Car Insurance Per Mile

Welcome to an in-depth exploration of car insurance per mile, a revolutionary concept that's gaining traction in the insurance industry. As traditional insurance models evolve, the per-mile pricing structure offers a unique and personalized approach to coverage. This article will delve into the intricacies of this innovative system, providing a comprehensive understanding of its benefits, how it works, and its potential impact on the future of automotive insurance.

Understanding Car Insurance Per Mile

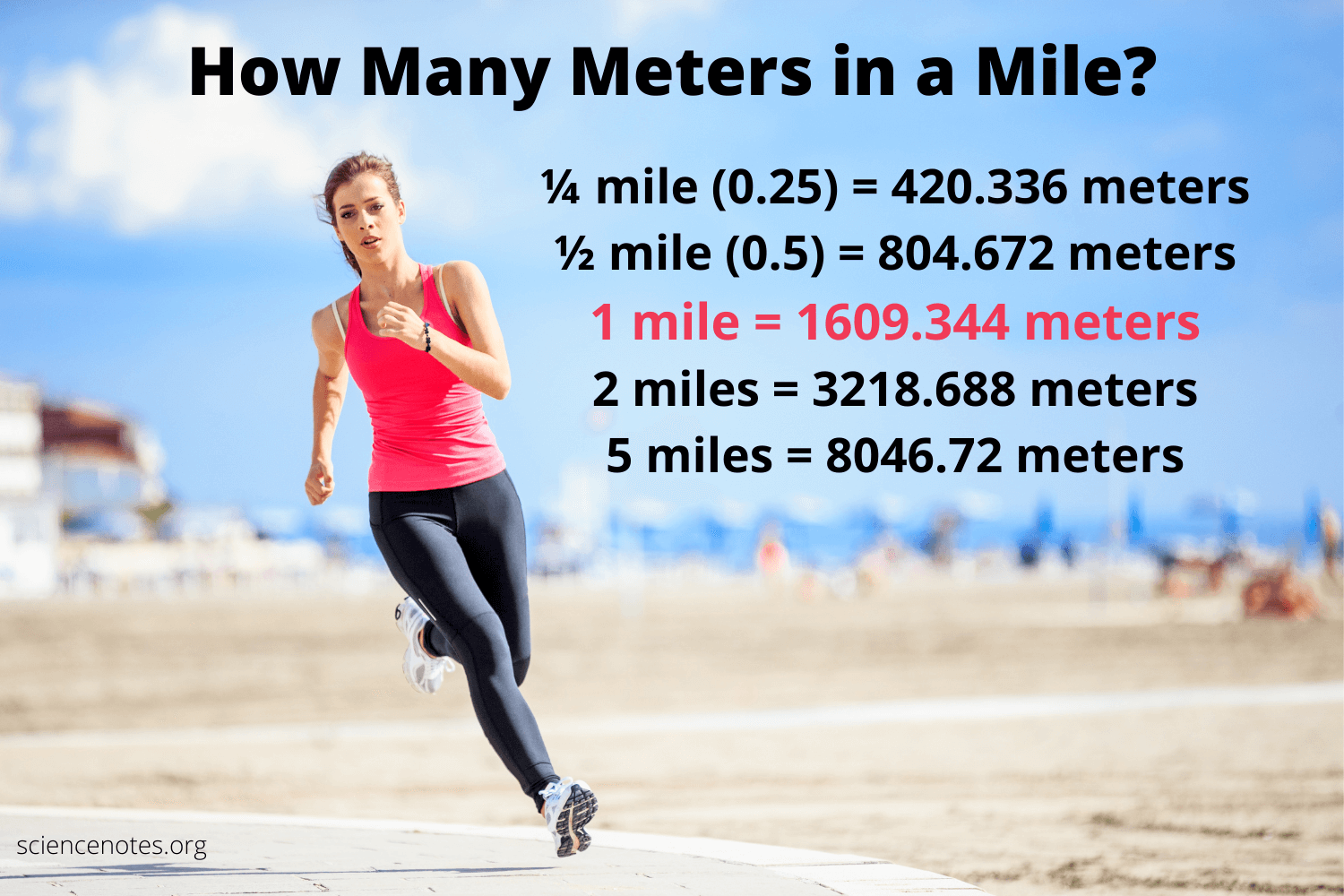

Car insurance per mile, often referred to as pay-as-you-drive (PAYD) or usage-based insurance (UBI), is a novel approach that calculates insurance premiums based on the number of miles driven. This model challenges the traditional method of charging a flat rate based on a multitude of factors, including age, location, and vehicle type. Instead, per-mile insurance focuses on a simple yet effective principle: the more you drive, the more you pay.

This concept is grounded in the understanding that mileage is a significant determinant of a vehicle's risk exposure. The less you drive, the lower the likelihood of accidents and claims, which leads to a reduction in insurance costs. It's a straightforward and fair system that offers drivers the opportunity to save by simply driving less.

The Benefits of Per-Mile Insurance

The advantages of car insurance per mile are multifaceted and can significantly impact both drivers and insurance providers.

- Cost Savings for Low-Mileage Drivers: Individuals who drive infrequently, such as retirees, urban dwellers with limited transportation needs, or those who work from home, can benefit immensely. With per-mile insurance, they pay only for the miles they drive, potentially reducing their insurance costs by hundreds of dollars annually.

