Affordable Liability Car Insurance

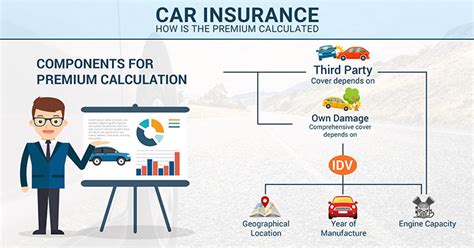

Finding affordable liability car insurance is a crucial task for any vehicle owner. With rising costs and diverse coverage options, navigating the insurance landscape can be daunting. This comprehensive guide aims to shed light on the intricacies of liability car insurance, offering expert insights and practical tips to help you secure the best coverage at the most favorable rates.

Understanding Liability Car Insurance

Liability car insurance is a fundamental component of any comprehensive auto insurance policy. It provides coverage for damages and injuries caused to others in an accident for which you are held responsible. This type of insurance is essential as it protects you from potentially devastating financial consequences that can arise from accidents.

The coverage offered by liability car insurance typically includes:

- Bodily Injury Liability: Covers medical expenses, lost wages, and pain and suffering for injured parties in an accident you caused.

- Property Damage Liability: Pays for repairs or replacements of damaged property, such as other vehicles, fences, or buildings, due to an accident caused by you.

- Legal Defense: Provides coverage for legal fees if you are sued as a result of an accident.

Understanding the specific limits and exclusions of your liability coverage is crucial. These limits dictate the maximum amount your insurance company will pay out for each covered incident. It's essential to review these limits regularly and adjust them as necessary to ensure adequate protection.

Assessing Your Liability Coverage Needs

Determining the right amount of liability coverage is a critical step in securing adequate protection. While state laws often mandate minimum liability coverage limits, these may not provide sufficient coverage in the event of a severe accident. Consider your financial situation, assets, and potential liabilities when deciding on coverage limits.

As a general guideline, experts recommend carrying liability limits significantly higher than the state minimums. This ensures that you have adequate protection against the financial risks associated with causing serious injuries or extensive property damage in an accident.

| State Minimum Liability Limits | Recommended Limits |

|---|---|

| Bodily Injury per Person: $25,000 | Bodily Injury per Person: $100,000 |

| Bodily Injury per Accident: $50,000 | Bodily Injury per Accident: $300,000 |

| Property Damage per Accident: $25,000 | Property Damage per Accident: $100,000 |

By increasing your liability limits, you reduce the risk of being underinsured, which could leave you financially vulnerable in the event of a serious accident. It's a prudent decision that provides peace of mind and comprehensive protection.

Tips for Finding Affordable Liability Car Insurance

Securing affordable liability car insurance involves a careful balance between adequate coverage and manageable costs. Here are some expert strategies to help you achieve this balance:

Shop Around and Compare Quotes

The insurance market is highly competitive, and rates can vary significantly between providers. It’s essential to compare quotes from multiple insurers to find the best combination of coverage and price. Online comparison tools can be a valuable resource for this, providing a quick and convenient way to assess various options.

When comparing quotes, pay attention to the coverage limits, deductibles, and any additional features or discounts offered. Ensure that you're comparing apples to apples by evaluating policies with similar coverage levels.

Understand Your Discount Options

Insurance companies offer a variety of discounts that can significantly reduce your premium. Common discounts include:

- Safe Driver Discount: Rewarding drivers with clean driving records.

- Multi-Policy Discount: Offering lower rates when you bundle multiple policies (e.g., car and home insurance) with the same provider.

- Loyalty Discount: Providing incentives for long-term customers.

- Good Student Discount: Targeted at students with a strong academic record.

- Defensive Driving Course Discount: Recognizing drivers who complete approved safety courses.

By taking advantage of these discounts, you can reduce your premium and make your liability car insurance more affordable. Be sure to inquire about available discounts when obtaining quotes and periodically review your policy to ensure you're maximizing your savings.

Choose the Right Coverage Levels

While it’s crucial to have adequate liability coverage, overinsuring yourself can lead to unnecessary expenses. Assess your specific needs and risk tolerance to determine the appropriate coverage levels. For instance, if you own a modest vehicle and have limited assets, you may not require the highest liability limits.

