State Farm Quote For Auto Insurance

Welcome to an in-depth exploration of the State Farm Quote for Auto Insurance, a comprehensive guide to understanding the ins and outs of this essential financial protection. In today's fast-paced world, ensuring your vehicle is adequately insured is paramount. State Farm, a renowned insurance provider, offers a range of auto insurance policies tailored to meet diverse needs. This article delves into the intricacies of obtaining a State Farm auto insurance quote, providing you with the knowledge to make informed decisions about your coverage.

Understanding the State Farm Quote Process

The process of obtaining a State Farm auto insurance quote is designed to be straightforward and personalized. State Farm aims to provide customers with accurate and competitive quotes, taking into account various factors that influence insurance rates.

When you initiate the quote process with State Farm, you'll be guided through a series of questions and data inputs. This information gathering stage is crucial as it allows State Farm to assess your unique circumstances and offer a quote that reflects your specific needs.

Factors Influencing Your Quote

Several key factors come into play when State Farm calculates your auto insurance quote. These include:

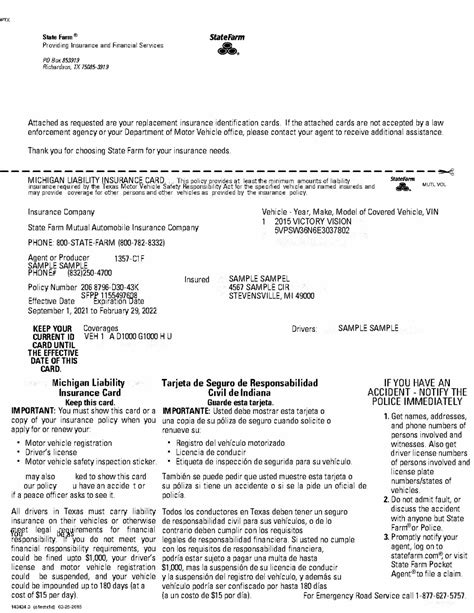

- Vehicle Type and Usage: The make, model, and year of your vehicle, along with how you primarily use it (commuting, pleasure, business, etc.), can significantly impact your quote.

- Driver Profile: Your age, gender, driving history, and years of driving experience are vital considerations. State Farm evaluates these factors to assess your risk profile.

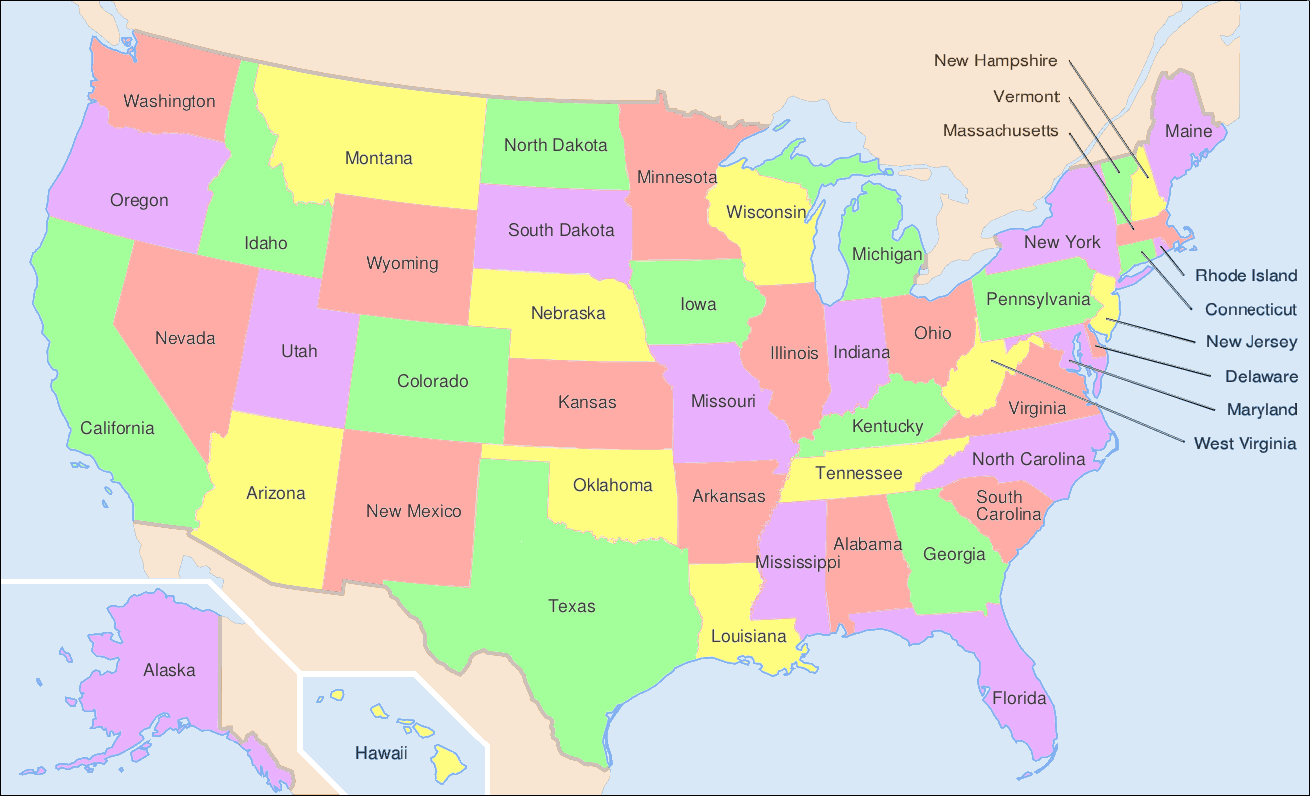

- Location and Mileage: Where you live and how many miles you drive annually are important. Different locations have varying accident and theft rates, which can affect your insurance costs.

