Best Health Insurance In Usa

Navigating the complex landscape of health insurance in the United States can be daunting, with a myriad of options and considerations. As a health insurance expert, I'm here to guide you through the intricacies of this vital topic, offering an in-depth analysis of the best health insurance options available in the USA.

Understanding the Health Insurance Landscape in the USA

The United States healthcare system is unique, characterized by a mix of public and private insurance providers. The Affordable Care Act (ACA), often referred to as Obamacare, introduced significant reforms, making health insurance more accessible and affordable for many Americans. This act mandates that all Americans have health insurance coverage, with specific enrollment periods and potential penalties for non-compliance.

Health insurance in the USA is primarily offered through the following avenues:

- Employer-Sponsored Plans: Many Americans receive health insurance through their employers, with companies often covering a significant portion of the premium costs. These plans are known for their comprehensive coverage and are a popular choice.

- Individual Market Plans: Individuals who are self-employed or do not have access to employer-sponsored plans can purchase health insurance directly from insurance companies or through state or federal marketplaces. These plans offer a wide range of options and are subject to ACA regulations.

- Medicare: This federal program provides health insurance for Americans aged 65 and older, as well as those with certain disabilities. Medicare is divided into different parts, covering hospital care, medical services, and prescription drugs.

- Medicaid: A joint federal and state program, Medicaid provides health coverage for individuals and families with low income and limited resources. Eligibility criteria vary by state, and it is an essential safety net for many vulnerable populations.

- Children's Health Insurance Program (CHIP): CHIP offers low-cost health coverage to children in families that earn too much to qualify for Medicaid but cannot afford private insurance. It provides vital healthcare services to ensure the well-being of children.

Key Factors to Consider When Choosing the Best Health Insurance

Selecting the best health insurance plan involves a careful evaluation of several critical factors. These include:

- Coverage and Benefits: Assess the scope of coverage, including medical, surgical, prescription drug, and mental health services. Ensure that the plan covers the specific healthcare needs of you and your family.

- Premium Costs: Premiums are the monthly payments for health insurance coverage. Consider the balance between premiums and out-of-pocket costs (deductibles, copayments, and coinsurance) to find an affordable plan that aligns with your budget.

- Network of Providers: Health insurance plans typically have networks of healthcare providers (doctors, hospitals, and specialists) with whom they have negotiated rates. Choose a plan that includes your preferred healthcare providers to ensure accessibility and lower costs.

- Out-of-Pocket Costs: In addition to premiums, you'll incur out-of-pocket costs for healthcare services. These include deductibles (annual amount paid before insurance kicks in), copayments (fixed amount paid for each service), and coinsurance (percentage of costs you pay after meeting the deductible). Understand these costs to manage your healthcare expenses effectively.

- Plan Type and Design: Health insurance plans come in various types, such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs). Each plan type has different features and cost structures. Choose the plan type that best suits your healthcare needs and preferences.

- Additional Benefits and Services: Some health insurance plans offer additional benefits like wellness programs, disease management support, and access to telehealth services. Consider these extras to enhance your overall healthcare experience.

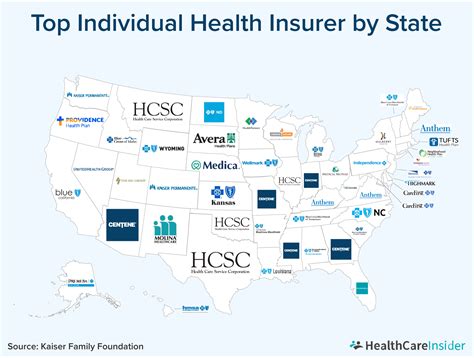

Top-Rated Health Insurance Providers in the USA

Based on comprehensive evaluations of coverage, customer satisfaction, financial stability, and industry reputation, the following health insurance providers consistently rank among the best in the USA:

1. Kaiser Permanente

With a focus on integrated healthcare delivery, Kaiser Permanente offers comprehensive health insurance plans across several states. Their HMO and PPO plans provide a wide range of services, including primary care, specialty care, and prescription drug coverage. Kaiser Permanente is known for its emphasis on preventive care and patient-centered approach.

2. Blue Cross Blue Shield

Blue Cross Blue Shield is a well-established and trusted name in the health insurance industry. Their network of providers is extensive, covering a broad range of medical services. Blue Cross Blue Shield offers a variety of plan types, including HMO, PPO, and POS plans, catering to different healthcare needs and preferences. They are particularly renowned for their excellent customer service and innovative healthcare solutions.

3. Cigna

Cigna is a global health service company known for its innovative approaches to healthcare. They offer a comprehensive range of health insurance plans, including PPO and POS options, with a focus on personalized care and wellness. Cigna’s plans often include access to their extensive network of healthcare professionals and specialized services.

4. UnitedHealthcare

UnitedHealthcare is one of the largest health insurance providers in the USA, offering a wide range of plans and services. Their plans, including HMO, PPO, and POS options, are known for their comprehensive coverage and competitive pricing. UnitedHealthcare also provides additional benefits such as wellness programs and digital health tools to enhance the overall healthcare experience.

