Home Auto Insurance Quote

Home and auto insurance are essential aspects of financial planning and risk management. These policies provide vital protection against unforeseen circumstances, offering peace of mind and security for individuals and their families. In the United States, the insurance industry is a significant sector, with a wide range of providers offering customized plans to suit diverse needs. Obtaining an accurate and competitive quote for home and auto insurance is crucial, and understanding the factors that influence these quotes can empower consumers to make informed decisions.

Understanding Home and Auto Insurance Quotes

Insurance quotes are estimates of the cost of an insurance policy, based on the level of coverage requested and various personal and property-related factors. For home insurance, quotes are influenced by the location, size, and construction of the home, as well as the desired coverage limits and deductibles. Similarly, auto insurance quotes consider factors such as the make and model of the vehicle, the driver’s age and driving record, and the desired coverage types and limits.

Factors Affecting Home Insurance Quotes

Home insurance quotes can vary significantly depending on the following key factors:

- Location: Insurance rates can differ greatly based on the geographical area. Factors such as crime rates, weather conditions, and proximity to fire stations can impact premiums. For instance, areas prone to natural disasters like hurricanes or earthquakes often command higher insurance rates.

- Home Value and Construction: The value of your home and the materials used in its construction play a vital role. Homes built with fire-resistant materials or located in neighborhoods with better fire protection services may enjoy lower insurance rates.

- Coverage Amount and Deductible: The amount of coverage you choose and the corresponding deductible can significantly affect your premium. Higher coverage limits and lower deductibles generally result in higher premiums.

- Homeowner’s Claims History: Insurance providers take into account any previous claims made on your policy. Multiple claims, especially those related to natural disasters or accidents, can lead to higher premiums or even policy non-renewal.

- Discounts and Bundles: Many insurance companies offer discounts for various reasons, such as having safety features like smoke detectors or security systems, or for being a loyal customer. Additionally, bundling your home and auto insurance policies with the same provider can often lead to substantial savings.

| Coverage Type | Description |

|---|---|

| Dwelling Coverage | Protects the physical structure of your home. |

| Personal Property Coverage | Covers the contents of your home, including furniture, electronics, and clothing. |

| Liability Coverage | Provides protection if someone is injured on your property or if you're found legally responsible for causing injury or property damage. |

| Additional Living Expenses | Covers temporary living expenses if your home becomes uninhabitable due to a covered loss. |

Factors Influencing Auto Insurance Quotes

Auto insurance quotes are influenced by a variety of factors, including:

- Vehicle Type and Usage: The make, model, and year of your vehicle play a significant role in determining insurance rates. Additionally, the purpose for which you use your vehicle, such as personal use, business use, or pleasure driving, can impact your premium.

- Driver’s Age and Record: Younger drivers, particularly those under the age of 25, often face higher insurance rates due to their lack of driving experience. Similarly, drivers with a history of accidents, moving violations, or DUI convictions may be considered high-risk and charged higher premiums.

- Coverage Types and Limits: The types of coverage you choose, such as liability, collision, comprehensive, and personal injury protection, as well as the corresponding coverage limits, can significantly affect your insurance premium.

- Discounts and Bundles: Insurance companies offer various discounts, including safe driver discounts, good student discounts, and loyalty discounts. Additionally, bundling your auto insurance with other policies, such as home or renters insurance, can often lead to substantial savings.

- Location and Usage Patterns: Where you live and where you typically drive can impact your insurance rates. Urban areas with higher traffic density and crime rates often command higher insurance premiums.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Covers bodily injury and property damage you may cause to others in an accident. |

| Collision Coverage | Pays for damage to your vehicle in the event of a collision, regardless of fault. |

| Comprehensive Coverage | Provides protection for your vehicle against non-collision incidents, such as theft, vandalism, or natural disasters. |

| Personal Injury Protection (PIP) | Covers medical expenses and lost wages for you and your passengers, regardless of fault. |

The Process of Obtaining a Home and Auto Insurance Quote

Obtaining a home and auto insurance quote is a straightforward process, but it’s important to ensure you provide accurate and detailed information to receive an accurate quote. Here’s a step-by-step guide to help you navigate the process:

