Top Car Insurance Companies In Texas

The Lone Star State, Texas, is known for its vibrant culture, diverse landscapes, and, of course, its love for cars. With a vast network of highways and roads, ensuring the safety and financial protection of drivers is paramount. In this comprehensive guide, we delve into the world of car insurance in Texas, uncovering the top insurance companies that offer the best coverage, value, and customer satisfaction. Get ready to navigate the intricate landscape of auto insurance with expert insights and real-world examples to make an informed decision.

Understanding the Texas Car Insurance Landscape

Texas boasts a highly competitive insurance market, with numerous providers vying for customers. This competitive environment often translates into a wide range of coverage options, competitive pricing, and innovative features to attract and retain policyholders. However, with so many choices, it’s essential to navigate this landscape carefully to find the best fit for your specific needs.

In Texas, the legal requirement for car insurance is a minimum of liability coverage, which includes bodily injury liability and property damage liability. However, most drivers opt for more comprehensive coverage, including collision and comprehensive insurance, to protect against a wider range of risks. Additionally, Texas is a tort state, which means at-fault drivers are responsible for damages and injuries they cause in an accident.

The average cost of car insurance in Texas is slightly higher than the national average, with factors such as the driver's age, driving record, and the make and model of the vehicle playing a significant role in determining premiums. Understanding these factors and how they influence insurance rates is crucial for getting the best deal.

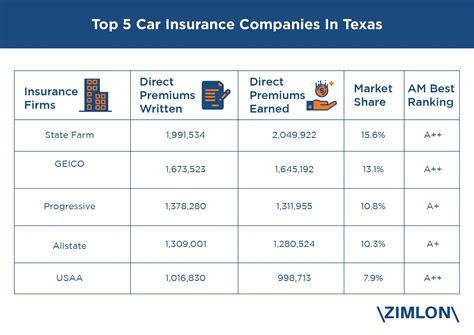

The Top Car Insurance Companies in Texas

Now, let’s explore the cream of the crop in the Texas car insurance market. These companies have consistently demonstrated exceptional performance, offering competitive rates, comprehensive coverage, and exceptional customer service.

State Farm: A Trusted Leader in Texas

State Farm has established itself as a prominent player in the Texas car insurance market, known for its extensive network of local agents and a commitment to customer satisfaction. With a focus on personalized service, State Farm offers a range of coverage options tailored to the unique needs of Texas drivers.

Key Features:

- Competitive Rates: State Farm consistently offers some of the most affordable premiums in Texas, especially for drivers with a clean record.

- Discounts: The company provides a wide range of discounts, including multi-policy, good student, and safe driver discounts, making it easy to save.

- Digital Tools: State Farm's mobile app and online platform make managing policies and filing claims convenient and efficient.

- Excellent Customer Service: With a dedicated team of local agents, State Farm ensures personalized support and guidance.

State Farm's strong presence in Texas and its commitment to providing quality coverage at competitive rates make it an excellent choice for many drivers. The company's focus on customer satisfaction and its extensive range of coverage options cater to a diverse range of needs.

Geico: A National Powerhouse in Texas

Geico, a well-known national brand, has made significant inroads into the Texas market, offering competitive rates and a user-friendly digital experience. The company’s focus on innovation and technology has attracted a loyal customer base, especially among younger drivers and those seeking a convenient, online insurance experience.

Key Features:

- Low Rates: Geico is renowned for its affordable premiums, making it an attractive option for budget-conscious drivers.

- Digital Convenience: The company's website and mobile app offer an intuitive experience, allowing customers to manage policies and file claims with ease.

- Discounts: Geico provides a variety of discounts, including those for military members, federal employees, and good students.

- Excellent Claims Process: Geico's efficient claims process, with options for online and app-based claims, ensures a seamless experience for policyholders.

Geico's combination of low rates, digital convenience, and a robust claims process has solidified its position as a top contender in the Texas car insurance market. Its ability to cater to diverse customer needs and preferences makes it a popular choice for many drivers.

Allstate: Comprehensive Coverage and Excellent Service

Allstate, a long-standing player in the insurance industry, has built a strong reputation in Texas for its comprehensive coverage options and exceptional customer service. With a focus on providing peace of mind, Allstate offers a wide range of coverage choices to suit different lifestyles and driving habits.

Key Features:

- Wide Range of Coverage Options: Allstate provides comprehensive coverage, including unique offerings like Safe Driving Bonus Checks and Disappearing Deductible, rewarding safe driving habits.

