Canadian Health Insurance

The Canadian healthcare system is a shining example of universal healthcare, offering comprehensive medical coverage to its residents. Known for its efficiency and inclusivity, it serves as a model for many nations worldwide. This article delves into the intricacies of Canadian health insurance, exploring its history, coverage, and the benefits it provides to Canadians and eligible residents.

A Brief History of Canadian Health Insurance

The roots of Canadian health insurance can be traced back to the early 20th century when the concept of socialized medicine began to gain traction. However, it was the post-World War II era that saw the true emergence of a comprehensive healthcare system in Canada. The Medicare program, as it is commonly known, was first introduced in the province of Saskatchewan in 1962, a pioneering move that would eventually set the standard for the entire nation.

The Medicare system was founded on the principles of accessibility, universality, and portability. It aimed to ensure that all Canadians, regardless of their financial status or geographic location, had access to essential medical services without incurring debilitating costs. This vision gradually spread across the country, with each province and territory adopting its own Medicare program, albeit with some variations in administration and coverage.

A significant milestone in the history of Canadian health insurance was the passage of the Canada Health Act in 1984. This federal legislation established the framework for a unified, national healthcare system, setting out the principles and criteria that provinces and territories must meet to receive full funding from the federal government. The Act emphasized the importance of comprehensiveness, universality, portability, accessibility, and public administration in healthcare delivery.

Understanding Canadian Health Insurance Coverage

Canadian health insurance, often referred to as public health insurance, covers a wide range of medical services and treatments. This includes:

- Hospital Care: Coverage for accommodation, meals, nursing care, and most medical services provided during a hospital stay.

- Physician Services: Includes visits to family doctors, specialists, and other medical practitioners.

- Diagnostic Services: Coverage for laboratory tests, X-rays, and other diagnostic procedures.

- Surgical Procedures: Medical surgeries and operations are generally covered.

- Ambulance Services: Emergency and non-emergency transportation to and from medical facilities.

- Maternity Care: Prenatal, delivery, and postnatal care for expectant mothers and newborns.

It's important to note that Canadian health insurance is not a single, monolithic system. Each province and territory has its own Medicare plan, administered by the respective provincial or territorial government. While the coverage offered is generally consistent across the country, there can be slight variations in specific services and the manner in which they are delivered.

Exclusions and Additional Coverage

While Canadian health insurance provides an extensive safety net, there are certain services and treatments that are not covered. These may include:

- Dental Care: Routine dental procedures and orthodontics are typically not covered, though some provinces offer limited coverage for specific groups like children or seniors.

- Vision Care: Eye exams, glasses, and contact lenses are generally not included in public health insurance plans.

- Prescription Drugs: While many provinces have prescription drug programs, coverage can vary, and some medications may not be included.

- Private Rooms in Hospitals: Unless medically necessary, the cost of a private room is usually not covered.

To fill these gaps, Canadians often opt for private health insurance, which can provide coverage for these additional services. Private insurance is particularly beneficial for those who require frequent medical attention or have specific health needs.

| Province/Territory | Public Health Insurance Coverage |

|---|---|

| Alberta | Covers hospital care, physician services, and some prescription drugs. |

| British Columbia | Includes hospital care, physician services, and limited dental and vision care for specific groups. |

| Manitoba | Offers comprehensive coverage, including hospital care, physician services, and some prescription drugs. |

The Benefits of Canadian Health Insurance

Canadian health insurance is renowned for its numerous advantages, which have contributed to the overall well-being of Canadians and the nation’s reputation for excellent healthcare.

Accessibility and Equity

One of the cornerstone principles of Canadian health insurance is accessibility. All residents, regardless of income or social status, have equal access to essential medical services. This ensures that no Canadian is denied healthcare due to their financial circumstances, promoting a more equitable society.

Comprehensive Coverage

The Canadian healthcare system provides comprehensive coverage for a wide array of medical services. From hospital stays to specialist consultations, Canadians can access the care they need without incurring substantial out-of-pocket expenses. This level of coverage is a significant relief, especially for those facing complex or long-term health conditions.

Portability and Continuity of Care

Canadian health insurance is highly portable, allowing individuals to move freely across the country without losing their healthcare coverage. This portability ensures continuity of care, as medical records and history can be easily transferred between provinces and territories. Whether traveling or relocating, Canadians can rest assured that their healthcare needs will be met.

