialized support and guidance.

Can I bundle my car insurance with other types of insurance, like home or life insurance, to save money?

+

Absolutely! Bundling your car insurance with other types of insurance, such as home or life insurance, is a great way to save money. Many insurance providers offer bundle discounts when you combine multiple policies. By bundling your insurance, you can often enjoy significant savings and streamlined policy management. Just be sure to compare the bundled rates with the individual policy rates to ensure you’re getting the best value.