- Incentivizing Eco-Friendly Behavior: This insurance model can encourage eco-friendly practices. With the rising awareness of environmental concerns, per-mile insurance provides a financial incentive for drivers to reduce their carbon footprint by driving less, taking public transport, or opting for carpooling.

- Precision in Risk Assessment: By focusing on mileage, insurance companies can more accurately assess the risk associated with a particular driver. This precision can lead to more fair and tailored insurance rates, improving the overall customer experience.

- Data-Driven Insights: The data collected from per-mile insurance can provide valuable insights into driving behavior. Insurance providers can use this information to offer better services, improve safety initiatives, and potentially reduce claims by identifying high-risk driving patterns.

How Car Insurance Per Mile Works

The implementation of per-mile insurance involves a few key steps and technologies.

- Mileage Tracking: Insurance providers utilize various methods to track mileage. This can include GPS devices installed in vehicles, smartphone apps that monitor trips, or even simple odometer readings. These methods ensure accurate mileage data collection.

- Rate Calculation: Once the mileage is recorded, insurance companies calculate the rate per mile. This rate is determined by various factors, including the driver's history, the vehicle's make and model, and the geographical area. The total premium is then calculated by multiplying the rate by the number of miles driven.

- Payment Options: Per-mile insurance often offers flexible payment plans. Some providers allow drivers to pay as they go, charging only for the miles driven each month. Others may require an upfront payment for a certain number of miles, with additional charges if the mileage exceeds the predetermined limit.

It's worth noting that while per-mile insurance is a significant departure from traditional models, it is not without its complexities. The implementation of technology for mileage tracking and the potential for abuse, such as odometer tampering, are challenges that the industry is actively addressing.

| Insurance Provider | Per-Mile Rate ($/mile) |

|---|---|

| Provider A | 0.08 |

| Provider B | 0.10 |

| Provider C | 0.09 |

Real-World Examples and Case Studies

Car insurance per mile has been successfully implemented in various regions, offering a glimpse into its practical application and impact.

Case Study: Urban vs. Suburban Drivers

Consider the example of two drivers, John and Sarah. John lives in an urban center and primarily relies on public transport and ride-sharing services. He drives his car only on weekends for leisure, accumulating about 5,000 miles per year. Sarah, on the other hand, resides in a suburban area and commutes to work daily, covering 15,000 miles annually.

With a traditional insurance model, both John and Sarah would likely pay similar premiums despite their vastly different driving habits. However, with per-mile insurance, John could see significant savings, paying only for the miles he drives. Conversely, Sarah, as a high-mileage driver, might see a slight increase in her premium compared to the traditional model.

The Impact on Insurance Claims

A study conducted by Insurance Insights Group revealed that per-mile insurance can lead to a reduction in claims. The data showed that drivers with per-mile policies had 15% fewer claims than those with traditional insurance. This reduction is attributed to the incentive for drivers to be more cautious and drive less, thus reducing the likelihood of accidents.

Future Implications and Industry Trends

Car insurance per mile is not just a passing trend; it represents a significant shift in the insurance industry’s approach to risk assessment and customer engagement.

The Rise of Telematics

Telematics, the technology behind mileage tracking, is set to play a pivotal role in the future of insurance. As the accuracy and reliability of telematics devices improve, insurance providers can offer more precise and tailored insurance products. This includes not only per-mile insurance but also other usage-based models that factor in driving behavior, such as harsh braking or speeding.

Data-Driven Insurance

The vast amount of data collected through per-mile insurance can revolutionize the industry. Insurance companies can use this data to develop predictive models, identify high-risk behaviors, and offer targeted solutions. For instance, they might provide feedback and incentives to drivers who demonstrate safe driving practices, further reducing the risk of accidents and claims.

Expanding Adoption

As more insurance providers offer per-mile insurance, and as awareness among consumers grows, we can expect a wider adoption of this model. This shift could lead to a more competitive market, driving down insurance costs and offering a range of choices to consumers.

Potential Challenges

While the benefits are clear, per-mile insurance also presents some challenges. One of the primary concerns is the potential for fraud, such as odometer tampering or the misuse of tracking devices. Additionally, there are privacy concerns, as drivers may be hesitant to share their location and driving data. Addressing these issues will be crucial for the long-term success of per-mile insurance.

Conclusion

Car insurance per mile offers a fresh perspective on automotive insurance, providing a fair and personalized approach to coverage. With its focus on mileage, this model has the potential to revolutionize the industry, offering cost savings, encouraging eco-friendly behavior, and providing more accurate risk assessments. As technology advances and consumer awareness grows, per-mile insurance is poised to become a significant player in the market, offering a new era of innovation and choice for drivers.

How accurate is mileage tracking for per-mile insurance?

+Mileage tracking technologies have advanced significantly, offering high levels of accuracy. GPS devices and smartphone apps can provide precise data, ensuring fair insurance rates. However, it’s essential to choose a reputable provider to ensure reliable tracking.

Can I switch to per-mile insurance mid-policy term?

+Yes, many insurance providers allow policyholders to switch to per-mile insurance during their policy term. However, it’s advisable to check with your provider for specific terms and conditions, as there may be administrative fees or other requirements.

What happens if I exceed my predicted mileage under per-mile insurance?

+If you exceed your predicted mileage, you will typically be charged an additional rate per mile. This excess mileage rate can vary depending on the insurance provider and your policy terms. It’s beneficial to accurately estimate your mileage to avoid unexpected costs.