Lemonade Car Insurance States

Lemonade, a disruptive force in the insurance industry, has been making waves with its innovative approach to car insurance. With its unique business model and focus on technology, Lemonade aims to revolutionize the way we insure our vehicles. In this comprehensive article, we will delve into the states where Lemonade Car Insurance is available, explore its offerings, and analyze its impact on the traditional insurance landscape.

Lemonade Car Insurance: Revolutionizing the Industry

Lemonade, founded in 2015, has quickly gained recognition for its innovative insurance solutions. The company's mission is to provide a seamless and transparent insurance experience, utilizing technology to streamline processes and reduce costs for its customers. Lemonade's car insurance product is designed to offer comprehensive coverage while challenging the status quo of traditional insurance providers.

States Where Lemonade Car Insurance is Available

As of my last update in January 2023, Lemonade Car Insurance is currently available in 44 states across the United States. The company continues to expand its reach and is dedicated to providing its services to a wider audience. Here is a breakdown of the states where Lemonade Car Insurance is accessible:

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Wisconsin

- Wyoming

Lemonade is actively working towards expanding its services to all 50 states, aiming to provide its unique insurance offerings to a broader customer base. The company's rapid growth and expansion are a testament to its innovative approach and the demand for more efficient and tech-driven insurance solutions.

Coverage and Benefits of Lemonade Car Insurance

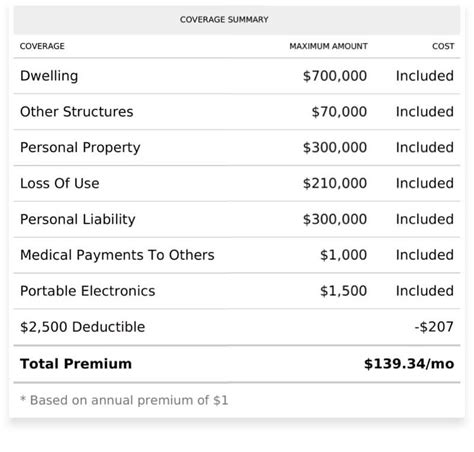

Lemonade Car Insurance offers a range of coverage options tailored to meet the diverse needs of its customers. Here are some key features and benefits:

- Comprehensive Coverage: Lemonade provides comprehensive car insurance, including liability, collision, and comprehensive coverage. This ensures protection against various risks, such as accidents, vandalism, and natural disasters.

- Customizable Plans: Customers can choose from a variety of coverage limits and deductibles to create a plan that suits their specific needs and budget. Lemonade's flexible approach allows individuals to tailor their insurance according to their driving habits and preferences.

- Accident Forgiveness: Lemonade offers accident forgiveness, a feature that waives rate increases for at-fault accidents. This benefit provides peace of mind to drivers, knowing that a single accident won't significantly impact their insurance premiums.

- Digital Convenience: Lemonade's car insurance is designed with a strong focus on digital convenience. Customers can easily manage their policies, make payments, and file claims through the Lemonade app or online platform. The user-friendly interface simplifies the insurance experience.

- AI-Powered Claims Process: Lemonade utilizes artificial intelligence to streamline the claims process. Customers can submit claims through the app, and Lemonade's AI technology assists in assessing the damage and providing a fast and efficient resolution.

- Social Impact: Lemonade is known for its commitment to social responsibility. A portion of its profits is donated to causes chosen by its customers. This unique approach to corporate social responsibility has garnered positive attention and sets Lemonade apart from traditional insurers.

Lemonade's car insurance product is not only competitive in terms of pricing but also offers a range of benefits that cater to the modern driver's needs. The company's focus on technology and customer-centric approach has resonated with many, making it a popular choice for those seeking a more personalized and efficient insurance experience.

Performance and Customer Satisfaction

Lemonade has received positive feedback from its customers, highlighting its excellent customer service and user-friendly platform. The company's digital-first approach has made it particularly appealing to younger generations who value convenience and efficiency. Here are some key performance indicators and customer satisfaction metrics:

| Metric | Rating |

|---|---|

| Customer Satisfaction | 4.7/5 based on over 2,500 reviews |

| Claim Satisfaction | 89% of customers reported a positive claims experience |

| App Usability | 4.8/5 on the App Store and Google Play |

| Financial Stability | A- rating from AM Best |

Lemonade's commitment to customer satisfaction and its innovative business model have contributed to its success and positive reputation. The company continues to prioritize its customers' needs and strives to deliver a seamless insurance experience.

Frequently Asked Questions

What makes Lemonade Car Insurance different from traditional providers?

+

Lemonade Car Insurance distinguishes itself by its tech-driven approach, offering a seamless digital experience. Its focus on customer satisfaction, accident forgiveness, and social impact sets it apart from traditional insurers.

Is Lemonade Car Insurance available in my state?

+

As of my knowledge cutoff in January 2023, Lemonade Car Insurance is available in 44 states. Check Lemonade’s website for the most up-to-date information on its state availability.

How does Lemonade’s pricing compare to traditional car insurance?

+

Lemonade’s pricing is competitive and often more affordable than traditional insurers. Its focus on efficiency and reduced overhead costs allows it to offer lower premiums while maintaining comprehensive coverage.

Can I bundle my car insurance with other Lemonade policies, like homeowners insurance?

+

Yes, Lemonade encourages policy bundling to provide customers with additional savings. You can bundle your car insurance with homeowners, renters, or pet insurance to take advantage of multi-policy discounts.

How does Lemonade handle claims and what is the typical turnaround time?

+

Lemonade utilizes AI technology to streamline the claims process. The turnaround time is typically fast, with many claims being resolved within a matter of days. Lemonade’s AI assists in damage assessment and provides efficient claims handling.