Auto Insurance Average Cost

The average cost of auto insurance is a topic that intrigues many vehicle owners and prospective buyers alike. It's an essential consideration when budgeting for vehicle ownership, as insurance premiums can vary significantly based on numerous factors. Understanding these costs is key to making informed decisions about vehicle selection, insurance coverage, and managing personal finances.

Factors Influencing Auto Insurance Premiums

Numerous variables contribute to the determination of auto insurance costs. These factors are multifaceted, encompassing personal details, vehicle specifications, and geographical considerations. By exploring these elements, we can gain a clearer understanding of the mechanics behind insurance premium calculations.

Personal Factors

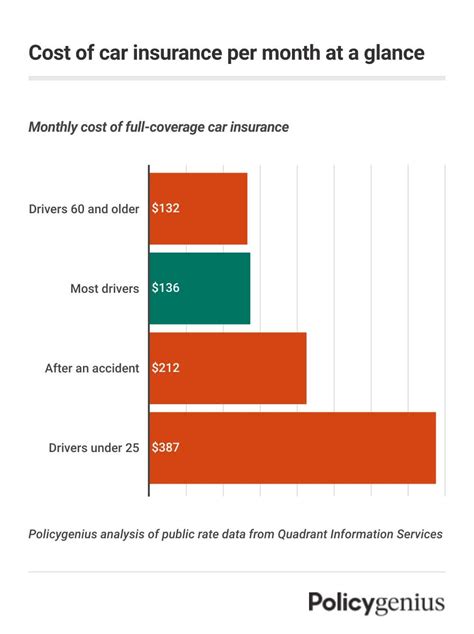

Insurance providers consider an array of personal attributes when calculating premiums. Age and driving experience are paramount; typically, younger drivers under 25 and those with limited driving experience tend to attract higher premiums due to the perceived higher risk of accidents. Conversely, mature drivers with extensive driving histories often enjoy lower rates.

Gender also plays a role in premium calculations. Historically, male drivers have been associated with higher accident risks and thus faced slightly elevated premiums. However, with changing societal norms and evolving legal landscapes, this trend is gradually shifting, with insurance providers moving towards gender-neutral pricing structures.

Your credit score is another significant factor. Many insurance companies utilize credit-based insurance scores to assess an individual's financial responsibility. A higher credit score generally indicates a lower insurance risk, leading to potentially reduced premiums.

Driving record is a critical determinant of insurance premiums. A clean driving history devoid of accidents or violations typically leads to lower costs. Conversely, a history of accidents, especially those deemed the policyholder's fault, can significantly increase insurance rates.

Vehicle Factors

The type of vehicle you drive is a substantial factor in insurance premium calculations. Insurers consider a vehicle’s make, model, and year of manufacture. High-performance vehicles, sports cars, and luxury models often attract higher premiums due to their perceived higher risk of theft, damage, or accidents.

The safety features and overall safety rating of a vehicle also impact insurance costs. Vehicles equipped with advanced safety technologies, such as collision avoidance systems, lane departure warnings, and adaptive cruise control, may attract lower premiums. These features not only reduce the risk of accidents but also mitigate the severity of potential collisions.

The purpose of the vehicle is another consideration. Vehicles primarily used for business or commercial purposes typically carry higher insurance premiums compared to those used solely for personal use. This is due to the increased risk and potential for more frequent and costly claims associated with commercial use.

Geographical Factors

Your location is a critical determinant of insurance costs. Premiums can vary significantly from state to state and even between different zip codes within the same city. Factors such as local traffic conditions, crime rates, and the frequency of natural disasters all contribute to the overall risk assessment and subsequent insurance premiums.

Population density is another crucial factor. Areas with higher population densities often have more frequent accidents and claims, leading to higher average insurance premiums. Conversely, rural areas with lower population densities may enjoy lower premiums due to the reduced risk of accidents and claims.

The local cost of auto repairs is also a consideration. Areas with higher repair costs, whether due to the prevalence of specialized mechanics or expensive parts, often result in higher insurance premiums. This is because insurance companies must factor in these increased repair costs when calculating potential claim payouts.

| Factor | Influence on Premiums |

|---|---|

| Age and Experience | Younger, less experienced drivers often pay more. |

| Gender | Gender-neutral pricing is becoming more common. |

| Credit Score | Higher scores may lead to lower premiums. |

| Driving Record | Clean records result in lower costs. |

| Vehicle Type | Luxury and high-performance vehicles are costlier to insure. |

| Safety Features | Advanced safety technologies can reduce premiums. |

| Vehicle Usage | Commercial use typically attracts higher premiums. |

| Location | Premiums vary based on state, city, and zip code. |

| Population Density | Dense areas may have higher premiums due to increased accident risks. |

| Local Repair Costs | Areas with higher repair costs may result in higher premiums. |

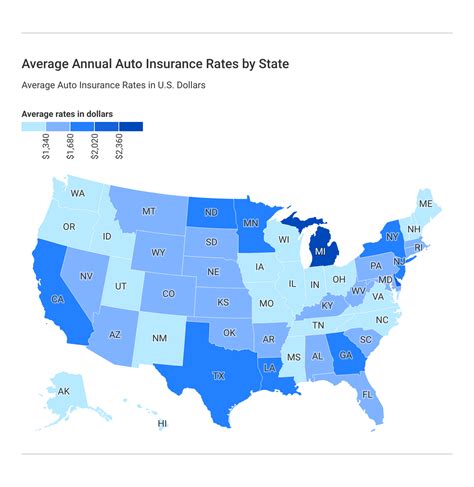

Average Auto Insurance Costs by State

The cost of auto insurance varies significantly across the United States. Several states stand out for their particularly high or low average insurance premiums. Understanding these variations can provide valuable insights for individuals planning to relocate or simply curious about insurance costs in different regions.