5. Aetna

Aetna, now a part of CVS Health, offers a comprehensive suite of health insurance plans. Their plans, which include HMO, PPO, and EPO options, are designed to provide a balance of coverage and affordability. Aetna is particularly known for its focus on consumer-directed health plans and its commitment to making healthcare more accessible and affordable.

Performance Analysis and Customer Satisfaction

When evaluating health insurance providers, it’s essential to consider their performance metrics and customer satisfaction ratings. Here’s a breakdown of key performance indicators for the top-rated health insurance providers:

| Provider | Customer Satisfaction Rating | Financial Strength Rating | Network Size |

|---|---|---|---|

| Kaiser Permanente | 4.5/5 | AA- (Very Strong) | 11,000+ medical facilities |

| Blue Cross Blue Shield | 4.3/5 | AA (Excellent) | Over 100,000+ physicians |

| Cigna | 4.2/5 | AA- (Very Strong) | 1.2 million+ healthcare professionals |

| UnitedHealthcare | 4.4/5 | AA (Excellent) | Over 1.3 million physicians and specialists |

| Aetna | 4.1/5 | AA- (Very Strong) | Over 1 million healthcare professionals |

These ratings and financial strength assessments are based on independent surveys and evaluations by leading financial rating agencies.

Future Implications and Industry Trends

The health insurance landscape in the USA is constantly evolving, influenced by legislative changes, technological advancements, and shifts in consumer preferences. Here are some key trends and implications to consider:

- Focus on Value-Based Care: The industry is moving towards value-based care models, which emphasize the quality and outcomes of healthcare services rather than the quantity of services provided. This shift aims to improve patient outcomes and reduce healthcare costs.

- Digital Transformation: Health insurance providers are increasingly adopting digital technologies to enhance customer experiences and streamline operations. This includes the use of telehealth services, digital health tools, and mobile apps for better access and convenience.

- Expansion of Telehealth Services: The COVID-19 pandemic accelerated the adoption of telehealth services, and this trend is expected to continue. Telehealth offers convenient access to healthcare services, particularly for individuals in rural or underserved areas.

- Emphasis on Preventive Care: There is a growing focus on preventive care measures to reduce the risk of chronic diseases and improve overall population health. Health insurance providers are offering incentives and discounts to encourage members to adopt healthier lifestyles.

- Integration of Health and Wellness Programs: Many health insurance providers are integrating wellness programs into their plans, recognizing the importance of holistic health. These programs often include fitness tracking, nutrition counseling, and stress management resources.

Conclusion: Choosing the Right Health Insurance for Your Needs

Selecting the best health insurance plan is a critical decision that impacts your financial well-being and access to quality healthcare. By understanding the key factors, performance metrics, and industry trends, you can make an informed choice. Remember, the “best” health insurance plan is the one that aligns with your specific healthcare needs, budget, and preferences. Stay informed, compare options, and don’t hesitate to seek guidance from insurance experts or financial advisors.

Frequently Asked Questions (FAQ)

What is the average cost of health insurance in the USA?

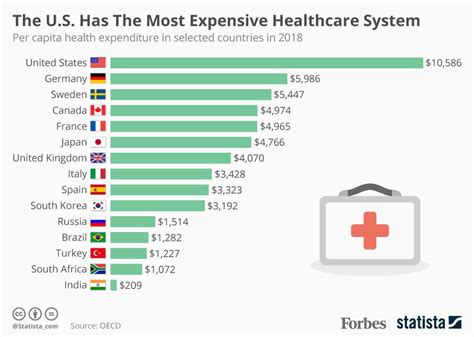

+The average cost of health insurance varies based on factors like age, location, and plan type. As of [most recent data], the average monthly premium for an individual plan is approximately 450, while family plans average around 1,150. These figures can vary significantly, and it’s essential to compare plans to find the best fit for your budget.

How can I reduce my health insurance costs?

+There are several strategies to reduce health insurance costs. Consider choosing a plan with a higher deductible if you’re generally healthy and don’t anticipate frequent medical expenses. Additionally, some employers offer incentives for participating in wellness programs, which can lower premiums. Shopping around and comparing plans can also help you find more affordable options.

What happens if I don’t have health insurance?

+Under the Affordable Care Act (ACA), all Americans are required to have health insurance coverage or pay a penalty. If you don’t have insurance, you may face a tax penalty during tax filing. However, there are exemptions for certain groups, and you can still purchase health insurance outside of the open enrollment period if you qualify for a special enrollment period due to life events like losing your job or getting married.

Can I switch health insurance plans during the year?

+In general, health insurance plans have specific enrollment periods, and you typically can’t switch plans outside of these periods. However, certain life events, such as moving to a new state, getting married, or losing your job, may qualify you for a special enrollment period, allowing you to change your health insurance plan.

How do I choose between an HMO and a PPO plan?

+The choice between an HMO and a PPO plan depends on your healthcare needs and preferences. HMO plans usually offer lower premiums but require you to choose a primary care physician and refer you to specialists within their network. PPO plans offer more flexibility, allowing you to see any in-network provider without a referral, but they often have higher premiums.