Geiko Insurance

When it comes to car insurance, one name that often comes up in discussions is Geico. As one of the leading insurance providers in the United States, Geico has built a reputation for its competitive rates and innovative approach to insurance. In this comprehensive guide, we will delve into the world of Geico Insurance, exploring its history, services, unique features, and the factors that make it a popular choice for many drivers.

A Legacy of Innovation: Geico’s Journey

Geico, an acronym for Government Employees Insurance Company, has a rich history that spans over 80 years. Founded in 1936, the company initially focused on providing insurance for government employees, a niche market that reflected its name. However, Geico’s vision soon expanded, and it set out to revolutionize the insurance industry by offering affordable and accessible auto insurance to a broader audience.

One of Geico's pioneering moves was its early adoption of direct-to-consumer sales. Instead of relying solely on traditional insurance agents, Geico introduced the concept of direct marketing, allowing customers to purchase insurance policies directly from the company. This innovative approach, combined with efficient operations and a focus on customer service, helped Geico establish itself as a formidable player in the insurance market.

Over the decades, Geico has continued to innovate, leveraging technology to enhance its services. The introduction of online quote generation and policy management systems made it easier for customers to obtain insurance and manage their policies. Additionally, Geico's iconic advertising campaigns, featuring memorable characters like the famous gecko, have contributed to its brand recognition and popularity.

Services and Coverage Offered by Geico

Geico offers a comprehensive range of insurance products tailored to meet the diverse needs of its customers. Here’s an overview of the key services provided by the company:

Auto Insurance

At the core of Geico’s business, auto insurance is designed to provide financial protection for vehicle owners. Geico offers a variety of coverage options, including liability, collision, comprehensive, and personal injury protection (PIP) insurance. Policyholders can customize their coverage to align with their specific requirements, taking into account factors such as vehicle type, driving history, and desired levels of protection.

Homeowners Insurance

Geico understands that many drivers also require insurance for their homes. As such, the company offers homeowners insurance policies that provide coverage for dwellings, personal property, liability, and additional living expenses. Policyholders can choose from different levels of coverage, ensuring that their homes and belongings are adequately protected.

Renters Insurance

For individuals who rent their homes, Geico provides renters insurance. This type of insurance covers personal belongings, provides liability protection, and offers additional living expenses coverage in the event of a covered loss. Renters insurance is an essential aspect of financial planning, and Geico offers competitive rates and customizable options to meet the needs of renters.

Motorcycle Insurance

Geico recognizes the unique needs of motorcycle enthusiasts and offers specialized insurance policies for motorcycles, scooters, and mopeds. These policies provide coverage for collision, comprehensive, liability, and medical payments, ensuring that riders have the protection they need while enjoying their rides.

Other Insurance Offerings

In addition to the aforementioned services, Geico also provides insurance for recreational vehicles (RVs), boats, and even pet insurance. The company’s comprehensive approach to insurance ensures that customers can find all their insurance needs under one roof, simplifying the process of managing their financial protection.

Unique Features and Benefits of Geico Insurance

Geico has established itself as a leader in the insurance industry by offering a range of unique features and benefits to its customers. These include:

Discounts and Savings

Geico is renowned for its commitment to providing customers with significant savings on their insurance policies. The company offers a variety of discounts, such as the Military Discount for active-duty military personnel and veterans, the Good Student Discount for students with a strong academic record, and the Multi-Policy Discount for customers who bundle their auto and homeowners insurance with Geico.

| Discount Category | Description |

|---|---|

| Military Discount | Offered to active-duty military and veterans |

| Good Student Discount | Available to students with a GPA of 3.0 or higher |

| Multi-Policy Discount | Provided for bundling auto and homeowners insurance |

Digital Convenience

In today’s fast-paced world, convenience is key. Geico understands this and has invested heavily in its digital platforms to provide customers with a seamless and efficient experience. Policyholders can manage their insurance policies, file claims, and make payments online or through the Geico mobile app. The company’s commitment to digital innovation ensures that customers can access their insurance information anytime, anywhere.

Excellent Customer Service

Geico prides itself on its customer-centric approach. The company’s dedicated customer service representatives are readily available to assist policyholders with any inquiries or concerns they may have. Whether it’s clarifying coverage details, providing assistance during the claims process, or offering guidance on policy changes, Geico’s customer service team is known for its responsiveness and expertise.

Claim Handling and Roadside Assistance

When accidents or unforeseen events occur, Geico’s efficient claim handling process ensures that policyholders receive the support they need. The company offers 24⁄7 claims service, allowing customers to report claims promptly. Additionally, Geico provides roadside assistance services, including towing, battery jump-starts, and flat tire changes, providing added peace of mind for drivers.