Consider your personal circumstances, such as your financial situation and the value of your assets, when deciding on coverage levels. This tailored approach ensures you're not paying for coverage you don't need, helping you maintain a cost-effective insurance policy.

Consider High Deductibles

Opting for a higher deductible can lead to significant savings on your premium. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By agreeing to pay a larger portion of the costs upfront, you can reduce your insurance company’s financial risk, resulting in lower premiums.

However, it's essential to choose a deductible that aligns with your financial capabilities. While a higher deductible can save you money in the long run, it also means you'll need to be prepared to cover more expenses out of pocket in the event of an accident. Assess your financial situation and comfort level with risk before selecting a deductible.

Maintain a Good Driving Record

Your driving history plays a significant role in determining your insurance rates. Insurance companies view drivers with clean records as less risky, offering lower premiums in recognition of their safe driving habits. Conversely, violations and accidents can lead to increased rates.

To keep your insurance costs down, focus on maintaining a safe driving record. This includes obeying traffic laws, avoiding distractions while driving, and regularly maintaining your vehicle to prevent unexpected breakdowns that could lead to accidents.

Bundle Your Policies

If you have multiple insurance needs, such as auto, home, and life insurance, consider bundling your policies with a single provider. Many insurance companies offer multi-policy discounts, rewarding customers who consolidate their insurance needs. This not only simplifies your insurance management but also can result in significant savings.

By bundling your policies, you may be eligible for reduced rates on all your insurance needs, making it a cost-effective strategy for managing your insurance portfolio.

Explore Usage-Based Insurance Programs

Usage-based insurance programs, also known as pay-as-you-drive or telematics insurance, offer a unique approach to pricing insurance. These programs use telematics devices or smartphone apps to track your driving habits, such as miles driven, driving speed, and braking patterns. Based on your actual driving behavior, your insurance premium can be adjusted accordingly.

If you're a safe and cautious driver, usage-based insurance can be an excellent way to save on your liability car insurance. By demonstrating responsible driving habits, you may qualify for lower rates, providing a personalized and potentially cost-effective insurance solution.

The Future of Affordable Liability Car Insurance

The insurance industry is evolving, and new technologies are shaping the future of liability car insurance. Telematics and advanced driver-assistance systems (ADAS) are already influencing insurance rates and coverage options. As these technologies become more prevalent, we can expect further innovations in the way insurance is priced and delivered.

For instance, the widespread adoption of autonomous vehicles could lead to a significant reduction in accidents, potentially resulting in lower liability insurance rates. Additionally, the increasing use of telematics and ADAS could provide more precise data on driving behavior, allowing insurance companies to offer highly tailored and affordable insurance options.

Stay informed about these technological advancements and their potential impact on the insurance landscape. Being aware of emerging trends can help you make more informed decisions about your liability car insurance coverage and ensure you stay ahead of the curve.

What is the average cost of liability car insurance?

+The average cost of liability car insurance can vary significantly depending on various factors such as your location, driving record, the make and model of your vehicle, and the coverage limits you choose. As a rough estimate, you can expect to pay anywhere from 500 to 1,500 per year for basic liability coverage. However, it’s important to note that these rates are highly individualized, and the best way to determine your specific cost is to obtain quotes from multiple insurers.

Can I get liability car insurance without a full coverage policy?

+Yes, you can opt for liability-only car insurance, which provides coverage for damages and injuries you cause to others but excludes coverage for your own vehicle. This can be a cost-effective option for older vehicles or those with low monetary value. However, it’s important to carefully consider your financial situation and the potential risks before choosing this option.

What happens if I cause an accident but have insufficient liability coverage?

+If you cause an accident and your liability coverage limits are insufficient to cover the damages and injuries sustained by others, you may be held personally liable for the remaining costs. This could result in significant financial hardship, potentially impacting your assets and future earnings. Therefore, it’s crucial to review your liability coverage limits regularly and adjust them as necessary to ensure adequate protection.