Cheap Health Insurance Florida

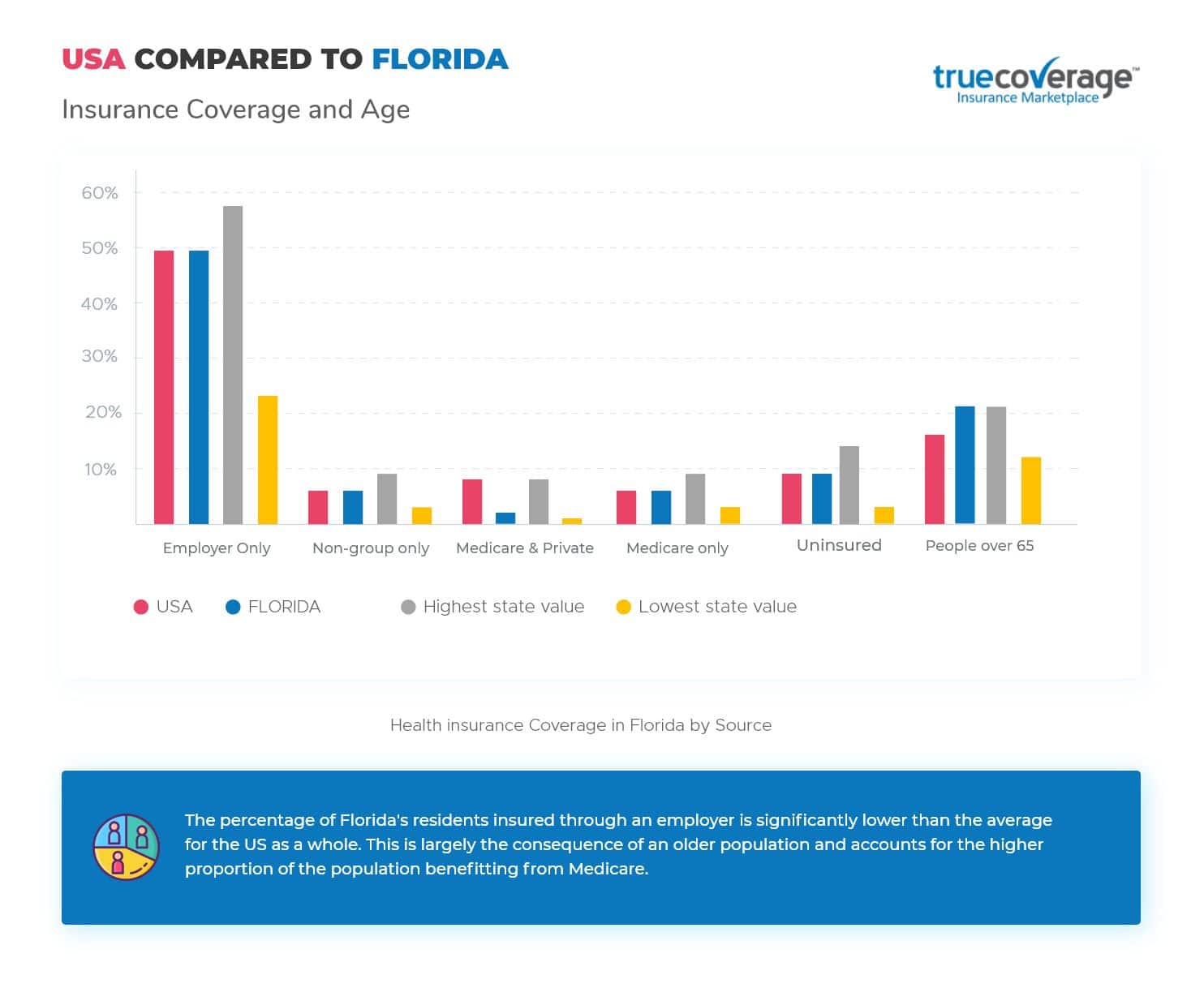

Finding affordable and comprehensive health insurance is a priority for many individuals and families, especially in states like Florida, where the cost of healthcare can vary significantly. In this article, we will delve into the world of cheap health insurance options in Florida, exploring the various plans, providers, and strategies to help you secure adequate coverage without breaking the bank.