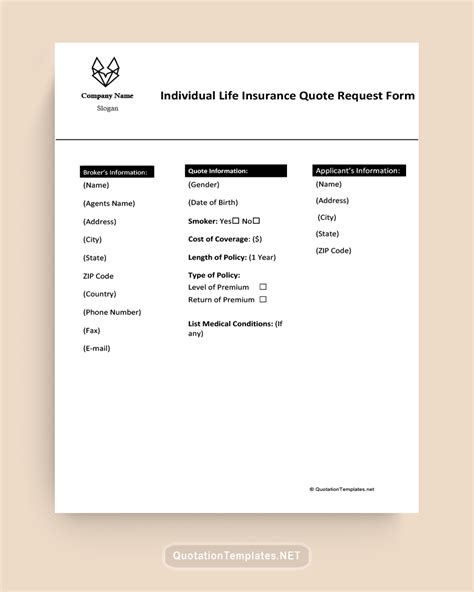

Step 1: Gather Necessary Information

Before requesting a quote, gather the following information to ensure a smooth and accurate quote process:

- Home Details: Address, square footage, number of stories, age of the home, and any recent renovations or improvements.

- Vehicle Details: Make, model, year, vehicle identification number (VIN), and any safety or anti-theft features.

- Personal Information: Full name, date of birth, driver’s license number, and social security number.

- Existing Policies: If you currently have home or auto insurance, provide details of your existing policies, including coverage limits, deductibles, and any recent claims.

Step 2: Choose the Right Insurance Provider

With a wide range of insurance providers available, it’s important to choose one that suits your specific needs. Consider the following factors when selecting an insurance provider:

- Reputation and Financial Stability: Opt for an insurance company with a solid reputation and financial stability to ensure they’ll be able to pay out claims if needed.

- Coverage Options: Select a provider that offers a range of coverage options to tailor your policy to your specific needs.

- Customer Service and Claims Handling: Choose a provider with a good track record of customer service and efficient claims handling.

- Discounts and Bundling Options: Look for providers that offer discounts or the option to bundle home and auto insurance policies for potential savings.

Step 3: Request a Quote

Once you’ve gathered the necessary information and selected a reputable insurance provider, you can request a quote. This can typically be done online, over the phone, or in person at an insurance agent’s office. Provide the insurance provider with the information you’ve gathered, including your personal details, home and vehicle information, and any existing policies.

Step 4: Review and Compare Quotes

After receiving quotes from multiple insurance providers, take the time to carefully review and compare them. Consider the following factors when evaluating the quotes:

- Coverage Limits and Deductibles: Ensure the quotes provide adequate coverage limits for your specific needs and compare the deductibles to determine which option offers the best balance between affordability and comprehensive coverage.

- Discounts and Bundling Opportunities: Look for quotes that offer discounts or the option to bundle home and auto insurance policies for potential savings.

- Customer Reviews and Reputation: Research the reputation and customer reviews of the insurance providers to ensure they have a good track record of customer service and claims handling.

- Policy Exclusions and Conditions: Carefully review the fine print of each policy to understand any exclusions or conditions that may impact your coverage.

The Benefits of Accurate Home and Auto Insurance Quotes

Obtaining accurate home and auto insurance quotes offers several key benefits, including:

- Financial Planning: Accurate quotes provide a clear understanding of the costs associated with insurance coverage, allowing for better financial planning and budgeting.

- Risk Management: By understanding the potential costs of different coverage options, individuals can make informed decisions to manage their financial risks effectively.

- Peace of Mind: With accurate quotes, individuals can choose insurance policies that provide adequate coverage, giving them peace of mind and security against unforeseen circumstances.

- Comparison Shopping: Accurate quotes enable individuals to compare policies from different providers, ensuring they find the best value and coverage for their specific needs.

How often should I review and update my home and auto insurance policies?

+

It’s recommended to review your insurance policies annually or whenever there are significant changes to your life or circumstances, such as a move to a new home, purchasing a new vehicle, or getting married. Regular reviews ensure that your coverage remains adequate and up-to-date.

Can I customize my home and auto insurance policies to fit my specific needs?

+

Yes, most insurance providers offer a range of coverage options and limits to customize your policy to your specific needs. You can choose the coverage types, limits, and deductibles that best suit your situation and budget.

What factors can lead to changes in my insurance premiums over time?

+

Insurance premiums can change due to various factors, including changes in your personal circumstances (e.g., age, driving record), changes in your property (e.g., renovations, location), and fluctuations in the insurance market. It’s important to regularly review your policies to ensure they remain competitive.

Are there any tips to lower my home and auto insurance premiums without sacrificing coverage?

+

Yes, there are several strategies to potentially lower your insurance premiums while maintaining adequate coverage. These include bundling your home and auto insurance policies, increasing your deductibles, taking advantage of discounts (e.g., safe driver discounts, loyalty discounts), and regularly reviewing and comparing quotes from different providers.