Auto Insurance Near Me

Finding reliable and affordable auto insurance is a crucial aspect of vehicle ownership. With a vast array of insurance providers offering various coverage options, it can be challenging to navigate the market and locate the best policies near your area. This comprehensive guide aims to demystify the process, providing you with the tools and knowledge to make informed decisions and secure the right auto insurance coverage.

Understanding Auto Insurance: The Fundamentals

Auto insurance is a contract between you, the policyholder, and the insurance company. It provides financial protection against potential losses, covering a range of risks associated with owning and operating a motor vehicle. This protection comes in the form of liability coverage, which pays for damages you cause to others, and comprehensive coverage, which covers your vehicle’s damages or loss.

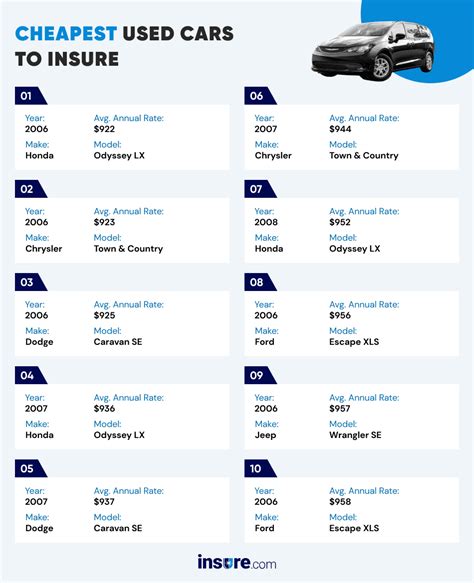

The cost of auto insurance, often referred to as the premium, is influenced by a multitude of factors. These include the type of vehicle you drive, your driving history, your age, gender, and marital status, the area where you live, and the amount of coverage you choose. It's important to understand these factors to make informed decisions and secure the best rates.

Key Components of Auto Insurance

- Liability Coverage: This is the most basic and essential type of auto insurance. It covers the costs associated with bodily injury and property damage that you cause to others in an accident. It’s divided into two main categories: Bodily Injury Liability and Property Damage Liability.

- Comprehensive Coverage: This type of insurance provides protection for your vehicle against non-collision events such as theft, vandalism, natural disasters, and damage caused by animals. It’s an optional coverage but highly recommended, especially if your vehicle is still being financed or leased.

- Collision Coverage: Collision insurance covers damages to your vehicle resulting from an accident, regardless of fault. It’s often required by lenders if you’re financing or leasing your car. This coverage is essential for protecting your vehicle’s value.

- Medical Payments Coverage: Also known as MedPay, this coverage pays for the medical expenses incurred by you or your passengers after an accident, regardless of who is at fault. It provides quick and easy access to funds for medical bills, making it a valuable addition to your insurance policy.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you in the event of an accident with a driver who has no insurance or insufficient insurance to cover the damages. It’s an important safeguard to have, as it ensures you’re not left financially responsible for damages caused by an uninsured driver.

The Auto Insurance Landscape Near You

The auto insurance market is diverse, with numerous providers offering a wide range of policies and coverage options. To make an informed decision, it’s crucial to understand the local market and the offerings of different insurers.

Local Providers and Their Offerings

Start by researching auto insurance providers that operate in your area. Some of the most prominent names in the industry include State Farm, GEICO, Progressive, and Allstate. These companies often have a strong presence in most regions and offer competitive rates and comprehensive coverage options.

In addition to these national players, there are also regional and local insurance providers. These companies might offer more tailored coverage options, better rates for specific demographics, or unique discounts based on your local community. For example, a local insurer might provide special rates for teachers or members of certain organizations.

| Insurance Provider | Coverage Highlights | Discounts |

|---|---|---|

| State Farm | Offers comprehensive coverage, including rental car insurance and roadside assistance. | Good Student Discount, Loyalty Discount, Multi-Policy Discount |

| GEICO | Known for competitive rates and online convenience. Provides pet injury coverage and emergency roadside service. | Military Discount, Good Student Discount, New Car Discount |

| Progressive | Offers snapshot program for personalized rates based on driving habits. Provides comprehensive rental car coverage. | Multi-Policy Discount, Good Student Discount, Pay-in-Full Discount |

| Allstate | Provides accident forgiveness and safe driving bonus checks. Offers roadside assistance and rental car reimbursement. | Safe Driver Discount, Multi-Policy Discount, Good Student Discount |

Comparing Auto Insurance Policies: What to Consider

When comparing auto insurance policies, it’s important to look beyond just the premium. Consider the coverage limits, deductibles, and additional benefits offered by each policy. Here’s a breakdown of what to look for:

Coverage Limits

Coverage limits refer to the maximum amount your insurance company will pay for covered damages or losses. It’s important to ensure that your policy’s limits are sufficient to cover potential losses. Here are some key coverage limits to consider:

- Bodily Injury Liability Limits: This covers the costs associated with injuries you cause to others in an accident. It’s typically expressed as two numbers, such as 100,000/300,000. The first number represents the maximum payout per person, while the second number represents the maximum payout per accident.