Understanding the Florida Health Insurance Market

Florida, known for its diverse population and vibrant healthcare landscape, offers a range of insurance options to cater to different needs and budgets. Understanding the key players and the unique aspects of the Florida market is essential when searching for affordable coverage.

Key Health Insurance Providers in Florida

Several major insurance companies operate in Florida, each with its own network of healthcare providers and unique plan offerings. Some of the notable providers include:

- Blue Cross Blue Shield of Florida: A well-established provider with a wide network, offering a variety of plans including PPOs and HMOs.

- UnitedHealthcare: Known for its comprehensive coverage options, UnitedHealthcare provides plans through its extensive network of hospitals and doctors.

- Aetna: Aetna's plans in Florida often include a variety of cost-sharing options, making them flexible for different budgets.

- Florida Blue: As Florida's largest health insurer, Florida Blue offers a range of affordable plans, including those tailored for individuals and families.

- Cigna: Cigna's plans in Florida often feature robust coverage for preventative care and specialty services.

The Impact of Florida's Healthcare Laws

Florida's healthcare regulations play a significant role in shaping the insurance landscape. The state has implemented various measures to ensure accessibility and affordability, including:

- The Florida Health Choices Program, which aims to provide affordable options for individuals and small businesses.

- The Healthy Kids Program, offering low-cost coverage for children from low-income families.

- The Florida Medicaid Program, providing healthcare coverage for eligible low-income adults, children, pregnant women, and people with disabilities.

Strategies for Finding Cheap Health Insurance in Florida

Securing affordable health insurance in Florida requires a strategic approach. Here are some key strategies to consider:

Explore Government-Subsidized Programs

Florida residents with low to moderate incomes may qualify for government-subsidized health insurance programs. These programs, such as Medicaid and the Children's Health Insurance Program (CHIP), provide comprehensive coverage at little to no cost. Understanding the eligibility criteria and applying for these programs can be a significant step towards affordable healthcare.

Consider Short-Term Health Insurance Plans

For those in between jobs or facing a gap in coverage, short-term health insurance plans can be a cost-effective option. These plans typically offer more limited coverage compared to traditional plans but can provide essential protection during transitional periods. It's important to carefully review the benefits and exclusions of these plans to ensure they meet your specific needs.

Utilize Online Comparison Tools

The internet offers a wealth of resources for comparing health insurance plans. Online comparison tools allow you to input your specific needs and budget, and then present a range of options from different providers. These tools can be a valuable starting point for researching and narrowing down your choices.

Negotiate with Providers

Don't underestimate the power of negotiation. Many insurance providers are willing to offer discounts or negotiate rates, especially if you're willing to bundle multiple types of insurance (e.g., health, life, and auto) with the same company. Additionally, some providers offer loyalty discounts for long-term customers, so it's worth inquiring about potential savings.

Evaluate Dental and Vision Plans

Dental and vision coverage are often separate from standard health insurance plans. However, including these services in your overall healthcare coverage can provide significant long-term savings. Evaluate the dental and vision plans offered by different providers to ensure you're getting the best value for your needs.

Assessing Plan Benefits and Coverage

When comparing health insurance plans, it's crucial to go beyond the price tag and assess the benefits and coverage offered. Here's a breakdown of key factors to consider:

Network of Providers

Understanding the network of healthcare providers associated with a plan is essential. Ensure that your preferred doctors, specialists, and hospitals are included in the plan's network to avoid unexpected out-of-network charges.

Coverage Limits and Exclusions

Review the plan's coverage limits and exclusions carefully. Some plans may have restrictions on certain treatments, procedures, or pre-existing conditions. Being aware of these limitations can help you make an informed decision and avoid unexpected costs.

