Benefits Of Pet Insurance

Pet insurance is a topic of growing importance as more and more pet owners seek to provide the best possible care for their beloved companions. With the rising costs of veterinary treatments and the increasing complexity of medical procedures available for animals, understanding the benefits of pet insurance is crucial. This article aims to delve into the advantages that pet insurance policies offer, providing a comprehensive guide for current and prospective pet owners.

Understanding Pet Insurance Policies

Pet insurance policies are designed to offer financial support to pet owners in the event of unexpected veterinary costs. These policies can cover a wide range of treatments, from routine check-ups and vaccinations to more complex surgeries and chronic conditions. By spreading the financial burden over time, pet insurance ensures that pet owners can provide the necessary medical care without incurring substantial debt.

The benefits of pet insurance extend beyond the financial aspect, offering peace of mind to pet owners. Knowing that their furry friends are covered can reduce stress and anxiety during emergencies, allowing owners to focus on their pet's recovery rather than worrying about the cost of treatment.

Coverage Options and Customization

One of the key advantages of pet insurance is the ability to customize coverage to fit individual needs and budgets. Policies can be tailored to include specific benefits such as accident-only coverage, comprehensive illness and accident coverage, or even routine care plans that include vaccinations and check-ups. This flexibility ensures that pet owners can find a plan that suits their pet’s unique requirements.

Additionally, some pet insurance providers offer add-on benefits, such as coverage for alternative therapies like acupuncture or chiropractic care, or even behavioral modification programs. These optional benefits can enhance the overall health and well-being of pets, providing a more comprehensive approach to veterinary care.

| Policy Type | Description |

|---|---|

| Accident-Only | Covers veterinary costs resulting from accidents, such as fractures or injuries. |

| Comprehensive Illness and Accident | Provides coverage for both illnesses and accidents, including chronic conditions. |

| Routine Care Plans | Includes routine check-ups, vaccinations, and preventative care. |

Financial Protection and Peace of Mind

The primary benefit of pet insurance is the financial protection it offers. Veterinary costs can quickly escalate, especially for specialized treatments or surgeries. Pet insurance policies help mitigate these costs by reimbursing a portion of the expenses, ensuring that pet owners can access the necessary care without facing significant financial strain.

For example, a pet owner with a policy that covers 80% of veterinary costs can expect to pay only a fraction of the total bill, with the insurance provider covering the majority. This financial support can make a significant difference, especially for unexpected emergencies or long-term treatments.

Emergency Care and Specialized Treatments

Pet insurance often provides crucial coverage for emergency situations. Whether it’s a sudden injury, an unexpected illness, or a life-threatening condition, having pet insurance can ensure that immediate treatment is accessible without worrying about the financial implications.

Furthermore, pet insurance can cover specialized treatments that may not be available through standard veterinary care. This includes advanced diagnostics, such as MRI or CT scans, or specialized surgeries performed by veterinary specialists. By covering these costs, pet insurance policies enable pet owners to explore all available treatment options, ensuring the best possible care for their pets.

| Treatment Type | Coverage Example |

|---|---|

| Emergency Care | Covered at 90% for unexpected accidents or illnesses. |

| Specialized Surgery | Reimbursement of 75% for a specialized procedure performed by a veterinary surgeon. |

| Advanced Diagnostics | Includes coverage for MRI scans, aiding in the accurate diagnosis of complex conditions. |

Promoting Preventative Care and Long-Term Health

Pet insurance policies not only provide coverage for unexpected events but also encourage preventative care and long-term health management. Many policies include coverage for routine check-ups, vaccinations, and preventative treatments, ensuring that pets receive regular veterinary attention.

Routine Care and Wellness Plans

Incorporating routine care into pet insurance policies is a strategic approach to promoting overall pet health. By covering annual check-ups, owners are encouraged to stay on top of their pet’s health, allowing for early detection of potential issues. This proactive approach can lead to better health outcomes and reduced costs in the long run.

