Allianz Life Insurance Company

Allianz Life Insurance Company is a renowned name in the insurance industry, known for its comprehensive life insurance solutions and innovative financial products. With a rich history and a global presence, Allianz has established itself as a trusted partner for individuals and businesses seeking financial security and peace of mind.

A Legacy of Financial Protection

Founded in 1890 as the Allianz Versicherungs-AG, the company has evolved over the decades to become a leading provider of insurance and financial services. Headquartered in Munich, Germany, Allianz has expanded its operations worldwide, serving customers in over 70 countries and employing a diverse workforce of more than 150,000 professionals.

The company's journey began with a focus on property and casualty insurance, but it soon recognized the growing demand for life insurance products. In 1904, Allianz entered the life insurance market, offering policies that provided financial protection and stability to families and individuals. This strategic move positioned Allianz as a comprehensive insurer, catering to a wide range of customer needs.

Global Expansion and Innovation

Allianz’s success story is marked by its ability to adapt and innovate. The company has consistently expanded its product offerings, keeping pace with the evolving needs of its customers. In the 1950s, Allianz introduced innovative products such as group life insurance and pension plans, catering to the growing importance of employee benefits in modern workplaces.

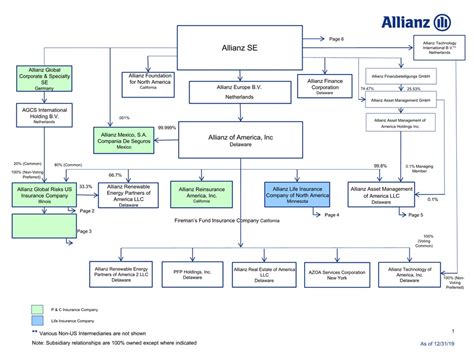

The 1980s witnessed a significant shift towards international expansion. Allianz established a strong presence in the United States, acquiring Fireman's Fund Insurance Company and later forming Allianz Life Insurance Company of North America. This strategic move allowed Allianz to tap into the lucrative North American market and offer its comprehensive suite of insurance products to a broader audience.

In recent years, Allianz has further solidified its position as a global leader by focusing on digital innovation and technological advancements. The company has invested heavily in developing digital platforms and tools to enhance the customer experience, making insurance products more accessible and convenient.

Product Portfolio and Services

Allianz Life Insurance Company offers a diverse range of insurance and financial products tailored to meet various life stages and financial goals. Here’s an overview of some of their key offerings:

- Life Insurance: Allianz provides a comprehensive range of life insurance policies, including term life, whole life, and universal life insurance. These policies offer financial protection, tax benefits, and the flexibility to meet individual needs.

- Annuities: Allianz's annuity products provide a stable income stream during retirement. These products offer tax advantages and a range of investment options, allowing retirees to secure their financial future.

- Long-Term Care Insurance: Recognizing the growing need for long-term care, Allianz offers policies that cover the costs associated with extended care, providing peace of mind and financial support during challenging times.

- Disability Insurance: Allianz's disability insurance policies protect individuals' earning potential by providing income replacement in the event of a disability, ensuring financial stability and security.

- Retirement Planning: Allianz offers comprehensive retirement planning services, helping individuals assess their financial goals and develop strategies to achieve a comfortable retirement. This includes pension plans, investment advice, and tax-efficient savings options.

| Product Category | Key Features |

|---|---|

| Life Insurance | Flexible coverage, tax benefits, and customizable policies. |

| Annuities | Stable income during retirement, tax advantages, and investment options. |

| Long-Term Care Insurance | Coverage for extended care needs, ensuring financial support during vulnerable times. |

| Disability Insurance | Income protection in case of disability, providing financial stability. |

| Retirement Planning | Comprehensive services for assessing and achieving retirement goals. |

Industry Recognition and Awards

Allianz Life Insurance Company’s commitment to excellence has been recognized by various industry accolades and awards. Here are some notable recognitions:

- A.M. Best Rating: Allianz Life Insurance Company has consistently maintained a Superior rating (A+) from A.M. Best, a leading insurance rating agency. This rating reflects the company's financial strength, stability, and ability to meet its obligations to policyholders.

- J.D. Power Awards: Allianz has received numerous awards from J.D. Power, a renowned customer satisfaction research firm. These awards recognize Allianz's dedication to providing exceptional customer service and product quality.

- Insurance Industry Awards: Allianz has been honored with various industry awards, including the International Insurance Awards and the National Insurance Awards, acknowledging its innovation, customer focus, and industry leadership.

- Sustainability and Corporate Responsibility: Allianz has also been recognized for its commitment to sustainability and corporate responsibility. The company has received accolades for its environmental initiatives, diversity and inclusion efforts, and community engagement programs.

A Commitment to Excellence

Allianz Life Insurance Company’s success is a testament to its unwavering commitment to providing top-notch financial products and services. Through its extensive product portfolio, global reach, and dedication to customer satisfaction, Allianz has become a trusted partner for individuals and businesses seeking financial security and peace of mind.

As the insurance landscape continues to evolve, Allianz remains at the forefront, leveraging its expertise and innovation to meet the changing needs of its customers. With a focus on digital transformation and a customer-centric approach, Allianz is well-positioned to continue its legacy of excellence in the insurance industry.

What are the key benefits of Allianz’s life insurance policies?

+Allianz’s life insurance policies offer a range of benefits, including flexible coverage options, tax advantages, and the ability to customize policies to meet individual needs. These policies provide financial protection, ensuring loved ones are cared for in the event of unforeseen circumstances.

How does Allianz’s annuity product provide financial security during retirement?

+Allianz’s annuity products offer a stable income stream during retirement, providing financial security and peace of mind. These products are designed to offer tax advantages and a range of investment options, allowing retirees to customize their retirement income to suit their needs.

What makes Allianz a trusted partner for financial security?

+Allianz’s reputation as a trusted partner stems from its commitment to excellence, innovation, and customer satisfaction. With a rich history, global presence, and a diverse range of financial products, Allianz provides individuals and businesses with the financial security and peace of mind they need to navigate life’s uncertainties.