Ppo Insurance Vs Hmo

When it comes to health insurance, two popular plans often considered by individuals and families are Preferred Provider Organization (PPO) and Health Maintenance Organization (HMO). These plans offer different approaches to healthcare coverage and management, each with its own set of advantages and considerations. In this comprehensive guide, we will delve into the specifics of PPO and HMO insurance, helping you understand their key differences and make an informed decision for your healthcare needs.

Understanding PPO Insurance

A Preferred Provider Organization (PPO) plan is a flexible healthcare insurance option that offers a wide network of healthcare providers and hospitals for its members to choose from. With a PPO, you have the freedom to visit any healthcare professional or facility within the network without needing a referral or prior authorization. This flexibility is one of the key attractions of PPO plans.

Key Features of PPO Plans

PPO insurance plans provide several benefits and features that cater to individuals who value choice and convenience:

- Network Flexibility: PPO plans typically have a larger network of healthcare providers compared to other plans. You can visit any in-network doctor, specialist, or hospital without restrictions.

- No Referrals Needed: Unlike some other insurance plans, PPOs do not require a referral from your primary care physician to see a specialist. This simplifies the process and gives you direct access to specialized care.

- Cost-Sharing Options: PPOs often offer a range of cost-sharing arrangements, such as copayments, coinsurance, and deductibles. These options allow you to customize your plan based on your budget and healthcare needs.

- Out-of-Network Coverage: While it’s more cost-effective to use in-network providers, PPO plans also provide coverage for out-of-network services. However, the out-of-pocket costs may be higher.

- Pre-Authorization for Certain Procedures: In some cases, PPO plans may require pre-authorization for certain procedures or treatments. This ensures that the insurance company approves the procedure in advance, preventing unexpected out-of-pocket expenses.

PPO Plan Example: Blue Cross Blue Shield PPO

Blue Cross Blue Shield (BCBS) is a well-known insurance provider that offers a range of PPO plans. For instance, their Blue Advantage PPO plan provides extensive coverage with a nationwide network of healthcare providers. This plan offers:

- A wide choice of doctors and hospitals

- No referrals needed for specialists

- Lower out-of-pocket costs for in-network services

- Pre-authorization for certain procedures, such as surgeries or expensive treatments

BCBS PPO plans are a great option for those who want flexibility and a large network of healthcare providers without sacrificing cost-effectiveness.

Exploring HMO Insurance

A Health Maintenance Organization (HMO) plan is a more structured approach to healthcare coverage, focusing on preventative care and managing healthcare costs. HMOs typically require members to select a primary care physician (PCP) who coordinates all their healthcare needs. This PCP acts as a gatekeeper, referring members to specialists and other healthcare providers within the HMO network.

Key Features of HMO Plans

HMO insurance plans offer a different set of benefits and considerations, making them a preferred choice for individuals who prioritize cost savings and coordinated care:

- Coordinated Care: HMOs emphasize the role of a primary care physician who oversees your overall healthcare. This coordination ensures that your healthcare needs are managed effectively and efficiently.

- Lower Costs: HMO plans are often more cost-effective than other insurance options. Members typically pay lower premiums and have reduced out-of-pocket expenses due to the managed care model.

- Preventative Care Focus: HMOs place a strong emphasis on preventative care, offering a range of wellness programs and screenings to help members stay healthy and avoid costly treatments.

- In-Network Coverage: Similar to PPOs, HMOs have a network of healthcare providers and facilities. It’s crucial to stay within this network to access the best coverage and minimize out-of-pocket costs.

- Referrals Required: In most cases, HMOs require a referral from your PCP to see a specialist. This ensures that your healthcare needs are properly managed and prevents unnecessary or redundant treatments.

