Finding Cheap Car Insurance

Finding cheap car insurance is a top priority for many drivers, as it can significantly impact their monthly expenses and overall financial well-being. With rising insurance costs and the multitude of options available, it's essential to navigate the process strategically to secure the best deal without compromising on coverage. This comprehensive guide will delve into various strategies, tips, and industry insights to help you identify and obtain affordable car insurance tailored to your specific needs.

Understanding Car Insurance Basics

Car insurance is a contract between you and an insurance provider, offering financial protection against potential risks and liabilities associated with owning and operating a vehicle. It’s a vital safeguard against the unpredictable, ensuring you’re prepared for the costs of accidents, theft, and other mishaps. Understanding the fundamentals of car insurance is the first step towards making informed decisions and securing the best rates.

Types of Car Insurance Coverage

There are several types of car insurance coverage, each serving a specific purpose and providing distinct benefits. The most common types include:

- Liability Coverage: This is the minimum coverage required by law in most states. It covers the costs associated with bodily injury and property damage you cause to others in an accident.

- Collision Coverage: This optional coverage pays for repairs to your vehicle after an accident, regardless of who is at fault. It's particularly beneficial for newer or more valuable vehicles.

- Comprehensive Coverage: This coverage protects against damages to your vehicle caused by events other than collisions, such as theft, vandalism, weather-related incidents, or animal collisions. It's often required if you have a loan or lease on your vehicle.

- Personal Injury Protection (PIP): PIP coverage provides medical expense coverage for you and your passengers, regardless of who is at fault in an accident. It's a vital safeguard for your health and well-being.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who has no insurance or insufficient insurance to cover the damages.

Understanding these coverage types and their respective benefits will help you tailor your insurance policy to your unique needs and budget.

Factors Influencing Car Insurance Rates

Insurance rates are determined by a variety of factors, each of which can significantly impact the cost of your policy. These factors include:

- Age and Gender: Younger drivers, particularly males, often face higher insurance rates due to their perceived higher risk of accidents.

- Driving History: Your record of accidents, tickets, and claims can significantly affect your insurance rates. A clean driving record typically leads to lower premiums.

- Vehicle Type: The make, model, and year of your vehicle can influence your insurance rates. Sporty or luxury vehicles, for instance, often come with higher premiums.

- Location: The area where you live and primarily drive can impact your insurance rates. Urban areas with higher populations and traffic often result in higher premiums.

- Credit Score: In many states, insurance companies consider your credit score when determining your rates. A higher credit score is often associated with lower premiums.

- Claims History: The frequency and cost of your past insurance claims can affect your future rates. Multiple claims or expensive claims may lead to higher premiums.

- Coverage Types and Limits: The types of coverage you choose and the limits you set for each coverage type will directly impact your insurance costs.

Strategies for Finding Cheap Car Insurance

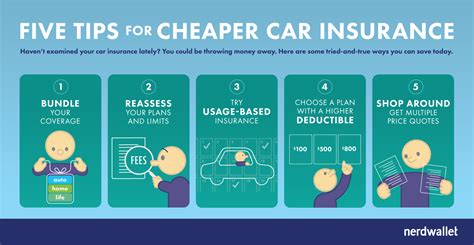

Now that we’ve covered the basics, let’s delve into practical strategies to help you find affordable car insurance.

Shop Around and Compare Quotes

One of the most effective ways to find cheap car insurance is to shop around and compare quotes from multiple providers. Insurance rates can vary significantly between companies, so getting multiple quotes will give you a comprehensive understanding of the market and help you identify the best deals.

Use online comparison tools or directly visit the websites of major insurance providers to request quotes. Ensure you're comparing apples to apples by requesting quotes with identical coverage limits and types. This process will help you pinpoint the companies offering the most competitive rates for your specific needs.

Examine Your Coverage and Limits

Take a close look at your current car insurance policy and assess whether you’re paying for coverage you may not need. For instance, if you own an older vehicle, comprehensive and collision coverage may not be as crucial as they are for newer models. Similarly, if you have sufficient savings to cover potential medical expenses, you might consider reducing your Personal Injury Protection (PIP) coverage limits.

Reviewing your coverage and adjusting your limits can help reduce your insurance premiums. However, ensure you maintain adequate coverage to protect yourself financially in the event of an accident or other mishap.

Consider Higher Deductibles

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can lead to lower insurance premiums. While this strategy may require you to pay more upfront in the event of a claim, it can significantly reduce your monthly insurance costs.

Before choosing a higher deductible, ensure you have sufficient savings to cover the deductible amount in case of an accident. This approach is particularly beneficial for drivers with clean driving records and those who are confident they won't need to make frequent claims.

