Cheap Auto Insurance Policy

Securing an affordable auto insurance policy is a top priority for many vehicle owners. With the right approach, it is possible to find comprehensive coverage without breaking the bank. This guide will delve into the strategies and considerations to help you navigate the world of auto insurance and find the best policy for your needs at the lowest possible cost.

Understanding Auto Insurance Policies

Auto insurance policies are contracts between you and an insurance provider. These policies protect you financially in the event of accidents, theft, or other vehicle-related incidents. Understanding the different types of coverage and their implications is crucial for making informed decisions.

Liability Coverage

Liability coverage is a fundamental aspect of auto insurance. It protects you against claims arising from accidents where you are at fault. This coverage typically includes both bodily injury and property damage liability. It’s essential to have adequate liability coverage to safeguard your assets and provide compensation to others in case of an accident.

For instance, if you cause an accident resulting in injuries to other people or damage to their property, your liability coverage will step in to cover the costs. This can include medical expenses, vehicle repairs, and legal fees.

Collision and Comprehensive Coverage

Collision and comprehensive coverage offer additional protection for your vehicle. Collision coverage pays for repairs or replacement if your car is damaged in an accident, regardless of fault. Comprehensive coverage, on the other hand, covers non-collision incidents like theft, vandalism, natural disasters, or collisions with animals.

Consider a scenario where your car is damaged in a hailstorm. Comprehensive coverage would come into play to cover the cost of repairs or, if the damage is extensive, the replacement value of your vehicle.

Additional Coverage Options

Beyond the basics, auto insurance policies can include various optional coverages. These may include personal injury protection (PIP), medical payments coverage, uninsured/underinsured motorist coverage, rental car reimbursement, and more. Each of these options adds an extra layer of protection and peace of mind.

| Coverage Type | Description |

|---|---|

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for you and your passengers, regardless of fault. |

| Medical Payments Coverage | Provides additional medical coverage for you and your passengers. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you're involved in an accident with a driver who has little or no insurance. |

| Rental Car Reimbursement | Covers the cost of renting a vehicle while yours is being repaired after an insured incident. |

Factors Affecting Auto Insurance Rates

Auto insurance rates are influenced by a variety of factors. Understanding these factors can help you make strategic choices to reduce your premiums.

Driver Profile and History

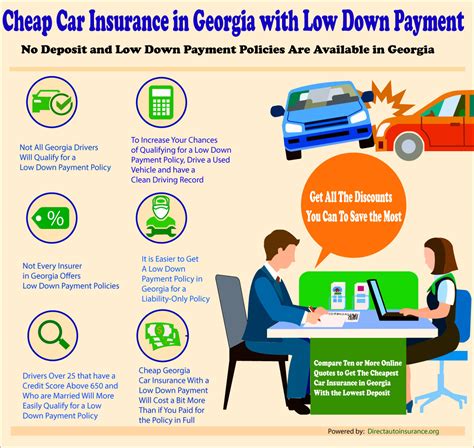

Your personal driving record and demographics play a significant role in determining your insurance rates. Insurance companies consider factors such as your age, gender, driving experience, and claim history. For instance, younger drivers and those with a history of accidents or traffic violations may face higher premiums.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can impact your insurance rates. Sports cars and luxury vehicles often have higher premiums due to their cost and potential for accidents. Additionally, the primary purpose of your vehicle (commuting, business, pleasure) and the annual mileage you drive can affect your rates.

If you primarily use your vehicle for long-distance commuting, you may face higher premiums compared to someone who primarily drives locally.

Location and Claims History

The geographic location where you reside and drive also influences your insurance rates. Areas with higher populations, denser traffic, or a history of frequent accidents and claims may result in higher premiums. Insurance companies analyze historical data to assess the risk associated with different locations.

Credit Score and Insurance Score

Surprisingly, your credit score can impact your auto insurance rates. Insurance companies often use your credit score as an indicator of financial responsibility. Maintaining a good credit score can potentially lead to lower premiums. Additionally, some insurance providers use an “insurance score,” which is a score based on your insurance claim history and other factors.

Strategies for Securing Cheap Auto Insurance

Now that we’ve explored the factors that influence auto insurance rates, let’s delve into practical strategies to help you find affordable coverage.

Shop Around and Compare Quotes

One of the most effective ways to find cheap auto insurance is to compare quotes from multiple providers. Each insurance company has its own methodology for calculating rates, so getting quotes from various sources can give you a better idea of the market and help you identify the most competitive options.

Online quote comparison tools can be a valuable resource for this purpose. They allow you to input your information once and receive multiple quotes, making it easier to identify the best deal.

Bundle Policies and Take Advantage of Discounts

Many insurance companies offer discounts when you bundle multiple policies together. For example, you may be able to save money by purchasing both your auto and home insurance from the same provider. Additionally, insurance companies often provide discounts for various reasons, such as good driving records, safety features in your vehicle, or membership in certain organizations.

