Insurance Car Auction Near Me

The world of insurance car auctions is an intriguing one, offering a unique opportunity for buyers to acquire vehicles at potentially attractive prices. These auctions feature a diverse range of vehicles, from slightly used to heavily damaged, all stemming from insurance claims and policy settlements. In this comprehensive guide, we'll delve into the intricacies of insurance car auctions, exploring their mechanics, benefits, and potential challenges. By understanding this niche market, you can make informed decisions and potentially find your dream car at a bargain.

Understanding Insurance Car Auctions

Insurance car auctions, also known as salvage or damaged vehicle auctions, are specialized events where vehicles that have been involved in accidents, experienced mechanical failures, or suffered other forms of damage are sold to the highest bidder. These auctions are a result of insurance companies’ need to dispose of vehicles that are deemed a total loss or are no longer economically viable to repair.

While some insurance car auctions are open to the public, many are exclusive to licensed dealers or require pre-registration and a valid buyer's license. This is because the vehicles at these auctions often require significant repairs and may not be roadworthy without professional attention. Despite these challenges, insurance car auctions can be a treasure trove for savvy buyers who are willing to invest time, effort, and resources into restoring vehicles.

Auction Formats and Platforms

Insurance car auctions can take various formats, each with its own unique characteristics and considerations. The most common types include:

- Live Auctions: These are traditional, in-person events where bidders gather at a physical location to bid on vehicles. Live auctions often have a lively atmosphere and provide an opportunity for buyers to inspect vehicles up close before placing bids.

- Online Auctions: With the advent of technology, many insurance car auctions have moved online, providing a convenient platform for buyers to participate from anywhere. Online auctions often feature detailed vehicle descriptions, photos, and sometimes even videos, allowing bidders to make informed decisions without physically being present.

- Simulcast Auctions: A hybrid of live and online auctions, simulcast auctions allow bidders to participate in real-time from multiple locations. This format combines the benefits of both live and online auctions, offering a more interactive experience than traditional online auctions.

Each auction format has its pros and cons, and the choice often depends on personal preferences, geographic location, and the specific auction requirements. Regardless of the format, it's essential to thoroughly research and understand the auction rules, buyer requirements, and the bidding process before participating.

The Benefits of Insurance Car Auctions

Insurance car auctions offer several advantages to buyers, particularly those who are knowledgeable, skilled, and willing to take on the challenges that come with purchasing salvage vehicles. Here are some key benefits:

Affordable Prices

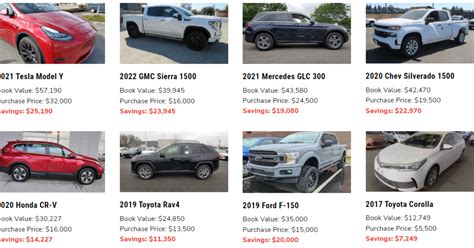

One of the most appealing aspects of insurance car auctions is the potential for significant savings. Vehicles at these auctions are often sold at prices far below their market value, especially when compared to traditional used car sales. This is because insurance companies are looking to recover some of their losses and are not concerned with maximizing profits on each vehicle.

| Vehicle Type | Average Market Price | Average Auction Price |

|---|---|---|

| Sedan | $20,000 | $12,500 |

| SUV | $35,000 | $22,000 |

| Sports Car | $50,000 | $35,000 |

The table above provides a hypothetical comparison of average market prices and auction prices for different vehicle types. As you can see, the potential savings can be substantial, making insurance car auctions an attractive option for budget-conscious buyers.

Diverse Vehicle Selection

Insurance car auctions offer a wide range of vehicle makes, models, and years, providing buyers with an extensive selection to choose from. This diversity allows buyers to find unique or rare vehicles that may not be readily available in traditional used car markets. Whether you’re looking for a classic car, a luxury SUV, or a performance sedan, insurance car auctions can be a treasure trove of options.

Potential for Customization

Many buyers are drawn to insurance car auctions because of the opportunity to customize and restore vehicles to their liking. With the right skills and resources, a damaged vehicle can be transformed into a one-of-a-kind masterpiece. This level of customization can be particularly appealing to car enthusiasts and those seeking a truly personalized driving experience.

Challenges and Considerations

While insurance car auctions offer many benefits, they also come with their fair share of challenges and considerations. It’s crucial to approach these auctions with a clear understanding of the potential risks and complexities involved.

Vehicle Condition and History

One of the primary challenges of insurance car auctions is the uncertainty surrounding the condition and history of the vehicles. While auction platforms provide information and documentation, it’s often limited and may not reveal the full extent of the damage. Buyers must rely on their own inspections, research, and expertise to assess the true state of the vehicle.

It's essential to conduct thorough inspections, either in person or through trusted mechanics, to identify any hidden issues or potential safety hazards. Additionally, understanding the vehicle's history, including any previous accidents or repairs, is crucial for making informed decisions.

Legal and Ownership Considerations

Purchasing a vehicle at an insurance car auction also comes with legal and ownership considerations. It’s important to understand the title status of the vehicle, as many salvage vehicles are sold with a “salvage title,” indicating that they have been declared a total loss by an insurance company. Salvage titles can impact the vehicle’s resale value and may require additional documentation and inspections to register and insure the vehicle.

Furthermore, buyers must ensure they have the necessary paperwork and licenses to legally purchase and own a salvage vehicle. Some states and countries have specific regulations regarding the purchase and registration of salvage vehicles, so it's crucial to research and comply with local laws.