- Discounts: Allstate offers various discounts, such as the Drivewise program, which rewards safe driving with potential savings.

- Local Agents: Allstate's network of local agents ensures personalized support and guidance for policyholders.

- Excellent Claims Service: Allstate's Claim Satisfaction Guarantee ensures a stress-free claims process, with a dedicated team to handle claims efficiently.

Allstate's commitment to providing comprehensive coverage and excellent customer service has earned it a strong reputation in Texas. The company's focus on rewarding safe driving habits and its extensive range of coverage options make it a top choice for drivers seeking peace of mind.

USAA: Premier Choice for Military Families

USAA is a highly regarded insurance provider, exclusively serving military members, veterans, and their families. With a deep understanding of the unique needs of this demographic, USAA has established itself as a top choice for those who have served or are currently serving in the military.

Key Features:

- Affordable Rates: USAA consistently offers some of the most competitive rates in the market, tailored to the financial needs of military families.

- Military-Centric Coverage: USAA provides specialized coverage, including deployment travel discounts and rental car coverage for those on leave.

- Excellent Customer Service: USAA's dedication to its members is evident through its highly responsive and knowledgeable customer service team.

- Discounts: USAA offers a range of discounts, including those for safe driving, multiple policies, and loyalty.

USAA's focus on serving the military community with affordable, tailored coverage and exceptional customer service has made it a top choice for military families in Texas. The company's understanding of the unique challenges faced by this demographic sets it apart in the insurance landscape.

Progressive: Innovative Options for Texas Drivers

Progressive, a well-known name in the insurance industry, has made a significant impact in the Texas market with its innovative coverage options and digital convenience. The company’s focus on providing customizable coverage and an efficient claims process has attracted a loyal customer base.

Key Features:

- Customizable Coverage: Progressive offers a range of coverage options, allowing drivers to tailor their policies to their specific needs.

- Snapshot Program: The Snapshot program rewards safe driving habits, potentially leading to significant savings on premiums.

- Digital Convenience: Progressive's website and mobile app provide an intuitive experience for policy management and claims filing.

- Excellent Claims Process: Progressive's efficient claims process, with options for online and app-based claims, ensures a smooth experience.

Progressive's combination of customizable coverage, innovative programs like Snapshot, and a seamless digital experience has made it a top choice for many Texas drivers. The company's focus on providing options and convenience sets it apart in the competitive Texas market.

Factors to Consider When Choosing a Car Insurance Company

When selecting a car insurance company in Texas, several factors come into play. Understanding these factors and how they impact your coverage and premiums is crucial for making an informed decision. Here’s a closer look at some key considerations:

Coverage Options

Different insurance companies offer a variety of coverage options. It’s essential to assess your specific needs and choose a company that provides the right mix of coverage to protect you and your vehicle adequately. Consider factors such as liability limits, collision and comprehensive coverage, personal injury protection, and uninsured/underinsured motorist coverage.

Cost of Premiums

Premiums can vary significantly between insurance companies, even for similar coverage. It’s crucial to compare rates and understand the factors that influence them, such as your driving record, the make and model of your vehicle, and your location. Remember, the cheapest option might not always provide the best value, so strike a balance between cost and coverage.

Customer Service and Claims Handling

The quality of customer service and the efficiency of the claims process are critical aspects to consider. Look for companies with a strong reputation for prompt and fair claims handling. Reading reviews and checking ratings can provide valuable insights into a company’s customer service performance.

Discounts and Rewards

Insurance companies often offer a range of discounts to attract and retain customers. These can include safe driver discounts, multi-policy discounts, good student discounts, and loyalty rewards. Understanding the types of discounts available and how you can qualify for them can help you save on your premiums.

Digital Tools and Convenience

In today’s digital age, many insurance companies provide online and mobile platforms for policy management and claims filing. Consider whether a company’s digital tools align with your preferences for convenience and ease of use. A user-friendly digital experience can streamline the insurance process and make it more efficient.

Financial Stability

The financial stability of an insurance company is crucial, as it ensures the company’s ability to pay claims in the long term. Look for companies with strong financial ratings from reputable agencies like AM Best, Moody’s, or Standard & Poor’s. This indicates the company’s financial health and its ability to honor its commitments to policyholders.