Always inquire about available discounts and ensure you’re taking advantage of all the opportunities to reduce your premiums.

Adjust Your Coverage and Deductibles

The level of coverage you choose and your deductible amount can significantly impact your insurance premiums. While it’s essential to have adequate coverage, carefully assessing your needs and adjusting your coverage limits can lead to savings. For instance, if you have an older vehicle with low market value, you may consider reducing your collision and comprehensive coverage.

Similarly, increasing your deductible (the amount you pay out-of-pocket before your insurance kicks in) can lower your premiums. However, it’s important to strike a balance and ensure you can afford the higher deductible in the event of a claim.

Maintain a Clean Driving Record

Your driving behavior and record have a direct impact on your insurance rates. Maintaining a clean driving record by avoiding accidents, traffic violations, and claims can lead to significant savings over time. Insurance companies reward safe drivers with lower premiums, so focus on developing safe driving habits and avoid any behaviors that may lead to accidents or citations.

Explore Telematics and Usage-Based Insurance

Telematics and usage-based insurance programs use technology to monitor your driving behavior and offer customized premiums based on your actual driving habits. These programs can be beneficial for safe drivers who don’t often drive long distances. By demonstrating responsible driving behavior, you may be able to qualify for lower premiums.

However, it’s essential to carefully review the terms and conditions of these programs to ensure they align with your privacy expectations and driving habits.

The Importance of Comprehensive Research and Expert Advice

Finding the cheapest auto insurance policy isn’t solely about comparing prices. It’s crucial to thoroughly research and understand the coverage options available to you. Consulting with insurance experts or brokers can provide valuable insights and guidance tailored to your specific needs and circumstances.

Insurance professionals can help you navigate the complex world of auto insurance, ensuring you get the right coverage at the best possible price. They can assess your individual situation, explain the nuances of different policies, and provide recommendations based on your unique profile.

Future Trends and Considerations

The auto insurance industry is continuously evolving, and several trends and considerations are worth keeping an eye on as you plan your insurance strategy.

Advancements in Telematics and Usage-Based Insurance

Telematics and usage-based insurance programs are expected to become even more sophisticated and widespread. As technology advances, these programs may offer more precise assessments of individual driving behavior, leading to even greater customization in insurance premiums.

Stay informed about these developments and consider whether participating in such programs could benefit your insurance situation.

The Rise of Electric Vehicles (EVs) and Their Impact on Insurance

The increasing popularity of electric vehicles is expected to have an impact on auto insurance rates. EVs often come with unique safety features and may have lower maintenance costs, which could potentially lead to lower insurance premiums. However, the initial cost of EVs and their specialized repair needs may influence insurance rates differently.

Environmental and Social Factors

Environmental and social factors can also influence auto insurance rates. For example, areas with severe weather conditions or a higher risk of natural disasters may see fluctuations in insurance premiums. Additionally, societal trends and initiatives, such as car-sharing programs or autonomous vehicle technology, could impact the overall insurance landscape.

Regulatory Changes and Market Competition

Keep an eye on regulatory changes and market competition in the auto insurance industry. Changes in legislation or increased competition among insurance providers can lead to shifts in pricing and coverage options. Staying informed about these developments can help you make timely adjustments to your insurance strategy.

Conclusion

Securing an affordable auto insurance policy requires a combination of thorough research, understanding of your needs, and strategic decision-making. By familiarizing yourself with the factors that influence insurance rates and implementing the strategies outlined above, you can navigate the auto insurance landscape with confidence and find the best coverage at the lowest possible cost.

Remember, auto insurance is a crucial investment in your financial security, and taking the time to find the right policy can pay dividends in the long run. Stay informed, compare options, and seek expert advice to ensure you're making the most of your insurance choices.

How often should I review my auto insurance policy?

+It’s a good practice to review your auto insurance policy annually or whenever your life circumstances change significantly. This includes events like getting married, having children, purchasing a new vehicle, or moving to a different location. Regular reviews ensure your coverage remains up-to-date and aligned with your needs.

What factors can I control to lower my auto insurance premiums?

+You can influence your auto insurance premiums by maintaining a clean driving record, choosing a vehicle with good safety ratings, increasing your deductible, and exploring discounts for safe driving habits or vehicle safety features. Additionally, bundling policies and shopping around for the best rates can lead to significant savings.

How do usage-based insurance programs work, and are they worth considering?

+Usage-based insurance programs use telematics devices or smartphone apps to monitor your driving behavior and offer premiums based on your actual driving habits. These programs can be beneficial for safe, low-mileage drivers. However, it’s essential to understand the terms and conditions and ensure your privacy expectations are met.

What should I do if I’m unhappy with my current auto insurance provider or policy?

+If you’re dissatisfied with your current provider or policy, it’s worth shopping around for alternatives. Compare quotes from multiple insurers, review the coverage and terms offered, and consider consulting with an insurance broker to find the best fit for your needs. Remember, you’re not obligated to stay with your current provider if you find a better option.