Best Type Of Life Insurance Policy

In today's complex financial landscape, choosing the right life insurance policy is crucial to securing your family's future. With a myriad of options available, from term life to permanent policies, the decision can be daunting. This article aims to provide a comprehensive guide, breaking down the best life insurance policies to help you make an informed choice.

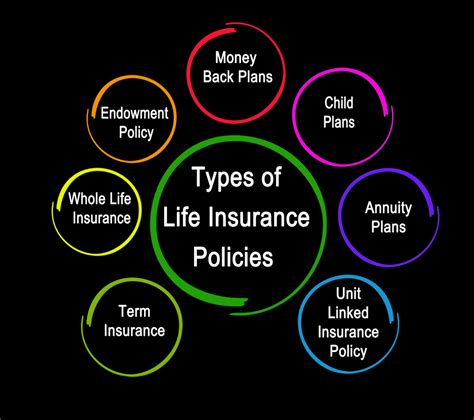

Understanding the Key Types of Life Insurance

Life insurance is an essential financial tool that provides a safety net for your loved ones in the event of your untimely demise. It offers peace of mind, ensuring that your family’s financial stability is maintained even after your passing. The market offers a range of life insurance policies, each designed to meet different needs and circumstances.

Term Life Insurance

Term life insurance is the most straightforward and affordable type of life insurance. It provides coverage for a specific period, typically ranging from 10 to 30 years. During this term, the policy pays out a lump sum to your beneficiaries in the event of your death. Term life is ideal for individuals seeking coverage for a defined period, such as until their children become independent or their mortgage is paid off.

One of the key advantages of term life insurance is its flexibility. You can choose the coverage amount and term that suits your needs. For instance, if you're a young professional starting a family, a 20-year term policy might be ideal to cover your children's education and other expenses until they're self-sufficient.

| Pros of Term Life Insurance | Cons of Term Life Insurance |

|---|---|

| Affordable premiums | Coverage ends after the term |

| Flexible term lengths | No cash value accumulation |

| Can be converted to permanent insurance | May require medical exams |

Permanent Life Insurance

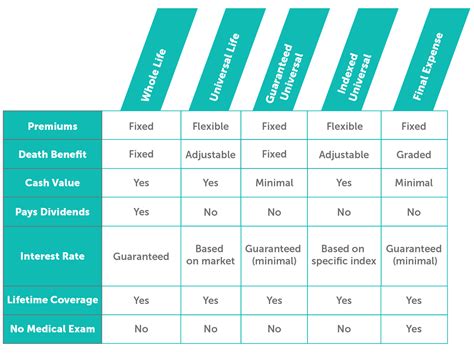

Permanent life insurance, as the name suggests, provides coverage for the entirety of your life, as long as you continue to pay the premiums. This type of policy offers more than just a death benefit; it also accumulates cash value over time, which can be borrowed against or withdrawn.

There are several types of permanent life insurance policies, including whole life, universal life, and variable life insurance. Whole life insurance offers a fixed premium and a guaranteed death benefit, while universal life insurance provides more flexibility in premium payments and death benefit amounts. Variable life insurance allows you to invest a portion of your premium in different investment options.

| Pros of Permanent Life Insurance | Cons of Permanent Life Insurance |

|---|---|

| Lifetime coverage | Higher premiums than term life |

| Cash value accumulation | Complex policies with many features |

| Tax-free death benefit | May require extensive medical underwriting |

Factors to Consider When Choosing a Life Insurance Policy

Selecting the best life insurance policy involves evaluating various factors to ensure it aligns with your specific needs and circumstances. Here are some key considerations:

Your Age and Health

Your age and health status play a significant role in determining the type of life insurance policy that’s best for you. If you’re young and in good health, you might opt for a term life policy with a longer term, knowing that you can convert it to a permanent policy if your needs change.

On the other hand, if you have pre-existing health conditions or are older, permanent life insurance might be a better option. It offers guaranteed acceptance and provides coverage for life, regardless of any health changes.

