Allstate Quotes For Car Insurance

Are you searching for reliable car insurance quotes to protect your vehicle and ensure peace of mind on the road? Look no further than Allstate, a trusted insurance provider known for its comprehensive coverage options and personalized service. In this comprehensive guide, we'll explore the ins and outs of obtaining Allstate quotes for car insurance, empowering you to make informed decisions about your insurance needs.

Understanding Allstate’s Car Insurance Coverage

Allstate offers a wide range of car insurance coverage options to cater to diverse driving needs and preferences. From basic liability coverage to comprehensive protection plans, they aim to provide tailored solutions for every driver. Here’s a breakdown of the key coverage options:

Liability Coverage

Liability coverage is the cornerstone of any car insurance policy. Allstate’s liability insurance safeguards you against financial responsibility for bodily injury or property damage caused to others in an accident for which you are at fault. This coverage is essential to protect your assets and provide peace of mind.

| Liability Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses and lost wages for individuals injured in an accident caused by you. |

| Property Damage Liability | Provides coverage for damage to others' property, such as vehicles or structures, in an accident caused by you. |

Collision and Comprehensive Coverage

Collision and comprehensive coverage are two crucial components of a robust car insurance policy. Collision coverage helps cover the cost of repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. Comprehensive coverage, on the other hand, protects against non-accident-related incidents such as theft, vandalism, natural disasters, and collisions with animals.

Additional Coverage Options

Allstate understands that every driver’s needs are unique, which is why they offer a variety of additional coverage options to enhance your policy. These include:

- Uninsured/Underinsured Motorist Coverage: Protects you in the event of an accident with a driver who has little or no insurance.

- Medical Payments Coverage: Covers medical expenses for you and your passengers, regardless of fault.

- Rental Car Reimbursement: Provides rental car coverage if your vehicle is being repaired or replaced due to a covered incident.

- Gap Coverage: Bridges the gap between your vehicle's actual cash value and the amount you owe if it's totaled or stolen.

Obtaining Allstate Quotes: A Step-by-Step Guide

Getting an Allstate car insurance quote is a straightforward process that can be completed online or by contacting an Allstate agent. Here’s a step-by-step guide to help you navigate the process smoothly:

Step 1: Gather Essential Information

Before requesting a quote, it’s beneficial to have certain information readily available. This includes:

- Your personal details: Name, date of birth, driver's license number, and social security number.

- Vehicle information: Make, model, year, VIN (Vehicle Identification Number), and current mileage.

- Driving history: Details of any accidents, violations, or claims made in the past 5 years.

- Current insurance coverage: Information about your existing policy, including coverage limits and deductibles.

Step 2: Choose Your Quote Method

Allstate offers multiple avenues for obtaining quotes, catering to different preferences:

- Online Quote: Visit Allstate's official website and use their online quote tool. Simply input your personal and vehicle details to receive an instant quote.

- Agent Quote: Contact an Allstate agent near you. They can provide personalized guidance and assist you in choosing the right coverage options.

- Phone Quote: Call Allstate's customer service hotline and speak with a representative to obtain a quote over the phone.

Step 3: Provide Additional Details

Once you’ve chosen your preferred quote method, you’ll be guided through a series of questions to tailor the quote to your needs. Be prepared to provide information such as:

- Garaging location: The address where your vehicle is primarily parked.

- Annual mileage estimate: An approximation of the distance you drive annually.

- Desired coverage limits: Your preferred liability limits and deductibles.

- Optional coverage choices: Decide which additional coverages you'd like to include.

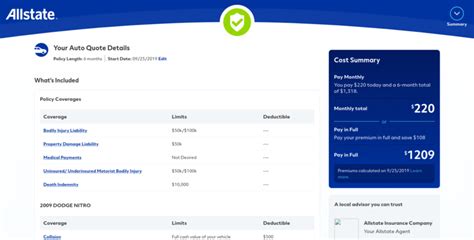

Step 4: Review and Compare Quotes

After providing the necessary details, you’ll receive one or more quotes based on your specified coverage options. Take the time to review these quotes carefully, comparing prices, coverage limits, and any applicable discounts.

Step 5: Customize Your Policy

If you’re satisfied with the quote, you can proceed to customize your policy further. This step allows you to adjust coverage limits, deductibles, and optional coverages to find the perfect balance between cost and protection.

Allstate’s Unique Features and Benefits

Allstate sets itself apart from other insurance providers with a range of unique features and benefits that enhance the overall customer experience. Here are some notable highlights:

Digital Tools and Resources

Allstate understands the importance of technology in today’s world, which is why they offer a suite of digital tools to streamline the insurance process. These include:

- Mobile App: Access your policy information, make payments, and report claims from the convenience of your smartphone.

