Individual Insurance

Understanding the Importance of Individual Insurance: A Comprehensive Guide

In today's complex and ever-changing world, individual insurance serves as a crucial safeguard for millions of people worldwide. From health emergencies to unforeseen accidents, the right insurance coverage can provide financial protection and peace of mind. This comprehensive guide aims to delve into the world of individual insurance, exploring its various facets, benefits, and how it can empower individuals to navigate life's uncertainties with confidence.

The Significance of Individual Insurance

Individual insurance, as the name suggests, is a personalized approach to risk management. Unlike group insurance policies, which are often provided by employers or organizations, individual insurance policies are tailored to the specific needs and circumstances of an individual. This flexibility is one of its key strengths, allowing individuals to customize their coverage based on their unique requirements.

The importance of individual insurance cannot be overstated, especially in a world where unexpected events can have significant financial implications. Whether it's a sudden illness, an accident leading to disability, or even the loss of a loved one, individual insurance policies offer a safety net. They ensure that individuals and their families are not left financially vulnerable during times of crisis.

Furthermore, individual insurance plays a pivotal role in promoting financial stability and long-term planning. By investing in suitable insurance policies, individuals can secure their future, protect their assets, and ensure a stable financial foundation for themselves and their dependents. This aspect of individual insurance is particularly relevant in an era where economic uncertainties are on the rise.

Types of Individual Insurance Policies

The world of individual insurance is vast and diverse, offering a range of policies to cater to different needs and risks. Here's an overview of some of the most common types of individual insurance policies:

Health Insurance

Health insurance is perhaps the most critical type of individual insurance. It provides coverage for medical expenses, ensuring that individuals can access quality healthcare without incurring massive financial burdens. With rising healthcare costs, health insurance has become an essential component of financial planning.

Health insurance policies can vary widely, offering different levels of coverage. Some policies focus on basic healthcare needs, while others provide comprehensive coverage for specialized treatments and procedures. The choice of health insurance policy often depends on an individual's health status, age, and personal preferences.

Life Insurance

Life insurance is designed to provide financial security to the dependents of the policyholder in the event of their death. It serves as a safety net, ensuring that the deceased's family can maintain their standard of living and meet their financial obligations. Life insurance policies can be tailored to meet specific needs, with options ranging from term life insurance to whole life insurance.

Disability Insurance

Disability insurance is crucial for individuals who wish to protect their income in the event of a disability that prevents them from working. This type of insurance provides a regular income stream, ensuring that the policyholder can meet their financial commitments even if they are unable to earn an income due to a disability.

Property Insurance

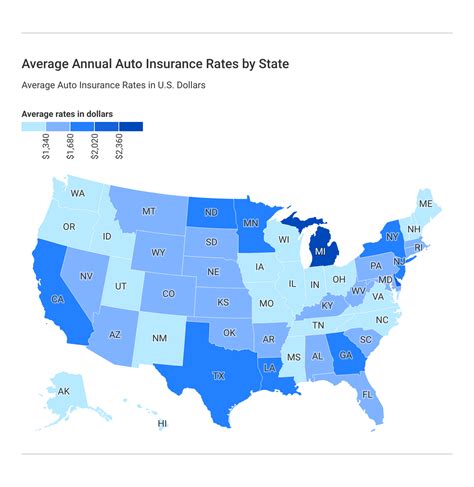

Property insurance, including home and auto insurance, is essential for protecting an individual's assets. Home insurance covers damages to a person's residence due to natural disasters, theft, or other unforeseen events. Auto insurance, on the other hand, provides coverage for vehicle-related incidents, offering protection against financial losses.

Travel Insurance

Travel insurance is a valuable addition to any trip, offering coverage for various travel-related emergencies. It can provide financial assistance in cases of medical emergencies while traveling, trip cancellations, lost luggage, or even personal liability during the journey. Travel insurance is particularly beneficial for frequent travelers and those embarking on adventurous trips.

Key Considerations When Choosing Individual Insurance

Selecting the right individual insurance policy is a critical decision that requires careful consideration. Here are some key factors to keep in mind when evaluating insurance options:

Assess Your Needs

Start by identifying your specific insurance needs. Consider your current health status, financial responsibilities, and future goals. Are you looking for comprehensive health coverage, income protection, or asset security? Understanding your unique requirements will help guide your insurance choices.

Compare Policies and Providers

Research and compare different insurance policies and providers. Look for policies that offer the right balance of coverage and affordability. Consider factors such as the insurer's reputation, financial stability, and customer service. Reading reviews and seeking recommendations from trusted sources can also be beneficial.

