Senior Life Insurance Companies

Life insurance is an essential financial tool that provides individuals and their families with peace of mind and security. As people advance in age, the need for comprehensive life insurance coverage becomes even more critical. This article explores the realm of senior life insurance companies, delving into their unique offerings, benefits, and considerations for those in their golden years.

Navigating the Senior Life Insurance Landscape

The life insurance market caters to a wide range of individuals, including seniors who often have specific needs and concerns. Senior life insurance companies have emerged as specialized providers, offering tailored policies and services to address the unique circumstances of older adults.

One of the key advantages of senior life insurance companies is their expertise in understanding the health and lifestyle factors that influence coverage for older individuals. These companies often have extensive experience in evaluating and underwriting policies for seniors, taking into account medical histories, prescription medications, and pre-existing conditions.

For seniors, obtaining life insurance can serve multiple purposes. It can provide a financial safety net for loved ones, ensuring they are protected in the event of a sudden passing. Life insurance policies can also be structured to cover end-of-life expenses, such as funeral costs and estate settlement fees, alleviating some of the financial burdens on surviving family members.

Coverage Options for Seniors

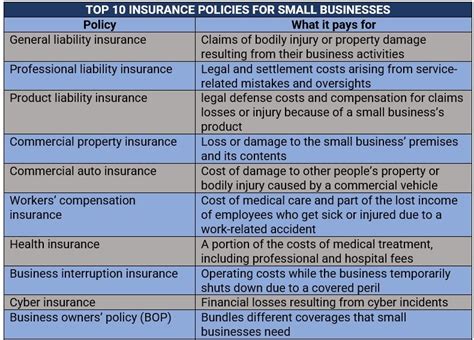

Senior life insurance companies offer a variety of coverage options to meet the diverse needs of their clients. These options include:

Term Life Insurance

Term life insurance is a popular choice for seniors seeking affordable coverage for a specific period. These policies typically have fixed premiums and provide coverage for a set term, ranging from 10 to 30 years. Term life insurance is often selected when individuals want to cover specific financial obligations, such as mortgage payments or children’s education expenses.

Whole Life Insurance

Whole life insurance, also known as permanent life insurance, offers lifetime coverage and accumulates cash value over time. This type of policy is ideal for seniors who want guaranteed coverage and the potential for financial growth. The cash value component can be used for various purposes, including supplemental retirement income or paying off medical expenses.

Guaranteed Issue Life Insurance

Guaranteed issue life insurance is designed for seniors who may have difficulty obtaining traditional coverage due to health issues or age. These policies do not require a medical exam and provide coverage regardless of an individual’s health status. However, they often have limited benefits and higher premiums compared to standard life insurance policies.

Final Expense Insurance

Final expense insurance, sometimes referred to as burial insurance, is specifically tailored to cover end-of-life expenses. These policies typically have lower coverage amounts and are designed to provide immediate funds for funeral costs, medical bills, and other associated expenses.

| Coverage Type | Key Features |

|---|---|

| Term Life Insurance | Affordable coverage for a specified term, ideal for covering specific financial obligations. |

| Whole Life Insurance | Lifetime coverage with cash value accumulation, offering financial flexibility. |

| Guaranteed Issue Life Insurance | Coverage for seniors with health concerns, no medical exam required. |

| Final Expense Insurance | Covers end-of-life expenses, provides immediate funds for funeral costs. |

Benefits of Senior Life Insurance Companies

Choosing a senior life insurance company offers several advantages, including:

- Specialized Expertise: Senior life insurance companies have extensive knowledge and experience in underwriting policies for older adults. They understand the unique health and financial considerations that come with age, ensuring accurate and fair coverage assessments.

- Flexible Coverage Options: These companies offer a range of policies to cater to diverse needs. Whether an individual seeks affordable term coverage or lifetime protection with cash value, senior life insurance companies provide tailored solutions.

- Simplified Application Process: Many senior life insurance companies offer simplified applications, reducing the need for extensive medical exams. This streamlines the process and makes obtaining coverage more accessible for older individuals.

- Financial Security: Life insurance provides a vital financial safety net for seniors and their loved ones. It ensures that end-of-life expenses are covered and that beneficiaries receive a predetermined sum, helping to alleviate financial worries during a difficult time.

- Estate Planning Tool: Life insurance policies can be integrated into comprehensive estate planning strategies. They can help fund trusts, cover inheritance taxes, and provide liquidity for the distribution of assets, ensuring a smooth transition of wealth to the next generation.

Performance and Trustworthiness

When considering a senior life insurance company, it’s essential to assess its performance and reputation. Factors to evaluate include:

- Financial Strength: Research the company's financial stability and ratings from reputable agencies. A strong financial foundation ensures that the company can fulfill its policy obligations over the long term.

- Claim Settlement Record: Examine the company's track record in settling claims promptly and fairly. Look for customer reviews and industry reports that highlight the company's commitment to honoring its promises.

