Insurance Broker Auto

The insurance industry is a vast and complex network, offering a wide range of services and products to protect individuals and businesses alike. Among its various sectors, the role of an insurance broker in the automotive industry is particularly crucial. Insurance brokers act as intermediaries, connecting clients with the most suitable insurance policies for their vehicles. In this article, we delve into the world of insurance brokers in the automotive sector, exploring their significance, the services they provide, and the impact they have on the industry and its customers.

Understanding the Role of Insurance Brokers in the Automotive Sector

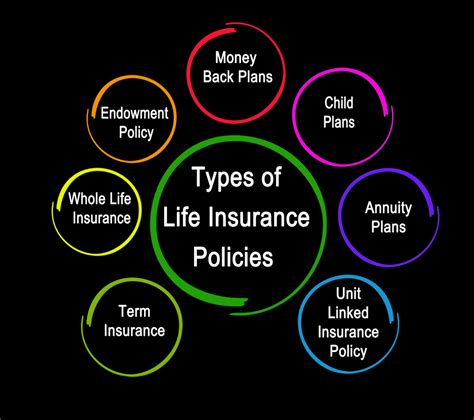

Insurance brokers are licensed professionals who work independently or for brokerages, offering impartial advice and guidance on insurance matters. In the context of the automotive industry, insurance brokers specialize in vehicle-related insurance policies, including car insurance, motorcycle insurance, commercial vehicle insurance, and more.

The primary role of an insurance broker is to act as a trusted advisor to their clients. They possess in-depth knowledge of the insurance market, understanding the intricate details of various policies and their benefits. This expertise allows them to match clients with the most appropriate insurance coverage, taking into account individual needs, budget constraints, and specific vehicle requirements.

Key Services Offered by Insurance Brokers

Insurance brokers provide a comprehensive range of services to ensure their clients receive the best possible insurance coverage. Here are some of the key services they offer:

- Policy Comparison: Brokers have access to a wide network of insurance providers, allowing them to compare various policies and their features. They can present clients with multiple options, ensuring a competitive and comprehensive insurance solution.

- Risk Assessment: Insurance brokers conduct thorough risk assessments to understand their clients’ specific needs. This involves evaluating factors such as driving history, vehicle type, usage, and location to determine the most suitable insurance coverage.

- Personalized Advice: Based on the risk assessment, brokers provide personalized advice tailored to each client. They consider individual circumstances and offer guidance on the most beneficial insurance policies, helping clients make informed decisions.

- Claims Support: In the event of an insurance claim, brokers assist their clients throughout the process. They help navigate the complex claims procedures, ensuring a smooth and efficient resolution. Brokers often act as a liaison between the client and the insurance company, advocating for their client’s best interests.

- Renewal Management: Insurance brokers actively manage policy renewals, ensuring clients receive the most up-to-date and cost-effective coverage. They review existing policies and negotiate with insurance providers to secure the best rates and terms.

- Add-On Services: Brokers often offer additional services, such as assistance with vehicle registration, license renewal, and even specialized insurance products like gap insurance or rental car coverage.

The Impact of Insurance Brokers on the Automotive Industry

The presence of insurance brokers in the automotive sector has had a significant impact on both industry dynamics and customer satisfaction.

Benefits for Insurance Companies

Insurance companies recognize the value of partnering with insurance brokers. Brokers bring a wealth of expertise and a deep understanding of the market, which helps insurance providers reach a wider audience and cater to diverse customer needs. Brokers can efficiently match potential clients with the right insurance products, resulting in higher customer satisfaction and retention.

Advantages for Customers

For customers, the benefits of working with insurance brokers are numerous. Brokers provide impartial advice, ensuring clients receive unbiased information and the best possible insurance coverage. They simplify the often-complex insurance landscape, making it easier for individuals and businesses to navigate the process of selecting and purchasing insurance policies. Additionally, brokers offer ongoing support, assisting with claims and policy renewals, which can be a significant relief for policyholders.

Enhanced Competition and Innovation

The presence of insurance brokers fosters a competitive environment within the automotive insurance sector. Brokers drive innovation by encouraging insurance companies to develop more specialized and tailored products to meet diverse customer demands. This competition ultimately benefits customers, as it leads to improved coverage options, enhanced customer service, and potentially lower insurance premiums.

