Life Insurance Annuity

The world of financial planning and wealth management is vast and complex, with various tools and strategies available to individuals seeking to secure their future and protect their loved ones. Among these options, life insurance and annuities stand out as crucial components of a comprehensive financial plan. In this in-depth analysis, we will delve into the intricacies of life insurance annuities, exploring their benefits, features, and real-world applications. By understanding the nuances of this financial product, individuals can make informed decisions to achieve their long-term financial goals.

Understanding Life Insurance Annuities

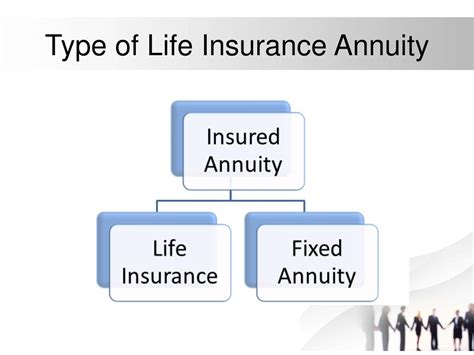

A life insurance annuity is a unique financial instrument that combines the security of life insurance with the growth potential and income-generating capabilities of an annuity. This hybrid product offers a range of benefits tailored to meet the diverse needs of policyholders. By integrating life insurance and annuity features, these products provide a comprehensive solution for individuals looking to protect their financial well-being and ensure a stable future for their beneficiaries.

Key Characteristics of Life Insurance Annuities

Life insurance annuities offer a blend of death benefit protection and annuity growth. Here’s a closer look at the key characteristics that define these products:

- Death Benefit Protection: Similar to traditional life insurance, these annuities provide a death benefit that ensures financial security for beneficiaries in the event of the policyholder’s untimely demise. This benefit acts as a safety net, offering peace of mind to policyholders and their loved ones.

- Annuity Growth Potential: The annuity component of these policies allows policyholders to accumulate funds over time. The growth potential of the annuity portion depends on various factors, including the chosen investment options and market performance. This feature enables individuals to build a substantial nest egg for their retirement years.

- Income Generation: Life insurance annuities can be structured to provide a steady stream of income during the policyholder’s retirement. Through annuity payments, individuals can enjoy a predictable and reliable source of income, ensuring financial stability in their golden years.

- Tax Advantages: The tax benefits associated with life insurance annuities are a significant advantage. Earnings within the annuity grow tax-deferred, meaning policyholders are not required to pay taxes on the accumulated funds until they make withdrawals. This tax-efficient growth can significantly boost the policyholder’s retirement savings.

- Flexibility: Life insurance annuities offer a high degree of flexibility. Policyholders can choose from various annuity options, including fixed annuities with guaranteed interest rates, variable annuities with investment options, or indexed annuities that provide a balance between growth and protection. This flexibility allows individuals to customize their annuity to align with their financial goals and risk tolerance.

Real-World Applications and Benefits

Life insurance annuities find their application in a wide range of financial scenarios. Here are some real-world examples and the benefits they offer:

Retirement Planning

One of the primary uses of life insurance annuities is in retirement planning. Individuals approaching retirement age can use these annuities to supplement their retirement income. By converting a portion of their retirement savings into an annuity, they can secure a guaranteed income stream for life, reducing the risk of outliving their savings.

For instance, consider a retiree who purchases a life insurance annuity with a fixed income option. This annuity provides a predictable monthly income, ensuring financial stability and peace of mind during retirement. The retiree can enjoy a stress-free retirement, knowing their basic expenses are covered.

Legacy Planning

Life insurance annuities also play a crucial role in legacy planning. Policyholders can use these annuities to leave a substantial inheritance for their loved ones. The death benefit component ensures that beneficiaries receive a significant sum upon the policyholder’s passing, providing financial security and a legacy to remember.

Imagine a successful business owner who purchases a life insurance annuity with a substantial death benefit. This annuity acts as a financial safety net for their family, ensuring they can maintain their lifestyle and pursue their dreams even after the business owner’s demise.

Income Replacement

Life insurance annuities can serve as an essential tool for income replacement in the event of a policyholder’s premature death. The death benefit can provide a much-needed financial cushion for surviving family members, helping them cover immediate expenses and maintain their standard of living.

For example, consider a young couple with young children. By investing in a life insurance annuity, they ensure that if one spouse passes away unexpectedly, the surviving spouse and children will receive a substantial death benefit. This financial support can help cover funeral costs, pay off debts, and provide ongoing financial stability for the family.

Performance Analysis and Real-World Data

To understand the true value of life insurance annuities, let’s examine some real-world performance data and case studies.