- Property Damage Liability Limits: This covers the cost of damage you cause to others’ property, typically expressed as a single number, like $50,000. Ensure this limit is sufficient to cover potential property damage claims.

- Collision and Comprehensive Coverage Limits: These limits determine the maximum amount your insurer will pay for damages to your vehicle. Consider your vehicle’s value and potential repair costs when choosing these limits.

Deductibles

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium, but it also means you’ll have to pay more out of pocket if you need to make a claim. On the other hand, a lower deductible provides more financial protection but results in a higher premium.

Additional Benefits and Coverage Options

Beyond the standard coverage types, many insurers offer additional benefits and coverage options. These can include:

- Rental Car Reimbursement: This coverage provides a daily allowance for a rental car if your vehicle is being repaired due to a covered loss.

- Roadside Assistance: Offers emergency services like towing, flat tire changes, and battery jump-starts.

- Gap Insurance: Covers the difference between what you owe on your vehicle and its actual cash value in case it’s totaled or stolen.

- Custom Parts and Equipment Coverage: Provides protection for custom modifications and accessories installed on your vehicle.

Securing the Right Auto Insurance Policy

Now that you understand the fundamentals of auto insurance and have researched the local market, it’s time to secure the right policy for your needs. Here’s a step-by-step guide to help you through the process:

Step 1: Determine Your Coverage Needs

Start by assessing your specific needs and circumstances. Consider factors like your vehicle’s value, your driving history, and your financial situation. Determine the type and amount of coverage you require. Remember, while it’s tempting to choose the lowest premium, it’s crucial to ensure you have sufficient coverage to protect yourself and your assets.

Step 2: Compare Quotes from Multiple Providers

Use online tools and resources to obtain quotes from multiple insurance providers. Compare the premiums, coverage limits, deductibles, and additional benefits offered by each. Don’t forget to check for discounts that you might be eligible for, such as safe driver discounts, multi-policy discounts, or good student discounts.

Step 3: Review Policy Details

Once you’ve obtained quotes, delve deeper into the policy details. Read the fine print to understand what’s covered and what’s not. Pay attention to any exclusions or limitations. Ensure that the policy aligns with your needs and provides the level of protection you’re seeking.

Step 4: Choose the Right Provider

Based on your comparisons and reviews, select the provider that offers the best combination of coverage, premium, and additional benefits. Consider the provider’s reputation, customer service, and financial stability. It’s important to choose a reliable and trustworthy insurer to ensure seamless claim processes and long-term protection.

Step 5: Purchase Your Policy

Once you’ve made your decision, it’s time to purchase your auto insurance policy. You can often do this online or over the phone. Make sure to review the policy documents carefully and ask any questions you might have before finalizing the purchase. Ensure that you understand the coverage terms and conditions.

The Benefits of Having the Right Auto Insurance

Securing the right auto insurance policy provides a range of benefits, including:

- Financial Protection: Auto insurance protects you from significant financial losses in the event of an accident or other covered event. It ensures that you’re not left with unaffordable repair bills or medical expenses.

- Peace of Mind: With comprehensive coverage, you can drive with confidence, knowing that your vehicle and assets are protected. This peace of mind can greatly reduce stress and anxiety associated with vehicle ownership.

- Legal Compliance: Most states require a minimum level of auto insurance coverage. Having the right policy ensures that you’re in compliance with the law and avoids potential penalties or legal issues.

- Accident Forgiveness: Many insurers offer accident forgiveness programs, which protect your premium from increasing after your first at-fault accident. This can provide significant savings over time.

Conclusion

Navigating the world of auto insurance can be complex, but with the right knowledge and tools, you can secure the best coverage for your needs. Remember to compare policies, understand the coverage options, and choose a reputable provider. By doing so, you’ll be well-protected on the road and have peace of mind knowing that you’re adequately insured.

How much does auto insurance typically cost?

+The cost of auto insurance varies widely depending on numerous factors, including the type of vehicle, driving history, age, and location. On average, drivers can expect to pay between 500 and 1,500 per year for a basic liability policy. However, comprehensive coverage and additional benefits can significantly increase the premium.

What factors influence auto insurance rates?

+Auto insurance rates are influenced by various factors, including the type of vehicle, the driver’s age and gender, driving history, credit score, and the area where the vehicle is garaged. Insurers also consider the likelihood of accidents and theft in a particular region.

How can I save money on auto insurance?

+There are several ways to save on auto insurance. These include shopping around for quotes, maintaining a clean driving record, increasing your deductible, bundling policies with the same insurer, and taking advantage of discounts for safe driving, good grades, or membership in certain organizations.