Case Study: Insurance Broker Success in the Automotive Sector

To illustrate the impact of insurance brokers, let’s examine a case study of a successful brokerage firm specializing in automotive insurance.

Meet Automotive Insure Brokers, a leading brokerage firm with a reputation for excellence in the industry. With a team of experienced brokers, Automotive Insure Brokers has established strong relationships with numerous insurance providers, allowing them to offer a wide range of insurance products to their clients.

One of their key success factors is their commitment to personalized service. Brokers at Automotive Insure Brokers take the time to understand each client’s unique needs and provide tailored advice. They conduct comprehensive risk assessments, considering factors such as driving behavior, vehicle usage, and location to ensure clients receive the most suitable insurance coverage.

Furthermore, Automotive Insure Brokers offers an innovative online platform that streamlines the insurance process. Clients can easily compare policies, receive personalized quotes, and purchase insurance coverage directly through the platform. This digital approach not only enhances convenience but also allows clients to take control of their insurance decisions.

The success of Automotive Insure Brokers has had a ripple effect on the automotive insurance industry. Their commitment to customer satisfaction and innovation has encouraged other brokers and insurance providers to elevate their services, resulting in a more competitive and customer-centric market.

The Future of Insurance Brokers in the Automotive Sector

The role of insurance brokers in the automotive sector is expected to evolve further as the industry embraces technological advancements and changing consumer preferences.

Digital Transformation

Insurance brokers are increasingly adopting digital tools and platforms to enhance their services. Online comparison tools, digital document management systems, and secure online payment gateways are becoming standard features. This digital transformation not only improves efficiency but also caters to the growing preference for online services among consumers.

Specialization and Niche Markets

As the automotive industry diversifies, insurance brokers are likely to specialize further to cater to specific niche markets. For instance, brokers may focus on electric vehicle insurance, classic car insurance, or insurance for autonomous vehicles. By specializing, brokers can offer highly tailored insurance solutions to meet the unique needs of these niche markets.

Data-Driven Insights

The availability of vast amounts of data in the insurance industry presents an opportunity for brokers to leverage analytics and machine learning. By analyzing data patterns, brokers can identify trends, predict risks, and offer more accurate insurance coverage recommendations. This data-driven approach can enhance the accuracy and efficiency of the insurance process, benefiting both brokers and their clients.

Collaboration and Partnerships

Insurance brokers are expected to foster stronger partnerships with insurance providers, automotive manufacturers, and other industry stakeholders. These collaborations can lead to the development of innovative insurance products, improved customer experiences, and enhanced industry standards.

Conclusion

Insurance brokers play a vital role in the automotive sector, acting as trusted advisors and advocates for their clients. Their expertise, personalized services, and commitment to customer satisfaction make them invaluable assets in the insurance landscape. As the industry evolves, insurance brokers will continue to adapt, embracing digital transformation, specialization, and data-driven insights to provide the best possible insurance solutions to their clients.

How do insurance brokers ensure they provide the best insurance coverage for their clients?

+Insurance brokers employ several strategies to ensure they provide the best insurance coverage. They conduct thorough risk assessments, considering factors like driving history, vehicle type, and usage. Brokers also maintain a wide network of insurance providers, allowing them to compare policies and find the most suitable options. Additionally, they stay updated on industry trends and changes, ensuring they offer the most current and beneficial insurance products to their clients.

What are the benefits of working with an insurance broker instead of directly with an insurance company?

+Working with an insurance broker offers several advantages. Brokers provide impartial advice, ensuring you receive unbiased information. They simplify the insurance process, helping you navigate complex policies and find the best coverage. Brokers also offer ongoing support, assisting with claims and policy renewals. Additionally, brokers have access to a wider range of insurance providers, increasing the likelihood of finding the most suitable and cost-effective policy for your needs.

How do insurance brokers stay updated on the latest industry trends and regulations?

+Insurance brokers invest in continuous professional development to stay updated on industry trends and regulations. They attend industry conferences, workshops, and training sessions to enhance their knowledge. Additionally, they maintain close relationships with insurance providers, who often provide insights and updates on new products and changes in the market. Brokers also leverage digital resources and industry publications to stay informed about the latest developments.