HMO Plan Example: Kaiser Permanente HMO

Kaiser Permanente is a prominent HMO provider known for its integrated healthcare system. Their HMO plans, such as the Kaiser Permanente Individual and Family HMO, offer comprehensive coverage with the following features:

- A dedicated primary care physician who coordinates all your healthcare needs

- Lower premiums and out-of-pocket costs compared to other insurance plans

- A wide range of preventative care services, including annual physicals and screenings

- Referrals to specialists within the Kaiser Permanente network

Kaiser Permanente's HMO plans provide a cost-effective and coordinated approach to healthcare, ensuring that members receive the right care at the right time.

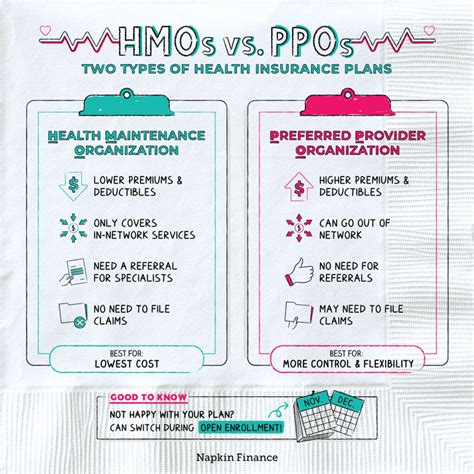

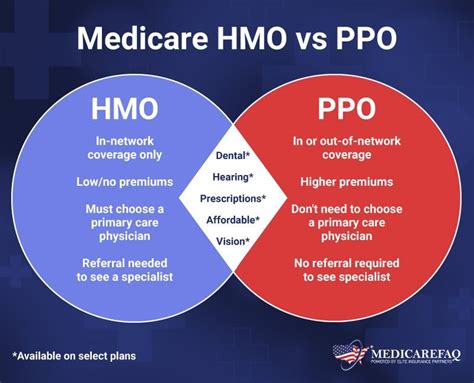

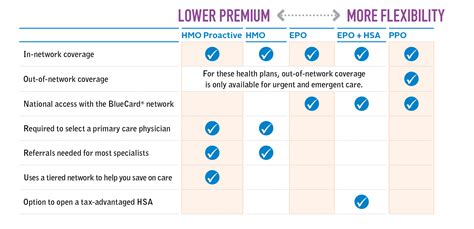

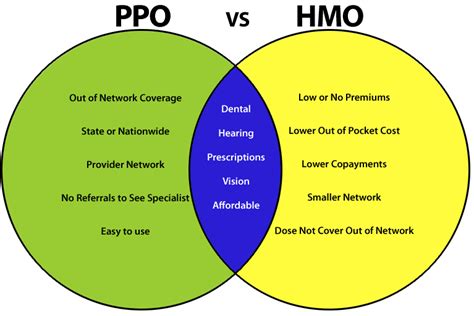

Comparing PPO and HMO Plans

When deciding between a PPO and an HMO plan, it’s essential to consider your personal healthcare needs and preferences. Here’s a comparison table highlighting the key differences between these two types of insurance plans:

| Category | PPO | HMO |

|---|---|---|

| Network Flexibility | Larger network, freedom to choose providers without referrals | Smaller network, typically requires referrals for specialists |

| Cost-Sharing | Offers various cost-sharing options, including copays and deductibles | Lower premiums and out-of-pocket costs, but may have higher copays for out-of-network services |

| Coordinated Care | Less emphasis on coordination, members have more freedom to choose providers | Strong focus on coordinated care through a primary care physician |

| Preventative Care | May offer preventative services, but not as comprehensive as HMOs | Emphasizes preventative care with a range of wellness programs and screenings |

| Out-of-Network Coverage | Provides coverage for out-of-network services, but at a higher cost | Limited or no coverage for out-of-network services |

The choice between a PPO and an HMO plan depends on your healthcare needs and personal preferences. If you value flexibility and the ability to choose your healthcare providers without restrictions, a PPO plan might be a better fit. On the other hand, if you prioritize cost savings, coordinated care, and preventative services, an HMO plan could be the right choice.

