Car Insurance Quotes Uk

Car insurance is a vital aspect of vehicle ownership, offering protection and financial security to drivers across the United Kingdom. With a diverse range of insurance providers and policies available, understanding the process of obtaining car insurance quotes in the UK is essential for making informed decisions. In this comprehensive guide, we delve into the world of car insurance quotes, exploring the factors that influence them, the steps to obtain accurate estimates, and the key considerations for securing the best coverage at the most competitive rates.

Understanding Car Insurance Quotes in the UK

In the realm of car insurance, quotes serve as the initial step towards securing coverage. These quotes provide an estimated cost of insurance based on various factors unique to each driver and their vehicle. In the UK, the car insurance market is highly competitive, with numerous insurers vying for customers. As a result, obtaining multiple quotes is a common practice to ensure you find the most suitable policy at an affordable price.

When seeking car insurance quotes, it's crucial to be prepared with the necessary information. This includes details about yourself, your vehicle, and your driving history. Insurers use this information to assess the level of risk associated with insuring you, which directly impacts the quoted premium. Here's a breakdown of the key factors that influence car insurance quotes in the UK:

Driver Profile

- Age: Younger drivers, particularly those under 25, often face higher insurance premiums due to their perceived higher risk on the roads.

- Gender: Historically, insurance premiums have been influenced by gender, with males often paying more. However, this practice is gradually changing as insurers adopt a more neutral approach.

- Driving Experience: New drivers with little experience may pay higher premiums. Conversely, experienced drivers with a clean driving record can benefit from lower rates.

- Claims History: A history of insurance claims can impact future premiums. Insurers may view drivers with multiple claims as higher risk.

- Occupation: Some occupations are associated with higher risks, which can affect insurance premiums.

Vehicle Details

- Vehicle Make and Model: Certain car models are more expensive to insure due to factors like repair costs, theft rates, or performance.

- Vehicle Age: Older vehicles may be cheaper to insure, as they typically have lower replacement and repair costs.

- Vehicle Usage: Insurers consider how the vehicle is used. Commuting to work daily, business use, or leisure driving can all impact premiums.

- Vehicle Security: Vehicles with advanced security features or immobilizers may attract lower insurance rates.

Location

The area where you live and park your vehicle can significantly affect insurance quotes. Areas with higher crime rates or a history of accidents may result in increased premiums.

Insurance Type

The level of coverage you choose, whether it’s third-party, third-party fire and theft, or comprehensive insurance, will impact your quote. Comprehensive coverage tends to be more expensive but offers the highest level of protection.

Steps to Obtain Accurate Car Insurance Quotes

To ensure you receive accurate car insurance quotes, follow these steps:

1. Gather Necessary Information

Before requesting quotes, have the following information readily available:

- Your personal details, including name, date of birth, and driving license number.

- Vehicle registration number and details of the make and model.

- Information about any previous insurance policies, including the insurer, policy number, and claim history.

- Details of any modifications made to your vehicle.

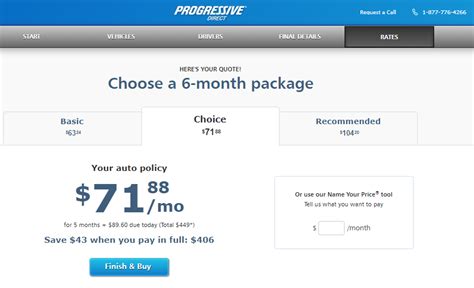

2. Compare Quotes from Multiple Insurers

Don’t settle for the first quote you receive. Compare quotes from at least three to five insurers to get a sense of the market rates. You can use online comparison websites or contact insurers directly.

3. Be Honest and Accurate

Provide accurate and honest information when applying for quotes. Misrepresenting yourself or your vehicle could lead to invalid insurance and legal consequences.

4. Consider Add-ons and Extras

Some insurers offer additional benefits or add-ons with their policies, such as breakdown cover or legal assistance. Evaluate these options and their impact on the overall premium.

5. Understand the Policy Details

Before accepting a quote, carefully read the policy documents to understand the coverage, exclusions, and any excess amounts you may need to pay in the event of a claim.

Tips for Securing the Best Car Insurance Deal

To find the most suitable and cost-effective car insurance policy, consider the following tips:

1. Shop Around and Compare

Don’t rely on a single quote. Shopping around and comparing multiple quotes is essential to finding the best deal. Online comparison websites can be a great starting point.

2. Adjust Your Excess

Increasing your voluntary excess (the amount you pay towards a claim) can often reduce your insurance premium. However, ensure you can afford this excess amount if needed.

3. Consider Annual or Multi-Year Policies

Some insurers offer discounts for longer policy terms. Annual or multi-year policies may be more cost-effective than monthly payments.

4. Review Your Needs

Regularly review your insurance needs and consider if your current policy still suits your requirements. Your circumstances may change, and you may need to adjust your coverage accordingly.

5. Maintain a Clean Driving Record

A clean driving record is crucial for obtaining lower insurance premiums. Avoid driving convictions and reduce the number of claims you make to keep your record clean.

6. Explore Discounts and Promotions

Insurers often offer discounts or promotions, especially to new customers. Keep an eye out for these opportunities and consider switching insurers if a better deal is available.

Conclusion

Obtaining car insurance quotes in the UK is a straightforward process, but it requires careful consideration and comparison. By understanding the factors that influence quotes and following the steps outlined above, you can navigate the car insurance market with confidence. Remember, the key to securing the best deal is to shop around, compare multiple quotes, and tailor your coverage to your specific needs.

How often should I review my car insurance policy?

+

It’s recommended to review your car insurance policy annually, especially when your policy is up for renewal. This allows you to assess if your coverage still meets your needs and compare it with other available options.

Can I switch insurers mid-policy if I find a better deal?

+

Yes, you can switch insurers at any time, even mid-policy. However, be aware that some insurers may charge a fee for cancelling your policy early.

What documents do I need to have when applying for car insurance quotes?

+

When applying for car insurance quotes, you’ll typically need your driving license, vehicle registration documents, and details of any previous insurance policies.