Cars That Are Cheapest To Insure

When it comes to purchasing a vehicle, the initial cost is just the beginning. Ongoing expenses, including insurance, can significantly impact your budget. For many car owners, finding an affordable insurance policy is a top priority. In this comprehensive guide, we delve into the world of car insurance, uncovering the vehicles that offer the most cost-effective coverage. By analyzing various factors and real-world data, we aim to provide valuable insights to help you make an informed decision.

Understanding the Factors that Influence Insurance Costs

Before we dive into the list of cheapest cars to insure, it’s essential to grasp the key factors that insurance companies consider when determining premiums.

Vehicle Type and Make

Insurance rates can vary significantly based on the type and make of your vehicle. Factors such as the car’s safety features, repair costs, and historical insurance claims play a vital role.

For instance, luxury sports cars often command higher insurance premiums due to their powerful engines, which may result in more frequent accidents and costly repairs. On the other hand, compact sedans with standard safety features and affordable parts are generally more economical to insure.

Safety Features

Modern vehicles are equipped with an array of safety technologies, and these features can significantly impact insurance costs. Advanced driver-assistance systems (ADAS) like lane departure warning, automatic emergency braking, and adaptive cruise control have been proven to reduce accidents, leading to lower insurance rates.

According to a recent study, vehicles with ADAS technology can see insurance savings of up to 15% compared to similar models without these features. This highlights the importance of considering safety technologies when choosing a car.

Historical Claims Data

Insurance companies heavily rely on historical claims data to assess the risk associated with insuring a particular vehicle. If a specific model or make has a higher incidence of accidents or insurance claims, it may result in increased premiums.

For example, sports utility vehicles (SUVs), despite their popularity, often carry higher insurance costs due to their involvement in a greater number of accidents. This is primarily attributed to their higher center of gravity, which can make them more prone to rollover accidents.

The Cheapest Cars to Insure: A Comprehensive List

Now, let’s explore the vehicles that consistently rank among the most affordable to insure. These cars offer a balance of reliability, safety, and cost-effectiveness, making them an excellent choice for budget-conscious drivers.

Subcompact and Compact Cars

Subcompact and compact cars are renowned for their affordability and efficiency, and this extends to insurance costs as well. Here are some popular models that are consistently among the cheapest to insure:

- Honda Fit: Known for its versatility and fuel efficiency, the Honda Fit offers excellent value. With a low risk profile and affordable parts, it’s no surprise that it consistently tops the list of cheapest cars to insure.

- Toyota Yaris: Another reliable and economical choice, the Toyota Yaris boasts low maintenance costs and excellent safety ratings. Its overall affordability makes it an attractive option for budget-minded drivers.

- Hyundai Accent: The Hyundai Accent provides an impressive blend of features and affordability. With a solid safety record and competitive insurance rates, it’s a practical choice for those seeking an economical car.

Sedans and Hatchbacks

Sedans and hatchbacks offer a more spacious and refined driving experience, often without breaking the bank when it comes to insurance costs. Here are some top picks:

- Toyota Corolla: The Toyota Corolla has long been a staple in the affordable car market, and its insurance rates reflect its reliability and safety. With a reputation for longevity and low maintenance, it’s a wise choice for those seeking a practical sedan.

- Honda Civic: The Honda Civic is renowned for its balance of performance and practicality. Its excellent safety features and low repair costs contribute to its position as one of the cheapest sedans to insure.

- Volkswagen Jetta: The Volkswagen Jetta offers a premium driving experience at an affordable price. With its advanced safety systems and reliable build quality, it consistently ranks among the most economical sedans to insure.

Electric and Hybrid Vehicles

Electric and hybrid vehicles have gained popularity due to their environmental benefits and, in many cases, their cost-effectiveness. Here are some models that offer excellent insurance value:

- Toyota Prius: A pioneer in the hybrid market, the Toyota Prius is renowned for its fuel efficiency and low running costs. Its advanced hybrid technology and excellent safety features make it an attractive option for those seeking an eco-friendly and affordable vehicle.

- Nissan Leaf: The Nissan Leaf is a fully electric vehicle that offers a smooth and environmentally conscious driving experience. With low maintenance requirements and competitive insurance rates, it’s an excellent choice for those embracing the electric vehicle revolution.

- Hyundai Ioniq: The Hyundai Ioniq offers a versatile range of powertrains, including hybrid, plug-in hybrid, and electric options. Its advanced safety systems and competitive insurance rates make it a compelling choice for eco-conscious drivers.

