How To Find The Best Car Insurance

Choosing the right car insurance is a crucial step for any vehicle owner. With a vast array of insurance providers and policies available, it can be challenging to navigate the market and identify the best coverage for your needs. In this comprehensive guide, we will explore the essential factors to consider, provide valuable insights, and offer a step-by-step process to help you find the ideal car insurance that offers the perfect balance of coverage and cost.

Understanding Your Car Insurance Needs

Before diving into the world of car insurance, it’s essential to assess your specific requirements. Consider the following factors to tailor your search effectively:

Vehicle Type and Usage

The type of vehicle you own and how you use it can significantly impact your insurance needs. Factors such as make, model, age, and mileage can influence the cost and coverage options. For instance, a high-performance sports car may require different coverage compared to a standard sedan used for daily commuting.

| Vehicle Type | Coverage Considerations |

|---|---|

| Sports Car | Higher liability and comprehensive coverage due to increased risk. |

| Family Sedan | Focus on affordable, reliable coverage with optional add-ons for peace of mind. |

| Hybrid/Electric Vehicle | Consider unique coverage options for specialized repairs and charging station liability. |

Driver Profile

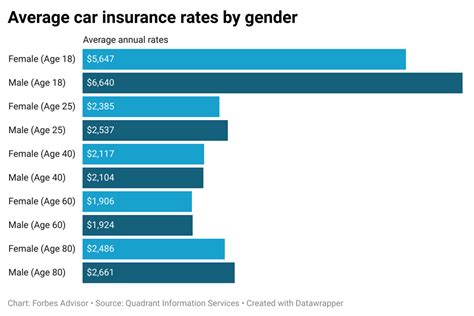

Your driving history and personal details play a crucial role in determining insurance rates. Insurance companies consider factors like age, gender, driving record, and credit score when calculating premiums. Younger drivers or those with a history of accidents may face higher rates, so it’s essential to find a provider that offers discounts or programs tailored to your specific situation.

Coverage Requirements

Understand the minimum insurance requirements in your state or country. Additionally, consider your personal needs and preferences. Do you frequently drive long distances or face high-risk conditions like severe weather or urban traffic? Evaluating your coverage requirements will help you choose the right policy limits and additional coverage options.

Researching Car Insurance Providers

Once you have a clear understanding of your needs, it’s time to research and compare insurance providers. Here’s a systematic approach to help you find the best options:

Online Comparison Tools

Utilize online platforms and comparison websites that allow you to enter your details once and receive multiple quotes from different insurers. These tools provide a convenient way to quickly assess a range of options and identify potential discounts or special offers.

Direct Insurance Companies

Visit the websites of major insurance companies directly. Many providers offer online quote tools or the option to request a quote via email or phone. This allows you to explore their specific coverage options and understand their unique selling points.

Independent Insurance Agents

Consider working with an independent insurance agent who represents multiple insurance companies. These professionals can provide personalized advice and help you navigate the complex world of car insurance. They can offer insights into different policies, coverage options, and potential discounts, ensuring you find the best fit.

Check Provider Ratings and Reviews

Research and evaluate the reputation and financial stability of the insurance companies you’re considering. Check industry ratings from organizations like AM Best or Standard & Poor’s to ensure the provider is reliable and capable of honoring claims. Additionally, read customer reviews and testimonials to gain insights into the provider’s customer service and claim handling processes.

Evaluating Car Insurance Quotes

When you’ve gathered a list of potential insurance providers, it’s time to evaluate and compare the quotes they offer. Here are some key factors to consider:

Coverage Options

Ensure that the quotes you receive include the coverage options you require. Compare the policy limits, deductibles, and any additional coverage add-ons to ensure you’re getting the right level of protection for your needs.

Premium Costs

While cost is an essential consideration, it’s not the only factor. Compare premiums for similar coverage options across different providers. Remember, the cheapest quote may not always offer the best value if it lacks crucial coverage or has higher deductibles.

Discounts and Special Offers

Insurance companies often provide discounts to attract customers. Look for discounts based on your driving record, vehicle safety features, or membership in certain organizations. Additionally, some providers offer package deals or loyalty discounts for bundling multiple insurance policies.

Policy Terms and Conditions

Carefully review the terms and conditions of each policy. Pay attention to exclusions, limitations, and any specific requirements or restrictions. Understanding these details will help you make an informed decision and avoid any surprises down the line.

Negotiating and Finalizing Your Policy

Once you’ve identified the insurance provider and policy that best meets your needs, it’s time to finalize the process. Here are some steps to ensure a smooth transition:

Contact the Provider

Reach out to the insurance company or agent to discuss the quote and any final questions or concerns you may have. This is an opportunity to clarify any doubts and ensure you fully understand the policy terms.

Review and Compare Again

Before making a final decision, review the quote and policy details one last time. Compare it to other options you’ve considered to ensure you’re making the right choice. Consider reaching out to other providers to negotiate better rates or explore additional discounts.

Complete the Application Process

Once you’re satisfied with your choice, complete the application process. Provide accurate and detailed information to ensure a smooth onboarding experience. Remember to carefully review and understand the policy documents before signing.

Maintaining and Reviewing Your Car Insurance

Finding the best car insurance is an ongoing process. Regularly review and update your policy to ensure it continues to meet your changing needs. Here are some tips for effective policy management:

Annual Policy Review

Set a reminder to review your car insurance policy annually. This allows you to assess whether your coverage and premium remain competitive in the market. It’s an opportunity to explore new providers, negotiate better rates, or add/remove coverage options as your circumstances change.

Keep Your Records Up-to-Date

Maintain accurate and up-to-date records of your vehicle, driving history, and any changes to your personal details. This ensures that your insurance provider has the correct information and can offer the most appropriate coverage.

Utilize Discount Opportunities

Stay informed about potential discounts and special offers. Insurance companies may introduce new programs or adjust existing ones, so regularly check for opportunities to save on your premium.

Seek Professional Advice

If you have complex insurance needs or are unsure about specific coverage options, consider seeking advice from an insurance broker or financial advisor. These professionals can provide personalized guidance and help you make informed decisions.

How often should I review my car insurance policy?

+It’s recommended to review your car insurance policy annually to ensure it aligns with your current needs and remains competitive in the market. Regular reviews allow you to assess potential discounts, coverage adjustments, or changes in your circumstances.

What are some common car insurance discounts I should look for?

+Common car insurance discounts include safe driver discounts, multi-policy discounts (bundling car and home insurance), good student discounts, loyalty discounts, and discounts for vehicle safety features like anti-theft devices or advanced driver assistance systems.

How can I save money on my car insurance premium without compromising coverage?

+To save money without sacrificing coverage, consider increasing your deductible, reviewing and adjusting coverage limits, and exploring package deals or loyalty discounts. Additionally, maintaining a clean driving record and taking advantage of available discounts can help reduce your premium.