Additionally, some insurance providers offer wellness plans that go beyond basic check-ups. These plans may include coverage for parasite control, dental care, and even obesity management programs. By focusing on preventative measures, pet insurance providers contribute to the well-being of pets and help owners avoid more costly treatments down the line.

| Wellness Plan Benefit | Description |

|---|---|

| Parasite Control | Includes coverage for parasite prevention and treatment, such as flea and tick medications. |

| Dental Care | Covers routine dental exams and cleanings, as well as necessary dental procedures. |

| Obesity Management | Provides support for weight management programs, including nutritional counseling and exercise plans. |

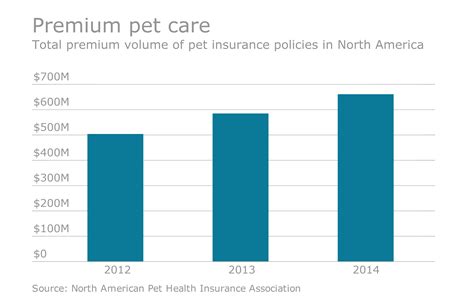

The Impact of Pet Insurance on Veterinary Care

The introduction and widespread adoption of pet insurance have had a significant impact on the veterinary industry. With more pet owners able to afford advanced treatments and specialized care, veterinarians can focus on providing the highest quality of care without financial constraints.

Access to Advanced Treatments and Technologies

Pet insurance has opened doors to innovative treatments and technologies that were previously inaccessible to many pet owners. From advanced imaging techniques to cutting-edge surgical procedures, pet insurance policies ensure that these options are financially feasible, leading to improved outcomes for pets.

For instance, pet insurance coverage for MRI scans has allowed for more accurate diagnoses of neurological conditions, leading to more effective treatment plans. Similarly, advanced surgical techniques, such as laparoscopic procedures, can now be performed on pets with the financial support of insurance policies.

Improved Veterinary Communication and Education

Pet insurance providers often offer additional resources and support to pet owners, including educational materials and access to veterinary professionals. This enhances the overall pet owner experience, providing valuable information on pet health and care. By promoting better understanding and communication, pet insurance contributes to the overall health and well-being of pets.

Conclusion: The Value of Pet Insurance

Pet insurance offers a multitude of benefits, ranging from financial protection and peace of mind to enhanced veterinary care and long-term health management. By providing coverage for a wide range of treatments and encouraging preventative care, pet insurance policies ensure that pets receive the best possible care throughout their lives.

For pet owners, the value of pet insurance lies not only in the financial support but also in the knowledge that their furry companions are protected. With pet insurance, the focus shifts from financial worries to the well-being of pets, allowing owners to make the best decisions for their beloved animals.

FAQs

What is the average cost of pet insurance per month?

+

The cost of pet insurance can vary widely depending on factors such as the pet’s breed, age, location, and the level of coverage chosen. On average, pet insurance policies range from 30 to 60 per month for accident and illness coverage. However, it’s important to note that the cost can be higher or lower based on individual circumstances.

Are pre-existing conditions covered by pet insurance?

+

Most pet insurance policies exclude coverage for pre-existing conditions. A pre-existing condition is typically defined as any illness, injury, or symptom that occurred or was diagnosed before the pet’s insurance policy was purchased. However, some providers offer waiting periods or limited coverage for certain pre-existing conditions, so it’s important to review the policy terms carefully.

Can pet insurance be used for routine check-ups and vaccinations?

+

Yes, many pet insurance policies include coverage for routine check-ups, vaccinations, and preventative care. These plans, often referred to as wellness or routine care plans, can help offset the costs of regular veterinary visits and keep your pet healthy. However, it’s essential to check the specific coverage details of your chosen policy, as some providers may offer this coverage as an optional add-on.

How does the reimbursement process work for pet insurance claims?

+

The reimbursement process for pet insurance claims typically involves submitting the veterinary invoice along with the necessary documentation, such as the pet’s medical records. The insurance provider then reviews the claim and reimburses the pet owner for the covered portion of the expenses. The exact process and timeline can vary between providers, so it’s beneficial to understand the specific steps outlined in your policy.

Is pet insurance worth the cost for healthy pets?

+

While it’s true that healthy pets may not require immediate veterinary care, the unexpected can happen at any time. Pet insurance provides peace of mind and financial protection in the event of an emergency or the onset of a serious illness. Additionally, including routine care coverage can ensure that your pet receives regular check-ups and preventative treatments, contributing to their long-term health. Considering the potential costs of veterinary care, pet insurance can be a valuable investment for any pet owner.