Will Car Insurance Cover Rental Car

When you find yourself in need of a rental car, whether it's for a road trip, a business trip, or due to unforeseen circumstances with your own vehicle, one question often arises: "Will my car insurance cover the rental car?" Understanding the extent of your insurance coverage is crucial to ensure a smooth and stress-free rental experience. In this comprehensive guide, we will delve into the world of car insurance and rental car coverage, exploring the ins and outs to help you make informed decisions.

Understanding Car Insurance and Rental Car Coverage

Car insurance policies are designed to provide financial protection in the event of accidents, vehicle damage, or other unforeseen circumstances. While these policies primarily cover your own vehicle, they can also extend to rental cars under certain conditions. The coverage options for rental cars can vary significantly depending on your insurance provider and the specific policy you hold.

Types of Car Insurance Coverage for Rental Cars

Let's explore the different types of car insurance coverage that may apply to rental cars:

- Liability Coverage: This type of insurance covers damages or injuries you cause to others while driving the rental car. It is essential to have liability coverage to protect yourself financially in the event of an accident.

- Collision Coverage: Collision insurance covers damage to the rental car itself in the event of an accident. This coverage ensures that you won't be responsible for paying the full cost of repairs or replacement if the rental car is damaged during your rental period.

- Comprehensive Coverage: Comprehensive insurance provides protection against damage to the rental car caused by non-collision incidents, such as theft, vandalism, or natural disasters. This coverage is crucial to safeguard against unexpected events that could result in costly repairs or replacement.

- Rental Car Coverage (Loss Damage Waiver): Some insurance policies offer specific coverage for rental cars, known as a Loss Damage Waiver (LDW) or Collision Damage Waiver (CDW). This waiver relieves you of financial responsibility for damage to the rental car, typically excluding personal injury or liability claims.

Factors Influencing Rental Car Insurance Coverage

The extent of your car insurance coverage for rental cars can be influenced by several factors. Understanding these factors is key to determining the level of protection you have:

- Insurance Provider and Policy: Different insurance companies offer varying levels of coverage for rental cars. It's essential to review your specific policy to understand the inclusions and exclusions. Some policies may provide comprehensive coverage, while others may require additional endorsements or riders to extend coverage to rental cars.

- Rental Company and Location: Rental car companies often have their own insurance policies and terms. The coverage they offer can vary based on the company and the location where you rent the vehicle. Some rental companies may require you to purchase their insurance if you wish to decline your personal insurance coverage.

- Length of Rental: The duration of your rental period can impact the coverage provided. Some insurance policies may have limitations or exclusions for rentals exceeding a certain number of days. It's crucial to review your policy's terms and conditions to ensure you're covered for the entire rental period.

- Type of Vehicle: The type of rental car you choose can also affect your insurance coverage. Certain policies may have restrictions or exclusions for high-end, luxury, or exotic vehicles. It's important to check your policy's guidelines to ensure the vehicle you wish to rent is covered.

Comparative Analysis: Personal Insurance vs. Rental Company Insurance

When considering rental car coverage, it's essential to compare the options offered by your personal insurance provider with those provided by the rental car company. Each option has its advantages and considerations:

| Personal Insurance | Rental Company Insurance |

|---|---|

| Personal insurance policies often provide broader coverage, including liability, collision, and comprehensive protection. This can be a more cost-effective option if you already have comprehensive coverage on your own vehicle. | Rental company insurance may be more straightforward and convenient, as it covers the rental car directly. However, it can be more expensive, and you may be required to purchase additional coverage if your personal insurance policy has limitations. |

| Using your personal insurance can be beneficial if you have a good driving record and a history of safe driving, as it may result in lower insurance premiums over time. | Rental company insurance may provide more flexibility, allowing you to choose the coverage level that suits your needs. However, it's essential to read the fine print and understand any exclusions or limitations. |

| Some personal insurance policies may offer rental car coverage as an optional add-on, providing greater control over your coverage and potentially saving you money. | Rental company insurance may be more comprehensive, covering a wider range of incidents and providing additional benefits such as personal accident insurance or roadside assistance. |

