Public Liability Insurance Cost

Public liability insurance is a vital protection for businesses and professionals, offering financial coverage in the event of accidents, injuries, or property damage caused to third parties. The cost of this insurance is a critical consideration for any entity operating in a space where the risk of such incidents is present. While the premium can vary greatly depending on the nature of the business, its location, and the level of coverage required, understanding the factors influencing these costs is essential for making informed decisions.

In this comprehensive guide, we delve into the intricacies of public liability insurance costs, exploring the key variables that determine premiums and providing a detailed analysis of the coverage options available. By examining real-world examples and industry data, we aim to equip readers with the knowledge needed to assess their own public liability insurance needs accurately and make cost-effective choices.

Understanding the Basics of Public Liability Insurance

Public liability insurance is a type of general liability insurance that provides coverage for bodily injury, property damage, and personal injury claims made against a business or professional. It is designed to protect against the financial risks associated with accidents or incidents that occur during the course of business operations.

The coverage offered by public liability insurance is extensive and can include a wide range of incidents. For instance, if a customer slips and falls on a wet floor in a retail store, the store owner's public liability insurance would typically cover the resulting medical expenses and any legal costs associated with the incident. Similarly, if a construction company's work results in damage to a neighbor's property, the insurance would step in to cover the costs of repairs.

The key purpose of public liability insurance is to safeguard businesses and professionals from the potentially catastrophic financial consequences of legal claims and settlements. Without this insurance, a single accident or incident could lead to significant financial loss, potentially threatening the very existence of the business.

Factors Influencing Public Liability Insurance Costs

The cost of public liability insurance can vary significantly based on a multitude of factors. Understanding these factors is crucial for businesses and professionals to make informed decisions about their insurance coverage.

Industry and Business Type

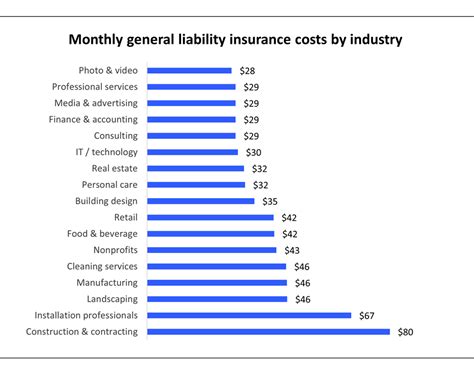

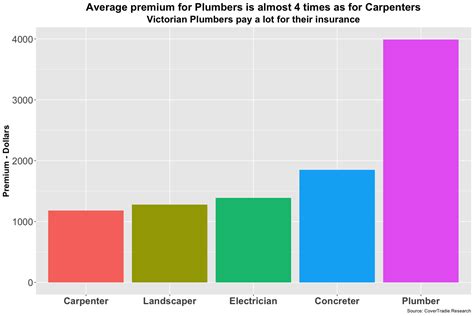

The industry in which a business operates plays a significant role in determining public liability insurance costs. Certain industries, such as construction, manufacturing, and hospitality, inherently carry higher risks due to the nature of their operations. For instance, a construction company faces a higher risk of accidents and property damage compared to a software development firm, which primarily operates in a digital environment.

Within industries, the specific business type also influences insurance costs. For example, a restaurant that serves alcohol may face higher insurance premiums compared to a cafe due to the increased risk of accidents and potential liability issues.

Size and Location of Business

The size and location of a business are additional key factors in determining public liability insurance costs. Generally, larger businesses with more employees, customers, and operations have a higher potential for accidents and incidents, leading to increased insurance premiums.

The location of the business is also significant. Areas with higher population densities, more traffic, or a history of frequent accidents may result in higher insurance premiums. This is because the risk of incidents is generally higher in such locations.

Level of Coverage Required

The level of coverage a business chooses to purchase is a critical factor in determining insurance costs. Public liability insurance policies typically offer different levels of coverage, with higher limits resulting in increased premiums. The coverage limit refers to the maximum amount the insurer will pay out for a single claim or across multiple claims during the policy period.

