Online Renter Insurance

Renting a home or an apartment comes with its own set of unique challenges and considerations. One often overlooked aspect is the need for adequate insurance coverage. While many individuals assume that their landlord's insurance will protect their belongings, this is not always the case. Online renter insurance has emerged as a convenient and accessible solution, offering comprehensive protection for tenants. In this comprehensive guide, we will delve into the world of online renter insurance, exploring its benefits, coverage options, and how it can provide peace of mind for renters across the globe.

Understanding the Importance of Renter Insurance

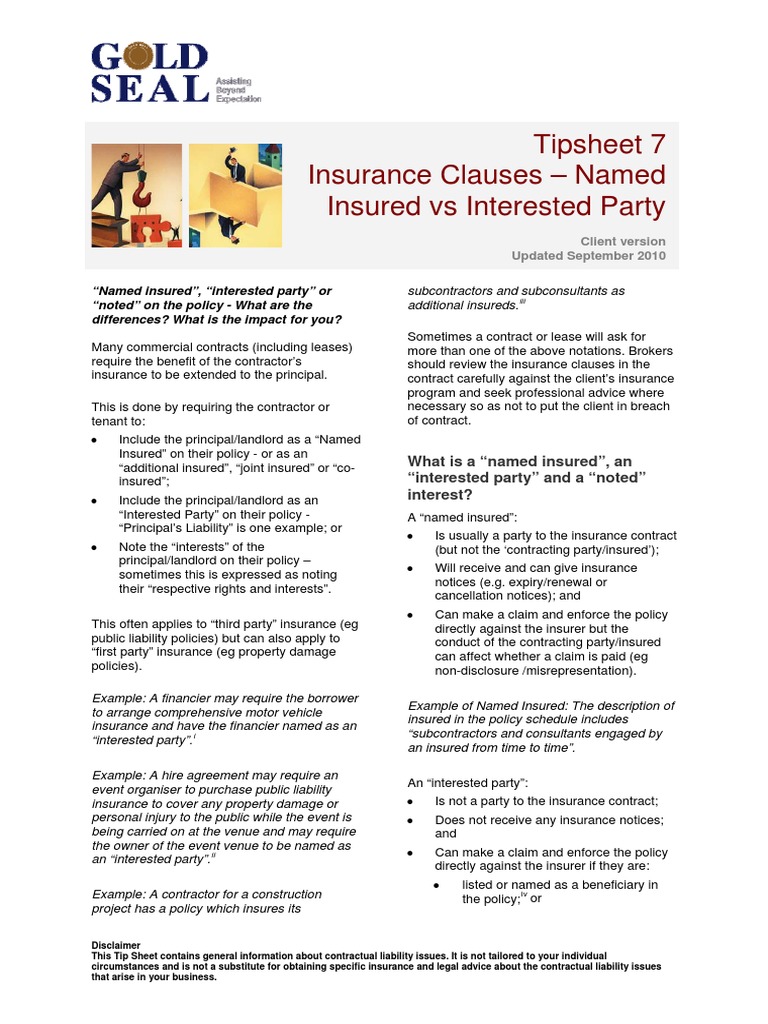

When you rent a property, you may believe that your landlord is responsible for insuring the building and your belongings. However, this is a common misconception. Landlord insurance typically covers the structure and any fixtures or fittings owned by the landlord, but it rarely extends to the personal possessions of tenants. This means that in the event of a fire, theft, or natural disaster, your valuable items might not be covered, leaving you financially vulnerable.

Renter insurance, also known as tenant insurance or contents insurance, is specifically designed to protect your personal belongings and provide liability coverage. It acts as a safety net, ensuring that you can replace lost or damaged items and cover any legal expenses that may arise during your tenancy.

Benefits of Online Renter Insurance

In today’s digital age, the convenience of online services cannot be overstated, and renter insurance is no exception. Here are some key advantages of opting for online renter insurance:

- Accessibility and Convenience: Online renter insurance platforms offer an easy and efficient way to obtain coverage. You can compare policies, calculate quotes, and purchase insurance from the comfort of your home, eliminating the need for tedious paperwork and in-person meetings.

- Customizable Coverage: These platforms provide a wide range of coverage options, allowing you to tailor your policy to your specific needs. Whether you require coverage for high-value items, additional liability protection, or unique circumstances like pet ownership, online renter insurance can accommodate your requirements.

- Competitive Pricing: By leveraging technology and direct-to-consumer models, online renter insurance providers often offer more competitive rates compared to traditional insurance agencies. This can result in significant savings, especially for tenants on a budget.

- Quick Claims Process: In the event of a claim, online renter insurance companies streamline the process. You can typically submit claims online, providing a faster and more efficient resolution. This ensures that you receive the compensation you need without unnecessary delays.

Key Components of Online Renter Insurance

To fully understand the value of online renter insurance, it’s essential to explore its core components and the coverage it provides:

Personal Property Coverage

This is the cornerstone of renter insurance. It covers your personal belongings, including furniture, electronics, clothing, and other items, against various perils such as fire, theft, vandalism, and natural disasters. By insuring your possessions, you can rest assured that you’ll be able to replace them if they are damaged or lost.

Liability Protection

Renter insurance also provides liability coverage, which is crucial for protecting you against legal claims. If someone is injured in your rental property or if your actions result in property damage, liability coverage can help cover the associated costs, including medical expenses and legal fees.

Additional Living Expenses

In certain situations, such as a fire or severe weather event, your rental property may become uninhabitable. Online renter insurance often includes coverage for additional living expenses, which can help you cover the cost of temporary accommodation and other necessary expenses until you can return to your home.

