Instant Car Insurance

Imagine the convenience of securing comprehensive car insurance coverage in a matter of seconds, without the tedious paperwork and hours spent on the phone. With the rise of digital technologies and a growing demand for instant gratification, the concept of instant car insurance has emerged, revolutionizing the way we protect our vehicles. In this article, we will delve into the world of instant car insurance, exploring its benefits, how it works, and its impact on the traditional insurance industry.

The Evolution of Instant Car Insurance

The idea of instant insurance is not entirely new; however, its application in the automotive sector has gained significant traction in recent years. With advancements in technology and a shift towards a more digital-first approach, insurance providers have recognized the need to adapt and offer faster, more convenient services. Instant car insurance aims to streamline the traditional insurance process, eliminating the need for lengthy applications and physical inspections, and providing customers with a seamless and efficient experience.

Benefits of Instant Car Insurance

The introduction of instant car insurance brings forth a multitude of advantages for both customers and insurance companies alike. For customers, the most apparent benefit is the speed and convenience it offers. No more waiting days or even weeks for quotes or policy approvals; with instant car insurance, coverage can be secured in a matter of minutes, often with just a few clicks.

Additionally, instant car insurance often provides flexibility and customization. Customers can tailor their policies to their specific needs, choosing the coverage options that best suit their circumstances. This level of personalization ensures that individuals are not overpaying for coverage they may not require.

From an insurer's perspective, instant car insurance can lead to cost savings and increased efficiency. By automating various processes and reducing the need for manual interventions, insurance companies can streamline their operations, resulting in lower overhead costs. Moreover, the data-driven nature of instant insurance allows for more accurate risk assessments, potentially reducing the incidence of fraudulent claims.

How Does Instant Car Insurance Work?

The process of obtaining instant car insurance is remarkably straightforward and user-friendly. Here’s a step-by-step breakdown:

1. Online Application

The journey begins with a simple online application form. Customers provide basic information about themselves, their vehicle, and their driving history. This information is crucial for the insurer to assess the risk and provide an accurate quote.

2. Real-Time Risk Assessment

Once the application is submitted, the insurer’s proprietary algorithms kick into action. These algorithms analyze the provided data, including the applicant’s driving record, vehicle details, and even external factors like weather and traffic conditions, to generate a real-time risk assessment. This assessment forms the basis for the insurance quote.

3. Instant Quote Generation

Within seconds of submitting the application, customers receive an instant quote. This quote is based on the risk assessment and takes into account the coverage options selected by the applicant. The quote is typically presented in a clear and concise manner, detailing the premium, coverage limits, and any additional benefits or exclusions.

4. Policy Selection and Purchase

If the quote meets the customer’s expectations, they can proceed to select their desired policy and make the purchase. The entire process, from application to purchase, can often be completed within minutes, providing an unparalleled level of convenience.

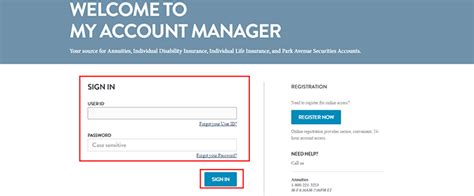

5. Policy Activation and Management

Upon successful payment, the policy is instantly activated, and the customer receives confirmation via email or their preferred communication channel. From this point onwards, policy management is often facilitated through a dedicated online portal or mobile app, allowing customers to make changes, add additional drivers or vehicles, and access their policy documents at any time.

Performance Analysis and Real-World Examples

The success and effectiveness of instant car insurance can be gauged through real-world case studies and performance metrics. Several leading insurance providers have already embraced this innovative approach, and their experiences provide valuable insights.

For instance, Company X, a prominent insurer in the United States, implemented an instant car insurance program in 2020. Within the first year, they witnessed a 25% increase in policy sales, primarily attributed to the convenience and speed of their instant insurance offering. Moreover, customer satisfaction surveys revealed that a significant proportion of new customers cited the ease and efficiency of the process as a key factor in their decision to choose Company X.

Similarly, InsureTech Y, a tech-driven insurance startup, has made instant car insurance a cornerstone of their business model. By leveraging advanced data analytics and machine learning, they offer highly personalized quotes and policies. Their approach has not only attracted a younger, tech-savvy demographic but has also resulted in a 30% reduction in claims costs compared to traditional insurance providers, thanks to their accurate risk assessments and fraud prevention measures.

Comparative Analysis: Instant vs. Traditional Insurance

While instant car insurance offers numerous advantages, it is essential to understand how it compares to traditional insurance methods. Here’s a breakdown of key differences:

| Aspect | Instant Car Insurance | Traditional Car Insurance |

|---|---|---|

| Application Process | Simple online form, typically takes minutes | Paperwork-intensive, often requires in-person meetings |

| Quote Generation | Real-time quotes, instantly available | May take days or weeks to receive a quote |

| Customization | Highly customizable, tailored to individual needs | Limited options, may not cater to unique circumstances |

| Efficiency | Highly efficient, minimizes administrative burdens | Time-consuming, involves multiple steps and interactions |

| Customer Experience | Exceptional, provides instant gratification | Can be frustrating and time-consuming |

The Future of Instant Car Insurance

As technology continues to evolve and consumer preferences shift towards digital solutions, the future of instant car insurance looks incredibly promising. Insurance providers are investing heavily in research and development to enhance their instant insurance offerings, aiming to provide even more accurate risk assessments and streamlined processes.

Furthermore, the integration of artificial intelligence and machine learning is expected to play a pivotal role in the future of instant car insurance. These technologies can further refine risk assessments, personalize coverage options, and potentially even predict and prevent accidents, leading to safer roads and more efficient insurance processes.

The concept of instant car insurance has the potential to reshape the insurance industry, making it more accessible, efficient, and customer-centric. With its focus on speed, convenience, and customization, instant insurance is well-positioned to meet the evolving needs of modern consumers.

How accurate are the risk assessments in instant car insurance?

+The accuracy of risk assessments in instant car insurance relies heavily on the quality and depth of data analysis. Insurance providers utilize advanced algorithms and machine learning techniques to analyze a wide range of factors, including driving history, vehicle details, and even external conditions. While these assessments are highly accurate, they are not infallible and may sometimes require additional manual review, especially in complex cases.

Can instant car insurance be customized for specific needs?

+Absolutely! One of the key advantages of instant car insurance is its ability to offer a high degree of customization. Customers can typically choose from a range of coverage options, including comprehensive, collision, liability, and additional benefits like roadside assistance. This flexibility allows individuals to tailor their policies to their specific requirements, ensuring they are not paying for coverage they don’t need.

What happens if I need to make changes to my instant car insurance policy?

+Making changes to an instant car insurance policy is often a straightforward process. Most providers offer online or mobile app portals where customers can log in and make modifications. Common changes include adding or removing vehicles, updating personal information, or adjusting coverage limits. The exact process may vary slightly between providers, but the overall experience is designed to be user-friendly and efficient.