SUVs and Crossovers

While SUVs and crossovers generally carry higher insurance costs due to their size and accident statistics, certain models offer more affordable coverage. Here are some top picks:

- Subaru Forester: The Subaru Forester is renowned for its all-wheel-drive capability and excellent safety ratings. With competitive insurance rates and a reputation for reliability, it’s a popular choice for those seeking an SUV without breaking the bank.

- Kia Sportage: The Kia Sportage offers a balance of style, practicality, and affordability. Its advanced safety features and reasonable insurance costs make it an attractive option for those seeking a compact SUV.

- Honda CR-V: The Honda CR-V is a stalwart in the SUV market, known for its spacious interior and excellent safety record. Its competitive insurance rates and overall value make it a top choice for families seeking an affordable SUV.

Additional Factors to Consider

While the above list provides a comprehensive overview of the cheapest cars to insure, it’s essential to remember that insurance rates can vary based on several additional factors.

Driver Profile

Your personal circumstances, such as age, driving history, and location, can significantly impact your insurance premiums. Younger drivers, for instance, often face higher insurance rates due to their lack of driving experience. Similarly, drivers with a history of accidents or traffic violations may see higher premiums.

Usage and Coverage

The way you use your vehicle and the level of coverage you require can also influence insurance costs. If you primarily use your car for commuting, your insurance rates may be lower compared to someone who frequently travels long distances or uses their vehicle for business purposes.

Insurance Provider and Discounts

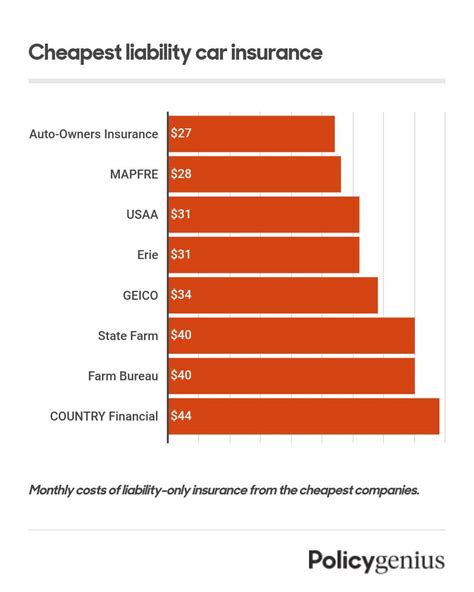

Different insurance providers offer varying rates and discounts. It’s essential to shop around and compare quotes from multiple insurers to find the most competitive rates. Additionally, many providers offer discounts for safe driving records, loyalty, or bundling multiple policies.

Future Trends and Implications

As the automotive industry continues to evolve, we can expect insurance rates to be influenced by emerging technologies and market trends.

Autonomous Vehicles

The rise of autonomous and semi-autonomous vehicles is expected to have a significant impact on insurance rates. With advanced driver-assistance systems becoming more common, accident rates are likely to decrease, leading to lower insurance costs over time.

Electric Vehicle Adoption

The increasing popularity of electric vehicles (EVs) is another trend that may influence insurance rates. As more drivers adopt EVs, insurance providers will have a larger pool of data to analyze, potentially leading to more accurate risk assessments and competitive rates for EV owners.

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior, is gaining traction in the insurance industry. Usage-based insurance programs offer personalized rates based on an individual’s driving habits. This technology has the potential to reward safe drivers with lower premiums, further incentivizing responsible driving.

Conclusion

Finding the cheapest car to insure is not just about selecting a particular model; it’s about understanding the factors that influence insurance rates and making informed choices. By considering vehicle type, safety features, historical claims data, and your personal circumstances, you can identify the vehicles that offer the best value in terms of insurance costs.

Remember, the cheapest car to insure for one person may not be the same for another, so it’s crucial to assess your individual needs and preferences. With the right vehicle and insurance provider, you can enjoy the benefits of affordable coverage without compromising on safety and reliability.

What are the main factors that influence insurance costs for a vehicle?

+Several factors impact insurance costs, including the vehicle’s make and model, safety features, historical claims data, driver profile, usage, and the chosen insurance provider.

Why are electric and hybrid vehicles often cheaper to insure?

+Electric and hybrid vehicles generally have lower maintenance and repair costs, and they are often equipped with advanced safety features. Additionally, their eco-friendly nature can result in lower insurance premiums as they are seen as less risky to insure.

How can I get the most accurate insurance quotes for my vehicle?

+To get the most accurate insurance quotes, it’s advisable to provide detailed information about your vehicle, driving history, and usage. Comparing quotes from multiple insurers is also essential to find the best rates.

Are there any discounts available for insurance policies?

+Yes, many insurance providers offer discounts for safe driving records, loyalty, or bundling multiple policies. It’s worth inquiring about these discounts when obtaining quotes.