- Coverage Preferences: State Farm offers a range of coverage options, including liability, collision, comprehensive, medical payments, and uninsured/underinsured motorist coverage. The coverage levels and deductibles you choose will influence your quote.

- Discounts and Bundle Opportunities: State Farm provides discounts for safe driving, multiple vehicles, and policy bundling. Understanding these discounts can help you optimize your quote and potentially save money.

| Discount Type | Description |

|---|---|

| Safe Driver Discount | Reward for maintaining a clean driving record. |

| Multiple Vehicle Discount | Savings for insuring more than one vehicle. |

| Bundle Discount | Discount for combining auto and home insurance. |

Tailoring Your State Farm Auto Insurance Coverage

State Farm offers a wide range of coverage options to ensure you can customize your auto insurance policy to fit your specific needs. Here’s a breakdown of some key coverage types:

Liability Coverage

Liability coverage is a fundamental component of auto insurance. It provides financial protection in the event you cause an accident that results in bodily injury or property damage to others. State Farm offers varying levels of liability coverage to ensure you have adequate protection.

Collision and Comprehensive Coverage

Collision coverage helps cover the costs of repairing or replacing your vehicle after an accident, regardless of fault. Comprehensive coverage, on the other hand, protects against non-collision incidents such as theft, vandalism, or natural disasters. Both of these coverages are essential for comprehensive protection.

Medical Payments Coverage

Medical payments coverage, also known as MedPay, assists with the cost of medical treatment for you and your passengers after an accident, regardless of fault. This coverage can be a valuable addition to your policy, ensuring you’re not left with unexpected medical bills.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you’re involved in an accident with a driver who either has no insurance or has insufficient coverage to compensate for the damages. This coverage is particularly important for ensuring you’re not left with significant out-of-pocket expenses.

Analyzing Your State Farm Quote

Once you’ve received your State Farm auto insurance quote, it’s essential to thoroughly analyze it to ensure it meets your needs and provides the best value. Here are some key considerations:

Coverage Adequacy

Review your chosen coverage levels to ensure they align with your financial goals and risk tolerance. Consider the potential costs of an accident and whether your chosen liability limits and deductibles provide sufficient protection.

Discount Optimization

Take advantage of State Farm’s various discounts. If you haven’t already, explore opportunities to bundle your auto insurance with other policies, such as home or renters insurance. Additionally, consider safe driving habits and any applicable safe driver discounts.

Comparative Analysis

While State Farm is a trusted provider, it’s always beneficial to compare quotes from multiple insurers. This ensures you’re getting the best value for your money. Online tools and insurance brokers can assist in this process, providing a comprehensive view of the market.

Understanding Policy Exclusions

Carefully review the policy exclusions to ensure you’re aware of any limitations or scenarios where coverage may not apply. This step is crucial to avoiding unexpected gaps in your coverage.

Future Implications and Adjustments

Your auto insurance needs may evolve over time. It’s important to periodically review your State Farm policy to ensure it remains aligned with your changing circumstances. Here are some scenarios that may prompt a policy adjustment:

- Life Changes: Events like getting married, having children, or moving to a new home can impact your insurance needs.

- Vehicle Changes: Upgrading or downgrading your vehicle may affect your insurance costs and coverage requirements.

- Driving Record: A clean driving record can lead to insurance discounts, while violations or accidents may result in increased premiums.

- Discount Eligibility: Keep an eye on your eligibility for various discounts. As your circumstances change, you may become eligible for new discounts or lose eligibility for others.

Can I get a State Farm auto insurance quote online?

+Yes, State Farm offers an online quote tool that allows you to get a personalized quote without visiting a physical office. This tool is user-friendly and provides accurate quotes based on the information you provide.

What factors influence my State Farm auto insurance premium?

+Your premium is influenced by various factors, including your driving history, age, gender, vehicle type, location, and coverage preferences. State Farm assesses these factors to determine your risk profile and set your premium accordingly.

Can I customize my State Farm auto insurance policy?

+Absolutely! State Farm offers a range of coverage options and customizable features to tailor your policy to your specific needs. You can choose the coverage types, limits, and deductibles that best fit your financial goals and risk tolerance.

Are there any discounts available with State Farm auto insurance?

+Yes, State Farm offers a variety of discounts to help you save on your auto insurance. These include safe driver discounts, multiple vehicle discounts, and bundle discounts when you combine your auto insurance with other policies like home or renters insurance.

How often should I review my State Farm auto insurance policy?

+It's recommended to review your policy annually or whenever you experience significant life changes. This ensures your coverage remains adequate and aligned with your evolving needs.

In conclusion, obtaining a State Farm auto insurance quote is a critical step in ensuring your vehicle is adequately protected. By understanding the quote process, customizing your coverage, and analyzing your options, you can make informed decisions about your auto insurance. Remember, regular policy reviews are essential to adapt to changing circumstances and ensure you maintain the best coverage for your needs.