Aaa Insurance Claim Phone Number

The world of insurance is a complex and often confusing landscape, but one essential aspect that policyholders frequently need to navigate is making a claim. Whether it's for an auto accident, a home emergency, or a health-related issue, knowing how to initiate and progress through the claims process is crucial. This article will delve into the specifics of making an insurance claim, focusing on the Aaa Insurance claim phone number and the steps involved in this often-stressful process.

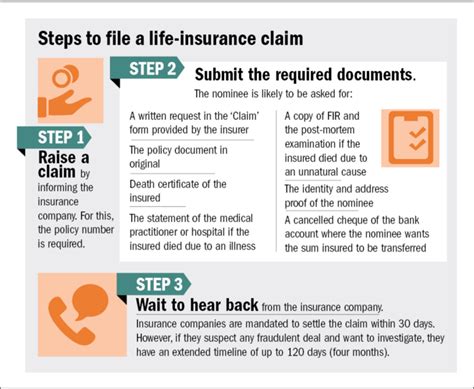

Understanding the Aaa Insurance Claims Process

Before we dive into the specific phone number, it’s important to understand the broader claims process for Aaa Insurance. This process typically involves several stages, each requiring careful attention and documentation.

Step 1: Notifying Aaa Insurance

The first step in making an insurance claim is to notify your insurance provider, in this case, Aaa Insurance. This notification can be done via various methods, including a phone call, an online form, or even an in-person visit to an Aaa Insurance branch.

When making the notification, ensure you have all the relevant details at hand. This includes your policy number, a description of the incident, and any supporting documentation you may have. Being as detailed as possible at this stage can help expedite the claims process.

Step 2: Claim Assessment and Investigation

Once Aaa Insurance receives your claim notification, their team will begin assessing and investigating the claim. This involves a thorough review of the incident, your policy details, and any evidence you’ve provided. The insurer may also conduct their own investigations to verify the claim’s validity.

During this stage, it's important to remain patient and cooperative. Aaa Insurance may request additional information or documentation to support your claim. Providing these promptly can help prevent delays in the process.

Step 3: Claims Decision and Settlement

After the assessment and investigation phase, Aaa Insurance will make a decision on your claim. They will either approve the claim, providing you with the agreed-upon settlement, or deny the claim, explaining the reasons for their decision.

If your claim is approved, you will receive the settlement amount as per your policy terms. This could be a one-time payment or an ongoing benefit, depending on the nature of your claim. If your claim is denied, you have the right to appeal the decision and provide additional evidence or arguments to support your case.

The Aaa Insurance Claim Phone Number

Now, let’s get to the heart of the matter - the Aaa Insurance claim phone number. While Aaa Insurance provides various ways to make a claim, one of the most direct and immediate methods is to call their claims department.

The Aaa Insurance claim phone number is 1-800-AAA-CLAIM (1-800-222-2542). This number is a dedicated line for policyholders to report claims and receive assistance throughout the claims process.

When calling this number, you can expect to speak with a trained claims representative who will guide you through the initial steps of the claims process. They will gather the necessary details about your claim, provide you with an estimate of the next steps, and offer support and guidance throughout the journey.

| Claim Type | Contact Number |

|---|---|

| Auto Insurance Claims | 1-800-AAA-CLAIM (1-800-222-2542) |

| Home Insurance Claims | 1-800-AAA-CLAIM (1-800-222-2542) |

| Health Insurance Claims | 1-800-AAA-CLAIM (1-800-222-2542) |

| Life Insurance Claims | 1-800-AAA-CLAIM (1-800-222-2542) |

It's important to note that while the Aaa Insurance claim phone number is a valuable resource, it's not the only way to initiate a claim. Policyholders can also utilize the Aaa Insurance website, mobile app, or visit a local Aaa Insurance branch to report and manage their claims.

Benefits of Calling the Aaa Insurance Claim Phone Number

Calling the Aaa Insurance claim phone number offers several advantages, especially for those who prefer a more personal and immediate approach to resolving their insurance needs.

