Cheapest Automobile Insurance

Automobile insurance, or car insurance, is an essential financial protection for vehicle owners. It provides coverage for various risks and liabilities associated with owning and operating a motor vehicle. With the vast number of insurance providers and policy options available, finding the cheapest automobile insurance that offers adequate coverage can be a challenging task. This article aims to guide you through the process, offering expert insights and practical tips to help you secure the most cost-effective insurance policy without compromising on essential coverage.

Understanding Automobile Insurance Policies

Automobile insurance policies can vary significantly in terms of coverage, premiums, and additional benefits. Understanding the different components of a policy is crucial to making an informed decision. Here’s a breakdown of the key elements:

Liability Coverage

Liability coverage is a fundamental aspect of any automobile insurance policy. It protects you financially in the event that you are found legally responsible for causing an accident that results in bodily injury or property damage to others. This coverage is typically divided into two parts: bodily injury liability and property damage liability.

| Liability Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses, lost wages, and pain and suffering for individuals injured in an accident caused by you. |

| Property Damage Liability | Covers the cost of repairing or replacing property damaged in an accident caused by you, such as other vehicles, fences, buildings, or even personal belongings. |

Most states have minimum liability requirements that you must meet. These minimums, however, may not provide sufficient coverage in the event of a serious accident. It's generally recommended to carry higher liability limits to ensure adequate protection.

Collision and Comprehensive Coverage

Collision coverage pays for the repair or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. Comprehensive coverage, on the other hand, covers damage to your vehicle caused by non-collision events, such as theft, vandalism, natural disasters, or collisions with animals.

While these coverages are optional, they are highly recommended, especially if your vehicle is still being financed or leased. Without them, you would have to pay for repairs or replacements out of pocket, which could be financially devastating.

Additional Coverages and Endorsements

Automobile insurance policies often offer a range of additional coverages and endorsements that can be added to your policy to provide more comprehensive protection. These may include:

- Medical Payments Coverage: Covers the medical expenses of you and your passengers, regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: Protects you if you're involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

- Rental Car Reimbursement: Provides coverage for rental car expenses if your vehicle is being repaired after an insured loss.

- Roadside Assistance: Offers emergency services such as towing, flat tire changes, or fuel delivery.

Factors Influencing Automobile Insurance Premiums

The cost of automobile insurance, or the premium, is influenced by a variety of factors. These factors are used by insurance companies to assess the risk associated with insuring a particular individual or vehicle. Understanding these factors can help you identify areas where you might be able to reduce your insurance costs.

Vehicle Factors

The make, model, and year of your vehicle play a significant role in determining your insurance premium. Vehicles that are more expensive to repair or that are frequently targeted by thieves may cost more to insure. Additionally, the primary use of your vehicle (e.g., commuting, business, pleasure) and the average annual mileage can impact your premium.

Driver Factors

Your personal driving record is a key factor in determining your insurance premium. A clean driving record with no accidents or violations typically results in lower premiums. Conversely, a history of accidents, moving violations, or DUI convictions can significantly increase your insurance costs.

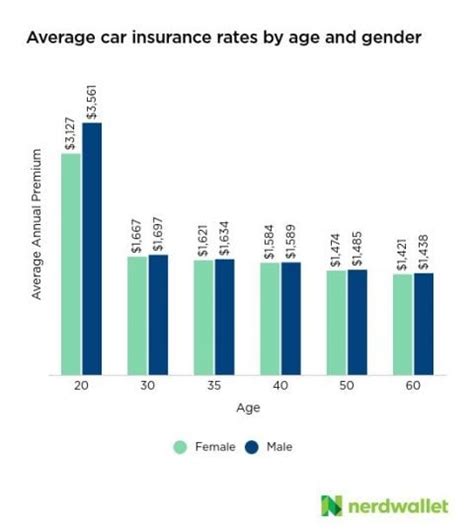

Your age and gender also play a role. Young drivers, particularly males under the age of 25, are often considered higher-risk and may face higher premiums. Similarly, older drivers may also face higher premiums due to increased risk associated with age-related factors.

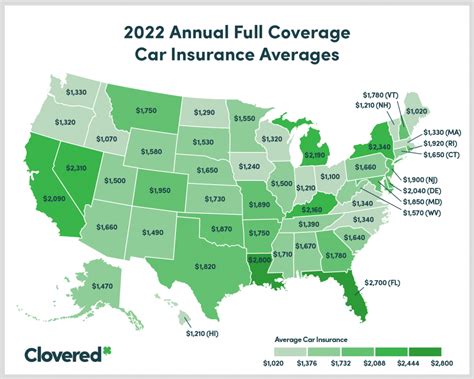

Location and Usage Factors

Where you live and where you typically drive your vehicle can impact your insurance premium. Areas with higher rates of accidents, theft, or vandalism may have higher insurance costs. Additionally, the primary use of your vehicle (e.g., commuting, business, pleasure) and the average annual mileage can influence your premium.

Coverage and Deductible Factors

The level of coverage you choose and the associated deductibles can significantly impact your insurance premium. Higher coverage limits and lower deductibles typically result in higher premiums, while lower coverage limits and higher deductibles can reduce your premium.

It's important to strike a balance between coverage and cost. While opting for lower coverage and higher deductibles can reduce your premium, it may leave you financially vulnerable in the event of a significant loss. It's advisable to consult with an insurance professional to find the right balance for your specific situation.