Geico’s Performance and Reputation

Geico’s success and popularity are not merely based on its innovative approaches and unique features; the company’s performance and reputation speak volumes about its commitment to excellence. Here’s a closer look at Geico’s standing in the insurance industry:

Financial Strength and Stability

Geico is backed by the financial might of its parent company, Berkshire Hathaway. This association ensures that Geico maintains a strong financial position, providing policyholders with confidence in the company’s ability to fulfill its obligations. Geico’s financial stability is further evidenced by its consistently high ratings from renowned rating agencies, such as AM Best and Standard & Poor’s.

Customer Satisfaction and Recognition

Geico consistently ranks among the top insurance providers in terms of customer satisfaction. Its commitment to providing exceptional service and meeting customer needs has earned it numerous accolades. Geico has been recognized by J.D. Power for its outstanding customer service and claims handling, highlighting its dedication to delivering a positive experience to its policyholders.

Community Engagement and Corporate Social Responsibility

Beyond its core insurance business, Geico actively engages in community initiatives and corporate social responsibility programs. The company supports various causes, including education, environmental sustainability, and disaster relief efforts. By giving back to the communities it serves, Geico demonstrates its commitment to making a positive impact beyond its business operations.

Comparative Analysis: Geico vs. Other Insurance Providers

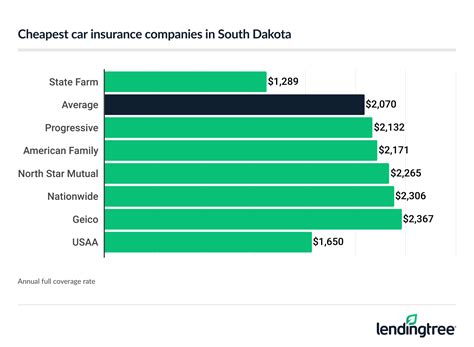

While Geico has established itself as a prominent player in the insurance industry, it’s essential to consider how it stacks up against other leading providers. Here’s a comparative analysis of Geico’s key features and how they compare to those offered by competitors:

Pricing and Discounts

Geico is known for its competitive pricing and generous discounts. While other insurance providers may offer similar discounts, Geico’s comprehensive approach to savings and its focus on providing affordable insurance set it apart. Additionally, Geico’s online quoting system allows customers to obtain accurate quotes quickly, making it easy to compare rates and find the best deal.

Digital Convenience and Customer Service

In today’s digital age, convenience and accessibility are crucial factors. Geico’s investment in its digital platforms and customer service infrastructure sets it apart from many competitors. The company’s commitment to providing a seamless and efficient experience, coupled with its responsive customer service, ensures that policyholders receive prompt assistance when needed.

Claim Handling and Roadside Assistance

Efficient claim handling and reliable roadside assistance are critical aspects of insurance services. Geico’s 24⁄7 claims service and comprehensive roadside assistance program demonstrate its commitment to supporting policyholders during challenging times. While many insurance providers offer similar services, Geico’s focus on responsiveness and customer satisfaction sets it apart in this regard.

The Future of Geico Insurance

As the insurance industry continues to evolve, Geico remains at the forefront, embracing technological advancements and innovative business practices. The company’s focus on data analytics and artificial intelligence (AI) will likely enhance its ability to offer personalized insurance solutions and improve customer experiences. Additionally, Geico’s expansion into new markets and its commitment to community engagement position it for continued growth and success.

In conclusion, Geico Insurance has established itself as a trusted and innovative provider, offering a comprehensive range of insurance services with a customer-centric approach. With its rich history, unique features, and commitment to excellence, Geico continues to be a preferred choice for drivers and homeowners seeking reliable and affordable insurance solutions. As the company embraces the future, it is well-positioned to meet the evolving needs of its customers and maintain its position as a leader in the insurance industry.

How can I get a quote for Geico insurance?

+

Obtaining a quote for Geico insurance is straightforward. You can visit the Geico website, where you’ll find an online quoting tool. Alternatively, you can call Geico’s customer service hotline or use the Geico mobile app to start the quoting process. The process typically involves providing basic information about yourself, your vehicle(s), and your driving history. Geico’s algorithms will then generate a personalized quote based on the details you provide.

What types of discounts does Geico offer?

+

Geico offers a wide range of discounts to its policyholders. Some of the notable discounts include the Military Discount for active-duty military personnel and veterans, the Good Student Discount for students with good academic standing, and the Multi-Policy Discount for customers who bundle their auto and homeowners insurance with Geico. Additionally, Geico provides discounts for safe driving, vehicle safety features, and multiple vehicles insured with the company.

How does Geico handle claims?

+

Geico is known for its efficient claims handling process. Policyholders can report claims 24⁄7 through the Geico website, mobile app, or by calling the dedicated claims hotline. Geico’s claims adjusters work diligently to assess the extent of the damage and provide prompt resolutions. The company’s commitment to customer satisfaction ensures that policyholders receive the support they need during the claims process.