Performance Analysis: Assessing the Coverage Options

To help you make an informed decision, let's evaluate the performance of different coverage options based on real-world scenarios and industry insights:

Scenario 1: Basic Liability Coverage

Imagine you're renting a car for a weekend getaway and opt for the basic liability coverage offered by your insurance provider. In this scenario, you would be covered for any damages or injuries you cause to others while driving the rental car. However, this coverage typically does not extend to damage to the rental car itself. If an accident occurs, you would be responsible for paying for repairs or replacement out of pocket, which could be a significant financial burden.

Scenario 2: Collision and Comprehensive Coverage

Let's consider a different scenario where you choose to purchase collision and comprehensive coverage through your insurance provider. With this level of coverage, you would be protected in the event of an accident, as it covers damage to the rental car. Additionally, comprehensive coverage would safeguard you against non-collision incidents, ensuring peace of mind throughout your rental period. This option provides a more comprehensive level of protection, reducing your financial risk.

Scenario 3: Rental Car Coverage (LDW/CDW)

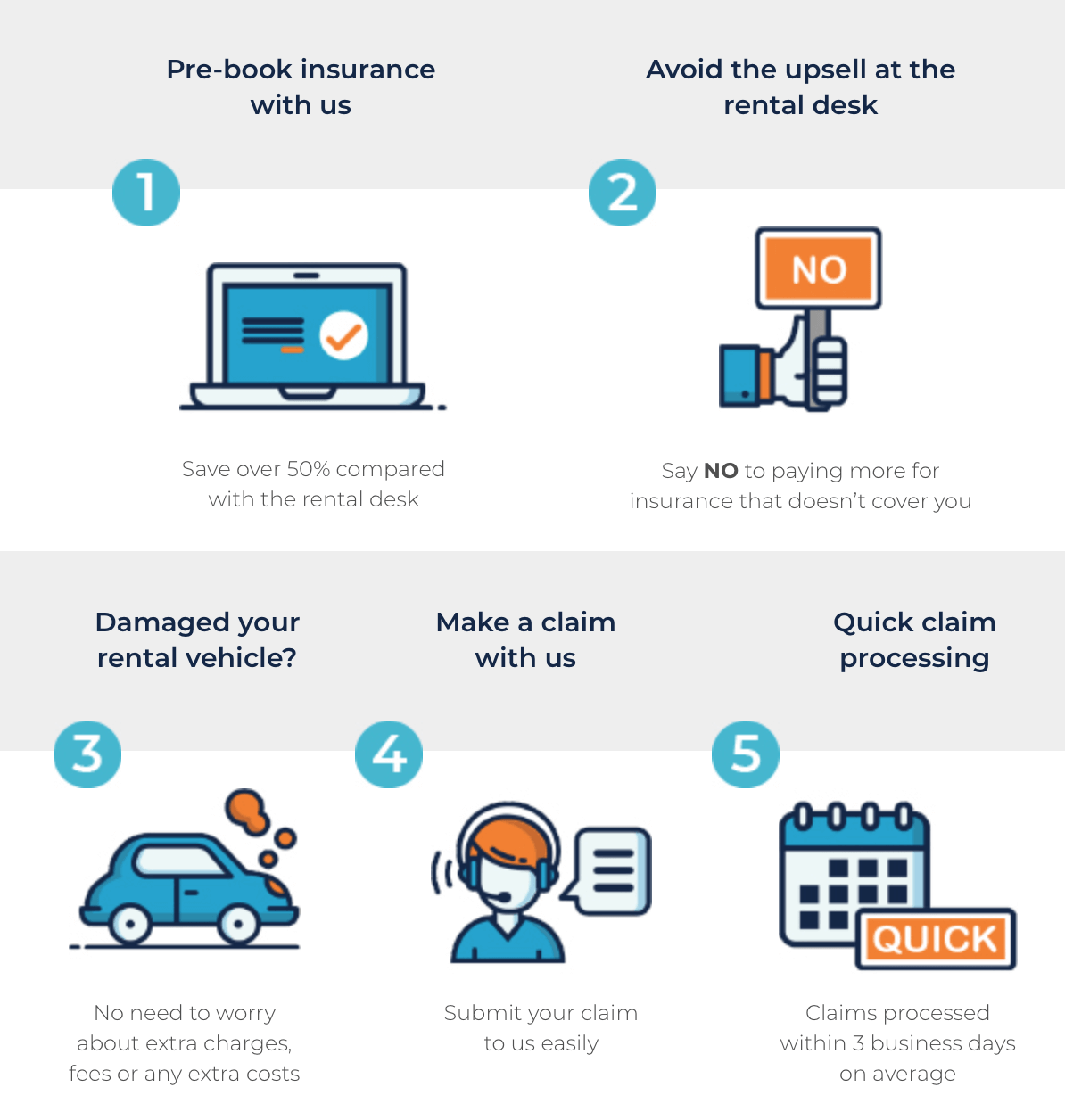

Now, let's explore the option of purchasing rental car coverage, also known as a Loss Damage Waiver (LDW) or Collision Damage Waiver (CDW), from the rental car company. This coverage essentially relieves you of financial responsibility for damage to the rental car. While it provides convenience and peace of mind, it may come at a higher cost. It's important to carefully review the terms and conditions to understand any exclusions or limitations, as these waivers typically do not cover liability or personal injury claims.

Industry Insights and Future Implications

The world of car insurance and rental car coverage is constantly evolving, with insurance providers and rental car companies adapting to meet the changing needs of consumers. Here are some industry insights and future implications to consider:

Embracing Digital Solutions

Insurance providers are increasingly leveraging digital technologies to enhance the customer experience. Online platforms and mobile apps now allow policyholders to easily manage their insurance policies, including rental car coverage. These digital solutions provide convenience and efficiency, enabling customers to quickly access and understand their coverage options.

Personalized Insurance Plans