Comparative Analysis: Top Texas Car Insurance Companies

To provide a more comprehensive view, let’s take a closer look at how the top car insurance companies in Texas compare across various key metrics. This analysis will help you understand the strengths and weaknesses of each company and make an informed decision based on your specific needs.

| Insurance Company | Average Premium | Discounts | Customer Satisfaction | Claims Process |

|---|---|---|---|---|

| State Farm | $1,200 annually | Multi-policy, good student, safe driver | 4.5/5 | Efficient, with a dedicated agent support |

| Geico | $1,150 annually | Military, federal employee, good student | 4.4/5 | Seamless digital process, efficient claims team |

| Allstate | $1,350 annually | Drivewise, safe driving bonus | 4.3/5 | Claim Satisfaction Guarantee, local agent support |

| USAA | $1,050 annually | Military-centric, safe driving, loyalty | 4.7/5 | Efficient, tailored to military needs |

| Progressive | $1,250 annually | Snapshot, multi-policy | 4.2/5 | Seamless digital process, efficient claims team |

This comparative analysis provides a snapshot of how these top insurance companies stack up against each other in terms of average premiums, discounts, customer satisfaction, and the claims process. It's important to note that individual experiences may vary, and this analysis is based on general trends and customer feedback.

Expert Tips for Getting the Best Car Insurance in Texas

Now that we’ve explored the top car insurance companies in Texas and analyzed their key features, here are some expert tips to help you navigate the insurance landscape and secure the best coverage for your needs:

Shop Around and Compare Quotes

Don’t settle for the first quote you receive. Shopping around and comparing quotes from multiple insurance companies is essential to finding the best deal. Online comparison tools can be a convenient way to get quotes from several providers quickly.

Understand Your Coverage Needs

Assess your specific needs and understand the types of coverage available. Consider factors like your driving record, the value of your vehicle, and your personal risk tolerance. This will help you choose the right coverage limits and options to protect yourself adequately.

Explore Discounts and Rewards

Insurance companies offer a variety of discounts and rewards to attract and retain customers. Research the types of discounts available and see if you qualify for any. This can significantly reduce your premiums and provide additional savings.

Consider Digital Convenience

In today’s digital age, many insurance companies provide online and mobile platforms for policy management and claims filing. Consider whether these digital tools align with your preferences for convenience and ease of use. A user-friendly digital experience can make managing your insurance more efficient.

Read Reviews and Check Ratings

Researching customer reviews and ratings can provide valuable insights into a company’s performance, customer service, and claims handling. Check reputable review sites and financial rating agencies to ensure you’re choosing a company with a solid reputation.

Ask for Recommendations

Word-of-mouth recommendations can be powerful. Ask friends, family, or colleagues about their experiences with car insurance companies in Texas. Their insights and personal stories can help you make an informed decision.

Future Trends in Texas Car Insurance

The car insurance landscape in Texas is constantly evolving, influenced by technological advancements, changing consumer preferences, and regulatory developments. Here’s a glimpse into some future trends that are likely to shape the industry:

Increased Use of Telematics

Telematics, the technology that tracks driving behavior, is likely to become more prevalent in the Texas car insurance market. Insurance companies may offer discounts or tailored premiums based on real-time driving data, encouraging safer driving habits.

Expansion of Digital Services

Insurance companies will continue to enhance their digital platforms, providing more convenient and efficient services. From policy management to claims filing, the insurance experience is expected to become increasingly digital, catering to the preferences of tech-savvy consumers.

Focus on Personalized Coverage

The future of car insurance in Texas is likely to emphasize personalized coverage options. Insurance companies will continue to develop innovative products and services that cater to the unique needs of different customer segments, offering tailored solutions for various lifestyles and driving habits.

Regulatory Changes

Regulatory changes can significantly impact the insurance industry. While it’s challenging to predict specific changes, staying informed about potential legislative developments and their implications is essential for understanding how they may affect coverage options and premiums.

Emphasis on Sustainability

As sustainability and environmental concerns gain prominence, the insurance industry may see a shift towards greener practices. This could include incentives for eco-friendly vehicles or initiatives to reduce carbon footprints, reflecting a growing societal focus on environmental responsibility.

Conclusion

The Texas car insurance market offers a diverse range of options, with top insurance companies competing to provide the best coverage, value, and customer satisfaction. From State Farm’s personalized service to Geico’s digital convenience, each company brings unique strengths to the table. By understanding your specific needs, comparing quotes, and staying informed about the latest trends, you can make an informed decision and secure the best car insurance coverage for your unique circumstances.

What is the average cost of car insurance in Texas?

+The average cost of car insurance in Texas is slightly higher than the national average, with factors like age, driving record, and vehicle make and model influencing premiums. It’s essential to shop around and compare quotes to find the best rates.