Understand Policy Details

Before committing to a policy, ensure you thoroughly understand its terms and conditions. Pay attention to coverage limits, deductibles, exclusions, and renewal options. Be aware of any waiting periods or pre-existing condition clauses that may impact your coverage. Don't hesitate to ask questions to clarify any uncertainties.

Consider Cost and Budget

Insurance policies come with varying premium costs. It's essential to find a policy that aligns with your budget while providing adequate coverage. Remember that the cheapest option may not always be the best choice. Strike a balance between affordability and comprehensive coverage to ensure you're adequately protected.

Maximizing the Benefits of Individual Insurance

Individual insurance is more than just a financial tool; it's a means to secure your future and the future of your loved ones. Here are some strategies to make the most of your insurance coverage:

Regular Policy Reviews

Life is dynamic, and your insurance needs may evolve over time. Regularly review your insurance policies to ensure they align with your current circumstances. Consider updating your coverage as your life changes, whether it's a new job, marriage, birth of a child, or retirement.

Understand Claim Procedures

Familiarize yourself with the claim process for your insurance policies. Know what documentation is required and the steps you need to take to initiate a claim. Being prepared and informed can streamline the claims process and ensure you receive the benefits you're entitled to.

Utilize Preventive Care

Many health insurance policies offer preventive care benefits, such as annual check-ups, screenings, and vaccinations. Take advantage of these services to maintain your health and detect potential issues early on. Preventive care can lead to better health outcomes and potentially reduce your long-term healthcare costs.

Explore Additional Benefits

Some insurance policies offer additional benefits beyond the standard coverage. These may include discounts on health-related services, access to wellness programs, or even travel assistance. Take the time to explore and utilize these benefits to enhance your overall insurance experience.

Future Trends in Individual Insurance

The insurance industry is continually evolving, and individual insurance is no exception. As technology advances and consumer preferences shift, we can expect to see several trends shaping the future of individual insurance:

Digital Transformation

The insurance industry is embracing digital technologies, making insurance more accessible and convenient. From online policy management to digital claim submissions, the industry is moving towards a more tech-centric approach. This trend is expected to continue, with insurers investing in innovative digital solutions to enhance the customer experience.

Personalized Insurance

The future of individual insurance lies in personalization. Insurers are leveraging data analytics and artificial intelligence to offer customized insurance products. These policies will be tailored to an individual's unique risk profile, lifestyle, and preferences, providing a more tailored and efficient insurance experience.

Wellness-Focused Policies

There is a growing trend towards wellness-focused insurance policies. These policies incentivize healthy behaviors and provide rewards for maintaining a healthy lifestyle. With a focus on prevention and early detection, these policies aim to reduce long-term healthcare costs and promote overall well-being.

Collaborative Insurance Models

The concept of collaborative insurance, where individuals share risks collectively, is gaining traction. This model allows for more affordable insurance options, especially for those with pre-existing conditions or high-risk profiles. Collaborative insurance models leverage the power of community and shared responsibility to provide comprehensive coverage.

Conclusion: Empowering Individuals through Insurance

Individual insurance is a powerful tool that empowers individuals to take control of their financial well-being. By understanding the different types of insurance policies, evaluating their needs, and making informed choices, individuals can navigate life's uncertainties with confidence. The future of individual insurance looks promising, with advancements in technology and a shift towards personalized and wellness-focused policies.

As we move forward, it's essential to recognize the value of insurance as a means to secure our financial future and protect the ones we love. With the right insurance coverage, individuals can embrace life's adventures with peace of mind, knowing they are prepared for whatever the future may bring.

How does individual insurance differ from group insurance?

+Individual insurance policies are tailored to the specific needs of an individual, offering flexibility and customization. In contrast, group insurance policies are often provided by employers or organizations and may have more standardized coverage options.

What factors should I consider when choosing a health insurance policy?

+When selecting a health insurance policy, consider factors such as your current health status, the level of coverage you require (e.g., basic or comprehensive), the network of healthcare providers, and the cost of premiums. It’s also essential to review the policy’s terms, including deductibles and out-of-pocket expenses.

How can I ensure my life insurance policy provides adequate coverage for my family?

+To ensure your life insurance policy provides sufficient coverage, consider your family’s financial needs and obligations. Calculate the amount needed to cover expenses such as mortgages, education costs, and daily living expenses. You may also consult with a financial advisor to determine the appropriate coverage amount.

What are some common exclusions in insurance policies?

+Common exclusions in insurance policies may include pre-existing conditions, certain types of accidents (e.g., self-inflicted injuries), acts of war, and intentional acts. It’s crucial to carefully review the policy’s exclusions to understand what is and isn’t covered.