Cost Of Homeowners Insurance

Homeowners insurance is an essential aspect of homeownership, providing financial protection and peace of mind to millions of individuals and families across the globe. However, the cost of this insurance can vary significantly depending on numerous factors, leaving many potential buyers wondering about the expenses they might incur. This article aims to delve into the intricate world of homeowners insurance, offering a comprehensive breakdown of the costs involved and exploring the key variables that influence these expenses. By the end of this exploration, readers will possess a clearer understanding of the financial commitments associated with homeowners insurance, enabling them to make more informed decisions when it comes to safeguarding their most valuable assets.

Understanding the Basics of Homeowners Insurance Costs

The expense of homeowners insurance is influenced by a multitude of factors, each playing a unique role in determining the overall cost. These factors include the location of the property, the value of the home, the coverage limits chosen, and the insurance provider itself. Additionally, the specific features and amenities of the home, as well as the personal history and claims record of the homeowner, can impact the premium. Understanding these elements is crucial for individuals aiming to secure the most suitable and cost-effective insurance policy for their home.

Location and Its Impact on Insurance Premiums

The geographical location of a home is a significant determinant of insurance costs. Areas prone to natural disasters, such as hurricanes, earthquakes, or floods, generally face higher insurance premiums. For instance, coastal regions frequently exposed to hurricanes often have elevated insurance rates due to the increased risk of property damage. Similarly, homes situated in areas with high crime rates or a history of frequent claims may also experience higher insurance costs.

Insurance providers utilize sophisticated algorithms to assess the risk associated with insuring a property in a specific location. These algorithms consider factors such as the historical data of natural disasters, crime rates, and local building codes to determine the likelihood of a claim being filed. Consequently, homes in high-risk areas may be subject to additional surcharges or even face difficulties in securing coverage from certain providers.

| Location | Average Annual Premium |

|---|---|

| Hurricane-prone coastal regions | $2,500 - $5,000 |

| High-crime urban areas | $1,500 - $3,000 |

| Rural areas with low crime rates | $1,000 - $2,000 |

Home Value and the Cost of Insurance

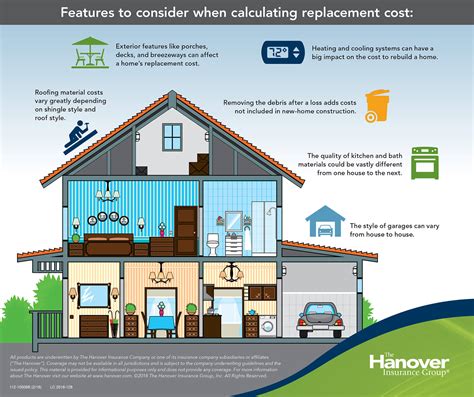

The value of a home is another critical factor in determining insurance costs. In general, homes with higher market values tend to have higher insurance premiums. This is because the insurance provider will need to cover a greater financial loss in the event of a claim. For instance, a luxurious mansion with high-end finishes and valuable possessions will likely require a more extensive insurance policy, resulting in a higher premium.

When determining the value of a home for insurance purposes, providers consider factors such as the replacement cost of the structure, the value of personal belongings, and any additional living expenses that may arise if the home becomes uninhabitable due to a covered loss. It is essential for homeowners to accurately assess the value of their property to ensure they have adequate coverage without overpaying for unnecessary insurance.

Coverage Limits and Their Effect on Premiums

The coverage limits chosen by a homeowner significantly impact the cost of their insurance policy. Coverage limits refer to the maximum amount an insurance provider will pay out in the event of a covered loss. Higher coverage limits provide more protection but also result in higher premiums. It is crucial for homeowners to carefully consider their coverage limits, ensuring they have adequate protection without overpaying for coverage they may not need.

When selecting coverage limits, homeowners should consider the value of their home, the cost of rebuilding or repairing it, and the value of their personal belongings. It is advisable to consult with an insurance professional to determine the appropriate coverage limits based on their specific circumstances. Additionally, homeowners should regularly review their coverage limits to ensure they remain adequate as their home and its contents change over time.

Factors Influencing Homeowners Insurance Costs

In addition to the basic factors outlined above, several other variables can influence the cost of homeowners insurance. These include the insurance provider chosen, the type of policy purchased, and the homeowner’s personal history and claims record.

Insurance Provider and Policy Type

The insurance provider and the type of policy selected can significantly impact the cost of homeowners insurance. Different insurance companies offer varying rates and coverage options, so it is essential to shop around and compare quotes from multiple providers. Additionally, the type of policy chosen, such as a standard homeowners policy or a more specialized policy for high-value homes, can also affect the premium.

When selecting an insurance provider, it is crucial to consider factors such as the company's financial stability, its reputation for customer service, and its claims handling process. Homeowners should also carefully review the policy's terms and conditions, ensuring they understand the coverage limits, deductibles, and any exclusions or limitations. By thoroughly researching and comparing providers and policies, homeowners can make informed decisions to secure the most suitable and cost-effective coverage for their needs.

