Dental Insurance Plans Georgia

Dental insurance is an essential aspect of maintaining good oral health, and for residents of Georgia, there are a variety of plans available to cater to different needs and budgets. In this comprehensive guide, we will delve into the world of dental insurance plans in Georgia, exploring the options, benefits, and considerations to help you make an informed decision for your dental care.

Understanding Dental Insurance Plans in Georgia

Dental insurance plans in Georgia, like in many other states, offer a range of coverage options to help individuals and families manage the costs associated with dental care. These plans typically fall into two main categories: Indemnity Plans and Preferred Provider Organization (PPO) Plans. Let’s explore each of these in more detail.

Indemnity Plans

Indemnity plans, also known as Fee-for-Service plans, provide the most flexibility in terms of dental care choices. With this type of plan, you can visit any licensed dentist of your choice without needing a referral or prior approval. The insurance company will typically reimburse you for a portion of the dental fees, based on a predetermined schedule of allowances or fee guidelines.

One of the key advantages of indemnity plans is the freedom to choose your dentist. You are not restricted to a network of providers, which can be beneficial if you have a trusted dentist or specific dental needs. However, it's important to note that these plans often have higher monthly premiums and may require you to pay a deductible before your coverage kicks in.

| Advantages of Indemnity Plans | Considerations |

|---|---|

| Freedom to choose any dentist | Higher monthly premiums |

| No need for prior approvals | May require a deductible |

| Flexibility in treatment options | Out-of-pocket expenses for uncovered procedures |

Preferred Provider Organization (PPO) Plans

PPO plans offer a balance between flexibility and cost savings. With a PPO plan, you have the option to visit any licensed dentist, but you’ll save the most when you choose a dentist within the plan’s network. These plans typically have a wider network of providers compared to other types of insurance, making it easier to find a suitable dentist nearby.

One of the key benefits of PPO plans is the reduced out-of-pocket costs. When you visit an in-network dentist, you'll often pay a lower copay or coinsurance rate, and the insurance company will cover a higher percentage of the treatment costs. However, it's important to note that the savings are generally greater when you stick to the network, as out-of-network care may result in higher expenses.

| Advantages of PPO Plans | Considerations |

|---|---|

| Wider network of dentists | Out-of-network care may be costly |

| Reduced out-of-pocket costs for in-network care | Higher premiums compared to HMO plans |

| Freedom to choose dentists, though network providers offer greater savings | May require referrals for specialized care |

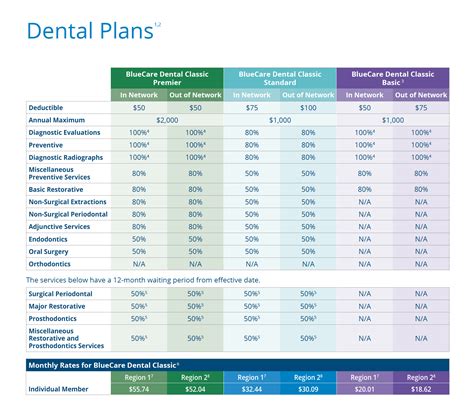

Evaluating Dental Insurance Options in Georgia

When evaluating dental insurance plans in Georgia, it’s crucial to consider your specific dental needs and budget. Here are some key factors to keep in mind:

- Coverage Benefits: Review the plan's coverage benefits, including routine cleanings, fillings, root canals, crowns, and any other procedures you anticipate needing. Ensure that the plan covers these services adequately.

- Network Providers: Check if your preferred dentist is within the plan's network, especially if you have a strong relationship with them. If not, consider the plan's out-of-network benefits and potential costs.

- Premiums and Deductibles: Compare the monthly premiums and any deductibles required. Higher premiums may offer more comprehensive coverage, but consider your budget and the likelihood of utilizing the plan's benefits.

- Annual Maximums: Understand the plan's annual maximum coverage amount. This is the most the insurance company will pay out in a year. If you anticipate extensive dental work, ensure the plan's maximum aligns with your needs.

- Waiting Periods: Some plans have waiting periods for certain procedures, especially for more complex or expensive treatments. Consider how urgent your dental needs are and if you can wait before receiving coverage.

- Additional Benefits: Look for plans that offer additional benefits like orthodontics coverage, which can be a significant cost saver for those needing braces or other orthodontic treatments.

The Impact of Dental Insurance on Oral Health

Dental insurance plays a crucial role in promoting good oral health. By providing coverage for preventive care, such as regular cleanings and check-ups, dental insurance plans encourage individuals to prioritize their dental health. This proactive approach can help detect and address dental issues early on, potentially preventing more serious and costly problems down the line.