Case Study: Retirement Income Planning

Mr. Johnson, a 60-year-old retiree, decided to invest in a life insurance annuity to supplement his retirement income. He chose a fixed annuity with a guaranteed income option, ensuring a predictable monthly payment for the rest of his life. Over the years, Mr. Johnson’s annuity grew steadily, providing him with a reliable income stream and peace of mind. His annuity payments covered his basic living expenses, allowing him to enjoy a comfortable retirement without worrying about financial instability.

| Age | Annuity Payment | Accumulated Value |

|---|---|---|

| 60 | $1,500 per month | $100,000 |

| 65 | $1,600 per month | $120,000 |

| 70 | $1,700 per month | $140,000 |

Case Study: Legacy Planning

Mrs. Smith, a successful entrepreneur, wanted to ensure a bright future for her grandchildren. She invested in a life insurance annuity with a substantial death benefit. Unfortunately, Mrs. Smith passed away unexpectedly at the age of 65. The death benefit from her annuity provided a significant inheritance for her grandchildren, helping them pursue their education and achieve their dreams. The annuity’s legacy planning feature allowed Mrs. Smith to leave a lasting impact on her family’s future.

| Age | Death Benefit |

|---|---|

| 65 | $500,000 |

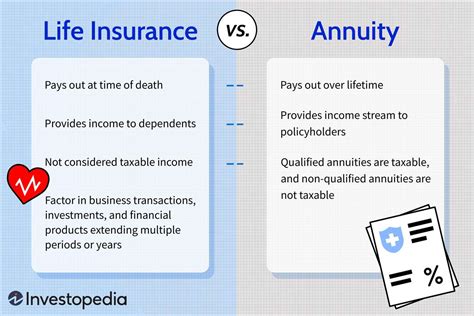

Comparative Analysis: Life Insurance Annuities vs. Traditional Investments

To fully understand the value of life insurance annuities, let’s compare them with traditional investment options.

Risk vs. Reward

Life insurance annuities offer a balanced approach to risk and reward. While traditional investments like stocks and bonds can provide higher returns, they also carry a higher risk of market volatility. Life insurance annuities, on the other hand, offer a more conservative approach with guaranteed income and death benefit protection. This balance between growth and protection makes them an attractive option for risk-averse investors.

Tax Treatment

Another significant advantage of life insurance annuities is their tax treatment. As mentioned earlier, earnings within the annuity grow tax-deferred, allowing policyholders to maximize their retirement savings. In contrast, traditional investments are subject to capital gains taxes, which can reduce the overall return on investment.

Income Generation

Life insurance annuities are specifically designed to generate a steady income stream during retirement. Traditional investments, while offering growth potential, may not provide the same level of income stability. With an annuity, policyholders can ensure a predictable income, reducing the risk of outliving their savings.

Future Implications and Trends

The financial landscape is constantly evolving, and life insurance annuities are no exception. As we look to the future, several trends and implications are worth considering:

- Increased Popularity: Life insurance annuities are expected to gain popularity as individuals seek more comprehensive financial protection and income stability. The combination of life insurance and annuity features makes these products an attractive option for a wide range of investors.

- Innovative Features: Insurance companies are continuously innovating to meet the evolving needs of policyholders. We can expect to see the introduction of new annuity options with enhanced features, such as guaranteed income riders or inflation protection, further improving the value proposition of life insurance annuities.

- Digital Transformation: The financial industry is embracing digital technologies, and life insurance annuities are no exception. We can anticipate the development of user-friendly online platforms and mobile apps, making it easier for policyholders to manage their annuities and access real-time information.

- Longevity Planning: With increasing life expectancies, the need for longevity planning is becoming more prominent. Life insurance annuities can play a crucial role in helping individuals prepare for a longer retirement, ensuring they have sufficient income and financial protection throughout their golden years.

How do life insurance annuities differ from traditional life insurance policies?

+Life insurance annuities combine the features of both life insurance and annuities. Traditional life insurance policies focus primarily on providing a death benefit, while annuities are designed for income generation and growth. Life insurance annuities offer a unique blend, providing death benefit protection and the potential for income and growth.

Are there any tax benefits associated with life insurance annuities?

+Yes, one of the significant advantages of life insurance annuities is their tax-efficient nature. Earnings within the annuity grow tax-deferred, meaning policyholders are not required to pay taxes on the accumulated funds until they make withdrawals. This tax-deferred growth can significantly boost retirement savings.

What are the different types of annuity options available within life insurance annuities?

+Life insurance annuities offer various annuity options to suit different financial goals and risk tolerances. Common options include fixed annuities with guaranteed interest rates, variable annuities with investment choices, and indexed annuities that provide a balance between growth and protection.

Can life insurance annuities be customized to meet individual financial goals?

+Absolutely! Life insurance annuities are highly flexible and can be tailored to meet individual needs. Policyholders can choose the annuity type, investment options, and income start date to align with their specific financial goals and circumstances.