For example, a business might choose a policy with a coverage limit of £1 million, which would provide sufficient protection for most common incidents. However, businesses operating in high-risk industries or with complex operations might require a much higher coverage limit, such as £5 million or more, to adequately protect themselves.

Claims History and Risk Assessment

Insurance companies carefully assess the risk profile of each business when determining insurance premiums. A business with a history of frequent claims or a high-risk profile is likely to face higher insurance costs. Conversely, a business with a strong safety record and low claims history may benefit from more competitive insurance rates.

Risk assessment involves evaluating various factors, including the business's safety procedures, its incident and accident record, and its overall risk management strategies. A thorough and effective risk management system can help lower insurance costs by demonstrating a commitment to safety and a reduced likelihood of incidents.

Policy Deductibles and Excesses

The policy deductible or excess is the amount a business must pay out-of-pocket before the insurance coverage kicks in. Choosing a higher deductible can lead to lower insurance premiums, as it reduces the insurer’s potential liability. However, this strategy carries the risk of having to pay a significant amount upfront in the event of a claim.

For example, if a business selects a policy with a £500 deductible, it will be responsible for paying the first £500 of any claim. This means that smaller claims may not trigger the insurance coverage, and the business will have to cover those costs on its own. While this can result in lower premiums, it's essential to carefully consider the potential financial implications.

Comparing Public Liability Insurance Costs

When comparing public liability insurance costs, it’s essential to consider not just the premium but also the coverage limits, policy terms, and exclusions. While a lower premium may be attractive, it’s important to ensure that the coverage offered is sufficient for the business’s needs.

Businesses should carefully review the policy terms and conditions to understand what is and isn't covered. Certain activities or incidents may be specifically excluded from the policy, leaving the business vulnerable to financial loss if an incident occurs. For example, some policies may exclude coverage for claims arising from certain types of accidents or incidents that occur during specific activities.

Additionally, businesses should consider the financial stability and reputation of the insurance provider. A reputable insurer with a strong financial standing is more likely to be able to pay out claims promptly and fully, providing peace of mind and security in the event of an incident.

| Insurance Provider | Premium (Annual) | Coverage Limit |

|---|---|---|

| ABC Insurance | £1,200 | £2 million |

| DEF Insurance | £1,500 | £3 million |

| GHI Insurance | £950 | £1.5 million |

The table above provides a simplified comparison of annual premiums and coverage limits for three different insurance providers. While ABC Insurance offers a lower premium, its coverage limit is also lower compared to DEF Insurance. GHI Insurance, with the lowest premium, provides a middle ground in terms of coverage limit. The specific needs and risk profile of the business will determine which option is the most suitable.

Tips for Reducing Public Liability Insurance Costs

While public liability insurance is a critical protection for businesses, it’s understandable that cost is a significant consideration. Here are some tips and strategies to potentially reduce insurance costs without compromising on coverage:

Shop Around and Compare Policies

Don’t settle for the first insurance quote you receive. Shopping around and comparing policies from different providers can help you find the best value for your money. Online comparison tools and insurance brokers can be valuable resources for this process.

Bundle Insurance Policies

If your business requires multiple types of insurance, consider bundling them together with a single insurer. Many insurance providers offer discounts for bundling policies, such as combining public liability insurance with professional indemnity insurance or property insurance.

Review Coverage Levels

Regularly review your insurance coverage levels to ensure they align with your business’s current needs. If your business has grown or changed, your insurance requirements may have shifted as well. Make sure your coverage limits are sufficient but not excessive, as this can lead to unnecessary premium costs.

Implement Risk Management Strategies

Insurance companies view businesses with strong risk management strategies more favorably. By implementing robust safety measures, training programs, and incident response plans, you can demonstrate a commitment to reducing the likelihood of incidents and claims. This can lead to more competitive insurance rates.