The insurance industry is moving towards personalized insurance plans, where coverage options are tailored to individual needs and preferences. This trend allows policyholders to customize their insurance policies, including rental car coverage, to align with their specific requirements. By offering flexible and customizable plans, insurance providers can better meet the diverse needs of their customers.

Expanded Rental Car Coverage Options

Rental car companies are also expanding their coverage options to provide greater flexibility and choice for customers. They are introducing new insurance products and partnerships with insurance providers to offer more comprehensive coverage. These initiatives aim to provide customers with a range of options to suit their budgets and coverage needs, ensuring a seamless rental experience.

Collaborative Partnerships

Insurance providers and rental car companies are forging collaborative partnerships to streamline the rental car coverage process. These partnerships aim to simplify the experience for customers by offering integrated insurance solutions. By working together, they can provide more seamless and efficient coverage options, making it easier for customers to understand and select the appropriate coverage for their rental car needs.

Frequently Asked Questions (FAQ)

What happens if I get into an accident while driving a rental car without proper insurance coverage?

+If you get into an accident while driving a rental car without proper insurance coverage, you may be held financially responsible for the damages. It's crucial to ensure you have adequate coverage before renting a vehicle to avoid potential financial burdens.

Can I use my personal insurance policy to cover a rental car abroad?

+Using your personal insurance policy to cover a rental car abroad may be possible, but it depends on your insurance provider and the country you're visiting. Some policies may have international coverage options, while others may require additional endorsements. It's essential to review your policy and consult with your insurer before traveling.

Are there any discounts or promotions available for rental car coverage?

+Insurance providers and rental car companies may offer discounts or promotions from time to time. Keep an eye out for special offers, loyalty programs, or bundled packages that can help reduce the cost of rental car coverage. Additionally, some companies may provide discounts for long-term rentals or for certain customer segments.

Remember, when it comes to rental car coverage, it’s always best to be prepared and informed. By understanding your insurance options and making the right choices, you can enjoy a smooth and worry-free rental experience.