- Online Policy Management: Manage your policy, make changes, and view billing and coverage details through Allstate's secure online portal.

- Claim Tracking: Stay updated on the status of your claims through Allstate's claim tracking system, ensuring a seamless and transparent process.

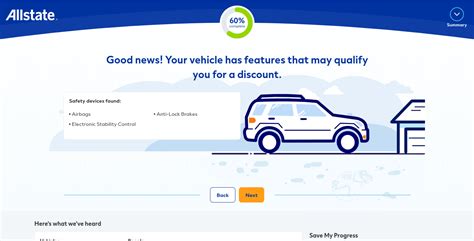

Discounts and Savings Opportunities

Allstate recognizes the importance of affordability in insurance coverage. They offer a variety of discounts to help customers save on their premiums, including:

- Safe Driving Discount: Reward for maintaining a clean driving record with no accidents or violations.

- Multi-Policy Discount: Savings for bundling your car insurance with other Allstate policies, such as homeowners or renters insurance.

- Loyalty Discount: Recognition for long-term customers who have been with Allstate for multiple years.

- Good Student Discount: Available for young drivers who maintain good grades in school.

Claim Service Excellence

Allstate is dedicated to providing exceptional claim service to its customers. They offer a 24⁄7 claims hotline, ensuring prompt assistance whenever you need it. Additionally, Allstate’s claim adjusters are known for their expertise and dedication to resolving claims fairly and efficiently.

Roadside Assistance and Additional Services

Allstate’s roadside assistance program provides peace of mind when you’re on the road. It includes services such as:

- Towing and emergency repairs

- Flat tire assistance

- Battery jump-starts

- Lockout services

- Fuel delivery

Comparative Analysis: Allstate vs. Competitors

To help you make an informed decision, let’s take a closer look at how Allstate stacks up against some of its competitors in the car insurance market:

Coverage Options

Allstate offers a comprehensive range of coverage options, similar to most major insurance providers. However, they excel in providing personalized attention and guidance to help customers choose the right coverage for their needs.

Pricing

When it comes to pricing, Allstate’s rates are generally competitive in the market. They offer a variety of discounts to help customers save, making their policies affordable for a wide range of drivers.

Customer Service and Claim Handling

Allstate is renowned for its exceptional customer service and claim handling. Their dedicated agents and claim adjusters are known for their expertise and commitment to customer satisfaction. Additionally, their digital tools and resources enhance the overall customer experience.

Additional Services and Features

Allstate sets itself apart with its suite of additional services and features, including roadside assistance, accident forgiveness, and a variety of discounts. These added benefits provide customers with extra peace of mind and value.

Conclusion: Empowering Your Car Insurance Journey

Obtaining Allstate quotes for car insurance is a crucial step in ensuring you have the right coverage to protect your vehicle and yourself on the road. By understanding Allstate’s coverage options, exploring their unique features, and comparing them with competitors, you can make an informed decision that aligns with your needs and budget.

Remember, car insurance is not a one-size-fits-all solution. Take the time to review your options, customize your policy, and leverage Allstate's resources to find the perfect coverage for your driving lifestyle. With Allstate by your side, you can drive with confidence, knowing you're protected.

How can I get the most accurate Allstate car insurance quote?

+To obtain the most accurate quote, provide Allstate with detailed and accurate information about your driving history, vehicle, and desired coverage options. The more precise the information, the more tailored the quote will be to your needs.

What factors influence Allstate’s car insurance rates?

+Allstate’s rates are influenced by various factors, including your driving record, vehicle type, location, and the coverage options you choose. Additionally, personal factors like age, gender, and marital status may also impact your rates.

Can I bundle my car insurance with other Allstate policies to save money?

+Yes, bundling your car insurance with other Allstate policies, such as homeowners or renters insurance, can lead to significant savings. Allstate offers multi-policy discounts to reward customers who choose to bundle their coverage.

How can I ensure I have the right coverage for my specific needs?

+Working closely with an Allstate agent can help you determine the right coverage for your needs. They can guide you through the various options, explain the benefits of each, and help you customize a policy that provides adequate protection at an affordable price.

What should I do if I’m involved in an accident while insured with Allstate?

+In the event of an accident, contact Allstate’s 24⁄7 claims hotline immediately. Their claim adjusters will guide you through the process, ensuring a smooth and efficient resolution. It’s important to report the accident promptly to avoid any potential delays or complications.