Life Insurances Quotes

Life insurance is a crucial aspect of financial planning, offering individuals and families peace of mind and a safety net during uncertain times. The process of obtaining life insurance quotes can be complex, with numerous factors influencing the final premium and coverage options. In this comprehensive guide, we will delve into the world of life insurance quotes, exploring the key considerations, the role of technology, and the impact of various factors on policy pricing. By the end of this article, you'll have a deeper understanding of the life insurance landscape and be equipped with the knowledge to make informed decisions when seeking quotes for your specific needs.

Understanding Life Insurance Quotes: A Comprehensive Overview

Life insurance quotes are estimates of the cost of a life insurance policy, tailored to an individual’s unique circumstances and requirements. These quotes provide a snapshot of the financial commitment involved in securing life insurance coverage. Obtaining multiple quotes allows individuals to compare options, assess value, and make informed choices about their insurance coverage.

The quote process typically involves a thorough assessment of an individual's health, lifestyle, and personal circumstances. This evaluation helps insurance providers determine the level of risk associated with insuring that person. Factors such as age, gender, health status, occupation, and family medical history all play a role in shaping the final quote.

The Role of Technology in Life Insurance Quoting

Advancements in technology have revolutionized the life insurance industry, making the quoting process more efficient and accessible. Online platforms and digital tools have emerged as powerful resources, enabling individuals to quickly and conveniently obtain multiple quotes from various insurance providers.

Digital quoting tools often feature interactive questionnaires and real-time quote generation. These tools gather relevant information about an individual's health, lifestyle, and coverage needs, and then use sophisticated algorithms to generate accurate quotes. This streamlines the traditional quoting process, providing individuals with immediate insights into their insurance options.

Additionally, technology has facilitated the integration of health data and medical records into the quoting process. Insurance providers can now leverage digital health records and wearable technology to assess an individual's health status more accurately. This data-driven approach enhances the precision of quotes and enables insurance companies to offer more tailored coverage options.

Factors Influencing Life Insurance Quotes

Several key factors influence the quotes an individual receives for life insurance coverage. Understanding these factors is essential for making informed decisions and optimizing the value of your insurance policy.

- Age: Age is a significant factor in life insurance quotes. Generally, younger individuals pay lower premiums, as they are considered less risky to insure. As individuals age, their premiums tend to increase due to the higher likelihood of health issues and reduced life expectancy.

- Health Status: An individual's health status is a critical determinant of life insurance quotes. Insurance providers assess health conditions, medical history, and lifestyle habits to gauge the risk associated with insuring that person. Pre-existing conditions, smoking status, and overall health can significantly impact premium costs.

- Occupation: The nature of an individual's occupation can influence life insurance quotes. Certain high-risk occupations, such as those involving hazardous activities or exposure to dangerous environments, may result in higher premiums. Insurance providers assess the level of risk associated with different occupations when determining quotes.

- Family Medical History: Family medical history plays a role in life insurance quotes. If there is a history of serious illnesses or genetic disorders within the family, it may impact the premiums and coverage options available to an individual.

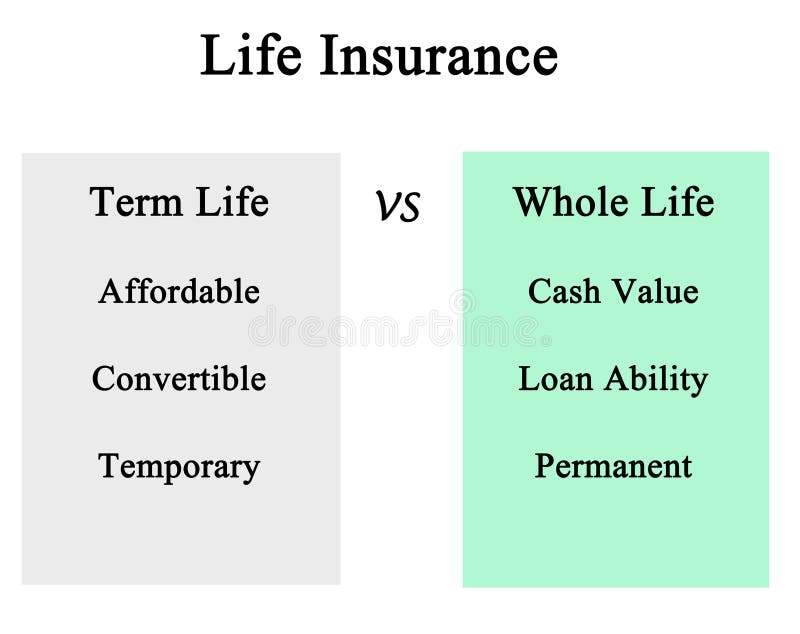

- Coverage Amount and Type: The amount of coverage an individual chooses and the type of policy selected also affect quotes. Higher coverage amounts and certain policy types, such as whole life insurance, tend to have higher premiums compared to basic term life insurance policies.

The Impact of Lifestyle on Life Insurance Quotes

Lifestyle choices and habits can significantly influence life insurance quotes. Insurance providers consider an individual’s lifestyle when assessing risk and determining premiums. Here’s how lifestyle factors impact quotes:

- Smoking and Alcohol Consumption: Smoking and excessive alcohol consumption are major risk factors for various health conditions. Insurance providers typically charge higher premiums for individuals who engage in these habits, as they increase the likelihood of health issues and shorten life expectancy.

- Weight and Fitness: Body mass index (BMI) and overall fitness levels are considered when assessing life insurance quotes. Individuals with higher BMIs or those who lead sedentary lifestyles may face higher premiums due to the increased risk of health complications.