Choosing the Right Plan for You

Selecting the appropriate health insurance plan is a crucial decision that impacts your access to healthcare and your financial well-being. When considering a PPO or HMO plan, it’s essential to assess your individual needs and circumstances. Here are some factors to consider when making your choice:

Healthcare Needs

Think about your current and anticipated healthcare needs. If you require frequent medical attention or have specific healthcare conditions, an HMO plan with its coordinated care approach and focus on preventative services might be more suitable. On the other hand, if you prefer the flexibility to choose your healthcare providers and specialists without restrictions, a PPO plan could be a better fit.

Network Coverage

Review the network of healthcare providers and facilities covered by each plan. Ensure that your preferred doctors and hospitals are included in the network to avoid unexpected out-of-pocket expenses. If you frequently travel or live in an area with limited healthcare options, a PPO plan with a larger network might provide more convenience.

Cost Considerations

Evaluate the premiums, deductibles, copays, and other out-of-pocket costs associated with each plan. HMOs often have lower premiums and out-of-pocket expenses, making them more cost-effective for individuals who prioritize cost savings. PPO plans, while offering more flexibility, may have higher costs, especially for out-of-network services.

Referral Requirements

Consider the referral process for specialists. HMOs typically require referrals from your primary care physician, which can be a drawback for those who prefer direct access to specialists. PPO plans, on the other hand, often allow direct access to specialists without referrals, providing more convenience.

Preventative Care Services

If preventative care and wellness programs are important to you, an HMO plan’s focus on these services could be beneficial. HMOs often offer a range of preventative services, including annual physicals, screenings, and health education programs, helping you maintain your health and well-being.

Plan Flexibility

Assess your preference for flexibility in choosing healthcare providers. PPO plans offer a wider network and the freedom to choose providers without restrictions, making them a popular choice for those who value this flexibility. HMOs, while providing a more structured approach, may require you to stay within their network for the best coverage.

Plan Reputation and Reviews

Research the reputation and reviews of the insurance provider and their specific plans. Look for customer feedback and ratings to gain insights into the quality of services, claim processing, and overall customer satisfaction. This can help you make an informed decision and choose a plan that aligns with your expectations.

Remember, the right health insurance plan for you depends on your unique needs and circumstances. Take the time to thoroughly review the plan details, network coverage, and cost considerations to ensure you make a choice that provides the best healthcare coverage and financial protection for your situation.

FAQs

Can I switch between PPO and HMO plans anytime?

+Switching between PPO and HMO plans typically occurs during open enrollment periods, which are designated times each year when you can make changes to your insurance coverage. However, there may be exceptions, such as qualifying life events (e.g., marriage, birth of a child) that allow you to switch plans outside of the open enrollment period. It’s important to check with your insurance provider for specific rules and guidelines regarding plan changes.

Are PPO plans more expensive than HMO plans?

+PPO plans often have higher premiums compared to HMO plans. This is because PPO plans offer more flexibility in choosing healthcare providers and typically have a larger network. The increased flexibility and network size contribute to the higher cost of PPO plans. However, the actual cost difference can vary based on the specific plan and your individual healthcare needs.

Do I need to stay within the HMO network for coverage?

+Yes, it is generally recommended to stay within the HMO network to ensure the best coverage and minimize out-of-pocket expenses. While some HMO plans may provide limited coverage for out-of-network services, the costs can be significantly higher. To make the most of your HMO plan, it’s best to utilize in-network providers and facilities.

Can I choose my own specialist with a PPO plan?

+Yes, one of the key advantages of a PPO plan is the freedom to choose your own specialist without the need for a referral from your primary care physician. This flexibility allows you to select the specialist that best meets your healthcare needs, whether it’s based on their expertise, location, or personal recommendations.

Do HMO plans cover preventative care services?

+Yes, HMO plans place a strong emphasis on preventative care and typically cover a wide range of preventative services. These may include annual physicals, immunizations, cancer screenings, and health education programs. By prioritizing preventative care, HMO plans aim to help members stay healthy and avoid more costly treatments down the line.