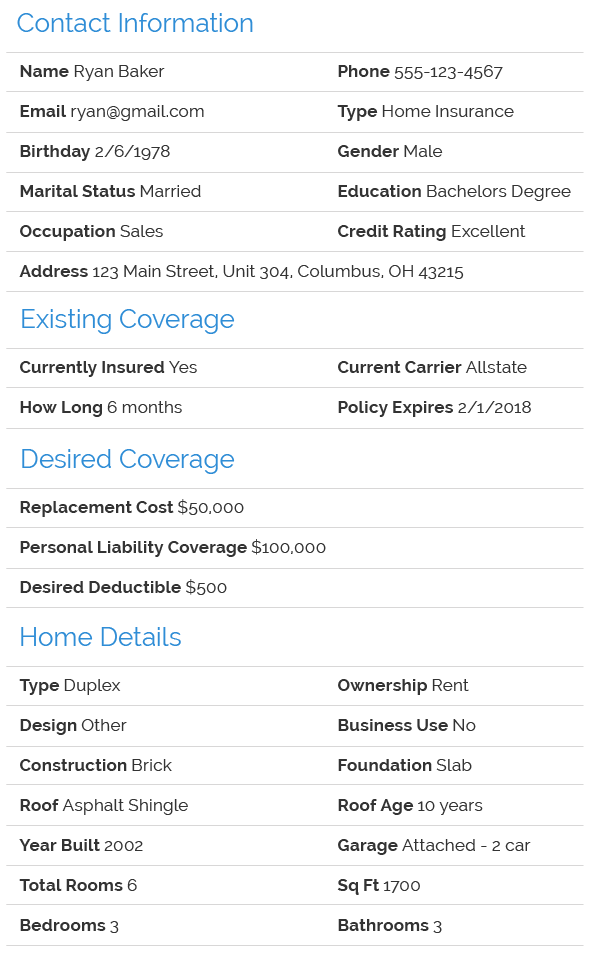

Compare The Health Insurance

Understanding Health Insurance: A Comprehensive Guide to Choosing the Right Coverage

In the complex world of healthcare, navigating the maze of health insurance options can be a daunting task. With various plans, providers, and coverage details to consider, making an informed decision is crucial. This comprehensive guide aims to demystify the process, empowering individuals to select the health insurance plan that best suits their needs and circumstances.

Health Insurance 101: The Basics

Health insurance is a contract between an individual and an insurance provider, where the insurer agrees to cover a portion of the policyholder's medical expenses in exchange for regular premium payments. These expenses can include doctor visits, hospital stays, prescription medications, and other healthcare services. The specific coverage and costs vary widely depending on the plan and the insurance company.

There are several key terms to understand when discussing health insurance:

- Premium: This is the amount paid regularly (usually monthly) to maintain insurance coverage.

- Deductible: The deductible is the amount the policyholder must pay out-of-pocket before the insurance coverage kicks in.

- Copayment (Copay): A fixed amount paid by the policyholder for a covered medical service, usually at the time of service.

- Coinsurance: This is the percentage of costs the policyholder pays after the deductible is met, often shared with the insurance company.

- Out-of-Pocket Maximum: The maximum amount the policyholder will pay in a year for covered services, excluding premiums.

- Network: A group of healthcare providers, such as doctors and hospitals, that have a contract with the insurance company to provide services at agreed-upon rates. Using in-network providers typically results in lower costs.

Types of Health Insurance Plans

Health insurance plans come in various formats, each with its own set of advantages and drawbacks. Understanding these plan types is essential for making an informed choice.

Health Maintenance Organization (HMO)

HMOs are known for their comprehensive coverage and emphasis on preventive care. Policyholders must select a primary care physician (PCP) from the HMO's network, who coordinates all medical care and refers patients to specialists as needed. HMOs typically have lower premiums and out-of-pocket costs but may limit coverage to in-network providers.

Preferred Provider Organization (PPO)

PPOs offer more flexibility than HMOs, allowing policyholders to choose any healthcare provider, in or out of the network. While out-of-network care may be more expensive, PPOs provide coverage for a wider range of services. PPOs often have higher premiums but may be more suitable for individuals who prefer the freedom to choose their healthcare providers.

Exclusive Provider Organization (EPO)

EPOs are similar to PPOs but with one key difference: they do not cover out-of-network care, except in emergencies. Like PPOs, EPOs allow policyholders to choose any provider within the network, but they typically have lower premiums and out-of-pocket costs compared to PPOs.

Point of Service (POS) Plans

POS plans combine elements of both HMO and PPO plans. Policyholders must choose a primary care physician from the plan's network, but they have the option to seek care outside the network, although at a higher cost. POS plans offer a balance between the structure of HMOs and the flexibility of PPOs.

