Texas Life Insurance Company

Texas Life Insurance Company, a prominent player in the insurance landscape, has been a trusted name in the industry for over a century. With a rich history and a commitment to financial security, this company has earned its place as a leading provider of life insurance solutions tailored to the diverse needs of Texans. In this comprehensive article, we delve into the world of Texas Life Insurance Company, exploring its origins, unique offerings, and the impact it has had on the lives of its policyholders.

A Legacy of Protection: The Story of Texas Life Insurance Company

Texas Life Insurance Company was founded in 1897, during a period of rapid growth and development in the Lone Star State. The company’s inception was driven by a group of visionary entrepreneurs who recognized the need for robust financial protection in a region experiencing rapid economic expansion. Over the years, Texas Life Insurance Company has evolved to become a pillar of stability, offering a comprehensive suite of life insurance products to individuals, families, and businesses across the state.

One of the key strengths of Texas Life Insurance Company lies in its deep understanding of the unique challenges and opportunities present in the Texas market. From the diverse cultural tapestry of Houston to the rugged landscapes of the Hill Country, the company has tailored its offerings to cater to the specific needs of its customers. This localized approach has allowed Texas Life Insurance Company to establish itself as a trusted partner, providing customized solutions that reflect the values and aspirations of the communities it serves.

Innovative Products and Services

Texas Life Insurance Company prides itself on its innovative approach to insurance solutions. The company has consistently pushed the boundaries of traditional life insurance, introducing a range of products that address the evolving needs of its policyholders. Here’s a glimpse into some of their flagship offerings:

Term Life Insurance

Texas Life Insurance Company offers a range of term life insurance plans, providing customers with flexible coverage options to suit their specific timelines and budgetary requirements. Whether it’s a 10-year, 20-year, or 30-year term, policyholders can secure affordable protection for their loved ones during crucial stages of life.

| Term Length | Coverage Options |

|---|---|

| 10 Years | Flexible premiums, ideal for short-term financial planning. |

| 20 Years | Popular choice for families, offering comprehensive coverage during key life stages. |

| 30 Years | Long-term protection, suitable for individuals seeking lifelong coverage. |

Whole Life Insurance

For those seeking lifelong financial protection, Texas Life Insurance Company’s whole life insurance plans offer a stable and reliable solution. These policies provide guaranteed coverage for the policyholder’s entire life, ensuring peace of mind for their beneficiaries.

| Plan Type | Key Features |

|---|---|

| Traditional Whole Life | Fixed premiums, guaranteed death benefit, and cash value accumulation. |

| Universal Life | Flexible premiums and death benefits, with the option to adjust coverage as needed. |

| Indexed Universal Life | Combines the flexibility of universal life with potential for higher cash value growth tied to market indices. |

Additional Riders and Benefits

Texas Life Insurance Company understands that life insurance needs can be complex and unique. To address this, the company offers a range of additional riders and benefits that can be added to their core policies. These include:

- Accidental Death Benefit: Provides additional coverage in the event of an accidental death.

- Waiver of Premium: Allows policyholders to pause premium payments if they become disabled.

- Children's Term Insurance: Offers affordable coverage for the policyholder's children.

- Long-Term Care Rider: Provides coverage for long-term care needs, ensuring financial support during extended illnesses or disabilities.

Customer-Centric Approach

At the heart of Texas Life Insurance Company’s success is its unwavering dedication to its customers. The company recognizes that life insurance is more than just a financial product; it’s a promise of security and peace of mind. With this understanding, Texas Life Insurance Company has cultivated a culture of excellence, ensuring that its policyholders receive personalized attention and support throughout their insurance journey.

From the initial application process to ongoing policy management, Texas Life Insurance Company prioritizes transparency and simplicity. The company's team of experienced agents and customer service representatives are dedicated to guiding individuals and families through the often complex world of life insurance, ensuring that every policyholder understands their coverage and feels empowered to make informed decisions.

