How Much Car Insurance Cost

Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind to drivers. The cost of car insurance can vary significantly depending on various factors, and understanding these variables is crucial for anyone seeking to obtain the right coverage at a suitable price. This comprehensive guide aims to delve into the intricacies of car insurance costs, exploring the key determinants and offering insights to help drivers make informed decisions.

The Complexity of Car Insurance Costs

The price of car insurance is not a straightforward matter, as it is influenced by a multitude of factors. These include personal characteristics, vehicle details, driving history, and the coverage options chosen. Each of these elements plays a unique role in determining the overall cost, making it a complex equation to solve.

Personal Factors

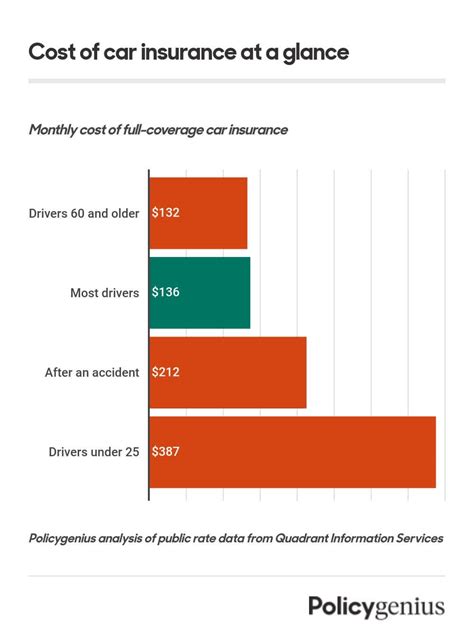

Several personal attributes can impact car insurance costs. Age is a significant factor; typically, younger drivers (especially those under 25) are considered higher risk and often pay more for insurance. Gender also plays a role, with statistics suggesting that male drivers may face higher premiums due to perceived risk. Additionally, marital status can be a factor, as married individuals are often viewed as lower-risk drivers.

Driving experience is another crucial aspect. New drivers with little experience are often charged higher premiums, as they are statistically more likely to be involved in accidents. Conversely, long-term, experienced drivers may benefit from lower rates.

Vehicle-Related Factors

The type of vehicle you drive can significantly influence insurance costs. High-performance cars, sports cars, and luxury vehicles often attract higher premiums due to their higher repair costs and potential for speed-related incidents. On the other hand, standard sedans and family cars are generally more affordable to insure.

The age of the vehicle is another consideration. Newer cars, especially those with advanced safety features, may result in lower insurance rates. Older vehicles, particularly those over 10 years old, might require more specialized coverage, leading to increased costs.

Location and Usage

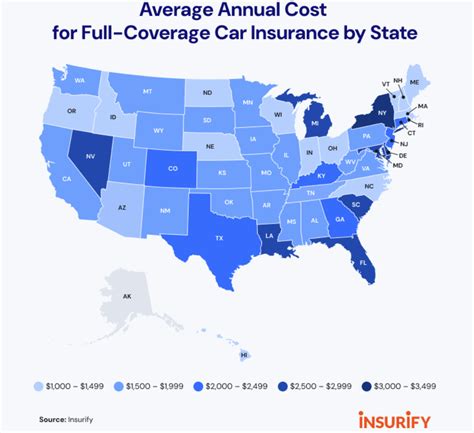

Where you live and how you use your vehicle can also impact insurance costs. Urban areas often have higher insurance rates due to increased traffic and the potential for accidents. Similarly, if you use your vehicle for business purposes or commute long distances, your insurance costs may increase.

Coverage Options and Deductibles

The type of coverage you choose and the associated deductibles play a significant role in the overall cost. Comprehensive coverage, which includes protection for a wide range of incidents (such as theft, fire, and natural disasters), tends to be more expensive than basic liability coverage. Additionally, choosing a higher deductible can reduce your premium, as you’ll be responsible for a larger portion of any claim.

Understanding Insurance Quotes

When seeking car insurance, you’ll often receive quotes from various providers. These quotes are estimates based on the information you provide and the company’s assessment of risk. It’s important to note that quotes can vary significantly between insurers, so shopping around is essential to find the best deal.