Explore Discounts

Insurance providers offer a variety of discounts to attract and retain customers. Common discounts include:

- Multi-Policy Discounts: Bundling your car insurance with other policies, such as home or renters insurance, can lead to significant savings.

- Good Student Discount: Students with a certain GPA or higher may qualify for this discount, making it an excellent incentive for young drivers to maintain good academic standing.

- Safe Driver Discounts: Insurance companies often reward drivers with clean records by offering discounts. The specifics of these discounts can vary, so be sure to inquire with your provider.

- Loyalty Discounts: Staying with the same insurance provider for an extended period can lead to loyalty discounts, so it's worth inquiring about these when comparing quotes.

- Usage-Based Insurance (UBI) Discounts: Some insurance companies offer UBI programs that track your driving habits and reward safe driving with discounts. These programs often use telematics devices or smartphone apps to monitor your driving behavior.

Inquire about these discounts when comparing quotes, and don't hesitate to ask your current provider about potential savings opportunities.

Maintain a Clean Driving Record

Your driving record is a critical factor in determining your insurance rates. A clean driving record with no accidents or moving violations can lead to lower premiums. Conversely, a record with accidents or violations can significantly increase your insurance costs.

To maintain a clean record, drive defensively, obey traffic laws, and avoid distractions while driving. Additionally, consider taking a defensive driving course, which can not only improve your driving skills but may also lead to insurance discounts.

Consider Pay-As-You-Drive Insurance

Pay-As-You-Drive (PAYD) insurance, also known as usage-based insurance, is an innovative approach to car insurance that charges premiums based on your actual driving habits and mileage. This type of insurance can be particularly beneficial for low-mileage drivers or those who primarily drive during safer hours.

PAYD insurance typically involves the use of a telematics device or smartphone app to track your driving behavior, including mileage, driving time, and habits like hard braking or rapid acceleration. By rewarding safe and responsible driving, PAYD insurance can lead to significant savings for eligible drivers.

Choosing the Right Car Insurance Provider

Once you’ve identified the best rates and coverage options, it’s time to select the right insurance provider. Here are some key considerations to guide your decision:

Financial Strength and Stability

Ensure your chosen insurance provider has a strong financial standing and a history of paying claims promptly. You can research their financial ratings and stability using independent rating agencies like AM Best, Moody’s, or Standard & Poor’s.

Customer Service and Claims Handling

Excellent customer service and efficient claims handling are vital aspects of any insurance provider. Research their reputation for customer satisfaction and claims processing. Online reviews and ratings can provide valuable insights into their service quality.

Coverage Options and Customization

Choose a provider that offers a comprehensive range of coverage options and allows for customization to meet your specific needs. This flexibility ensures you can tailor your policy to your budget and risk tolerance.

Technology and Digital Tools

In today’s digital age, insurance providers often offer a variety of online and mobile tools to enhance the customer experience. Look for providers with user-friendly websites, mobile apps, and other digital tools that streamline the insurance process, from quote comparisons to claims submissions.

Final Considerations and Tips

As you embark on your journey to find cheap car insurance, keep these final considerations and tips in mind:

- Regularly review and adjust your car insurance policy as your circumstances change. Life events like moving to a new location, purchasing a new vehicle, or getting married can impact your insurance needs and rates.

- Consider adding safety features to your vehicle, such as anti-theft devices or advanced driver assistance systems. These features can lead to insurance discounts and enhanced protection.

- Don't be afraid to negotiate with your insurance provider. Many companies are willing to work with you to find a policy that fits your budget and needs.

- Stay informed about changes in the insurance market and industry trends. Keeping up with industry developments can help you make more informed decisions and potentially save money.

Finding cheap car insurance requires a combination of thorough research, strategic planning, and an understanding of the insurance market. By following the strategies outlined in this guide, you can secure affordable car insurance without compromising on coverage. Remember, your goal is to find the best balance between cost and protection, ensuring you're adequately covered while keeping your insurance expenses manageable.

Can I switch insurance providers to save money?

+Absolutely! Shopping around and comparing quotes from different insurance providers is one of the most effective ways to find cheaper car insurance. Switching providers can lead to significant savings, especially if you’ve been with the same company for an extended period.

How often should I review my car insurance policy?

+It’s a good practice to review your car insurance policy annually or whenever your circumstances change significantly. Life events like moving, buying a new car, or getting married can impact your insurance needs and rates.

What are some common car insurance discounts I should look for?

+Common car insurance discounts include multi-policy discounts, good student discounts, safe driver discounts, loyalty discounts, and usage-based insurance (UBI) discounts. Inquire about these discounts when comparing quotes and with your current provider to ensure you’re taking advantage of all available savings opportunities.