Furthermore, dental insurance plans often cover a range of restorative and cosmetic procedures, ensuring that individuals have access to the care they need to maintain a healthy and confident smile. Whether it's filling a cavity, repairing a broken tooth, or undergoing a cosmetic procedure, dental insurance can make these treatments more affordable and accessible.

The Role of Preventive Care

Preventive care is a cornerstone of oral health, and dental insurance plans in Georgia typically cover a range of preventive services. These may include:

- Dental Cleanings: Regular cleanings help remove plaque and tartar buildup, reducing the risk of tooth decay and gum disease.

- Dental Exams: Routine exams allow dentists to identify any potential issues early on, enabling timely treatment and prevention of more serious problems.

- X-rays: Diagnostic X-rays provide a detailed view of the teeth and surrounding structures, aiding in the detection of cavities, impacted teeth, and other issues.

- Fluoride Treatments: Fluoride helps strengthen tooth enamel, making it more resistant to decay. Dental insurance plans often cover fluoride treatments for both children and adults.

Restorative and Cosmetic Procedures

In addition to preventive care, dental insurance plans in Georgia also offer coverage for a variety of restorative and cosmetic procedures. These may include:

- Fillings: Dental fillings are used to repair cavities and restore the function and appearance of teeth.

- Root Canals: Root canal treatment is necessary when the pulp of a tooth becomes infected or damaged. Dental insurance plans often cover a portion of the cost of this procedure.

- Crowns and Bridges: Crowns are used to restore damaged or missing teeth, while bridges are used to replace one or more missing teeth. Insurance coverage for these procedures varies depending on the plan.

- Implants: Dental implants are a popular and effective solution for replacing missing teeth. While the coverage for implants can be limited, some plans offer partial coverage for this procedure.

- Orthodontic Treatment: Orthodontic care, such as braces or clear aligners, can help straighten teeth and improve bite alignment. Many dental insurance plans now offer coverage for orthodontic treatment, making it more accessible for individuals of all ages.

Tips for Choosing the Right Dental Insurance Plan

When selecting a dental insurance plan in Georgia, consider the following tips to make an informed decision:

- Assess Your Dental Needs: Evaluate your current and future dental needs. If you have ongoing dental issues or anticipate needing extensive work, choose a plan with higher coverage limits and lower out-of-pocket costs.

- Review Network Providers: Check if your preferred dentist is in the plan's network. If not, consider the plan's out-of-network benefits and whether it aligns with your dental care preferences.

- Compare Premiums and Deductibles: Balance the cost of the plan with your budget. Higher premiums may offer more comprehensive coverage, but ensure it fits within your financial means.

- Understand Coverage Exclusions: Read the plan's fine print to understand what procedures are not covered. This will help you manage your expectations and plan for potential out-of-pocket expenses.

- Consider Additional Benefits: Look for plans that offer added benefits like orthodontics coverage, which can provide significant savings for those needing braces or other orthodontic treatments.

The Future of Dental Insurance in Georgia

The landscape of dental insurance in Georgia is continually evolving to meet the changing needs of its residents. As dental technology advances and the understanding of oral health’s impact on overall well-being grows, we can expect to see further innovations in dental insurance plans.

One potential future development is the expansion of coverage for preventive and diagnostic procedures. With a focus on early intervention and disease prevention, insurance providers may offer more comprehensive coverage for services like oral cancer screenings, periodontal disease assessments, and advanced imaging technologies. This shift towards preventive care has the potential to significantly improve oral health outcomes and reduce the need for more costly and invasive treatments down the line.

Additionally, as the integration of digital technologies continues to transform the healthcare industry, we may see dental insurance plans embracing digital solutions. This could include the use of telehealth platforms for virtual consultations and teledentistry services, making it more convenient for individuals to access dental care and advice. Furthermore, the adoption of digital record-keeping and claims processing could streamline administrative processes, reducing paperwork and potential delays in claim settlements.

FAQ

Can I use my dental insurance plan outside of Georgia?

+

Many dental insurance plans offer nationwide coverage, allowing you to visit dentists outside of Georgia. However, it’s essential to check with your specific plan to understand any limitations or potential out-of-network costs.

Are there any discounts available for families or groups?

+

Yes, many dental insurance providers offer discounts or special rates for families or groups. These plans can provide significant savings, especially for larger families or small businesses.

How often should I schedule dental check-ups with my insurance coverage?

+

It’s generally recommended to schedule dental check-ups every six months. Many dental insurance plans cover two check-ups per year, including cleanings and exams. Regular check-ups help maintain good oral health and allow for early detection of any issues.

As the dental insurance market in Georgia adapts to the evolving needs of its residents, it is important for individuals to stay informed and actively engage with their insurance providers to ensure they are maximizing the benefits of their chosen plan. By staying abreast of the latest developments and understanding the nuances of their coverage, individuals can make informed decisions about their oral health and access the care they need to maintain a healthy smile.