Cheapest Automobile Insurance Quotes

Finding the cheapest automobile insurance quotes is a top priority for many vehicle owners, especially with the rising costs of insurance premiums. In this comprehensive guide, we will delve into the world of automobile insurance, exploring the factors that influence rates, comparing quotes, and uncovering strategies to secure the most affordable coverage without compromising on quality. By understanding the intricacies of the insurance landscape, you can make informed decisions and potentially save hundreds of dollars annually on your policy.

Understanding the Landscape of Automobile Insurance

Automobile insurance is a crucial financial safeguard for drivers, offering protection against a range of potential risks and liabilities. The cost of this coverage, however, can vary significantly based on a multitude of factors. Understanding these variables is essential for securing the best deal.

Factors Influencing Automobile Insurance Rates

Insurance companies employ a complex algorithm to calculate premiums, taking into account various personal and vehicular details. Here are some of the key factors that can impact your automobile insurance rates:

- Age and Gender: Younger drivers, particularly males under 25, often face higher premiums due to their perceived risk. Gender can also play a role, with some insurers charging slightly different rates for men and women.

- Driving History: Your record of accidents, violations, and claims is a significant determinant of your insurance cost. A clean driving history can lead to substantial savings.

- Vehicle Type and Usage: The make, model, and age of your vehicle influence your premium. Additionally, how you use your car - for commuting, business, or pleasure - can impact your rates.

- Location and Mileage: The area you live in and the average number of miles you drive annually are crucial factors. High-risk areas with frequent accidents or thefts can result in higher premiums.

- Credit Score: Believe it or not, your credit score can affect your insurance rates. Many insurers believe that individuals with higher credit scores are more responsible and less likely to file claims.

- Insurance Coverage and Deductibles: The type and extent of coverage you choose, along with your deductible amount, can significantly impact your premium. Higher deductibles usually result in lower premiums.

Comparing Quotes for the Best Deal

Now that we understand the factors that influence insurance rates, let’s explore how to compare quotes effectively to find the cheapest option.

Researching and Requesting Quotes

The first step is to research and request quotes from multiple insurance providers. Fortunately, the internet has made this process much easier and more convenient. Here’s a step-by-step guide:

- Online Quote Tools: Many insurance companies offer online quote tools on their websites. These tools allow you to input your details and receive an estimated quote instantly.

- Comparison Websites: Consider using insurance comparison websites. These platforms aggregate quotes from multiple insurers, making it convenient to compare rates and coverage options.

- Broker or Agent: You can also work with an insurance broker or agent who represents multiple companies. They can guide you through the process and help you understand the nuances of different policies.

- Direct Contact: Don’t hesitate to reach out to insurance companies directly. Sometimes, you may find better rates by speaking with a representative and negotiating.

Evaluating the Quotes

Once you have a few quotes in hand, it’s essential to evaluate them carefully. Here are some tips to ensure you’re making an informed decision:

- Coverage Comparison: Ensure that the quotes you’re comparing offer similar coverage levels. Different insurers may offer varying levels of coverage for the same premium.

- Discounts and Bundles: Look for potential discounts and bundle offers. Many insurers provide discounts for safe driving records, multiple vehicles, or policy add-ons.

- Read the Fine Print: Don’t just focus on the premium. Carefully read the policy documents to understand what’s included and excluded. Some policies may have higher deductibles or restrictions that can impact your coverage.

- Company Reputation: Research the reputation and financial stability of the insurance companies you’re considering. A reliable company with a strong financial background is essential for peace of mind.

Strategies for Securing Cheaper Automobile Insurance

In addition to comparing quotes, there are several strategies you can employ to potentially reduce your automobile insurance premiums.

Improving Your Driving Record

Your driving history is a significant factor in determining your insurance rates. A clean driving record can lead to substantial savings. Here’s how you can improve your record:

- Avoid Accidents and Violations: Practice safe driving habits to prevent accidents and avoid traffic violations. This can significantly reduce your insurance costs over time.

- Defensive Driving Courses: Consider taking a defensive driving course. These courses can improve your driving skills and may even qualify you for insurance discounts.

- Monitor Your Credit Score: As mentioned earlier, your credit score can impact your insurance rates. Regularly check your credit report and work on improving your score if needed.

Choosing the Right Coverage and Deductibles

The type of coverage you choose and your deductible amount can have a significant impact on your premium. Here’s what you need to know:

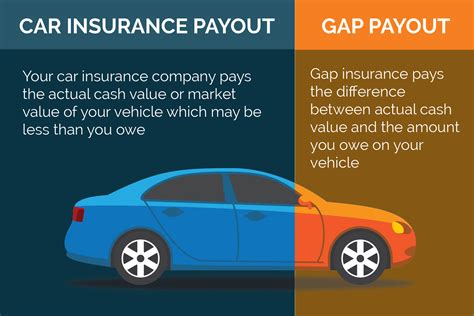

- Understanding Coverage Types: Different coverage types, such as liability, collision, and comprehensive, offer varying levels of protection. Understand your needs and choose coverage that aligns with your requirements.

- Increasing Your Deductible: Opting for a higher deductible can lower your premium. However, be cautious and ensure you can afford the deductible in the event of a claim.

- Bundling Policies: Consider bundling your automobile insurance with other types of insurance, such as homeowners or renters insurance. Many insurers offer discounts for bundling multiple policies.