Repair and Restoration Costs

The most significant challenge for many buyers is the potential cost of repairs and restoration. While insurance car auctions offer low purchase prices, the cost of repairing and restoring a vehicle can quickly add up. Buyers must have a clear understanding of the extent of the repairs needed and a realistic budget to ensure they don’t overspend on a project that may not be financially feasible.

It's also important to consider the time and effort required for repairs. Some projects may take months or even years to complete, and buyers should be prepared for the long-term commitment and potential delays that can arise.

Tips for Success at Insurance Car Auctions

Navigating the world of insurance car auctions can be challenging, but with the right approach and preparation, buyers can increase their chances of success. Here are some valuable tips to keep in mind:

Do Your Research

Thorough research is key to making informed decisions at insurance car auctions. Study the auction catalog, vehicle descriptions, and any available photos or videos. Research the market value of similar vehicles to get a sense of their worth and potential for savings. Additionally, research the auction platform, its reputation, and any feedback from previous buyers.

Inspect Vehicles Thoroughly

Whenever possible, inspect vehicles in person before bidding. Bring a trusted mechanic or automotive expert who can assess the vehicle’s condition and provide an estimate for any necessary repairs. If an in-person inspection is not feasible, consider hiring an independent inspector to evaluate the vehicle on your behalf.

Set a Realistic Budget

Define a clear budget for your auction purchases, including not only the purchase price but also the estimated costs for repairs, registration, and insurance. Stick to your budget to avoid overspending and ensure that the project remains financially feasible.

Understand the Bidding Process

Familiarize yourself with the auction’s bidding process, including any rules, requirements, and fees. Understand the auction’s terms and conditions, as well as any warranties or guarantees offered. This knowledge will help you navigate the bidding process with confidence and make strategic decisions.

Stay Disciplined

Auctions can be exciting and competitive, but it’s important to maintain discipline and stick to your plan. Set a maximum bid for each vehicle based on your budget and the vehicle’s estimated value. Avoid getting caught up in bidding wars and remember that there will always be more auctions and opportunities to find the right vehicle.

Future Implications and Opportunities

The world of insurance car auctions is evolving, and with it, new opportunities and challenges arise. As technology continues to advance, we can expect to see further innovations in auction platforms and processes. Online auctions, in particular, are likely to become even more sophisticated, offering enhanced vehicle inspections and more detailed information to buyers.

Additionally, the rise of electric vehicles (EVs) and autonomous driving technologies is expected to impact the insurance car auction landscape. As these technologies become more prevalent, we may see an increase in salvage vehicles with unique features and advanced systems, presenting new opportunities for buyers and restorers.

Furthermore, the growing focus on sustainability and environmental consciousness may drive a shift towards more eco-friendly auction practices. Auction platforms may adopt more sustainable packaging and shipping methods, and buyers may prioritize vehicles with lower environmental impacts, such as hybrids or electric cars.

Conclusion

Insurance car auctions offer a unique and exciting opportunity for buyers seeking a challenge and the chance to acquire vehicles at potentially incredible prices. While these auctions come with their fair share of complexities and challenges, they also present the potential for significant savings, customization, and the thrill of restoring a vehicle to its former glory.

By understanding the auction process, conducting thorough research, and approaching these auctions with a strategic mindset, buyers can navigate the world of insurance car auctions with confidence. Whether you're a seasoned car enthusiast or a first-time buyer, insurance car auctions can be a rewarding and fulfilling experience, providing a chance to find your dream vehicle and make it your own.

Frequently Asked Questions

How do I find insurance car auctions near me?

+To find insurance car auctions near you, start by researching local auction houses and salvage yards. Many of these businesses host regular auctions, and their websites often provide details about upcoming events, including dates, locations, and vehicle listings. Additionally, online auction platforms and auction-specific websites can help you discover auctions in your area. You can also reach out to local auto repair shops or body shops, as they may have information about upcoming auctions or even recommend trusted auctioneers.

What should I look for when inspecting a vehicle at an insurance car auction?

+When inspecting a vehicle at an insurance car auction, there are several key aspects to consider. First, assess the overall condition of the vehicle, including its body panels, paint, and interior. Look for signs of damage, rust, or previous repairs. Check the engine and undercarriage for any leaks or signs of mechanical issues. Test all the vehicle’s functions, including lights, wipers, and electronics. Finally, take the vehicle for a test drive (if allowed) to evaluate its performance and handling.

Are there any risks associated with buying a salvage vehicle at an insurance car auction?

+Yes, there are potential risks when buying a salvage vehicle at an insurance car auction. The primary risk is the unknown extent of the vehicle’s damage and its true condition. While auction platforms provide information, it may not always be comprehensive. Additionally, some salvage vehicles may have hidden or structural damage that is not immediately apparent. It’s crucial to conduct thorough inspections and research to mitigate these risks and make an informed decision.

What are the benefits of purchasing a vehicle from an insurance car auction?

+Purchasing a vehicle from an insurance car auction offers several benefits. The most significant advantage is the potential for substantial savings compared to traditional used car markets. Insurance car auctions often feature a wide range of vehicles at attractive prices. Additionally, these auctions provide an opportunity to acquire unique or rare vehicles that may not be readily available elsewhere. For car enthusiasts and restorers, insurance car auctions offer the chance to customize and restore vehicles to their liking.