Digital Innovation for Enhanced Customer Experience

Texas Life Insurance Company embraces digital transformation to enhance its customer service capabilities. The company’s online platform offers a seamless and secure experience, allowing policyholders to manage their accounts, view policy details, and make payments with just a few clicks. Additionally, the company leverages advanced analytics to provide personalized recommendations and tailored insurance solutions, ensuring that customers receive the coverage that aligns perfectly with their needs.

Community Engagement and Philanthropy

Beyond its core business, Texas Life Insurance Company is deeply rooted in the communities it serves. The company actively participates in philanthropic initiatives, supporting causes that align with its values and the needs of its policyholders. From sponsoring local events and charities to promoting financial literacy and education, Texas Life Insurance Company demonstrates its commitment to making a positive impact beyond the insurance realm.

One of the company's notable initiatives is its partnership with local schools and universities, offering educational programs and scholarships to empower the next generation of Texans. Additionally, Texas Life Insurance Company actively advocates for insurance reform and consumer protection, ensuring that its policyholders have access to fair and transparent insurance practices.

Environmental Stewardship

Texas Life Insurance Company recognizes its responsibility as a corporate citizen and has taken proactive steps towards environmental sustainability. The company has implemented eco-friendly practices in its operations, reducing its carbon footprint and promoting sustainable business practices. This commitment to environmental stewardship extends to its investment portfolio, with a focus on environmentally responsible and socially conscious investments.

Conclusion: A Legacy of Trust and Innovation

Texas Life Insurance Company’s journey over the past century is a testament to its resilience, innovation, and commitment to its customers. From its humble beginnings to its position as a leading provider of life insurance solutions, the company has consistently adapted to the changing needs of its policyholders. With a focus on financial security, personalized service, and community engagement, Texas Life Insurance Company continues to shape the insurance landscape, ensuring that Texans can navigate life’s uncertainties with confidence and peace of mind.

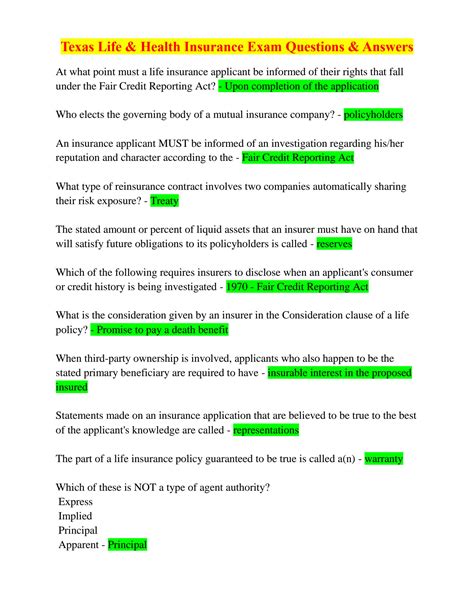

What sets Texas Life Insurance Company apart from its competitors?

+

Texas Life Insurance Company stands out for its deep understanding of the Texas market and its commitment to personalized service. The company’s innovative product offerings, tailored to the unique needs of its policyholders, and its focus on community engagement and environmental sustainability further differentiate it in the industry.

How does Texas Life Insurance Company ensure the financial security of its policyholders?

+

Texas Life Insurance Company offers a comprehensive range of life insurance products, including term and whole life insurance, with flexible coverage options. Additionally, the company’s financial strength and stability ensure that policyholders can rely on their chosen coverage throughout their lifetime.

What are the key benefits of choosing Texas Life Insurance Company for my insurance needs?

+

By choosing Texas Life Insurance Company, you gain access to a diverse range of insurance products tailored to your specific needs. The company’s focus on customer service and its commitment to community engagement ensure that you receive personalized attention and support throughout your insurance journey. Additionally, Texas Life Insurance Company’s financial stability and innovative approach provide peace of mind and confidence in your chosen coverage.