Factors Influencing Quotes

Insurers use a variety of factors to determine the quote they offer. This includes your personal and vehicle information, as well as data from external sources such as credit scores and claims history. Some insurers may also use telematics devices to track your driving behavior and adjust your premium accordingly.

Comparing Quotes

When comparing quotes, it’s crucial to ensure you’re comparing like for like. This means looking at the same coverage options and deductibles across different providers. It’s also beneficial to read the fine print to understand any exclusions or limitations that may apply.

Negotiating and Adjusting Coverage

In some cases, you may be able to negotiate your insurance premium, especially if you have a long-standing relationship with the insurer or a good claims history. Additionally, you can adjust your coverage to find the right balance between cost and protection. For instance, you might consider increasing your deductible to lower your premium or opting for a higher excess to reduce the cost of your insurance.

Saving on Car Insurance Costs

While car insurance is a necessary expense, there are strategies you can employ to reduce the cost. Here are some tips to consider:

- Shop Around: Compare quotes from multiple insurers to find the best deal.

- Bundle Policies: Many insurers offer discounts when you bundle multiple policies (e.g., car and home insurance) with them.

- Safe Driving: Maintaining a clean driving record can lead to lower premiums. Avoid accidents and traffic violations to keep your insurance costs down.

- Choose a Higher Deductible: Opting for a higher deductible can reduce your premium, but ensure you can afford the deductible in the event of a claim.

- Consider Telematics: Some insurers offer telematics-based insurance, where your premium is based on your actual driving behavior. This can be beneficial for safe drivers.

- Ask for Discounts: Inquire about discounts for good students, mature drivers, or safety features in your vehicle.

- Maintain a Good Credit Score: Insurers often use credit scores as a factor in determining premiums. A higher credit score may lead to lower insurance costs.

The Impact of Claims

Making a claim on your car insurance can impact your future premiums. While it’s essential to make a claim when necessary, frequent or small claims can lead to increased rates or even policy cancellation. Therefore, it’s crucial to weigh the benefits of making a claim against the potential increase in your insurance costs.

Future of Car Insurance Costs

The landscape of car insurance is constantly evolving, and future developments may impact the cost and availability of coverage. The rise of autonomous vehicles and advanced safety features could potentially reduce accidents and, consequently, insurance costs. However, the introduction of new technologies may also introduce new risks and challenges, potentially offsetting any cost savings.

Technology and Data-Driven Insurance

The insurance industry is increasingly leveraging technology and data analytics to refine risk assessment and pricing. This includes the use of telematics, advanced analytics, and even AI to predict and manage risks. As these technologies mature, they may lead to more accurate pricing and potentially lower costs for some policyholders.

Regulatory and Legal Changes

Regulatory changes and legal developments can also impact car insurance costs. For instance, changes in state laws regarding insurance coverage requirements or the introduction of new liability laws can influence the cost and availability of insurance. Staying informed about these changes is crucial for understanding their potential impact on your insurance costs.

Conclusion

Understanding the factors that influence car insurance costs is crucial for making informed decisions about your coverage. By being aware of the various personal, vehicle, and coverage-related factors, you can navigate the complex world of car insurance with confidence. Remember, while car insurance is a necessary expense, there are strategies to manage and reduce these costs, ensuring you receive the right coverage at a competitive price.

What is the average cost of car insurance in the United States?

+The average cost of car insurance in the U.S. varies significantly based on location, with the national average premium being approximately 1,674 per year. However, this can range from around 1,000 in some states to over $3,000 in others.

Are there ways to get cheaper car insurance without compromising coverage?

+Yes, you can consider options like increasing your deductible, opting for a usage-based insurance policy, or taking advantage of discounts for safe driving, good students, or mature drivers. These strategies can help reduce your premium while maintaining adequate coverage.

How often should I review my car insurance policy and quotes?

+It’s a good practice to review your car insurance policy and quotes annually, especially when your policy is up for renewal. This allows you to assess whether you’re still getting the best value for your money and make any necessary adjustments to your coverage.