- Customer Service: Assess the company's customer service reputation. Responsive and knowledgeable customer support is crucial, especially when dealing with sensitive matters such as life insurance claims.

- Industry Recognition: Consider industry awards and recognition received by the company. This can indicate a high level of expertise and a commitment to excellence in the life insurance sector.

Real-World Insights and Considerations

Navigating the world of senior life insurance requires careful consideration and an understanding of one’s unique circumstances. Here are some insights and tips to keep in mind:

- Medical History: Be transparent about your medical history when applying for life insurance. While senior life insurance companies are understanding of age-related health concerns, providing accurate information is essential for obtaining fair coverage.

- Budgeting: Evaluate your financial situation and set a realistic budget for life insurance premiums. Senior life insurance policies can be tailored to fit various budgets, ensuring that coverage remains accessible.

- Coverage Duration: Consider the length of time you need coverage. Term life insurance may be sufficient for short-term obligations, while whole life insurance provides lifelong protection.

- Beneficiary Selection: Choose your beneficiaries carefully. Ensure that your life insurance policy aligns with your estate planning goals and reflects your wishes for the distribution of assets.

- Rider Options: Explore rider options, which are additional benefits that can be added to your policy. Common riders include accelerated death benefits, which allow for early access to a portion of the policy's death benefit for long-term care needs.

The Future of Senior Life Insurance

The landscape of senior life insurance is evolving to meet the changing needs of an aging population. As life expectancies increase and medical advancements improve the quality of life for older adults, senior life insurance companies are adapting their offerings to provide more comprehensive and flexible coverage.

One notable trend is the increasing focus on wellness and healthy aging. Senior life insurance companies are incentivizing policyholders to adopt healthier lifestyles by offering discounts or rewards for maintaining good health. This shift towards wellness-focused policies not only benefits individuals but also contributes to the overall longevity of the insured population.

Additionally, senior life insurance companies are leveraging technology to enhance the customer experience. Online portals and mobile apps are being developed to streamline policy management, allowing seniors to access their policy information, make premium payments, and update beneficiary details conveniently from their devices.

As the demand for senior life insurance grows, these companies are also expanding their partnerships with healthcare providers and financial institutions. By integrating with healthcare systems, senior life insurance companies can offer more holistic solutions, including coverage for long-term care and chronic illness management. This collaborative approach ensures that seniors receive comprehensive financial protection and access to quality healthcare services.

Furthermore, senior life insurance companies are exploring innovative products to address the unique challenges faced by older adults. For instance, some companies are introducing policies that provide coverage for extended periods, such as 40 or 50 years, to accommodate the increasing life expectancy of seniors. These policies offer long-term financial security and peace of mind, ensuring that individuals can maintain their desired standard of living throughout their golden years.

In conclusion, senior life insurance companies play a vital role in providing financial security and peace of mind to older adults. By offering specialized coverage options, streamlined application processes, and expert guidance, these companies empower seniors to protect their loved ones and plan for their financial future. As the industry continues to evolve, senior life insurance companies remain committed to adapting their offerings to meet the changing needs and expectations of an aging population.

What is the typical age range for senior life insurance policies?

+Senior life insurance policies are typically designed for individuals aged 50 and above. However, the age range can vary depending on the specific company and policy type. Some companies offer specialized policies for seniors as young as 40, while others cater to individuals well into their 80s.

Can seniors with pre-existing conditions obtain life insurance coverage?

+Absolutely! Senior life insurance companies understand that older adults often have pre-existing health conditions. These companies have underwriting guidelines that take into account various medical histories, allowing many individuals with pre-existing conditions to obtain coverage. However, the availability and cost of coverage may vary based on the severity of the condition.

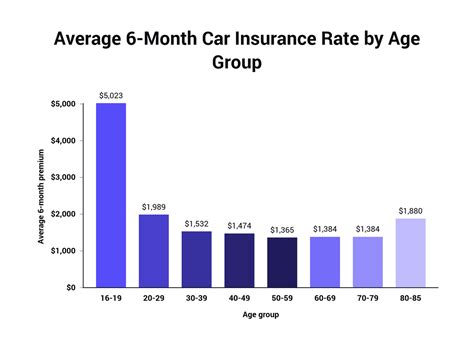

How much does senior life insurance cost?

+The cost of senior life insurance varies depending on several factors, including the type of policy, coverage amount, and the individual’s health and lifestyle. Term life insurance tends to be more affordable, while whole life insurance may have higher premiums due to its lifelong coverage and cash value accumulation. It’s best to obtain quotes from multiple providers to find the most suitable option for your budget.

Are there any tax benefits associated with senior life insurance policies?

+Yes, senior life insurance policies can offer tax advantages. The cash value component of whole life insurance, for example, grows on a tax-deferred basis. Additionally, the death benefit proceeds from a life insurance policy are typically income tax-free, providing beneficiaries with a substantial financial benefit.