Cost-Sharing Structures

Health insurance plans often have different cost-sharing structures, such as deductibles, copayments, and coinsurance. Evaluate these costs and consider how they align with your expected healthcare needs and budget. Plans with higher deductibles may be more affordable upfront but could result in higher out-of-pocket expenses if you require significant medical care.

Prescription Drug Coverage

Prescription medications can be a significant expense. Assess the plan's prescription drug coverage, including the cost of generic and brand-name medications. Some plans offer preferred pharmacies or mail-order options, which can provide additional savings.

Real-Life Examples of Affordable Health Insurance in Florida

To illustrate the variety of affordable health insurance options in Florida, let's explore a few real-life examples:

| Plan Type | Provider | Monthly Premium | Key Benefits |

|---|---|---|---|

| PPO | Blue Cross Blue Shield of Florida | $250 (individual), $400 (family) | Wide network, low copays, and coverage for preventive care |

| HMO | UnitedHealthcare | $180 (individual), $350 (family) | Affordable rates, includes specialty care services |

| High-Deductible Health Plan (HDHP) | Aetna | $150 (individual), $300 (family) | Lower premiums, compatible with Health Savings Accounts (HSAs) |

| POS | Florida Blue | $220 (individual), $450 (family) | Flexibility to choose providers inside or outside the network |

The Future of Affordable Health Insurance in Florida

The landscape of affordable health insurance in Florida is constantly evolving, influenced by national healthcare reforms, technological advancements, and changes in the insurance industry. Here's a glimpse into the potential future of cheap health insurance in the Sunshine State:

Digital Health Solutions

The integration of digital health technologies is expected to play a significant role in reducing healthcare costs. Telemedicine, remote monitoring, and digital health apps can provide more accessible and affordable care options, especially for those in rural areas.

Value-Based Care Models

Value-based care models, which focus on the quality and outcomes of healthcare rather than the quantity of services provided, are gaining traction. These models have the potential to drive down costs and improve patient outcomes, benefiting both consumers and insurers.

Expanded Government Programs

There is ongoing discussion about expanding government-subsidized health insurance programs to cover more Floridians. Efforts to increase eligibility for programs like Medicaid and to implement universal healthcare initiatives could significantly impact the availability and affordability of health insurance in the state.

Insurance Industry Innovations

Insurance providers are continuously innovating to offer more affordable and accessible plans. This includes developing new products, such as micro-insurance plans or insurance plans tailored for specific health conditions, to meet the diverse needs of consumers.

Frequently Asked Questions (FAQ)

What is the average cost of health insurance in Florida?

+The average cost of health insurance in Florida varies based on factors such as age, location, and plan type. As of [insert most recent data], the average monthly premium for an individual plan is around $[average cost], while family plans average at $[average cost]. These costs can fluctuate based on the specific plan and provider chosen.

<div class="faq-item">

<div class="faq-question">

<h3>Are there any tax benefits for purchasing health insurance in Florida?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, Florida residents who purchase health insurance through the state's marketplace may be eligible for tax credits and subsidies to help offset the cost of their premiums. These tax benefits are based on income and family size, providing additional financial assistance for those who qualify.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I customize my health insurance plan to fit my needs?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Absolutely! Many health insurance providers in Florida offer customizable plans, allowing you to choose the level of coverage that best suits your needs and budget. This can include selecting different deductibles, copayments, and coverage limits for various healthcare services.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I miss a premium payment for my health insurance plan in Florida?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Missing a premium payment can have serious consequences. Depending on the terms of your plan, you may enter a grace period during which you can make the payment without penalty. However, if the grace period expires, your coverage could be terminated, and you may face challenges in securing new coverage due to pre-existing conditions.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Are there any discounts or incentives for long-term customers of health insurance plans in Florida?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, some health insurance providers in Florida offer loyalty discounts or incentives for long-term customers. These discounts can reduce your monthly premiums or provide additional benefits, such as lower copays or expanded coverage options. It's worth inquiring with your provider about potential loyalty programs.</p>

</div>

</div>

</div>