Average Term Life Insurance Cost

Life insurance is an essential financial tool that provides peace of mind and security to individuals and their loved ones. One of the most common types of life insurance is term life insurance, which offers coverage for a specified period, typically ranging from 10 to 30 years. Understanding the average cost of term life insurance is crucial for anyone considering this type of protection.

The average monthly premium for a 500,000 term life insurance policy for a 35-year-old non-smoker in good health is typically around 30 to 35. However, this can vary depending on the insurer and other individual factors.">What is the average monthly premium for a 500,000 term life insurance policy for a 35-year-old non-smoker in good health? +

Understanding Term Life Insurance Costs

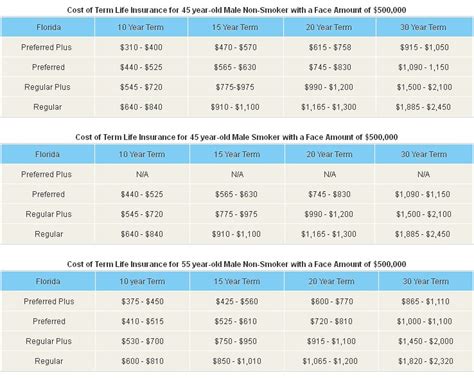

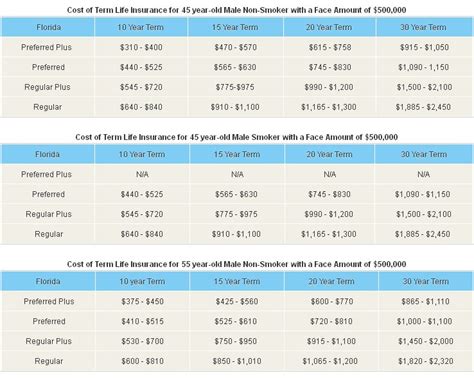

The cost of term life insurance can vary significantly depending on several factors, including the insured’s age, health status, lifestyle choices, and the coverage amount selected. It is important to note that term life insurance is designed to provide coverage for a defined term, and the premiums are generally fixed throughout the policy period. Here, we delve into the key aspects that influence the average cost of term life insurance.

Age and Health Considerations

Age is a primary factor in determining the cost of term life insurance. In general, younger individuals can expect to pay lower premiums compared to their older counterparts. This is because the likelihood of claiming on a life insurance policy increases with age, as the risk of health complications and accidents rises. For instance, a 30-year-old non-smoker in good health might pay an average monthly premium of 25</strong> for a <strong>500,000 term life insurance policy, while a 50-year-old with similar health conditions could expect to pay around $50 for the same coverage.

Health status is another critical factor. Insurers assess an individual's health through medical examinations and lifestyle questionnaires. Pre-existing health conditions, such as diabetes or heart disease, can lead to higher premiums or even the denial of coverage. On the other hand, individuals with healthy lifestyles and no significant health issues may qualify for preferred rates.

| Age | Health Status | Average Monthly Premium ($) |

|---|---|---|

| 30 | Excellent | 25 |

| 40 | Good | 35 |

| 50 | Average | 50 |

| 60 | Fair | 75 |

Coverage Amount and Term Length

The amount of coverage you choose directly impacts the cost of your term life insurance. Higher coverage amounts generally result in higher premiums. For example, a 1,000,000</strong> policy will typically cost more than a <strong>500,000 policy, even if all other factors remain constant. The term length of your policy also plays a role. Longer terms provide coverage for a more extended period, but they usually come with slightly higher premiums compared to shorter terms. It’s essential to strike a balance between the coverage amount and term length to ensure adequate protection without straining your budget.

| Coverage Amount ($) | Term Length (Years) | Average Annual Premium ($) |

|---|---|---|

| 500,000 | 10 | 350 |

| 1,000,000 | 20 | 850 |

| 1,500,000 | 30 | 1,450 |

Lifestyle and Occupation Factors

Your lifestyle and occupation can also influence the cost of your term life insurance. Certain high-risk occupations, such as those in construction, aviation, or emergency services, may result in higher premiums due to the increased likelihood of accidents or health issues. Additionally, lifestyle choices like smoking or engaging in extreme sports can impact your insurance rates. Insurers often offer incentives for policyholders who adopt healthier lifestyles, so making positive changes can lead to more affordable coverage over time.

Shopping for Term Life Insurance

When shopping for term life insurance, it’s crucial to compare quotes from multiple insurers to find the best coverage at the most competitive rates. Online quote comparison tools can be a valuable resource, allowing you to quickly assess a range of options. However, it’s essential to carefully review the policy details and understand any exclusions or limitations before making a decision. Consulting with an insurance broker or financial advisor can also provide valuable guidance tailored to your specific needs and circumstances.

Group Life Insurance Plans

Group life insurance plans, often offered through employers, can be an affordable option for term life insurance. These plans typically provide coverage at a group rate, which is usually more cost-effective than individual policies. However, it’s important to note that group plans may have limitations on coverage amounts and may not offer the same flexibility as individual policies. Additionally, coverage under a group plan may terminate if you leave your employment, so it’s essential to understand the terms and conditions of such plans.

The Importance of Adequate Coverage

While the average cost of term life insurance is an essential consideration, it’s crucial to prioritize adequate coverage over purely seeking the lowest premium. Your life insurance policy should provide sufficient financial protection for your loved ones in the event of your untimely passing. This means taking into account factors such as your income, outstanding debts, and the future financial needs of your family. A financial advisor or insurance professional can help you determine the appropriate coverage amount to ensure your loved ones are well-protected.

Reviewing Your Coverage Regularly

Life circumstances can change over time, and it’s essential to review your life insurance coverage periodically to ensure it remains adequate and aligned with your needs. Major life events, such as marriage, the birth of a child, or purchasing a home, may signal the need for increased coverage. Regularly reviewing your policy can also help you identify opportunities to optimize your coverage and potentially reduce costs. For instance, if your health improves significantly or you adopt a healthier lifestyle, you may qualify for lower premiums or even a policy upgrade.

Conclusion

Term life insurance is a vital component of financial planning, offering peace of mind and protection for your loved ones. While the average cost of term life insurance varies based on several factors, understanding these influences can help you make informed decisions when selecting a policy. By considering your age, health status, coverage amount, and lifestyle, you can find a term life insurance policy that provides the protection you need at a cost that fits your budget. Remember, adequate coverage is paramount, and regular reviews of your policy can ensure your financial security remains robust.

What is the average monthly premium for a 500,000 term life insurance policy for a 35-year-old non-smoker in good health?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>The average monthly premium for a 500,000 term life insurance policy for a 35-year-old non-smoker in good health is typically around 30 to 35. However, this can vary depending on the insurer and other individual factors.

Are there any ways to reduce the cost of term life insurance?

+Yes, there are several strategies to potentially reduce the cost of term life insurance. Maintaining a healthy lifestyle, quitting smoking, and regularly reviewing your policy for any changes in your health or lifestyle can lead to lower premiums. Additionally, some insurers offer discounts for policies purchased online or for bundling multiple insurance products.

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, the coverage expires, and you will no longer have insurance protection. However, some insurers offer the option to convert your term policy into a permanent life insurance policy, which provides coverage for your entire life. It’s essential to understand the terms of your policy and any conversion options available to you.