High Deductible Health Plans (HDHP)

HDHPs are known for their high deductibles, often paired with lower premiums. These plans are often combined with Health Savings Accounts (HSAs), allowing policyholders to save pre-tax dollars for medical expenses. HDHPs are suitable for individuals who are generally healthy and don't anticipate frequent medical care, as they can save on premiums but may face higher out-of-pocket costs when healthcare needs arise.

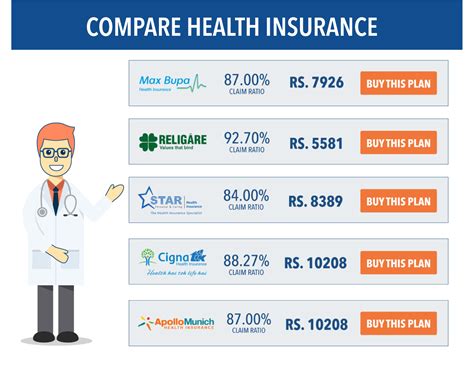

Evaluating Health Insurance Plans: A Comprehensive Approach

When comparing health insurance plans, it's crucial to look beyond just the premiums and deductibles. Here are some key factors to consider:

Network of Providers

Check if your preferred doctors, specialists, and hospitals are included in the plan's network. If you have specific healthcare needs or a preferred healthcare team, ensuring their inclusion in the network is essential.

Covered Services and Exclusions

Review the plan's benefits summary carefully. Understand what services are covered, including routine check-ups, specialist visits, prescription medications, and any specific treatments or procedures you may require. Also, be aware of any exclusions or limitations that could impact your healthcare needs.

Out-of-Pocket Costs

Consider not just the deductible but also copays, coinsurance, and any maximum out-of-pocket limits. Calculate the potential out-of-pocket costs for your anticipated healthcare needs to ensure the plan is affordable and aligns with your budget.

Prescription Drug Coverage

If you take prescription medications regularly, ensure that the plan covers your specific drugs. Some plans have different tiers for prescription drugs, with varying copays or coinsurance rates. Choose a plan that offers the best coverage for your medication needs.

Specialty Care and Chronic Condition Management

If you have a chronic condition or require specialty care, ensure that the plan covers these services adequately. Some plans may have separate networks or specific requirements for accessing specialty care, so carefully review the details.

Maternity and Pediatric Care

If you are planning a family or have children, ensure that the plan covers maternity care, pediatric visits, and any necessary vaccines or treatments for your little ones. Some plans may have additional costs or limitations for these services, so thorough research is essential.

Mental Health and Substance Abuse Coverage

Mental health and substance abuse treatment are crucial aspects of healthcare. Ensure that the plan covers these services adequately, including any required therapy sessions, psychiatric care, or rehabilitation programs. Some plans may have separate networks or additional costs for these services.

Wellness Programs and Preventive Care

Many insurance plans now offer incentives and discounts for participating in wellness programs, such as gym memberships or smoking cessation programs. Additionally, preventive care services like annual check-ups, cancer screenings, and vaccinations are often covered at no cost to the policyholder. Look for plans that encourage and support your overall well-being.

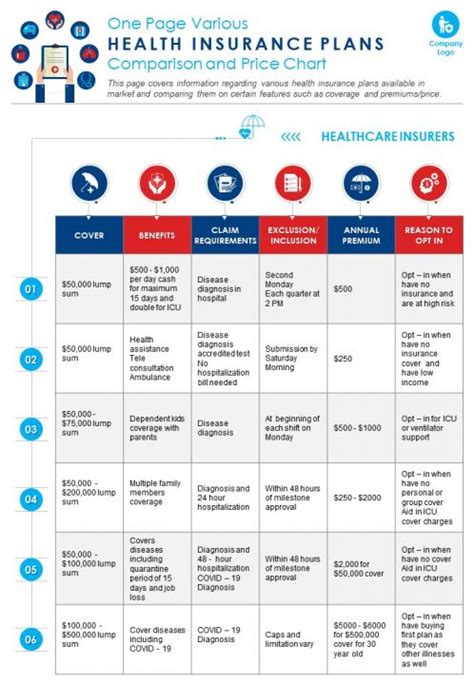

Personalizing Your Health Insurance Decision

The right health insurance plan for you depends on your unique circumstances and healthcare needs. Here are some tips to personalize your decision-making process:

Assess Your Healthcare Needs

Evaluate your current and anticipated healthcare needs. Consider your age, lifestyle, existing health conditions, and any potential future needs. Are you generally healthy and only require routine check-ups, or do you have ongoing medical conditions that require frequent specialist visits and treatments? Understanding your needs will help you choose a plan that provides adequate coverage.

