Nomads Travel Insurance

In today's dynamic world, travel has become more accessible and appealing than ever before. As a result, a new breed of travelers has emerged—the nomads. These individuals, often digital nomads or long-term travelers, embark on journeys that extend beyond traditional vacations. Their travels are not just about sightseeing but also about working remotely, exploring new cultures, and seeking unique experiences. With this shift in travel trends, the need for specialized insurance plans tailored to the unique needs of nomads has become increasingly apparent.

This article aims to delve into the world of Nomads Travel Insurance, exploring its features, benefits, and the unique protection it offers to modern-day travelers. We will uncover the intricacies of this insurance type, highlighting how it differs from traditional travel insurance and why it is essential for those embarking on extended journeys.

In an era where travel is no longer just a vacation but a lifestyle, understanding the importance of comprehensive insurance is crucial. Let's embark on this journey together and discover how Nomads Travel Insurance can provide peace of mind and support for travelers on their unique paths.

Understanding Nomads Travel Insurance: A Comprehensive Guide

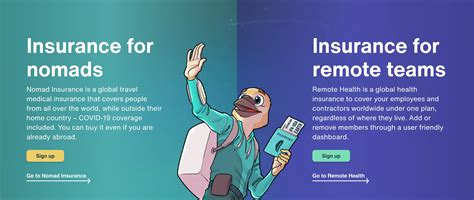

Nomads Travel Insurance is a specialized insurance plan designed to cater to the unique needs and lifestyles of modern travelers, particularly those who embrace the nomadic lifestyle. This insurance goes beyond the scope of traditional travel insurance, offering a comprehensive range of benefits and coverage tailored to the specific challenges and adventures nomads face on their journeys.

Who Are the Nomads and Why Do They Need Specialized Insurance?

Nomads, in the context of travel, refer to individuals who travel extensively, often for extended periods, combining work and exploration. This group includes digital nomads, remote workers, long-term travelers, and those who embrace a lifestyle of constant movement and exploration. Unlike traditional tourists, nomads often work remotely, change locations frequently, and may face unique challenges related to their nomadic lifestyles.

Nomads need specialized insurance because their travels are not just leisure trips. They often involve working remotely, which can expose them to risks like data breaches, equipment damage, or health issues far from home. Additionally, the frequent movement and extended stays in different countries present unique legal and medical challenges. Nomads Travel Insurance is designed to address these specific concerns, providing coverage for work-related accidents, equipment loss, and unexpected medical emergencies, among other benefits.

Key Features of Nomads Travel Insurance

- Extended Coverage Periods: Unlike standard travel insurance plans that typically cover trips lasting a few weeks, Nomads Travel Insurance offers coverage for extended periods, often up to 12 months or more. This is ideal for digital nomads and long-term travelers who plan to stay abroad for an entire year or more.

- Worldwide Coverage: This insurance plan provides comprehensive coverage valid worldwide. Whether a nomad is working remotely in a café in Berlin, exploring the rainforests of Costa Rica, or volunteering in a remote village in Asia, they are covered for any unforeseen incidents.

- Medical Emergency Evacuation: In the event of a serious illness or injury, Nomads Travel Insurance includes medical emergency evacuation coverage. This means that if a nomad requires specialized medical treatment that is not available locally, they can be transported to a medical facility that can provide the necessary care.

- Lost or Damaged Equipment: Nomads often carry valuable equipment like laptops, cameras, and other gadgets. Nomads Travel Insurance includes coverage for the loss or damage of these items, providing financial protection for the nomad's essential tools.

- Work-Related Accidents: Given that nomads often work remotely, this insurance plan covers work-related accidents. For instance, if a nomad slips and falls while on a work call, the insurance can cover the resulting medical expenses and even provide compensation for any workdays missed due to the accident.

- Legal Assistance: Traveling to different countries can sometimes involve legal complications, especially for those staying for extended periods. Nomads Travel Insurance includes legal assistance, providing guidance and support in case of any legal issues that may arise during the nomad's journey.

- Travel Delay and Cancellation: Unforeseen circumstances can lead to travel delays or cancellations. Nomads Travel Insurance covers such incidents, reimbursing the nomad for any non-refundable expenses incurred due to delays or cancellations.

- Liability Coverage: This insurance plan includes liability coverage, which protects the nomad if they are found legally responsible for causing bodily injury or property damage to a third party during their travels.

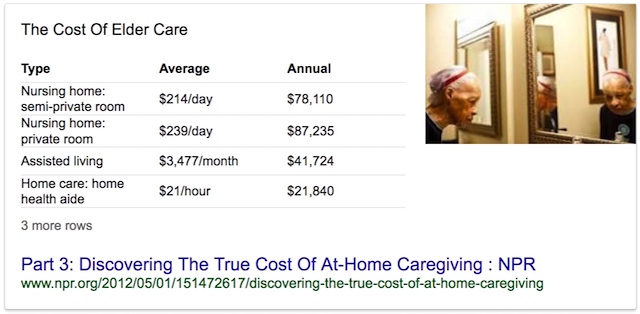

Comparative Analysis: Nomads Travel Insurance vs. Traditional Travel Insurance

While traditional travel insurance plans offer essential coverage for short-term trips, they often fall short when it comes to the unique needs of nomads. Let's explore how Nomads Travel Insurance differs from and surpasses traditional travel insurance:

| Aspect | Nomads Travel Insurance | Traditional Travel Insurance |

|---|---|---|

| Coverage Period | Extended coverage for up to 12 months or more | Typically covers short trips of a few weeks |

| Medical Coverage | Comprehensive medical coverage including emergency evacuation | Basic medical coverage, often with limited benefits |

| Equipment Protection | Coverage for lost or damaged work equipment | May not cover equipment loss or damage |

| Work-Related Accidents | Covers accidents during remote work | Does not typically cover work-related incidents |

| Legal Assistance | Provides legal support for issues arising during travel | May not offer legal assistance |

| Travel Delays/Cancellations | Reimburses for non-refundable expenses due to delays/cancellations | Limited coverage for delays/cancellations |

| Liability Coverage | Protects against legal liability for bodily injury/property damage | May have limited or no liability coverage |

As the table illustrates, Nomads Travel Insurance is specifically designed to address the unique challenges faced by modern travelers. It offers a more comprehensive and tailored approach to insurance, ensuring that nomads can explore the world with confidence and peace of mind.

Real-Life Examples: How Nomads Travel Insurance Provides Peace of Mind

Let's delve into a few real-life scenarios to illustrate how Nomads Travel Insurance can be a game-changer for digital nomads and long-term travelers:

-

Medical Emergency: Imagine a digital nomad working remotely from a co-working space in Bangkok. Suddenly, they experience severe abdominal pain and are rushed to the hospital. In this scenario, Nomads Travel Insurance would cover the medical expenses, provide emergency evacuation if needed, and offer support throughout the medical process.

-

Lost Laptop: A nomad traveling through Europe has their laptop, containing critical work files, stolen while sightseeing. Nomads Travel Insurance would compensate for the lost laptop, helping the nomad replace their essential work tool and continue their remote work without interruption.

-

Legal Support: A long-term traveler in South America is involved in a car accident. They require legal assistance to navigate the local legal system and ensure their rights are protected. Nomads Travel Insurance provides the necessary legal support, guiding the traveler through the legal process and covering any associated costs.

-

Travel Cancellation: A nomad plans a year-long journey, but due to a family emergency, they need to cancel their trip. Nomads Travel Insurance would reimburse the nomad for any non-refundable expenses, such as prepaid accommodations and tours, ensuring they don't incur significant financial losses.

These scenarios highlight the real-world impact of Nomads Travel Insurance, demonstrating how it can provide crucial support and protection during unexpected situations. By offering a comprehensive suite of benefits, this insurance plan empowers nomads to pursue their travel dreams with confidence, knowing they are covered for a wide range of potential challenges.

The Future of Travel Insurance: Embracing the Nomadic Lifestyle

As the world continues to embrace the nomadic lifestyle, the demand for specialized insurance plans like Nomads Travel Insurance is expected to grow. This type of insurance reflects a changing travel landscape, where individuals are no longer content with traditional vacations but seek extended, immersive experiences. By offering tailored coverage for work-related incidents, medical emergencies, and equipment protection, Nomads Travel Insurance is at the forefront of this evolving travel trend.

Furthermore, with advancements in technology and the increasing accessibility of remote work, the nomadic lifestyle is becoming more viable and appealing. This shift is likely to drive the need for innovative insurance solutions that cater to the unique needs of modern travelers. As such, Nomads Travel Insurance is not just a response to current trends but a forward-thinking approach to insurance, anticipating the needs of a new generation of travelers.

In conclusion, Nomads Travel Insurance is a vital tool for digital nomads, remote workers, and long-term travelers, offering a comprehensive safety net for their unique journeys. By understanding the specific challenges and adventures these travelers embark on, this insurance plan provides a level of protection and support that traditional travel insurance cannot match. As the world continues to embrace the nomadic lifestyle, Nomads Travel Insurance stands as a testament to the evolving nature of travel and the insurance industry's commitment to meeting the needs of modern explorers.

FAQ

Can I customize my Nomads Travel Insurance plan to suit my specific needs?

+

Absolutely! Nomads Travel Insurance is designed to be flexible and customizable. You can tailor your plan to include additional coverage for specific activities, such as adventure sports or photography equipment. This ensures that your insurance plan aligns perfectly with your unique travel needs and lifestyle.

What happens if I need to extend my trip beyond the initial coverage period?

+

Extending your trip is easy with Nomads Travel Insurance. Simply contact your insurance provider and request an extension. The provider will guide you through the process and ensure your coverage remains in place for the additional period.

Does Nomads Travel Insurance cover pre-existing medical conditions?

+

Yes, Nomads Travel Insurance offers coverage for pre-existing medical conditions. However, it’s important to disclose all pre-existing conditions when applying for insurance. Some conditions may require additional underwriting, but rest assured, we aim to provide coverage for as many conditions as possible.

How quickly can I expect a response from the insurance provider in case of an emergency?

+

In the event of an emergency, our dedicated emergency assistance team is available 24⁄7. You can expect a prompt response and support within minutes. Our goal is to provide timely assistance so you can focus on resolving the issue at hand.

Are there any restrictions on the countries I can visit with Nomads Travel Insurance?

+

Nomads Travel Insurance is designed for worldwide coverage. However, there may be certain countries or regions with specific exclusions or limitations due to political instability or high-risk activities. It’s essential to review the policy’s fine print or consult with our team to understand any potential restrictions.