Cost-Effectiveness

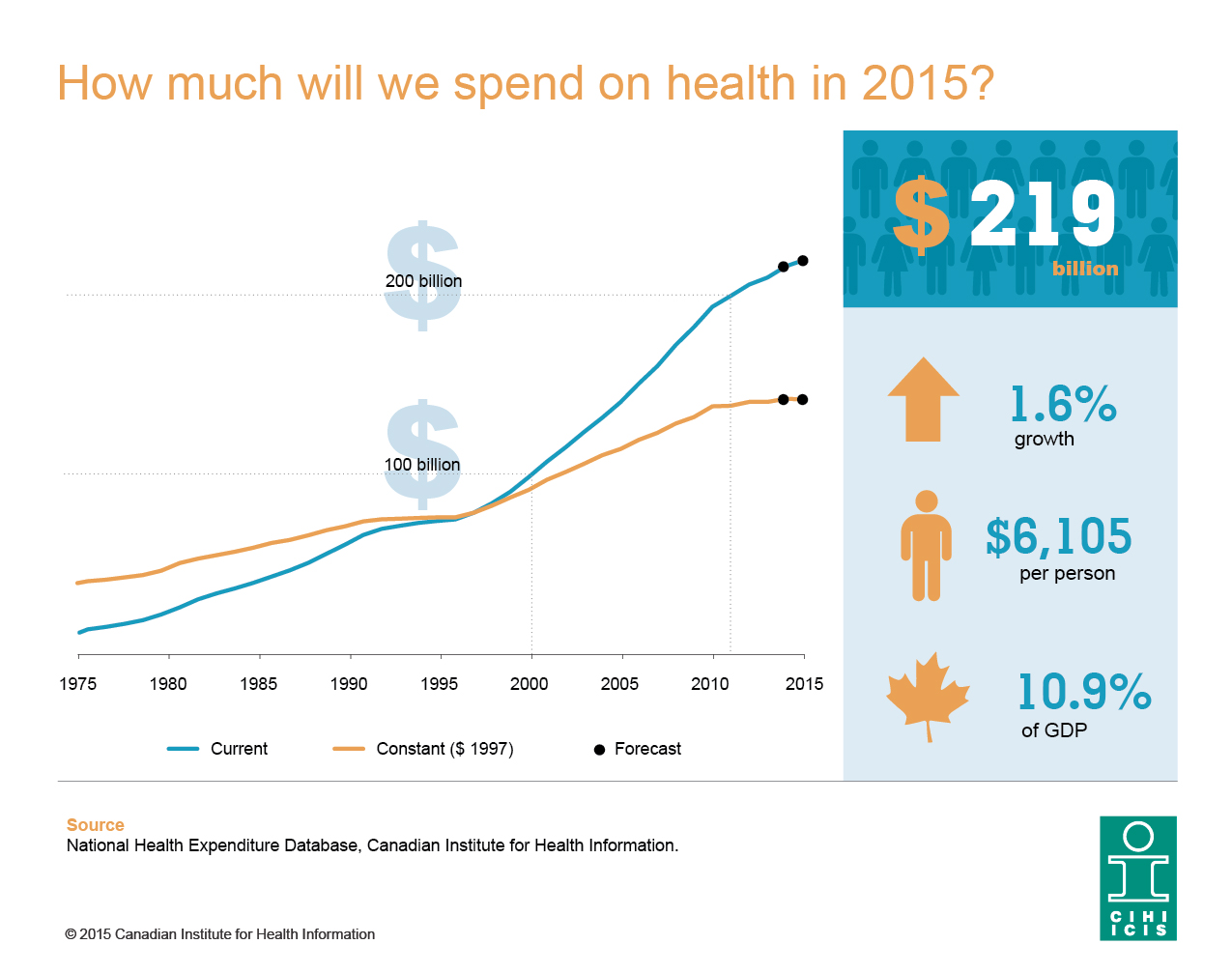

The Canadian healthcare system is known for its cost-effectiveness. By pooling resources and negotiating prices on a national scale, the government can secure more favorable rates for medical services and pharmaceuticals. This, in turn, keeps healthcare costs lower for individuals and reduces the financial burden on families.

Research and Innovation

Canadian health insurance not only provides excellent care but also supports medical research and innovation. The system’s emphasis on quality and accessibility has fostered a vibrant healthcare research community, contributing to advancements in medicine and patient care worldwide.

Conclusion: A System of Pride and Progress

Canadian health insurance stands as a testament to the nation’s commitment to the well-being of its residents. With its principles of accessibility, universality, and comprehensiveness, the Canadian healthcare system has become a model for other nations seeking to improve their own healthcare infrastructure. While there may be ongoing debates and challenges, the overall success and popularity of Canadian health insurance are undeniable.

As Canada continues to evolve and adapt its healthcare system, one thing remains clear: the health and welfare of Canadians will always be a top priority. This commitment to healthcare excellence ensures that the Canadian health insurance system will continue to thrive and improve, benefiting generations to come.

What is the difference between public and private health insurance in Canada?

+Public health insurance, provided by the government, covers a wide range of essential medical services and is accessible to all residents. Private health insurance, on the other hand, is optional and offers additional coverage for services not included in the public plan, such as dental, vision, and certain prescription drugs.

How do I know if I’m covered by Canadian health insurance?

+If you are a Canadian citizen or a permanent resident, you are likely covered by your province or territory’s public health insurance plan. To confirm your coverage and understand the specifics, you can contact your provincial or territorial health ministry or insurance plan administrator.

Are there any restrictions on who can access Canadian health insurance?

+Canadian health insurance is primarily designed for Canadian citizens and permanent residents. Visitors and temporary residents may not be eligible for full coverage. However, some provinces offer limited coverage for specific groups, such as international students or refugees.