Consider Higher Deductibles or Excesses

Choosing a higher deductible or excess can lower your insurance premiums. However, this strategy should be carefully considered, as it increases the financial burden on your business in the event of a claim. It’s important to strike a balance between cost savings and maintaining financial resilience.

Case Study: Impact of Public Liability Insurance on a Small Business

Let’s consider a real-world example to illustrate the impact of public liability insurance on a small business. Imagine a family-run cafe located in a busy city center. The cafe serves a variety of hot and cold beverages, as well as light meals, and has a cozy indoor seating area and a small outdoor patio.

Without public liability insurance, a single incident could have devastating financial consequences for the cafe. For instance, if a customer slips on a wet floor and sustains a serious injury, the cafe owner could face significant legal and medical costs. Without insurance, these costs would have to be covered out of pocket, potentially leading to financial ruin.

With public liability insurance, however, the cafe is protected from such financial risks. The insurance policy covers the costs associated with the customer's injury, including medical expenses and legal fees. This protection allows the cafe owner to focus on running the business without the constant worry of potential financial disasters.

Furthermore, the insurance policy provides peace of mind and helps maintain the cafe's reputation. By promptly addressing the customer's injury and ensuring proper compensation, the cafe can maintain a positive relationship with its customers and avoid negative publicity.

While the cost of public liability insurance is an additional expense for the cafe, it is a necessary investment to protect the business and its owners. By carefully selecting an appropriate policy with suitable coverage limits, the cafe can ensure it is adequately protected without incurring excessive insurance costs.

Future Trends and Considerations in Public Liability Insurance

The landscape of public liability insurance is continually evolving, influenced by changing legal and regulatory environments, emerging risks, and technological advancements. Staying informed about these trends is essential for businesses to make proactive decisions about their insurance coverage.

Emerging Risks and New Technologies

As businesses adopt new technologies and expand into new areas, they may face emerging risks that traditional insurance policies may not adequately cover. For instance, with the rise of e-commerce and online businesses, the risk of cyber attacks and data breaches has become a significant concern. Specialized insurance products are now available to address these risks, but it’s important for businesses to stay aware of these evolving needs.

Regulatory and Legal Changes

Changes in laws and regulations can have a significant impact on public liability insurance. For example, new health and safety regulations may increase the likelihood of incidents and claims, leading to higher insurance costs. Conversely, improvements in safety standards can reduce the risk of incidents, potentially resulting in lower insurance premiums.

Advancements in Risk Assessment and Underwriting

Insurance providers are continually refining their risk assessment and underwriting processes, leveraging advanced analytics and data-driven models. These improvements allow insurers to more accurately assess the risks posed by different businesses, potentially leading to more tailored and cost-effective insurance solutions.

The Impact of Economic Conditions

Economic conditions can also influence public liability insurance costs. During economic downturns, insurance premiums may decrease as insurers compete for a smaller pool of customers. Conversely, in robust economic conditions, premiums may rise as businesses expand and the risk of incidents increases.

How does the size of my business impact public liability insurance costs?

+

Larger businesses with more employees, customers, and operations generally face higher insurance costs due to the increased potential for accidents and incidents. However, the specific impact on premiums can vary depending on the nature of the business and other factors such as industry, location, and coverage limits.

What is the difference between public liability insurance and professional indemnity insurance?

+

Public liability insurance covers bodily injury, property damage, and personal injury claims made against a business or professional. On the other hand, professional indemnity insurance provides coverage for legal costs and compensation arising from negligence, errors, or omissions in the professional services provided by the insured. While both are essential protections, they cover different types of risks.

Can I customize my public liability insurance policy to meet my specific needs?

+

Yes, most insurance providers offer customizable public liability insurance policies. You can tailor the coverage limits, policy deductibles, and even the specific types of incidents covered to align with your business’s unique needs and risk profile. Consulting with an insurance broker can help you navigate the options and choose the best policy for your situation.