Consider Your Budget

Health insurance premiums can vary significantly, and it's important to choose a plan that fits within your financial means. While it's tempting to opt for the lowest premium, remember to consider the potential out-of-pocket costs, especially if you anticipate needing extensive medical care. Balancing premiums and out-of-pocket expenses is crucial for maintaining financial stability.

Evaluate Plan Flexibility

Think about your preference for flexibility in choosing healthcare providers. If you value the freedom to choose any doctor or specialist, regardless of network restrictions, a PPO or EPO plan might be more suitable. On the other hand, if you prefer a more structured approach with a primary care physician coordinating your care, an HMO plan could be a better fit.

Research Provider Networks

Ensure that your preferred healthcare providers are included in the plan's network. If you have a trusted doctor or specialist, verify their participation in the plan to avoid unexpected out-of-network costs. Some plans may have different networks for different types of care, so thorough research is essential.

Understand Plan Limitations

Carefully review the plan's benefits summary and any exclusions or limitations. Some plans may have restrictions on certain procedures, treatments, or medications. Understanding these limitations upfront can help you avoid unexpected denials or additional costs.

Seek Professional Guidance

If you're feeling overwhelmed by the choices or have specific healthcare needs, consider consulting with an insurance broker or a healthcare professional. They can provide personalized advice based on your circumstances and help you navigate the complex world of health insurance.

The Future of Health Insurance: Trends and Innovations

The healthcare industry is constantly evolving, and so is the world of health insurance. Here are some trends and innovations that are shaping the future of health insurance coverage:

Telehealth and Virtual Care

The COVID-19 pandemic accelerated the adoption of telehealth services, and this trend is here to stay. Many insurance plans now cover virtual doctor visits, mental health counseling, and even certain medical procedures performed remotely. Telehealth offers convenience, accessibility, and cost savings, making it an increasingly popular option for policyholders.

Value-Based Care and Incentivized Wellness Programs

Insurance providers are increasingly shifting towards value-based care models, where they reward healthcare providers for delivering high-quality, cost-effective care. This approach aims to improve patient outcomes and reduce unnecessary healthcare costs. Additionally, many plans offer incentives for policyholders to engage in wellness programs, such as fitness challenges or smoking cessation initiatives, promoting healthier lifestyles.

Digital Health and Wearable Technology

Digital health solutions and wearable technology are transforming the way healthcare is delivered and monitored. Insurance companies are integrating these tools into their plans, offering discounts or incentives for policyholders who use fitness trackers, health apps, or other digital health devices to manage their well-being. This integration of technology into healthcare is expected to continue growing.

Personalized Medicine and Genetic Testing

Advancements in genetic testing and personalized medicine are allowing healthcare providers to tailor treatments to an individual's unique genetic makeup. Some insurance plans are beginning to cover these services, recognizing the potential for improved patient outcomes and more efficient healthcare delivery. As personalized medicine evolves, insurance coverage is likely to adapt accordingly.

Global Healthcare Trends

The global healthcare landscape is also influencing the future of health insurance. International healthcare models and best practices are being adopted and adapted by insurance providers, leading to more efficient and patient-centric care. Additionally, the increasing focus on global health initiatives and cross-border healthcare collaborations is shaping the way insurance plans are designed and implemented.

FAQ

What is the difference between an HMO and a PPO plan?

+An HMO plan typically has lower premiums and out-of-pocket costs but requires policyholders to choose a primary care physician and limits coverage to in-network providers. On the other hand, a PPO plan offers more flexibility, allowing policyholders to choose any healthcare provider, in or out of the network, but may have higher premiums and out-of-pocket costs.

How do I know if a plan covers my specific healthcare needs?

+Carefully review the plan’s benefits summary, paying close attention to covered services, exclusions, and any limitations. Additionally, check if your preferred healthcare providers are included in the plan’s network. If you have specific healthcare needs, consider consulting with an insurance broker or healthcare professional for personalized advice.

What are some common exclusions or limitations in health insurance plans?

+Common exclusions and limitations may include certain types of elective procedures, cosmetic surgeries, experimental treatments, and pre-existing conditions. It’s important to thoroughly review the plan’s benefits summary to understand any exclusions or limitations that could impact your healthcare needs.

How can I save on health insurance costs without sacrificing coverage?

+Consider choosing a plan with a higher deductible and lower premiums, especially if you are generally healthy and don’t anticipate frequent medical care. Additionally, take advantage of wellness programs and preventive care services, which are often covered at no additional cost. Finally, shop around and compare plans to find the best fit for your needs and budget.

What is the difference between an EPO and a POS plan?

+An EPO plan, like a PPO plan, allows policyholders to choose any provider within the network. However, EPOs do not cover out-of-network care, except in emergencies. POS plans, on the other hand, combine elements of HMOs and PPOs, requiring a primary care physician but offering the option to seek care outside the network at a higher cost. POS plans provide more flexibility than HMOs but less than PPOs.