Tips for Finding the Cheapest Automobile Insurance

Finding the cheapest automobile insurance that provides adequate coverage requires a strategic approach. Here are some expert tips to help you navigate the process:

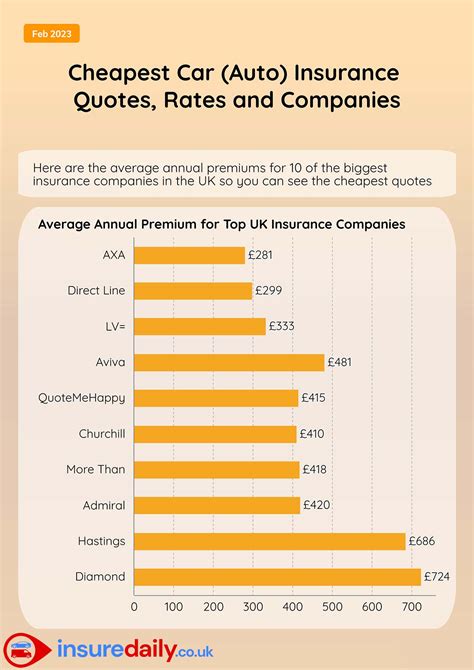

Compare Quotes from Multiple Insurers

Insurance premiums can vary significantly between providers, even for the same coverage and driver profile. It’s essential to compare quotes from multiple insurers to find the best deal. Online insurance comparison tools can be a convenient way to quickly obtain quotes from various providers.

Consider Bundling Policies

Many insurance companies offer discounts when you bundle multiple policies, such as auto insurance with homeowners or renters insurance. Bundling can result in significant savings, so it’s worth considering if you’re in the market for other types of insurance.

Explore Discounts

Insurance companies offer a variety of discounts that can reduce your premium. Common discounts include safe driver discounts, good student discounts, loyalty discounts, and discounts for completing a defensive driving course. Be sure to inquire about available discounts and take advantage of those that apply to your situation.

Maintain a Clean Driving Record

A clean driving record is one of the most effective ways to keep your insurance premiums low. Avoid speeding, obey traffic laws, and always drive defensively to reduce your risk of accidents and violations. Additionally, if you’ve had an accident or violation in the past, focus on maintaining a clean record to improve your chances of obtaining lower premiums in the future.

Consider Higher Deductibles

Opting for a higher deductible can reduce your insurance premium. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By agreeing to pay a larger portion of the costs in the event of a claim, you can often reduce your premium. However, it’s important to choose a deductible that you can afford in the event of a loss.

Review and Adjust Your Coverage Regularly

Your insurance needs may change over time. Regularly review your policy to ensure it still meets your needs and reflects your current circumstances. As your vehicle ages or your financial situation changes, you may be able to reduce your coverage and save on premiums. Conversely, if your circumstances change (e.g., you purchase a new vehicle or add a teen driver to your policy), you may need to increase your coverage to ensure adequate protection.

Common Misconceptions about Automobile Insurance

There are several common misconceptions about automobile insurance that can lead to poor decision-making. Here are a few of the most prevalent myths, debunked:

Myth: Insurance Premiums are the Same for Everyone

Insurance premiums are not one-size-fits-all. They are tailored to individual risk factors, such as driving record, age, gender, location, and vehicle type. As such, two people with similar profiles may have significantly different insurance premiums.

Myth: All Insurance Companies are the Same

While insurance companies may offer similar types of coverage, they are not all the same. Each insurer has its own unique underwriting guidelines, risk assessment models, and pricing structures. This means that the same coverage could be priced differently by different insurers.

Myth: Comprehensive Coverage is Unnecessary

Comprehensive coverage is often seen as an unnecessary expense, especially for older vehicles. However, it provides protection against a wide range of non-collision events, such as theft, vandalism, and natural disasters. For vehicle owners who live in areas prone to these risks, comprehensive coverage can be invaluable.

Conclusion: Making an Informed Decision

Finding the cheapest automobile insurance that provides adequate coverage requires careful consideration of your individual circumstances and needs. By understanding the various components of an automobile insurance policy, the factors that influence premiums, and the tips for reducing costs, you can make an informed decision that balances cost and coverage.

Remember, the goal is not just to find the cheapest insurance, but to find a policy that provides the right level of protection at a competitive price. With the right approach and a bit of research, you can secure an automobile insurance policy that offers peace of mind without breaking the bank.

What is the average cost of automobile insurance in the United States?

+The average cost of automobile insurance in the United States varies significantly depending on factors such as location, driving record, and vehicle type. According to recent data, the national average for annual car insurance premiums is approximately 1,674. However, this average can range from as low as 500 to over $3,000 depending on individual circumstances.

How can I reduce my automobile insurance premiums without sacrificing coverage?

+There are several strategies you can employ to reduce your insurance premiums without compromising on coverage. These include comparing quotes from multiple insurers, exploring available discounts, maintaining a clean driving record, and considering higher deductibles. Additionally, regularly reviewing and adjusting your coverage to reflect your changing needs and circumstances can help ensure you’re not paying for coverage you don’t need.

Is it better to have a higher or lower deductible for automobile insurance?

+The decision to choose a higher or lower deductible depends on your personal financial situation and risk tolerance. A higher deductible can reduce your insurance premium, but it means you’ll have to pay more out of pocket in the event of a claim. Conversely, a lower deductible provides more financial protection but may result in a higher premium. It’s important to find a balance that aligns with your financial capabilities and comfort level.