Additional Tips for Saving on Automobile Insurance

Here are some additional strategies to consider when shopping for automobile insurance:

- Shop Around Regularly: Insurance rates can change over time, so it’s a good idea to shop around annually or whenever your policy renews. You may find better deals or new discounts.

- Ask for Discounts: Don’t be afraid to ask your insurance provider about potential discounts. Many companies offer discounts for loyalty, safe driving, or certain professional affiliations.

- Consider Usage-Based Insurance: Usage-based insurance programs, also known as pay-as-you-drive, can reward safe drivers with lower premiums. These programs use telematics to track your driving habits and calculate your premium accordingly.

- Maintain a Good Credit Score: As mentioned earlier, your credit score can impact your insurance rates. Maintaining a good credit score can help you secure more affordable insurance premiums.

The Impact of Technology on Automobile Insurance

Technology is transforming the automobile insurance industry, offering new opportunities for both insurers and consumers. Here’s how technology is influencing the landscape:

Usage-Based Insurance (UBI)

Usage-based insurance, or UBI, is a growing trend in the industry. This type of insurance program uses telematics devices or smartphone apps to track your driving habits, such as miles driven, speed, and time of day. By analyzing this data, insurers can offer more personalized premiums based on your actual driving behavior.

UBI can be a great option for safe drivers, as it rewards those who drive responsibly with lower premiums. However, it’s essential to understand the privacy implications and terms of the program before enrolling.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning are revolutionizing the way insurance companies assess risk and set premiums. These technologies can analyze vast amounts of data, including historical claims data, driving behavior, and even social media activity, to predict potential risks and set more accurate premiums.

AI and machine learning are also being used to streamline the claims process, making it faster and more efficient for policyholders.

Online Platforms and Comparison Tools

The rise of online insurance platforms and comparison tools has made it easier than ever for consumers to shop for and compare automobile insurance quotes. These platforms provide a convenient way to research and compare policies from multiple insurers, often in a matter of minutes.

Online platforms also offer additional benefits, such as personalized recommendations, customer reviews, and the ability to manage your policy online.

Future Trends in Automobile Insurance

The automobile insurance industry is constantly evolving, and several trends are shaping its future. Here’s a glimpse into what we can expect in the coming years:

Telematics and Connected Cars

The integration of telematics and connected car technology is expected to play a significant role in the future of automobile insurance. With more vehicles becoming connected, insurers will have access to real-time driving data, allowing them to offer more personalized and accurate premiums.

Additionally, connected car technology can enhance road safety by providing real-time alerts and assistance, reducing the likelihood of accidents.

Data-Driven Pricing

As insurers continue to leverage advanced analytics and machine learning, data-driven pricing will become more prevalent. This means that premiums will be set based on an individual’s unique risk profile, taking into account a wide range of factors, from driving behavior to lifestyle choices.

Data-driven pricing has the potential to make insurance more affordable for responsible individuals while ensuring that high-risk drivers pay premiums that reflect their actual risk.

Enhanced Customer Experience

The focus on customer experience is expected to intensify in the automobile insurance industry. Insurers will continue to invest in digital platforms and tools to provide a seamless and convenient experience for policyholders.

This includes the development of mobile apps, online portals, and chatbots to streamline policy management, claims filing, and other interactions.

Conclusion: Navigating the Cheapest Automobile Insurance Quotes

Finding the cheapest automobile insurance quotes requires a combination of thorough research, comparison, and an understanding of the factors that influence rates. By comparing quotes from multiple insurers, evaluating coverage options, and employing strategies to reduce your premium, you can secure affordable coverage without sacrificing quality.

Additionally, staying informed about the latest trends and technologies in the automobile insurance industry can help you make more informed decisions and potentially save even more on your policy. Remember, shopping around and staying proactive are key to securing the best deal on your automobile insurance.

What is the average cost of automobile insurance in the United States?

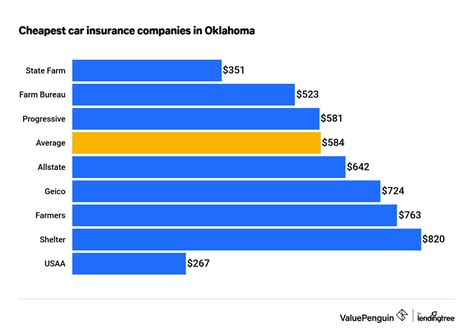

+The average cost of automobile insurance in the United States varies significantly based on factors such as location, age, driving history, and the type of coverage. As of [latest available data], the national average for annual automobile insurance premiums was approximately $[average amount] per year. However, it’s important to note that rates can differ significantly from state to state and even within different regions of the same state.

How can I reduce my automobile insurance premiums without compromising coverage?

+There are several strategies you can employ to reduce your automobile insurance premiums while maintaining adequate coverage. These include shopping around for quotes from multiple insurers, comparing coverage options, and considering usage-based insurance programs that reward safe driving habits. Additionally, you can opt for higher deductibles, bundle your policies, and take advantage of any available discounts, such as safe driver or loyalty discounts.

What factors determine my automobile insurance rates?

+A variety of factors influence your automobile insurance rates, including your age, gender, driving history, credit score, and the type of vehicle you drive. Additionally, the area you live in, the average number of miles you drive annually, and your chosen coverage and deductible amounts can impact your premiums. It’s important to understand these factors and how they affect your rates when shopping for insurance.