- Instant Assistance: By calling the dedicated claims number, policyholders can receive immediate assistance from a trained claims representative. This can be especially beneficial in emergency situations where time is of the essence.

- Clarification and Guidance: Claims representatives can provide detailed explanations of the claims process, answer any questions, and offer guidance on what to expect at each stage. This can help policyholders navigate the often-complex claims journey with greater ease.

- Personalized Support: When calling the claim phone number, policyholders have the opportunity to discuss their specific situation with a real person. This personalized approach can be comforting, especially when dealing with a stressful event.

Tips for a Smooth Claims Process

Making an insurance claim can be a daunting task, but with the right approach and preparation, it can be a smoother process. Here are some tips to ensure a more efficient and successful claims journey with Aaa Insurance:

Prepare Your Documentation

Before initiating your claim, gather all the relevant documentation. This includes your policy documents, incident reports, photographs or videos of the damage, and any other evidence that supports your claim. Having these readily available can speed up the claims process.

Understand Your Policy

Take the time to review your insurance policy documents thoroughly. Understand the coverage limits, exclusions, and any specific requirements for making a claim. This knowledge can help you navigate the claims process more effectively and ensure you receive the full benefits you’re entitled to.

Keep Detailed Records

Throughout the claims process, keep detailed records of all your interactions with Aaa Insurance. Note down the dates, times, and names of the representatives you speak with. Also, keep records of any emails, letters, or other communications related to your claim. These records can be valuable if you need to reference or appeal any decisions made by the insurer.

Stay Organized

Claims processes can involve a lot of paperwork and documentation. Stay organized by creating a dedicated folder or file for all your claim-related documents. This can help you easily access and reference the necessary information when needed.

Be Prompt and Responsive

Insurance companies, including Aaa Insurance, appreciate prompt and responsive policyholders. Respond to any requests for information or documentation promptly. The faster you can provide the necessary details, the faster the claims process can progress.

Conclusion

Making an insurance claim can be a challenging experience, but with the right information and preparation, it can be managed effectively. Knowing the Aaa Insurance claim phone number and understanding the steps involved in the claims process can empower policyholders to navigate this journey with confidence.

Remember, while the Aaa Insurance claim phone number is a valuable resource, it's not the only way to initiate a claim. Policyholders can also utilize the insurer's website, mobile app, or visit a local branch for assistance. The key is to choose the method that best suits your needs and preferences.

By following the tips outlined in this article and staying organized and responsive, you can ensure a smoother claims process with Aaa Insurance. Remember, your insurance provider is there to support you, so don't hesitate to reach out and utilize the resources available to you.

What should I do if I’m involved in an auto accident?

+

If you’re involved in an auto accident, ensure the safety of all involved parties first. Then, collect as much information as possible, including the other driver’s details, license plate number, and insurance information. Take photographs of the accident scene and any damage to the vehicles. Notify Aaa Insurance as soon as possible and provide them with all the details. Cooperate fully with the claims process, and remember to keep all documentation organized.

How long does it typically take for Aaa Insurance to process a claim?

+

The time it takes for Aaa Insurance to process a claim can vary depending on the complexity of the claim and the type of insurance involved. Simple claims with clear evidence and documentation may be resolved within a few days to a week. More complex claims, especially those involving legal or liability issues, can take several weeks or even months to resolve. It’s best to stay in touch with your claims representative to get regular updates on the progress of your claim.

Can I track the progress of my claim online?

+

Yes, Aaa Insurance provides online claim tracking tools on their website. Once you’ve reported your claim, you can log in to your online account and view the status of your claim. This tool provides real-time updates on the progress of your claim, allowing you to stay informed and involved throughout the process.

What happens if my claim is denied by Aaa Insurance?

+

If Aaa Insurance denies your claim, they will provide you with a detailed explanation of the reasons for the denial. This could be due to factors such as policy exclusions, insufficient evidence, or discrepancies in the information provided. If you disagree with the decision, you have the right to appeal. Gather additional evidence or arguments to support your case and resubmit your claim. The insurer will then re-evaluate your claim based on the new information provided.