Your Financial Goals

Your financial goals and obligations are crucial in deciding the type and amount of life insurance coverage you need. For instance, if you have young children and a mortgage, a term life policy might be sufficient to cover these expenses until your children are grown and your mortgage is paid off.

However, if you have significant assets or a complex financial portfolio, permanent life insurance could be more suitable. It provides a tax-free death benefit and cash value accumulation, which can be used to cover estate taxes or pass on wealth to your heirs.

Your Budget

Your budget is a critical factor in choosing a life insurance policy. Term life insurance is generally more affordable, making it a popular choice for those on a tight budget. However, if you can afford the higher premiums of permanent life insurance, it offers long-term financial benefits and peace of mind.

The Best Life Insurance Policies: A Comprehensive Review

Now, let’s delve into a detailed analysis of the best life insurance policies available in the market, highlighting their key features and benefits.

Whole Life Insurance

Whole life insurance is a type of permanent life insurance that offers a fixed premium and a guaranteed death benefit. It’s ideal for individuals seeking long-term, stable coverage. The policy accumulates cash value over time, which can be borrowed against or withdrawn.

One of the key advantages of whole life insurance is its simplicity. The policy provides consistent coverage and premiums, making it easy to budget for. Additionally, the cash value accumulation can be used to supplement retirement income or cover unexpected expenses.

Universal Life Insurance

Universal life insurance is another type of permanent life insurance that offers more flexibility than whole life. It allows you to adjust your premium payments and death benefit amounts, providing a level of customization that caters to changing financial needs.

Universal life insurance policies also accumulate cash value, which can be used to pay premiums or increase the death benefit. This feature makes it an attractive option for those seeking both life insurance coverage and a potential source of retirement income.

Variable Life Insurance

Variable life insurance is a type of permanent life insurance that allows you to invest a portion of your premium in different investment options, such as stocks, bonds, and mutual funds. This feature provides the potential for higher returns, but it also comes with more risk.

Variable life insurance is ideal for individuals seeking a life insurance policy that also offers investment opportunities. However, it's important to note that the investment performance is not guaranteed, and there is a risk of losing money if the investments perform poorly.

Expert Insights and Recommendations

As a life insurance expert, I recommend considering your unique circumstances and financial goals when choosing a life insurance policy. Term life insurance is an excellent choice for those seeking affordable, temporary coverage. It provides peace of mind without breaking the bank.

For individuals with long-term financial goals or complex financial portfolios, permanent life insurance, particularly whole life or universal life, can be a more suitable option. These policies offer the added benefit of cash value accumulation, which can be a valuable asset in retirement planning or estate planning.

Remember, life insurance is a crucial component of your financial plan, and it's essential to review your policy regularly to ensure it aligns with your changing needs and circumstances. Working with a qualified financial advisor can help you make informed decisions and choose the best life insurance policy for your situation.

FAQs

Can I switch from term life insurance to permanent life insurance?

+Yes, many term life insurance policies allow you to convert to a permanent life insurance policy without undergoing a new medical exam. This conversion is often subject to specific conditions, such as being within a certain age range or having held the term policy for a minimum number of years. It’s best to review your term policy’s terms and conditions or consult with your insurance provider for more details.

What happens if I stop paying premiums for my permanent life insurance policy?

+If you stop paying premiums for your permanent life insurance policy, the policy will typically enter a grace period, which allows you a certain amount of time (usually 30 to 60 days) to make the missed payment. If you fail to pay during this grace period, the policy will lapse, and you’ll lose your coverage and any accumulated cash value.

How much life insurance coverage do I need?

+The amount of life insurance coverage you need depends on various factors, including your income, debts, and financial obligations. A general rule of thumb is to have enough coverage to replace your income for a certain period, typically 10 to 20 years. However, it’s best to consult with a financial advisor to determine the precise amount of coverage that’s right for your unique circumstances.