Progressive Insurance Review

In the ever-evolving landscape of insurance providers, Progressive Insurance has emerged as a prominent player, offering a wide range of coverage options to meet the diverse needs of its customers. With a focus on innovation and customer satisfaction, Progressive has carved a niche for itself in the highly competitive insurance market. This in-depth review aims to explore the key aspects of Progressive Insurance, providing an insightful analysis for those seeking comprehensive coverage.

A Comprehensive Overview of Progressive Insurance

Progressive Insurance, headquartered in Mayfield Village, Ohio, is a leading provider of auto, home, and business insurance. Founded in 1937 by Joseph Lewis and Jack Green, the company has grown exponentially over the years, now offering its services across all 50 states and Washington, D.C.

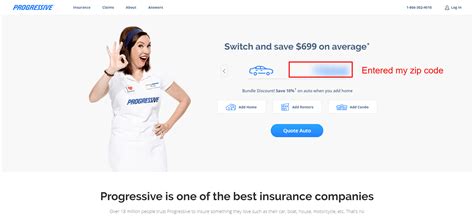

One of the standout features of Progressive is its commitment to technological advancement. The company was an early adopter of innovative practices, such as introducing drive-in claims service and becoming the first insurer to offer insurance quotes online. This forward-thinking approach has positioned Progressive as a go-to choice for tech-savvy consumers seeking convenience and efficiency in their insurance experience.

Beyond its technological prowess, Progressive is known for its extensive range of insurance products. From standard auto insurance to specialized coverage for high-risk drivers and unique vehicles, Progressive caters to a broad spectrum of customer needs. Additionally, the company offers comprehensive home and rental insurance plans, as well as business insurance tailored to the specific requirements of various industries.

A unique aspect of Progressive's offerings is its Snapshot program, a usage-based insurance program that utilizes a small device plugged into a vehicle's diagnostic port. This device collects data on driving habits, such as miles driven, time of day, and hard braking, to provide a personalized insurance rate. This innovative approach rewards safe drivers with potential savings, making Progressive an attractive option for those who practice defensive driving.

Progressive's customer-centric approach is further exemplified through its 24/7 customer service, which provides prompt assistance and guidance whenever needed. The company's dedicated claims teams work tirelessly to ensure a smooth and efficient claims process, earning Progressive a reputation for excellent customer service.

Key Features and Benefits of Progressive Insurance

Auto Insurance

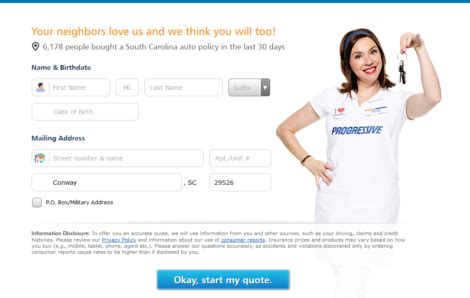

Progressive’s auto insurance policies offer a wide range of coverage options, including liability, collision, comprehensive, medical payments, uninsured/underinsured motorist coverage, and more. The company provides personalized quotes based on individual needs, ensuring that customers receive the most suitable coverage at competitive rates.

One notable feature of Progressive's auto insurance is its extensive network of repair shops. Customers can choose from a list of trusted repair facilities, ensuring high-quality repairs and a seamless experience. Progressive also offers various discounts, such as the Multi-Policy Discount, Safe Driver Discount, and Homeowner Discount, which can significantly reduce insurance premiums.

Home and Rental Insurance

For homeowners and renters, Progressive offers comprehensive coverage options. Homeowners can opt for standard or enhanced policies, which cover the structure of the home, personal belongings, and additional living expenses in case of a covered loss. Progressive’s rental insurance policies provide similar coverage for renters, protecting their personal property and offering liability protection.

Progressive's home insurance policies also include unique features, such as the Personal Property Replacement Cost option, which ensures that customers receive the full replacement cost for their belongings without any depreciation deductions. This level of coverage provides added peace of mind for homeowners.

Business Insurance

Progressive understands the diverse needs of businesses and offers tailored insurance solutions. Whether it’s coverage for a small business, a large corporation, or a specific industry, Progressive provides customized policies to protect against potential risks. Business insurance offerings include general liability, property, workers’ compensation, and commercial auto insurance.

Progressive's business insurance policies are designed to be flexible, allowing businesses to choose the coverage options that best suit their operations. This level of customization ensures that businesses receive the protection they need without paying for unnecessary coverage.

Progressive Insurance: Performance and Reputation

Progressive Insurance has consistently maintained a strong financial position, earning an A+ rating from A.M. Best, a leading insurance rating agency. This rating reflects Progressive’s excellent financial stability and ability to meet its obligations to policyholders.

In terms of customer satisfaction, Progressive has earned high marks. The company has received numerous awards, including recognition as one of the "100 Best Companies to Work For" by Fortune magazine. This acclaim underscores Progressive's commitment to both its customers and its employees, creating a positive and productive work environment.

Progressive's focus on innovation and customer service has resulted in a strong reputation in the insurance industry. The company's forward-thinking approach and commitment to providing personalized insurance solutions have made it a trusted choice for millions of customers across the United States.

Comparative Analysis: Progressive vs. Competitors

When compared to other major insurance providers, Progressive stands out for its comprehensive coverage options, competitive pricing, and innovative approach to insurance. While many insurance companies offer similar products, Progressive’s focus on technology and customer-centric services sets it apart.

For instance, Progressive's Snapshot program offers a unique value proposition, providing customers with the opportunity to save on their insurance premiums based on their individual driving habits. This program has been particularly appealing to safe drivers who seek recognition for their responsible driving practices.

Additionally, Progressive's extensive network of repair shops and its commitment to providing 24/7 customer service have earned it a reputation for excellence in the industry. These features, combined with its competitive pricing and personalized insurance plans, make Progressive a top choice for many consumers.

Future Implications and Industry Impact

As the insurance industry continues to evolve, Progressive’s focus on innovation and customer satisfaction positions it well for future growth. The company’s willingness to embrace technological advancements and adapt to changing consumer needs ensures its relevance and competitiveness in the market.

Furthermore, Progressive's success in the auto insurance market has paved the way for expansion into other insurance sectors. The company's expertise in risk assessment and its commitment to providing tailored coverage options can be leveraged to further enhance its position in the home, rental, and business insurance markets.

Progressive's influence extends beyond its own success, inspiring other insurance providers to adopt more customer-centric approaches and innovative technologies. As the industry continues to evolve, Progressive's leadership and forward-thinking strategies will likely shape the future of insurance, benefiting consumers and driving the industry forward.

What is the Progressive Insurance Snapshot program?

+The Snapshot program is a usage-based insurance program that uses a small device to collect data on driving habits. This data is then used to provide personalized insurance rates, rewarding safe drivers with potential savings.

How does Progressive Insurance compare to other major providers in terms of pricing and coverage?

+Progressive offers competitive pricing and a wide range of coverage options, making it a top choice for many consumers. Its focus on innovation and customer service sets it apart from other providers, providing added value to its customers.

What are some of the unique features of Progressive’s home insurance policies?

+Progressive’s home insurance policies offer unique features such as the Personal Property Replacement Cost option, which ensures full replacement cost for belongings without depreciation deductions.