States with High Average Premiums

Certain states consistently rank among the top for the highest average auto insurance premiums. These states often have a combination of factors, such as high population density, frequent natural disasters, or strict insurance regulations, that contribute to elevated insurance costs.

Louisiana tops the list with the highest average annual insurance premium of approximately $1,965. This is largely due to the state's unique no-fault insurance system and high rates of uninsured motorists. Florida and Michigan follow, with average premiums of $1,831 and $1,632 respectively. These states also have no-fault insurance systems and face high rates of uninsured drivers, which drive up insurance costs.

New York and New Jersey are other states with notably high average insurance premiums, at $1,514 and $1,441 respectively. These states have dense populations, busy roads, and high repair costs, all of which contribute to elevated insurance rates.

| State | Average Annual Premium |

|---|---|

| Louisiana | $1,965 |

| Florida | $1,831 |

| Michigan | $1,632 |

| New York | $1,514 |

| New Jersey | $1,441 |

States with Low Average Premiums

On the other end of the spectrum, several states have remarkably low average insurance premiums. These states typically have lower population densities, fewer natural disasters, and less stringent insurance regulations, which collectively contribute to more affordable insurance rates.

Vermont leads the way with the lowest average annual insurance premium of approximately $643. This is largely due to the state's low population density, relatively few traffic accidents, and a high percentage of insured drivers. Ohio and Idaho follow, with average premiums of $728 and $764 respectively. These states also benefit from low accident rates and high insurance coverage.

Other states with notably low average insurance premiums include South Dakota ($787), North Dakota ($790), and Iowa ($805). These states generally have a favorable combination of low accident rates, low repair costs, and a high proportion of insured drivers, all of which contribute to their low insurance costs.

| State | Average Annual Premium |

|---|---|

| Vermont | $643 |

| Ohio | $728 |

| Idaho | $764 |

| South Dakota | $787 |

| North Dakota | $790 |

| Iowa | $805 |

Tips for Reducing Auto Insurance Costs

While the average cost of auto insurance is influenced by various factors beyond our control, there are still several strategies that vehicle owners can employ to potentially reduce their insurance premiums. By implementing these cost-saving measures, individuals can optimize their insurance coverage and keep their costs as low as possible.

Shop Around and Compare Quotes

One of the most effective ways to reduce insurance costs is by shopping around and comparing quotes from multiple insurance providers. Premiums can vary significantly between companies, even for the same level of coverage. By obtaining quotes from at least three different insurers, you can ensure you’re getting the best possible rate for your specific circumstances.

Bundle Your Policies

If you have multiple insurance needs, such as auto, home, and life insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts when you purchase multiple policies from them. This can lead to significant savings on your overall insurance costs.

Maintain a Good Driving Record

Your driving record is a critical factor in insurance premium calculations. By maintaining a clean driving history devoid of accidents or violations, you can keep your insurance costs as low as possible. Safe driving not only reduces your risk of accidents but also ensures you don’t incur any penalty increases in your insurance premiums.

Take Advantage of Discounts

Insurance providers offer a variety of discounts that can significantly reduce your premiums. These discounts may be based on your age, profession, vehicle safety features, or even your payment method. Always inquire about available discounts and ensure you’re taking advantage of all the savings opportunities you’re eligible for.

Consider Higher Deductibles

Opting for a higher deductible can lead to lower insurance premiums. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you’re essentially sharing more of the financial risk with your insurer, which can result in reduced premiums.

Review Your Coverage Regularly

Your insurance needs can change over time, so it’s essential to review your coverage regularly. As your circumstances evolve, you may find that you no longer require certain types of coverage or that you need to increase your coverage limits. Regularly reviewing your policy ensures that you have the right level of coverage at the best possible price.

Conclusion

Understanding the average cost of auto insurance and the factors that influence it is a crucial step towards making informed decisions about vehicle ownership and insurance coverage. By exploring the various personal, vehicle, and geographical factors that contribute to insurance premiums, we can gain a clearer understanding of the mechanics behind these costs.

Furthermore, by delving into the average insurance costs by state and exploring strategies for reducing these costs, individuals can take control of their insurance expenses and optimize their coverage. Whether it's shopping around for quotes, bundling policies, maintaining a good driving record, or taking advantage of available discounts, there are numerous ways to potentially reduce insurance premiums.

Ultimately, while the average cost of auto insurance provides a valuable benchmark, it's important to remember that insurance premiums are highly personalized and can vary significantly based on individual circumstances. By staying informed, proactive, and diligent in managing your insurance coverage, you can ensure you're getting the best possible rate for your specific needs.

How often should I review my auto insurance policy?

+It’s a good practice to review your auto insurance policy annually, or whenever your circumstances change significantly. This ensures that your coverage remains up-to-date and tailored to your needs.

Can I negotiate my auto insurance premium?

+While insurance premiums are largely determined by algorithms and actuarial data, you can still negotiate with your insurer. Highlight any changes in your circumstances that might reduce your risk, such as a clean driving record or the addition of safety features to your vehicle.

What is comprehensive coverage, and do I need it?

+Comprehensive coverage protects against damage to your vehicle caused by incidents other than collisions, such as theft, vandalism, natural disasters, or animal collisions. While it’s not legally required, comprehensive coverage can provide valuable protection for your vehicle. Assess your risk and financial situation to determine if it’s the right choice for you.