Personal Liability Coverage

Beyond the liability coverage mentioned above, personal liability coverage extends protection to your actions outside of your rental property. For instance, if you accidentally cause damage to someone else’s property or injure someone, this coverage can help cover the costs associated with the incident.

Loss of Use Coverage

In some cases, your rental property may need to be repaired or renovated, rendering it temporarily unlivable. Loss of use coverage can help reimburse you for any additional expenses incurred during this period, such as the cost of alternative housing or food.

The Process of Obtaining Online Renter Insurance

Acquiring online renter insurance is a straightforward process that typically involves the following steps:

- Research and Comparison: Start by researching reputable online renter insurance providers. Compare their coverage options, policy terms, and customer reviews to find the best fit for your needs.

- Calculate Your Coverage Needs: Determine the value of your personal belongings and any additional coverage requirements, such as liability limits or specialized coverage for valuable items.

- Obtain Quotes: Request quotes from multiple providers to compare prices and coverage. Most online platforms offer instant quotes based on your input, making it easy to find the most competitive rates.

- Review Policy Details: Carefully read through the policy documents to understand the coverage, exclusions, and any potential limitations. Ensure that the policy aligns with your expectations and provides the protection you require.

- Purchase Your Policy: Once you've selected a provider and policy, complete the purchase process online. You'll typically receive your policy documents electronically, making it convenient to access and manage your insurance.

Tips for Choosing the Right Policy

When selecting an online renter insurance policy, consider the following tips to ensure you make an informed decision:

- Check for policy exclusions and limitations to understand what is not covered.

- Consider adding optional coverages, such as flood or earthquake insurance, if you live in high-risk areas.

- Review the claims process and customer support options to ensure they align with your expectations.

- Look for providers with a strong track record of prompt claim settlements and positive customer experiences.

Real-Life Examples and Case Studies

To illustrate the impact and benefits of online renter insurance, let’s explore a few real-life scenarios:

Case Study 1: Fire Damage

Imagine a renter, Sarah, who experienced a fire in her apartment building. The fire damaged her personal belongings, including furniture, electronics, and clothing. With online renter insurance in place, Sarah was able to file a claim and receive compensation to replace her damaged items. The insurance provider’s efficient claims process allowed her to quickly recover and get back on her feet.

Case Study 2: Burglary

John, a tenant in a busy urban area, unfortunately became a victim of burglary. His apartment was broken into, and several valuable items were stolen, including his laptop and jewelry. Thanks to his online renter insurance policy, John was reimbursed for the value of the stolen items, helping him overcome the financial burden of the loss.

Case Study 3: Liability Claim

Emily, a tenant with a playful dog, accidentally caused property damage when her dog knocked over a vase during a social gathering. Her online renter insurance policy’s liability coverage stepped in, covering the cost of repairing the damaged vase and any associated legal expenses, saving her from a potentially costly lawsuit.

Future Trends and Innovations in Renter Insurance

The renter insurance industry is continuously evolving, and several trends and innovations are shaping the future of coverage for tenants:

Digital Transformation

The shift towards digital platforms and online services is expected to continue, with insurance providers investing in user-friendly interfaces and mobile applications. This will further enhance the convenience and accessibility of renter insurance, making it even easier for tenants to manage their policies.

Data-Driven Personalization

Insurance providers are leveraging data analytics to offer more personalized coverage options. By analyzing individual risk factors and preferences, they can provide tailored policies that meet the unique needs of each tenant, ensuring optimal protection.

Integration with Smart Home Technologies

As smart home devices become more prevalent, renter insurance providers are exploring ways to integrate with these technologies. This could involve offering discounts for tenants who utilize smart security systems or providing additional coverage for connected devices.

Enhanced Loss Prevention Measures

Insurance companies are investing in loss prevention initiatives to reduce the likelihood of claims. This may include providing tenants with resources and guidance on improving home security, fire safety, and other risk mitigation measures.

Conclusion

Online renter insurance is a vital component of financial protection for tenants, offering peace of mind and comprehensive coverage for personal belongings and liability. By understanding the importance of renter insurance and exploring the benefits of online platforms, you can make an informed decision to safeguard your possessions and your future. Remember, a little investment in renter insurance can go a long way in ensuring a secure and worry-free rental experience.

What is the average cost of online renter insurance?

+The average cost of online renter insurance can vary depending on factors such as location, the value of your belongings, and the level of coverage you choose. On average, renters can expect to pay between 150 to 300 annually for basic coverage. However, prices can range from as low as 100 to upwards of 500 or more, depending on individual circumstances.

Does online renter insurance cover my landlord’s property as well?

+No, online renter insurance primarily covers your personal belongings and provides liability protection for your actions. It does not cover the structure of the building or any fixtures and fittings owned by your landlord. Your landlord should have their own insurance policy for these aspects.

How quickly can I obtain online renter insurance coverage?

+The speed at which you can obtain online renter insurance coverage depends on the provider and the complexity of your needs. In most cases, you can complete the entire process, from obtaining quotes to purchasing a policy, within a matter of hours or a few days. Some providers even offer instant coverage upon purchase.

What should I do if I need to file a claim with my online renter insurance provider?

+If you need to file a claim, start by contacting your insurance provider and providing them with all the necessary details about the incident. They will guide you through the claims process, which typically involves submitting documentation, such as police reports, photos, and receipts, to support your claim. It’s important to act promptly and follow the provider’s instructions to ensure a smooth claims process.

Are there any exclusions or limitations I should be aware of in online renter insurance policies?

+Yes, it’s crucial to carefully review the policy documents to understand any exclusions or limitations. Common exclusions may include damage caused by pests, intentional acts, or certain natural disasters. Limitations could involve maximum coverage amounts for specific items or categories of possessions. Being aware of these details will help you make informed decisions and choose a policy that best suits your needs.