Personal History and Claims Record

The personal history and claims record of a homeowner can also impact their insurance costs. Insurance providers consider factors such as the homeowner’s credit score, their claims history, and their criminal record when calculating premiums. A good credit score and a clean claims record can often lead to lower insurance premiums, as these factors indicate a lower risk of potential claims.

It is important for homeowners to maintain a positive credit score and to avoid filing unnecessary or fraudulent claims. Additionally, taking proactive measures to protect their home, such as installing security systems or implementing fire safety measures, can also help reduce insurance costs. By demonstrating a responsible and proactive approach to homeownership, homeowners can potentially lower their insurance premiums and secure more favorable coverage terms.

Tips for Reducing Homeowners Insurance Costs

While homeowners insurance is a necessary expense, there are several strategies that homeowners can employ to potentially reduce their insurance costs. These strategies include shopping around for the best rates, increasing deductibles, taking advantage of discounts, and making home improvements.

Shopping Around for the Best Rates

One of the most effective ways to reduce homeowners insurance costs is to shop around for the best rates. By obtaining quotes from multiple insurance providers, homeowners can compare premiums and coverage options to find the most suitable and cost-effective policy for their needs. It is important to note that insurance rates can vary significantly between providers, so it is crucial to obtain quotes from a range of companies to ensure the best value.

Increasing Deductibles

Increasing the deductible on a homeowners insurance policy is another strategy that can lead to reduced premiums. A deductible is the amount a homeowner must pay out of pocket before their insurance coverage kicks in. By selecting a higher deductible, homeowners can lower their insurance premiums, as they are assuming a greater portion of the financial risk in the event of a covered loss. However, it is essential to choose a deductible that is manageable and does not compromise the homeowner’s financial stability in the event of a claim.

Taking Advantage of Discounts

Insurance providers often offer various discounts to homeowners, which can significantly reduce insurance costs. These discounts may be available for a range of factors, such as having multiple policies with the same provider, installing security systems or fire safety measures, or being a member of certain organizations or associations. Homeowners should inquire about available discounts when obtaining quotes and ensure they take advantage of any applicable discounts to lower their insurance premiums.

Making Home Improvements

Investing in home improvements can also lead to reduced homeowners insurance costs. Certain home improvements, such as installing a new roof, reinforcing windows and doors, or updating electrical systems, can enhance the safety and security of the home, potentially reducing the risk of claims. Insurance providers often offer discounts or reduced premiums for homes that meet specific safety and security standards. By making these improvements, homeowners can not only enhance the value and functionality of their home but also potentially lower their insurance costs.

The Future of Homeowners Insurance Costs

The cost of homeowners insurance is expected to continue evolving as the insurance industry adapts to changing risk factors and market conditions. Advancements in technology, such as the use of artificial intelligence and data analytics, are likely to play a significant role in shaping future insurance costs. These technologies enable insurance providers to more accurately assess risk and personalize insurance policies, potentially leading to more precise pricing and improved coverage options for homeowners.

Additionally, the increasing awareness and adoption of sustainable and resilient building practices are likely to impact insurance costs in the future. Homes built or renovated with sustainable materials and energy-efficient systems may be viewed as lower-risk properties, potentially leading to reduced insurance premiums. As more homeowners embrace these practices, the insurance industry may respond by offering incentives or discounts for homes that meet certain sustainability and resilience standards.

Furthermore, the rise of shared economy platforms and the increasing prevalence of remote work may also influence homeowners insurance costs. As more individuals utilize platforms such as Airbnb or Vrbo to rent out their homes, insurance providers may need to adapt their policies and pricing to accommodate these new business models. Similarly, as remote work becomes more common, insurance providers may need to reconsider coverage options for home offices and related liabilities.

In conclusion, the cost of homeowners insurance is influenced by a multitude of factors, including location, home value, coverage limits, insurance provider, policy type, personal history, and claims record. By understanding these factors and employing strategies such as shopping around, increasing deductibles, taking advantage of discounts, and making home improvements, homeowners can potentially reduce their insurance costs. As the insurance industry continues to evolve, homeowners can expect advancements in technology and shifts in building practices to shape the future of homeowners insurance costs, offering more personalized and sustainable coverage options.

How often should I review my homeowners insurance policy?

+It is recommended to review your homeowners insurance policy annually to ensure it still meets your needs and to take advantage of any available discounts or changes in the market. Additionally, it is advisable to review your policy whenever you make significant changes to your home, such as renovations or additions, to ensure your coverage remains adequate.

Can I bundle my homeowners insurance with other policies to save money?

+Yes, many insurance providers offer discounts when you bundle multiple policies, such as homeowners insurance with auto insurance or life insurance. Bundling policies can often lead to significant savings, so it is worth exploring this option with your insurance provider.

What should I do if I’m denied homeowners insurance coverage?

+If you are denied homeowners insurance coverage, it is important to understand the reasons behind the denial. Insurance providers may deny coverage due to various factors, such as the location of your home, its age, or your personal history. You can try shopping around with other providers or considering specialized insurance companies that cater to high-risk properties. Additionally, you may need to make certain improvements to your home or address specific concerns to increase your chances of securing coverage.