- Diet and Nutrition: A healthy diet and proper nutrition play a role in maintaining overall health. Insurance providers may offer incentives or lower premiums for individuals who maintain a healthy diet and actively manage their nutritional intake.

- Stress and Mental Health: Chronic stress and mental health issues can impact an individual's overall health and life expectancy. Insurance providers may take these factors into account when determining quotes, as they can increase the risk of various health conditions.

Comparing Life Insurance Quotes: Tips and Strategies

Comparing life insurance quotes is essential to finding the best value and coverage for your specific needs. Here are some tips and strategies to help you make informed comparisons:

- Obtain Multiple Quotes: Gather quotes from a variety of insurance providers to gain a comprehensive understanding of the market. Compare not only the premiums but also the coverage limits, policy terms, and any additional benefits offered.

- Understand Policy Terms: Carefully review the policy terms and conditions associated with each quote. Look for differences in coverage exclusions, renewal options, and any rider benefits that may be included.

- Assess Financial Strength: Research the financial stability and reputation of the insurance providers offering quotes. Opt for companies with strong financial ratings and a solid track record of paying claims promptly.

- Consider Customer Service: Evaluate the level of customer service provided by each insurance company. Read reviews and seek recommendations to ensure you choose a provider known for excellent customer support and prompt claim processing.

- Customize Your Policy: Discuss your specific needs and circumstances with insurance agents or brokers. They can help tailor your policy to ensure it aligns with your goals and provides the necessary coverage.

Maximizing Value: Strategies for Lowering Life Insurance Quotes

While life insurance quotes are largely influenced by individual circumstances, there are strategies you can employ to potentially lower your premiums and maximize the value of your coverage. Here are some effective approaches:

- Improve Your Health: Focus on maintaining a healthy lifestyle. Quit smoking, adopt a balanced diet, and engage in regular physical activity. Improving your health not only benefits your overall well-being but can also lead to more favorable life insurance quotes.

- Bundle Policies: Consider bundling your life insurance with other insurance policies, such as auto or home insurance. Many insurance providers offer discounts when customers bundle multiple policies, potentially lowering your life insurance premiums.

- Increase Deductibles: Opting for higher deductibles can reduce your life insurance premiums. However, it's important to carefully consider your financial situation and ensure you can afford the increased out-of-pocket expenses in the event of a claim.

- Choose Term Life Insurance: Term life insurance policies generally offer lower premiums compared to permanent life insurance policies. If you're seeking coverage for a specific period, such as to protect your family during your working years, term life insurance may be a more cost-effective option.

- Shop Around: Don't settle for the first quote you receive. Compare quotes from multiple insurance providers to find the best value. Shopping around can help you identify providers offering competitive rates and tailored coverage options.

The Future of Life Insurance Quotes: Innovations and Trends

The life insurance industry is continuously evolving, driven by technological advancements and changing consumer preferences. Here’s a glimpse into the future of life insurance quotes and some of the innovations and trends shaping the industry:

- Artificial Intelligence and Machine Learning: AI and machine learning algorithms are transforming the quoting process. These technologies enable insurance providers to analyze vast amounts of data quickly and accurately, resulting in more precise quotes. AI-powered tools can also enhance customer service and streamline claim processes.

- Telemedicine and Remote Health Assessments: The rise of telemedicine and remote health assessments is revolutionizing the way insurance providers evaluate an individual's health status. These technologies allow for convenient and accurate health screenings, reducing the need for in-person medical exams and expediting the quoting process.

- Wearable Technology Integration: Wearable devices, such as fitness trackers and smartwatches, are becoming increasingly popular. Insurance providers are exploring ways to integrate wearable technology into the quoting process, leveraging real-time health data to offer more personalized and dynamic quotes.

- Blockchain Technology: Blockchain technology has the potential to enhance security, transparency, and efficiency in the insurance industry. By leveraging blockchain, insurance providers can streamline claim processes, reduce fraud, and provide customers with a more seamless and secure experience when obtaining quotes and managing their policies.

- Personalized Insurance Products: The future of life insurance quotes lies in the development of highly personalized insurance products. Insurance providers are leveraging advanced analytics and customer data to offer tailored coverage options that meet the unique needs and circumstances of each individual.

Conclusion: Empowering Your Financial Future

Obtaining life insurance quotes is a critical step in securing your financial future and providing peace of mind for your loved ones. By understanding the factors that influence quotes, leveraging technology, and employing strategic approaches, you can make informed decisions and maximize the value of your life insurance coverage.

Remember, life insurance is a long-term commitment, and it's essential to choose a policy that aligns with your specific needs and circumstances. Stay informed, compare quotes, and seek professional guidance when needed to ensure you make the right choices for your financial well-being.

How often should I review my life insurance coverage and quotes?

+

It’s recommended to review your life insurance coverage and quotes every few years or whenever significant life changes occur. Life events such as marriage, the birth of a child, career changes, or major health developments can impact your insurance needs. Regular reviews ensure your coverage remains adequate and aligned with your current circumstances.

Can I get life insurance quotes without providing personal health information?

+

Yes, it is possible to obtain preliminary life insurance quotes without providing detailed personal health information. Many online platforms offer instant quotes based on basic demographic data. However, for accurate and personalized quotes, you will eventually need to provide comprehensive health and lifestyle details to insurance providers.

What happens if my health status changes after obtaining a life insurance quote?

+

If your health status changes significantly after obtaining a life insurance quote, it’s essential to inform your insurance provider. They may need to reassess your risk and adjust your premiums accordingly. It’s important to be transparent about any changes in your health to ensure your coverage remains valid and appropriate.